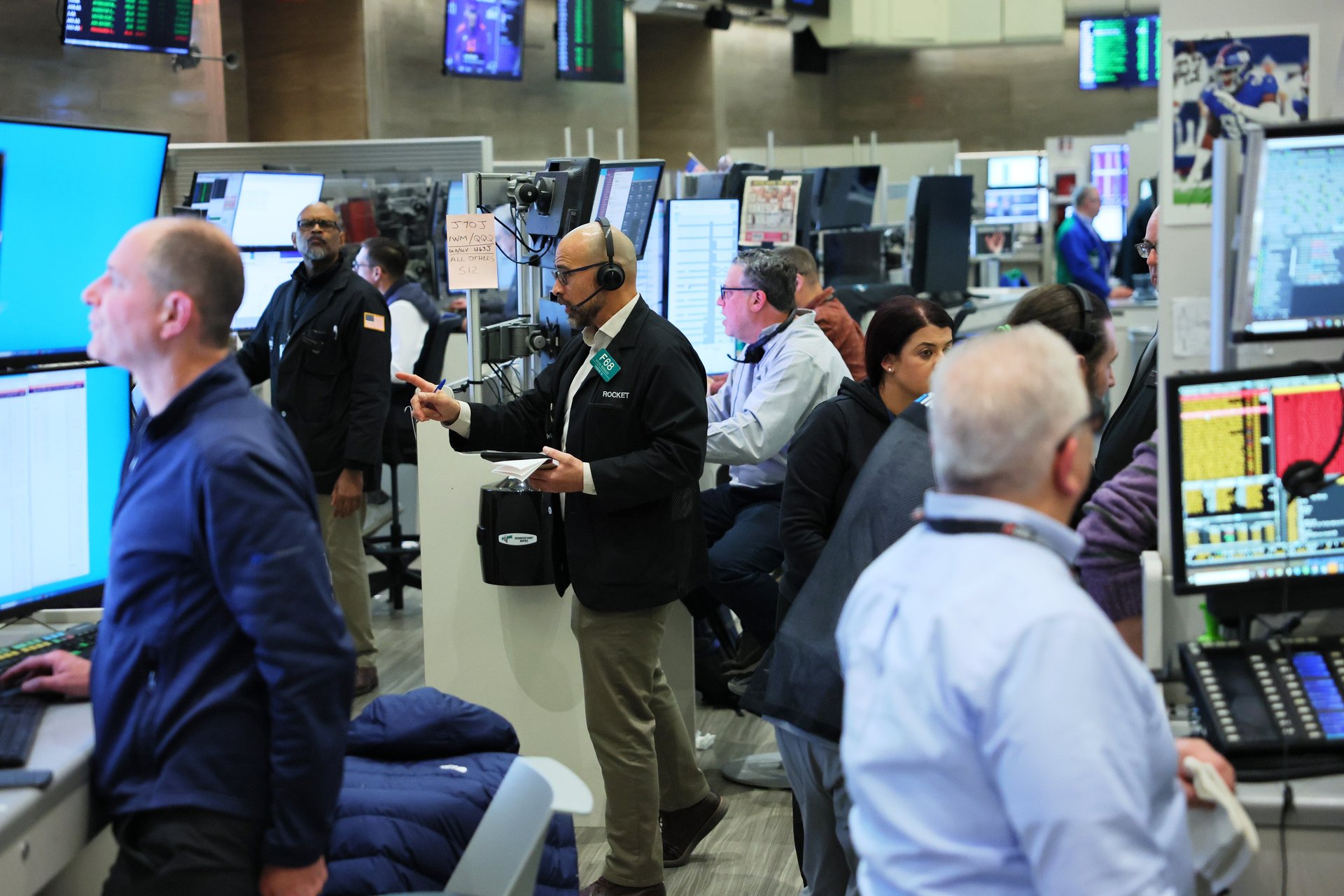

Stocks sink as tariff chill deepens. Nasdaq falls 4%, S&P drops 3.5%

After Wednesday’s historic rally, markets tumble on weak earnings signals and shaky faith in Trump’s trade pause

Stocks closed sharply down on Thursday as investors digested a wave of economic uncertainty, including tariff tensions, inflation data, and a string of downbeat corporate signals. The Nasdaq sank 4.3%, while the S&P 500 dropped 3.5% and the Dow fell 2.5%. The Russell 2000 Index, a benchmark for small-cap stocks, slid 4%.

Suggested Reading

Big Tech led the losses: Apple fell more than 4%, Amazon dropped over 5%, and Tesla slumped more than 7%. Used-car retailer CarMax was one of the day’s biggest losers, closing down 17% after a disappointing earnings report and broader concerns about the auto sector.

Related Content

Looking ahead, Friday will bring a wave of bank earnings, with JPMorgan Chase, Wells Fargo, and others set to report — offering fresh insight into credit conditions and consumer resilience. Investors will also parse new economic data, including producer price inflation figures, for clues about the path of interest rates.

Wall Street hits the brakes

Markets fell sharply Thursday, giving back a big chunk of Wednesday’s huge rally.

The Dow Jones Industrial Average was down 1,693 points in early-afternoon trading, or about 4.2%, after its historic 3,000-point surge the day before, The S&P 500 fell 4.9%, and the Nasdaq dropped 5.7%, with shares of the Magnificent Seven tech giants leading the retreat: Apple (AAPL) stock slid 6%, Tesla (TSLA) dropped 10%, and Amazon (AMZN) fell more than 6.5%. Shopify (SHOP) stock tumbled more than 9%.

Used car stocks were hit especially hard after CarMax’s earnings miss, with CarMax stock down almost 20% and Carvana (CVNA) off 10%.

The pullback reflects lingering skepticism around President Donald Trump’s 90-day pause on sweeping tariffs, which arrived even more abruptly than the trade war policy itself. Markets seem reluctant to trust a policy pivot that arrived without warning — even as inflation data offered some welcome relief.

The Consumer Price Index showed that core inflation, which excludes food and energy, rose just 0.1% in March, the slowest monthly pace in nine months. Year-over-year, core prices climbed 2.8%, marking the tamest reading since mid-2021.

Used car sales indicate economic engine still running

CarMax’s (KMX) fiscal fourth-quarter results, also released Thursday morning, revealed mixed performance amid a volatile market environment. The company reported net revenues of $6 billion, a 6.7% increase from the previous year. Earnings per diluted share rose to $0.58, up 81.3% from $0.32 a year ago. However, this fell short of analysts’ expectations of $0.66 per share.

Finance heavyweights will headline Friday’s earnings slate

Friday will bring a wave of first-quarter results from some of the biggest names in finance, giving investors a deeper look at how the bulge bracket and other banking behemoths are navigating 2025’s economic uncertainty.

JPMorgan Chase (JPM) will be closely watched for signals on loan growth, credit quality, and net interest margins — the critical metrics that show how it’s managing in a high-rate, low-visibility environment. Any signs of tightening credit or weakening consumer demand could ripple across the market.

Wells Fargo’s (WFC) numbers will offer a window into consumer lending, where even small shifts in behavior can signal broader household strain. With recession chatter back on the table, analysts are looking for clues about how the bank is adjusting its exposure.

Asset manager BlackRock (BLK) will report amid surging volatility and massive swings in investor sentiment. Its earnings should reveal whether clients are retreating into cash or leaning into risk — and where the big money is flowing.

Morgan Stanley (MS) will round out the Friday slate, with attention on investment banking fees and deal activity. With M&A pipelines reportedly thinning and IPOs still scarce, the results could help gauge the depth of Wall Street’s current dealmaking drought.