Sam Bankman-Fried's memo to FTX employees, edited to remove the bullshit

There’s a big gulf between being transparent and being honest

For a man facing financial ruin, endless lawsuits across the world, and possible criminal charges, Sam Bankman-Fried is awfully chatty.

Suggested Reading

His communications since the bankruptcy of FTX have conveyed a commitment to transparency about what really happened at the giant crypto-exchange he founded before it imploded. But if that’s true, he could use an editor.

Related Content

There’s a big gulf between being transparent and being honest. Bankman-Fried, like so many executives before him, pledges “way more transparency,” but uses the word simply to mean giving his side of the story. A faithful accounting of FTX’s collapse requires ruthlessly cutting the bullshit. (It would also require better accountants.)

Below, we’ve taken Bankman-Fried’s latest memo to current and former employees of FTX, and suggested a few edits. All of the links, cross-outs, and new text in bold, were added by Quartz.

Hi all–

I feel deeply sorry about what happened. I regret what happened to all of you. And I regret what happened to customers. You gave everything you could for FTX, and stood by the company–and me.

I didn’t mean for any of this to happen, and I would give anything to be able to go back and do things over again. You were my family. I’ve lost that, and our old home is an empty warehouse of monitors. When I turn around, there’s no one left to talk to. I disappointed all of you, and when things broke down I failed to communicate. I froze up in the face of pressure and leaks and the Binance LOI and said nothing. I lost track of the most important things in the commotion of company growth. I care deeply about you all, and you were my family, and I’m sorry.

I was CEO, and so it was my duty to make sure that ,ultimately, the right things happened at FTX. I wish that I had been more careful.

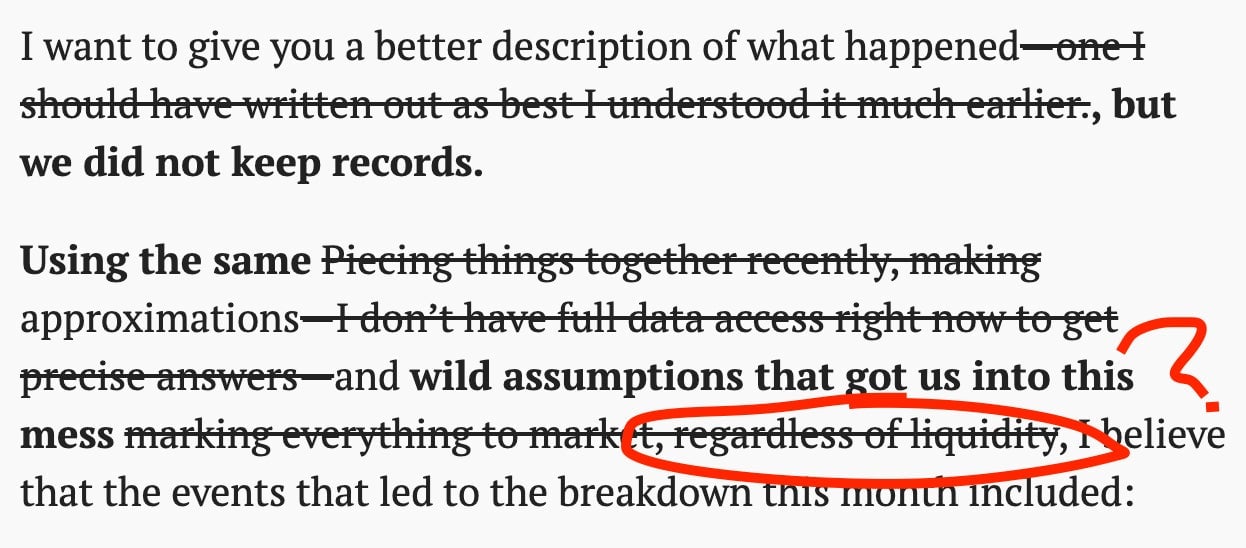

I want to give you a better description of what happened—one I should have written out as best I understood it much earlier., but we did not keep records.

Using the same Piecing things together recently, making approximations—I don’t have full data access right now to get precise answers—and wild assumptions that got us here in the first place marking everything to market, regardless of liquidity, I believe that the events that led to the breakdown this month included:

2 2) A crash in markets this spring that led to a roughly 50% reduction in the value of Collateral tokens we created and controlled the supply of;

2 3) Most of the credit in the industry drying up at once Extremely leveraged trades, unsecured loans, and other high-risk bets our hedge fund had made went to zero;

4) I allowed my hedge fund to cover its losses with FTX customer funds;

3 5) A concentrated, hyper-correlated crash The tokens we invented lost credibility in November, and that led to another roughly 50% reduction in the value of collateral a number people no longer really believed over a very short period of time, during which there was very little market bid-side liquidity; and who could we have sold the tokens to, anyway, ourselves?

4 6) A run on the bank exchange triggered by the same attacks more skepticism in November;

5 7) As we frantically put everything together, it became clear that the position was larger than its display on admin/users, we lost track of how much debt we’d taken on because of old fiat deposits before FTX had bank accounts how much money was freely sloshing between FTX and Alameda;

I never intended this to happen. I did not realize the full extent of the margin position, nor did I realize the magnitude of the risk posed by a hyper-correlated crash using tokens we created as collateral. The loans and secondary sales were generally used to reinvest in the business–including buying out Binance.–and not I also used my FTX wealth for large amounts of personal consumption.

I deeply regret my oversight failure. In retrospect, I wish that we had not done any of this at all, or done many many things differently. To name a few:

a) being substantially more skeptical of large margin positions

And none of this changes the fact that this all sucks for you guys, and it’s not your fault, and I’m really sorry about that. I’m going to do what I can to make it up to you guys–and to the customers–even if that takes the rest of my life. But I’m worried that even then I won’t be able to.

I also want to acknowledge those of you who gave me what I now believe to be the right advice about pathways forward for FTX following the crash. You were right, of course: I believe that a month earlier FTX had been a thriving, profitable, innovative business. Which means that FTX still had value, and that value could have gone towards helping to make everyone more whole. We likely could have raised significant funding; potential interest in billions of dollars of funding came in roughly eight minutes after I signed the Chapter 11 docs. Between those funds, the billions of dollars of collateral the company still held, and the interest we’d received from other parties, I think that we probably could have returned large value to customers and saved the business.

There would have had to be changes, of course: way more transparency, and way more controls in place, including oversight of myself. But FTX was something really special, and you all helped make it that. Nothing that happened was your fault. We had to make very hard calls very quickly. I have been in that position before, and should have known that when shitty things happen to us, we all tend to make irrational decisions. An extreme amount of coordinated pressure came, out of desperation, to file for bankruptcy for all of FTX–even entities that were solvent–and despite other jurisdictions’ claims. I understand that pressure and empathize with it; a lot of people had been thrust into challenging circumstances that generally were not their fault. I reluctantly gave in to that pressure, even though I should have known better; I wish I had listened to those of you who saw and still see value in the platform, which was and is my belief as well.

Maybe there still is a chance to save the company. I believe that there are billions of dollars of genuine interest from new investors that could go to making customers whole. But I can’t promise you that anything will happen, because it’s not my choice.

In the meantime, I’m excited to see some positive steps being taken, like LedgerX being turned back on selling the one part of FTX that wasn’t fatally intermingled with the rest of our entities.

I’m incredibly thankful for all that you guys have done for FTX over the years, and I’ll never forget that.

– SBF Sam