Hi Quartz Africa members!

Nigerians think of banks as places you go to pay a utility bill or send money through a teller. Few can claim to have large savings accounts: Only 2% of customers are responsible for 90% of deposits, and 99% of bank accounts held less than 500,000 naira (~$1,000) last year, according to one government regulator. Those numbers tally with the fact that 40% of Nigerians—83 million people—are living in poverty.

Given those realities, it might seem questionable for anyone to build a Nigerian tech company around a consumer savings app. But entrepreneurs are actively challenging the idea that Nigerians don’t or can’t save, by taking advantage of two factors: the complacency of traditional banks, and progress in digital payments.

While Nigerian banks take in billions of dollars in customer deposits (N33.9 trillion [$84 billion] in the first half of 2021), they barely exceed the Central Bank of Nigeria’s stipulated minimum of 1.15% interest per year on savings accounts. And because banks depend on business with big corporations, they have little time for retail savings needs. Meanwhile, payment processing pioneers like Paystack and Flutterwave have made it easier for any type of business to securely and cheaply collect money from consumers.

As a result, personal finance apps are chipping away at roles previously reserved for banks. Among the variety on offer—loan apps, Robinhood-like retail trading apps, Cash App-like apps—the most popular yet are savings apps offering interest rates that exceed what banks offer. To be sure, such apps have weathered a few years of skepticism around the security of deposits and whether they’re Ponzi schemes. But these apps have also grown each year, and are now among the household names in Africa’s startup scene.

🌍 Tell us what you think! To make sure Quartz Africa provides the content you’re looking for, we need to hear from you—take this four-minute survey to tell us what you think and how we can improve.

Cheat sheet

💡 The opportunity: Banking is undergoing a revision around the world—including in Africa, where traditional banking is not as established. Startups can take advantage of the growing adoption of mobile technology to create services for young users who crave special attention for personal finance needs like savings, credit, and insurance.

🤔 The challenge: Consumer-facing apps have to contend with low penetration of high-speed internet outside major African cities. And as much as such apps target user frustration with banks, they still require users to have bank accounts.

🌍 The road map: A good savings app depends on efficient payments processing for easy debits and credits, as well as a firm cybersecurity framework that assures user safety. Startups in the space also have the continuous duty of increasing user confidence by getting necessary licenses from regulators, and extending marketing efforts offline to garner more users.

💰 The stakeholders: The ecosystem of app-based savings and investments involves the startups, banks, and local financial system regulators; in Nigeria, the concerned regulators are the Central Bank of Nigeria, and the Securities and Exchange Commission.

By the digits

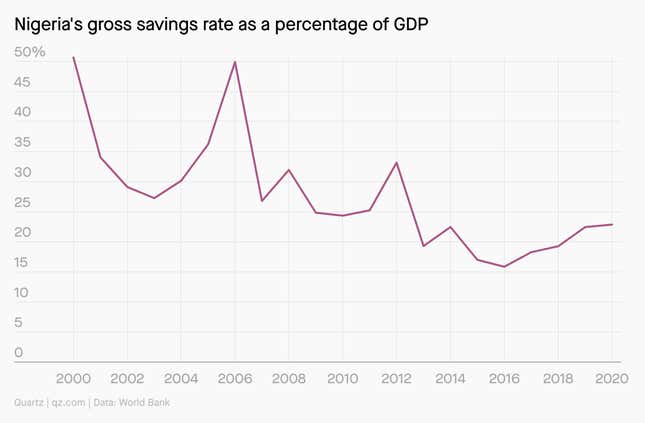

23%: Nigeria’s gross savings rate as of December 2020

$120: Average monthly living wage for a Nigerian individual in 2018 ($1 = N360)

53.6 million: Nigerian adults who use formal financial services, whether by a bank or non-bank

36%: Proportion of Nigeria’s 106 million adults who have no access to financial services

$580 million: Money savings app Piggyvest paid out to its users in 2021

62%: Increase in the money Piggyvest paid out to its users between 2020 and 2021

The case study

Name: Piggyvest

Founded: 2016

HQ: Nigeria

Founders: Somto Ifezue, Odunayo Eweniyi, and Joshua Chibueze

Latest valuation: Undisclosed

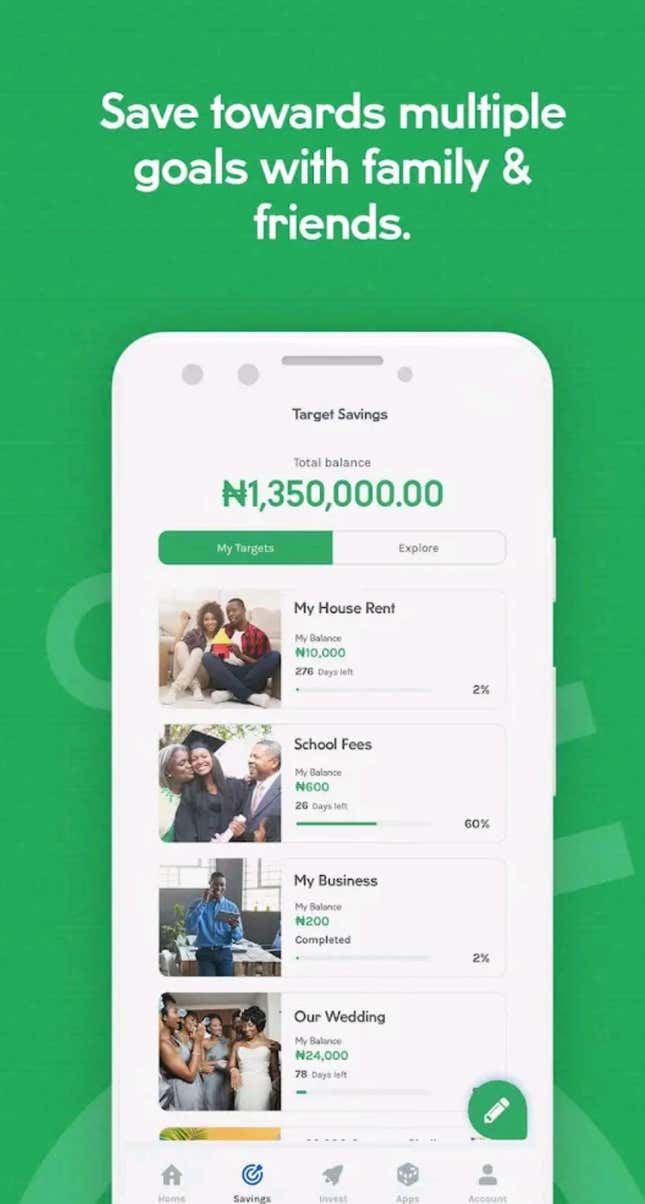

Piggyvest was founded as a digital piggy bank, the essential upgrade being the ability for customers to automate savings by connecting a bank debit card. To withdraw from a physical piggy bank, one has to break it in an almost irreparable way. Piggyvest’s digital spin on that is to charge users a 2.5% break fee for each withdrawal outside pre-selected periods, usually weekly, monthly, or quarterly. (There’s also a “safelock” product for personal accountability that is literally unbreakable until the set time.)

Six years into its existence, the app has more than 3 million users—mostly millennials and college-age Gen Zs turned off by commercial banks—and last year paid out $580 million in initial deposits and interest. “Our primary target market is working Nigerians who are tech-savvy and already have a bank account,” Joshua Chibueze, co-founder and chief marketing officer, tells Quartz. “They’re typically between the ages of 20 [and] 45.”

It helps that customers can verify Piggyvest’s interest payments every week on the app (or turn off interest to go Halal). As it grew, the company also added features for customers to save in groups or in dollars, as well as investment opportunities.

Piggyvest makes money by investing user deposits in government bonds and treasury bills, and splitting the returns with users. In other words, it is nearly a bank, though its microfinance bank license is limited. (International fund transfers are not permitted, for example.) The company insists it’s fine with that. “We want our users to be able to hit [their] financial goals without any worries,” Chibueze says.

To further its ambitions, Piggyvest has been buying up smaller startups like peer-to-peer payments app Abeg, and could itself at some point attract M&A attention from the world’s established financial companies.

In conversation with

Joshua Chibueze is the co-founder and chief marketing officer of Piggyvest. Before starting the company, he worked with Ifezue and Eweniyi on Push CV, a startup that helped job seekers create professional résumés for a fee. Here are some choice quotes from our conversation.

💸 On the role of venture capital in Piggyvest’s growth:

“In 2018, we raised $1.1 million in seed funding for Piggyvest. The funds mostly went towards the acquisition of a microfinance bank license. Piggyvest for the larger part of the past five years has relied on peer recommendations and word of mouth for growth. We’ve been able to grow with our users whilst understanding their needs and providing them with a product that works.”

📋 On the regulatory environment:

“It’s obviously been a journey, but so much progress has been made in terms of regulatory and licensing structures since we started in 2016 that it would be unfair not to recognize it. In 2016, the problem was clarity. We’re executing this way, so where do we fit? Five years down the line, the regulatory structure has become clearer, and while there are still some bumps on the way, it’s so much easier now to reach out to the regulating bodies and ask for help.”

💰 On the biggest lesson about savings culture in Nigeria:

“The job of building user trust is a never-ending one. Nigeria is a low-trust market. Wealth tech is mainly digital and people still find it difficult to trust digital platforms in Nigeria, but staying consistent and true to what you sell helps you get more people comfortable with saving and investing online.”

Fintech deals to 👀

Cowrywise, a Nigerian savings and investment app, raised $3 million in January 2021 in a round led by Quona Capital, a US investment firm. Tsadik Foundation, Gumroad’s CEO Sahil Lavingia, and a host of angel investors also participated. Founded in 2017, the company says it has over 300,000 users.

Bamboo, a Robinhood-like app for stock trading, raised $15 million this year in a round led by Tiger Global and Greycroft. While it isn’t a savings app like Piggyvest or Cowrywise, it targets a similar segment of users: young Africans who want to grow their money with an app. Bamboo said a fifth of its 300,000 users are active daily traders.

More from Quartz Africa

🤔 Retail trading apps in Nigeria face a defining moment

📱 Africans want their apps to do more for them

😺 Why 2022 could be a boom year for Nigerian retail investment apps

😱 Nigeria is punishing loan apps that abuse user data

💥 Africa’s biggest telco and how it plans to woo Gen Z users

🏦 Africa’s credit unions are tapping into fintech for growth

🎵 This brief was produced while listening to “La victoire” by Kerozen (Côte d’Ivoire)

Have a highly motivated rest of your week,

—Alexander Onukwue, west Africa correspondent

One 🎄 thing

The cost of celebrating Christmas in Africa is among the lowest in the world, according to WorldRemit’s study of 15 countries. Cost per household exceeds $1,600 in Canada, but is a mere $44 in Uganda.

Christmas costs tend to correlate with average household incomes, though not always: Ghana and Nigeria have similar household incomes, but Christmas is more expensive in the latter.