Fintech scams, Akon’s crypto ambitions, hot whales

Hi Quartz Africa readers!

Hi Quartz Africa readers!

Solar power is invaluable for households and businesses across Africa that lack access to reliable electricity from the grid. It can keep lights on, phones charged, and small businesses afloat, and is even helping to expedite the delivery of vaccines for Covid-19 and other infectious diseases.

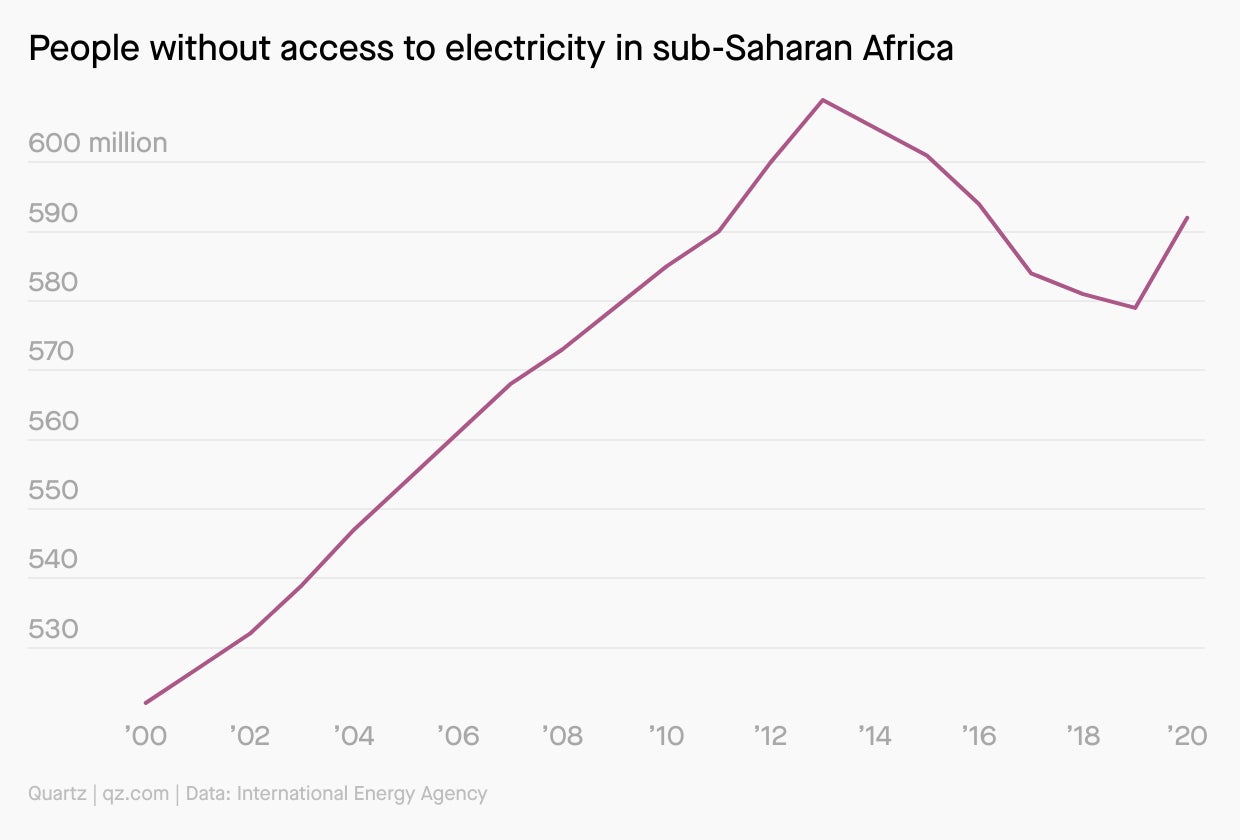

But solar has its limits. Without batteries or a grid connection, it doesn’t work sans sun. And even under the best conditions, it can’t provide enough juice to fully supply the continent’s growing manufacturing sector, or the nearly 600 million people who are still routinely in the dark—a number that grew during the pandemic, after falling every year since 2013.

That’s why some energy economists have raised an alarm about one of US president Joe Biden’s latest climate change policies: cutting off funding for fossil fuel projects overseas.

In the past five years, US agencies have channeled at least $9 billion into various oil and gas drilling projects, pipelines, and power plants around the world, predominantly in sub-Saharan Africa. The US is also supporting dozens of renewable energy projects on the continent, including its largest wind farm, at Kenya’s Lake Turkana.

Cutting off fossil fuel projects seems like a no-brainer for the global climate. Oil and gas installations also pose local risks, from pollution to attracting violence, as was made clear during a recent deadly attack on the Mozambique town that’s the hub for a major offshore gas drilling effort led by French oil major Total.

But to fight energy poverty and climate change at the same time, economists say, the Biden administration will likely need to leave room for the targeted use of fossil fuels to generate power at a larger scale and avoid reliability issues that can arise on a renewables-dominated grid, as they have in Kenya. Foreign aid could also help African power companies climb out from under a mountain of debt.

“There’s this idea that because Africa is lacking in legacy infrastructure, it’s a good canvas to paint the energy future,” says W. Gyude Moore, a senior fellow at the Center for Global Development and former minister of public works for Liberia. “But no African country has volunteered itself for that.”—Tim McDonnell, climate and energy reporter

Five stories from Quartz Africa

How online scammers fooled one of Africa’s biggest fintech startups. The same impunity and loopholes that fraudsters have always used are now turbocharged by fintech platforms like Paystack, Chikezie Omeje finds in an exclusive investigation. Aspiring university students have been left devastated by one such operation. Says one: “I don’t know that someone born of a woman, created by God, can actually formulate such a thing to scam people.”

Crypto dreams and realities. Plans announced by Senegalese-American singer Akon to build a futuristic new city in his homeland were initially greeted with enthusiasm. But what was “Akoin,” and why was it appearing on billboards advertising the 2,000-acre project? As Kingsley Kobo writes, the gap between the singer’s vision to launch his own cryptocurrency and the response on the ground provides a fascinating snapshot of the role digital currencies are playing across Africa.

The secrets of Chinese lending, revealed. A new report outlines the ways in which Chinese lenders use contracts to gain an advantage over other creditors in developing countries. Carlos Mureithi looks at the contracts tied to Africa, largely kept under wraps until now, to see what exactly debtors have signed on for.

Uganda’s government considers a new tack. The country’s controversial social media tax was bound to fail, given the widespread bipartisan opposition it has elicited since being instituted, writes Stephen Kafeero. Now, authorities are considering something less complicated but more worrying: a 12% tax on internet data, which could restrict access and hurt the country’s economic growth.

Whale and dolphin brains produce more heat than those of humans. South African researcher Paul Manger explains why these new findings can help scientists understand how important water temperature is to the survival of cetaceans, and in turn, what will happen to certain species of cetaceans during the inevitable rise in oceanic temperatures associated with anthropogenic-induced climate change.

Naspers’ South Africa focus

Naspers, Africa’s biggest company by market cap, has taken a wide-ranging approach to its international investments, from food delivery in Germany and Brazil to edtech in India. But the company’s recent growth in Africa has a more singular focus: backing South African tech startups with global potential. Let’s take it by the digits:

$314 million: What Naspers pledged in 2018 to fund and grow South African tech businesses

$92 million: Portion of that pledge dedicated to a startup fund called Naspers Foundry

10%-30%: Stake the Foundry takes in companies it invests in, as well as a board seat

R30 million ($2 million): The Foundry’s first investment, in SweepSouth, a service that connects customers to domestic cleaners

R253 million ($17 million): Size of a Foundry-led series B funding round in January for agritech company Aerobotics, Naspers’ latest startup investment

27%: Increase in investor funding for South African startups in 2020

✦ A Quartz membership will get you access to all of our in-depth Quartz Africa coverage, including field guides like Africa after Covid-19. Not yet a member? Try it for free.

Dealmaker

Sawari Ventures, the Egyptian-based venture capital firm, has raised $30 million to close a $71 million investment fund for innovation-driven startups in Egypt, Morocco, and Tunisia. Banque Misr, Banque du Caire, Ekuity, Misr Insurance Group, National Bank of Egypt, and Suez Canal Bank provided the investment, joining previous investors who provided the initial $41 million.

Pricepally, a Nigerian wholesale e-commerce platform that brings together consumers and producers, has raised a six-digit pre-seed funding round to steady its ascension. Samurai Incubate, an Asia-based VC, and early-stage VC fund Launch Africa Ventures provided the investment.

TakeStep, an Egyptian e-health startup, has raised an undisclosed seed investment round. Two angel investors provided the funding, one of whom is Mohamed Hossam Khedr, who joins the company as managing partner. TakeStep specializes in treatment for addiction and general psychiatry, with 15,000 patients benefiting from its 24/7 web and mobile platforms. The investment will help to expand operations to the Gulf region.

Other things we liked

Are elections needed in undemocratic African countries? Tanzania and Uganda are the latest countries to hold elections that stretch the definition of democratic. In the Mail and Guardian, authors of The Moral Economy of Elections in Africa explore all the moving parts of a typical African election, and interrogate the need for them when, in reality, nothing changes.

Africa’s ignored war reaches a turning point. Weeks after the brutal insurgent attack on Palma, the Mozambican town has been declared “safe again” by the military and president. But according to a Financial Times report, analysts believe an ISIS-sponsored war on the country’s richest region is hitting an inflection point.

Picking up the pieces. Last year, Malian kora player Ballaké Sissoko returned to Paris after a tour of the US with his group 3MA to find that border officials in New York City had dismantled his kora. Sissoko’s latest album, Djourou, comes with a new kora, and a healing of sorts, Dale Berning Sawa writes in The Guardian.

The faithful find humanity in the queer community. In Kenya, being queer is not only illegal, it’s also attributed to demonic manifestation and other myths. However, as New Frame’s Carl Collison found, a small group of religious leaders in the coastal Kenyan city of Mombasa are pushing for a broader acceptance of LGBTQIA+ people.

Sea life deaths. Authorities in Ghana are investigating the deaths of hundreds of dolphins and fish that washed up on the country’s beaches in recent days, Emmanuel Akinwotu writes for The Guardian, as fears grow that contaminated fish have been sold to customers.

ICYMI…

Google News innovation challenge. The leaders of African journalism projects focused on reader engagement and new business models are invited to apply for Google funds of up to $150,000 or 70% of the total project cost. (April 12)

Expecting the unexpected. Quartz Africa partners Development Reimagined hold their final webinar on reimagining African finance by posing the question: Can the world’s lenders of last resort deal with grey rhinos? Register here. (April 13)

🎵 This brief was produced while listening to “Ntawamusimbura” by Meddy (Rwanda/US).

Our best wishes for a productive and ideas-filled week ahead. Please send any news, comments, suggestions, ideas, Akoins, and hot whale songs to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.