Andela is a unicorn, mobile money capital, end “colonial” funding

Hi Quartz Africa readers!

Hi Quartz Africa readers!

In the seven years since Andela started a software engineering academy for Africans, it has raised money from venture capitalists at least seven times. The latest round, $200 million from a group of investors led by SoftBank, values the company at $1.5 billion.

Andela the unicorn has evolved a lot from Andela the startup. The first shift came in 2019, when it responded to declining demand for junior developers in the US by closing its academy. Today, Andela is strictly a business-process outsourcing company that finds, screens, and onboards technical talent.

This May—one year after shuttering its Africa offices and going fully remote—Andela extended its talent pool beyond Africa to include contractors from over 80 countries. It will also start helping companies hire designers, data engineers, and sales force developers.

Part of Andela’s next phase will see it accelerate its ambitions of being the world’s premier talent marketplace through M&A, according to CEO Jeremy Johnson. Indeed, there is no better time to pursue this mission. Over the past year, the pandemic has convinced many companies that remote work is possible and can be cost-effective.

If Johnson and his team, which still includes some full-time operations staff in Africa, fulfill their potential, their next big announcement might be from the floor of the New York Stock Exchange—though Johnson says not to expect bells soon. —Alexander Onukwue, West Africa correspondent

Stories this week

Nonprofits want funding to be decolonized. Civil society organizations play a vital role in filling humanitarian and social gaps left by governments and the private sector. But a new report, explored by Carlos Mureithi, says international development funding to African organizations has a “colonial” approach that favors Western ones.

A step towards pan-African payments. The long road to easy intra-Africa trade will need to be paved by seamless payments, and African institutions need to do some heavy lifting. Alexander Onukwue reports on the rollout of the Pan-African Payment and Settlement System for cross-border payments in African currencies.

A film about a same-sex couple was banned in Kenya. In a move that raises questions about censorship, freedom of speech, and colonial-era laws, Kenya—where gay sex is illegal—banned I Am Samuel, a documentary film about a gay relationship, Carlos Mureithi writes.

Zimbabwe cracks down on foreign currency trade. The country is investigating “illegal foreign currency traders” on social media and mobile money platforms, who it accuses of devaluing the local currency. Tawanda Karombo reports on why this is bad news for the country’s thriving mobile banking sector.

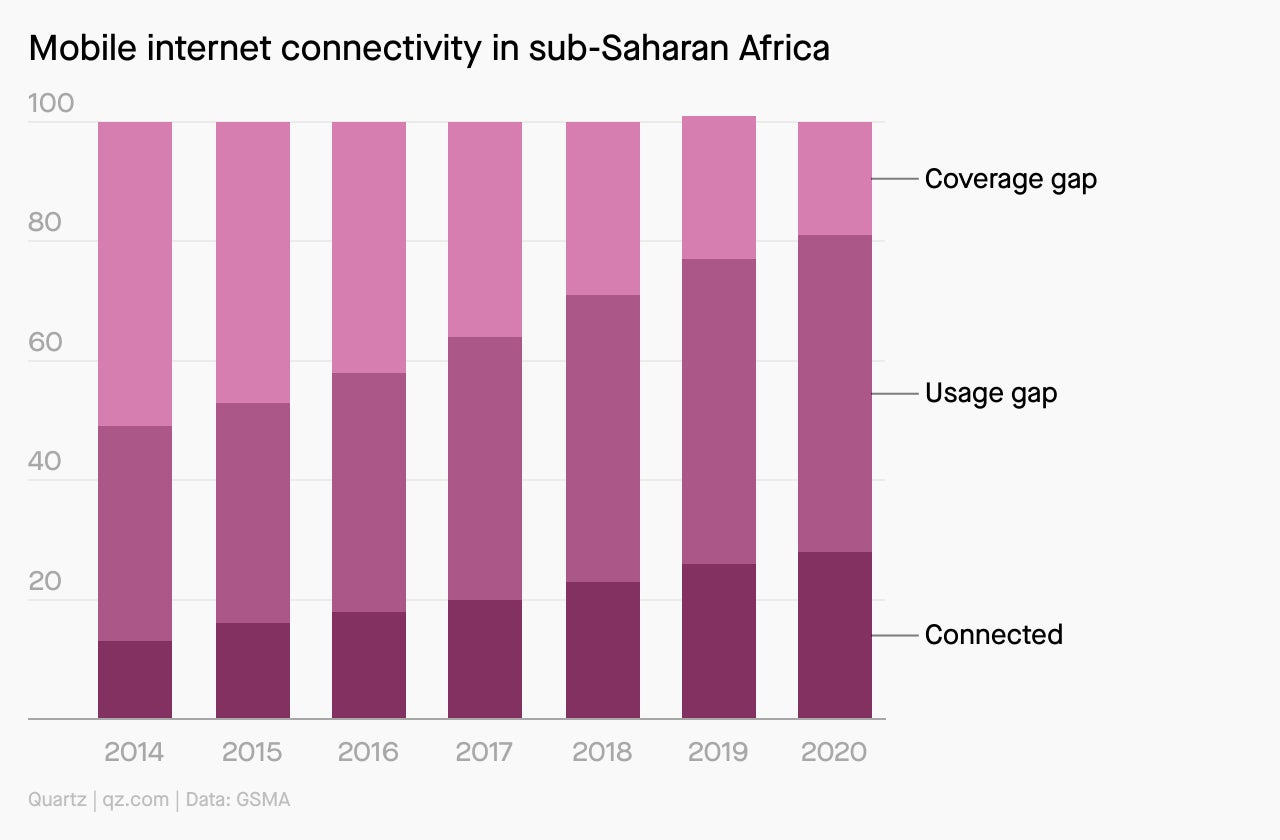

Breaking down mobile broadband coverage. The mobile phone is the main tool people use to access the internet in Africa. Carlos Mureithi unpacks a new report that says sub-Saharan Africa is the region with the largest coverage gap—people living in areas not covered by a mobile broadband network.

Charting Africa’s mobile money growth

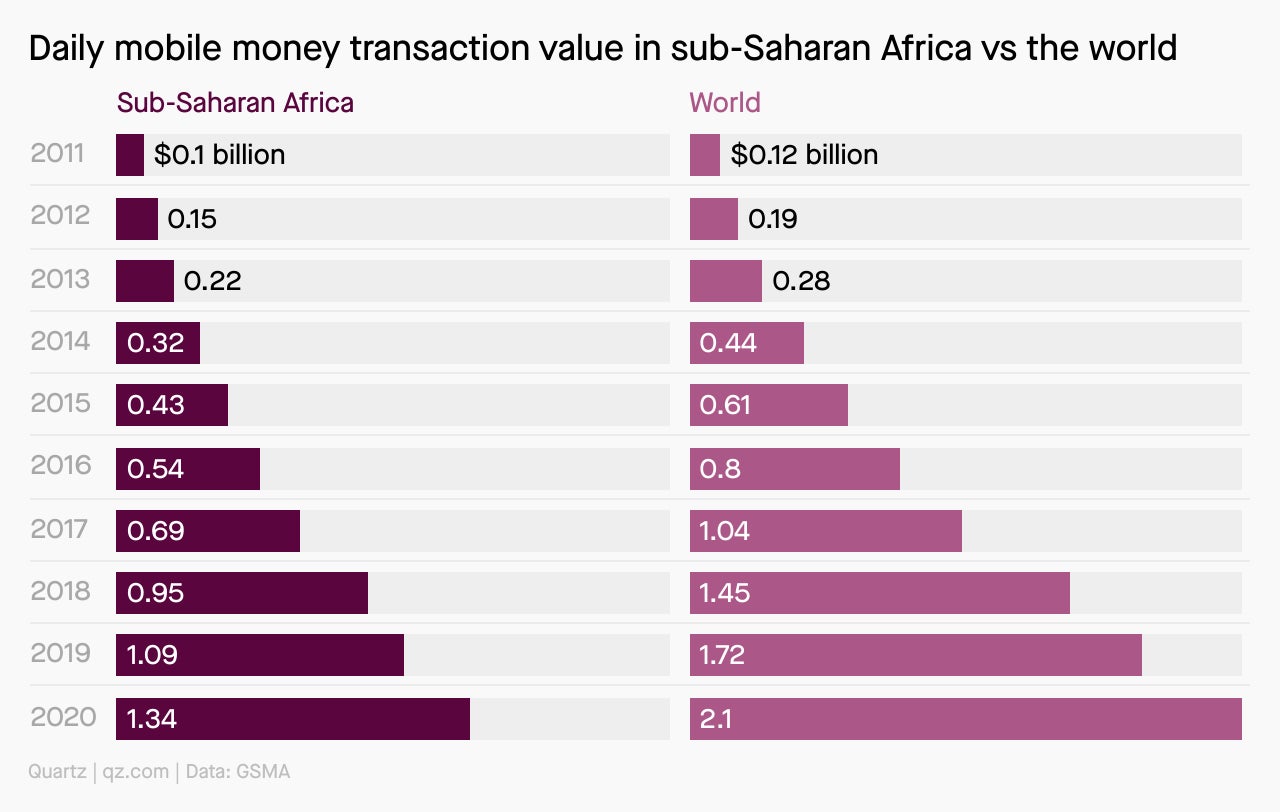

At least 11 countries in sub-Saharan Africa have five or more deployed mobile money services, from five in Kenya to 17 in Nigeria. More than half of the 310 live mobile money services in the world are in Africa.

As a result, sub-Saharan Africa is the mobile money capital of the world. Indeed, it has been so for the last 10 years, during which time the number of registered accounts and daily value of transactions in the region have grown 11- and 13-fold, respectively.

The data show why investors have been drawn to startups like OPay and Wave. As Alexander Onukwue explains, the markets in sub-Saharan Africa can be made more conducive to more investors who want to fund mobile money endeavors.

Dealmaker

Flat6Labs, a venture capital firm, has finished raising a $10 million fund, with which it will invest in early-stage startups in Tunisia. This is a follow-up to the $13 million fund it closed in May to invest in Egypt, and illustrative of the staggering rise of startup funding activity in 2021 in North Africa.

Baobab+, a distributor of solar home systems in west Africa and Madagascar, received €10 million ($11.6 million) from Norfund, the Norwegian government’s private equity firm that invests in developing countries. The equity investment will help the company expand to Nigeria and the Democratic Republic of the Congo, and add to operations in Côte d’Ivoire, Mali, and Senegal.

Yellow Card, a cryptocurrency exchange in Nigeria, raised $15 million in Series A funding. The round was led by Valar Ventures, Third Prime, and Castle Island Ventures, with Square, Blockchain.com Ventures, Coinbase Ventures, and a number of other investors participating. The company said it is present in 12 African countries, and that its users have increased by almost 30-fold since early last year.

Quartz Gems

Need something new to listen to? In two weeks we’re launching the Quartz Obsession podcast, an even deeper dive into the objects and ideas that shape the global economy. Listen to the trailer now, and subscribe wherever you get your podcasts, whether that’s Spotify, Apple, or Google.

And make sure you’re a Quartz member (take 40% off using code QZPODCAST) to get the full experience.

Other things we liked

Holding Shell accountable for oil spills. In Nigeria, foreign holding companies often refuse to take the blame for misdeeds by their local subsidiaries. For the Guardian, Maggie Andresen writes about a landmark legal case that may finally make it possible for communities to sue the negligent parent companies.

Supplying hospitals with cheaper oxygen. The Covid-19 pandemic drastically increased the demand for oxygen. For Bloomberg, David Herbling writes about Bernard Olayo, a Kenyan entrepreneur who is using a “milkman model” to supply hospitals at a lower price.

TikTok is jamming to the beat. If you thought Wizkid was the only Afrobeats star with a summer bop, then you haven’t been on TikTok, where CKay’s “Love Nwantinti” is stealing hearts. In Rolling Stone, Nelson C.J. explains why the young Nigerian artist is now getting love for a song that is two years old.

Land of the happiest people. The first novel by African Nobel Laureate Wole Soyinka in nearly 50 years is here. The New York Times review by Juan Gabriel Vásquez describes it as political satire meets murder mystery, which is on brand for the eclectic octogenarian Nigerian, who has had a unique view of the country’s rollercoaster pursuit of happiness since before independence.

ICYMI

Providing support for female business owners. The United Nations Institute for Training and Research has a survey for female entrepreneurs to help the body identify training need gaps for the business owners.

Rooting for Black representation. The 2022 Netflix Postgraduate Scholarship Programme aims to support the formal qualification and training of aspiring Black creatives in film and TV. (Oct. 31)

Keep an eye on

Ethiopia votes amid pressure over war. Ethiopians voted on Thursday to elect federal parliamentary representatives in three regions where elections had been delayed. After the elections, which were to originally take place in June, prime minister Abiy Ahmed will form a new government. The voting comes at a time when some opposition parties have boycotted the polls and Abiy is under intense pressure over the war in the Tigray region.

🎵 This brief was produced while listening to “Tapu Ku Banganhu” by Zeca Di Nha Reinalda (Cape Verde)

Our best wishes for a productive and ideas-filled week ahead. Please send any news, comments, suggestions, ideas, hard currency, and data bundles to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.