Coronavirus: Braving an economic epidemic

Hello Quartz readers!

Hello Quartz readers!

Welcome to Need to Know: Coronavirus. A few times each week, we’ll pop into your inbox to parse signal from noise, examining how Covid-19 is impacting the global economy and the way we live our lives. We also want to know what’s on your mind, so don’t hesitate to send questions, thoughts, or photos of your stocked pantry to [email protected]. Let’s get started.

Don’t touch your face—or your investments

Following global equities’ worst week since 2008, the US Federal Reserve on Tuesday cut its primary interest rate by half a percentage point in an attempt to ease the economy’s adverse reaction to the novel coronavirus. But the market’s reaction was muted—and why wouldn’t it be? The US central bank is, in central-banker parlance, pushing on a string.

To the Federal Reserve, every problem looks like a potential credit crunch, and the only solution is more rate cuts. But from an economic point of view, looser credit conditions are unlikely to reverse market declines driven by concerns about slowing economic activity in China, falling travel and tourism, and lower production overall as the virus spreads.

Markets appear most worried that the virus will cause what economists call “supply shocks.” Already, products and components that US businesses expect to arrive aren’t coming because Chinese factories are closed to prevent the spread of Covid-19. More businesses will face labor shortages if employees must stay home due to quarantines or school closures.

Cutting interest rates, meanwhile, is all about goosing demand for goods and services. That’s why it works during a traditional recession, when the economy tends to have a plentiful supply of idle workers and raw materials, but lacks the spending to get them into action. When unemployment is high, looser credit conditions can help businesses get those workers once again producing, and spending their paychecks. But there’s little reason to believe that more access to capital will help companies get sick workers back faster. Instead, governments should be considering short-term measures like picking up health care costs, covering lost hours for workers, and mandating temporary paid leave.

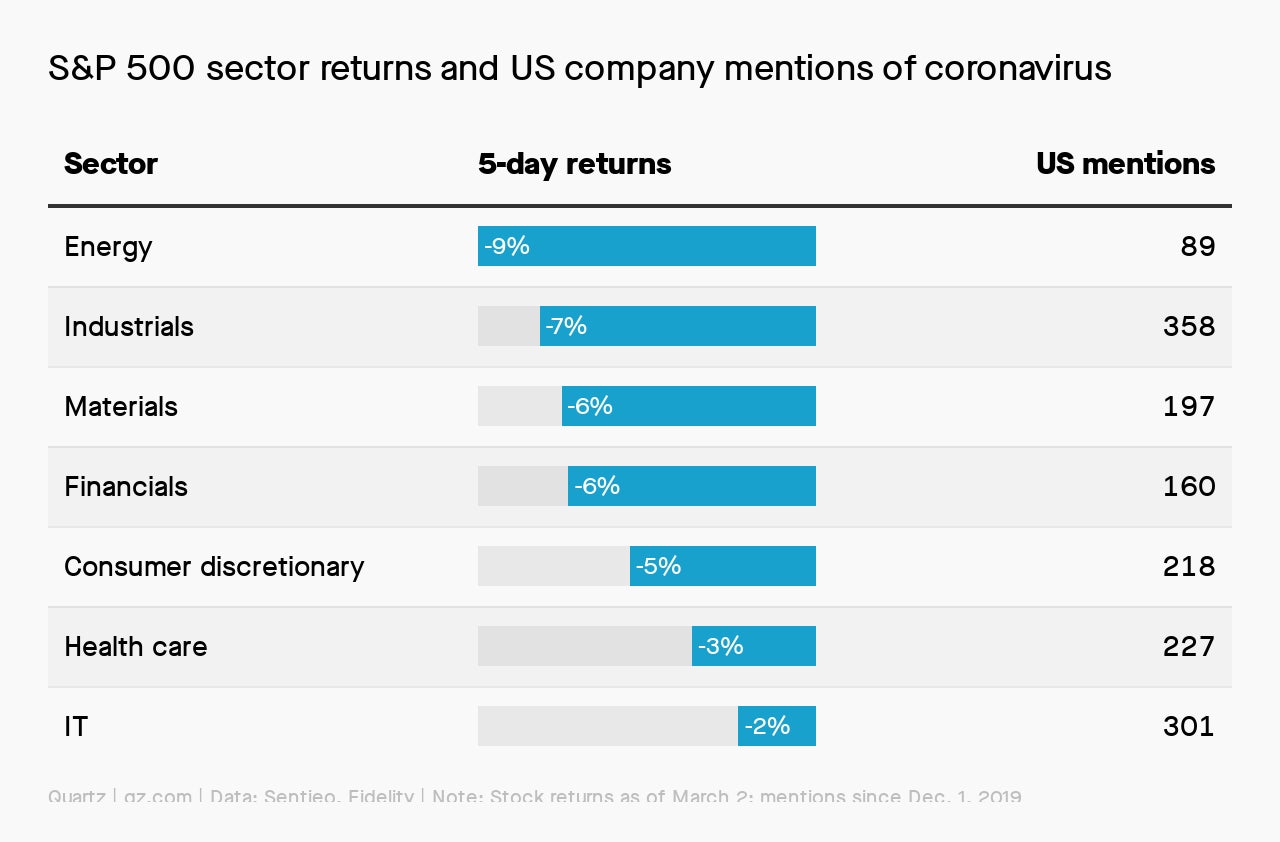

Already, all the uncertainty is showing up in corporate filings and earnings calls, as analysts and executives try to calculate the impact of the epidemic on supply chains, the global economy, and commodity prices.

Defining the relationship

Remember: Coronavirus and Covid-19 are not the same thing. Covid-19—technically COVID-19, but we find that a bit shouty—is the disease caused by the novel coronavirus that first emerged in China’s Hubei province. (Covid stands for COronaVIrus Disease.)

While we’re defining things: This is an epidemic, i.e. a sudden above-normal increase in the number of cases of a disease. A pandemic refers to an epidemic that spreads between people (check), can be fatal (check), and has spread worldwide (check?) So far, the World Health Organization hasn’t said the p-word.

By the digits

Due to coronavirus concerns, organizers have already canceled events that include Baselworld, Mobile World Congress, and the Facebook developers conference. But all 👀 are on Tokyo, where the 2020 Olympic Games are scheduled to take place in July.

This week, a spokesman for the International Olympic Committee said the games will move ahead as planned, though just last month the IOC warned of a possible cancellation if Covid-19 is not contained by June. Such a move would have, um, implications:

- 3: Number of times the Olympics have been canceled, all during world wars

- $3 billion: Amount Japanese companies have paid for related sponsorships, a record figure

- 7.8 million: Total number of tickets for this year’s Olympic Games, with 4.48 million sold to Japanese residents

- $300 billion: Japan’s expected tourism boost from the Olympics and the Paralympics

- 600: Athletes who are part of China’s 2020 Olympic team, making it the largest expected delegation

Let’s talk turkey

All these unanswered questions can be hard to handle, but embracing the unknown will benefit you well beyond coronavirus. In RISK, a video series for Quartz members, psychologist Gerd Gigerenzer explains the “turkey illusion,” a metaphor for our tendency to assume that the way something has always been is the way it will always be. (The metaphor has to do with a turkey not realizing its source of food will one day also kill it. Fun stuff!) This 10-minute episode is a perfect companion to stress-eating M&Ms while you order hand sanitizer on Amazon.

Essential reading:

- The latest figures: According to Johns Hopkins University, there are currently 92,818 confirmed cases globally, with 48,201 classified as “recovered.”

- Demand shock: OPEC members are deciding how to adjust oil prices in response to the outbreak.

- Empty seats: China’s box office receipts are off by almost $2 billion from this time last year.

- Big retail: Amazon and Walmart are trying to stay on top of price-gouging.

- List of solutions: To handle an epidemic, Bill Gates is pitching a public health system.

- Friendly reminder: You will probably get coronavirus, and you’ll also probably be OK.

- Relatable reaction: All we want to do now is touch our faces.

- Viral music: As a song, the DNA sequence of the virus isn’t so bad.

Our best wishes for a healthy day. Please send any news, comments, tips, questions, or extra hand sanitizer to [email protected]. Get the most out of Quartz by downloading our app and becoming a member. Today’s newsletter was brought to you by John Detrixhe, Ali Griswold, Tim Fernholz, Annabelle Timsit, Max Lockie, Susan Howson, and Kira Bindrim.