Coronavirus: The pace-time continuum

Hello Quartz readers,

Hello Quartz readers,

As best we can tell, March lasted eight years, and April eight minutes. Chronemics, or the study of time as a form of communication, can help explain why.

Dawna Ballard, a chronemics expert at the University of Texas at Austin, says time is wonky now because we’ve added tasks that we never had to think about before. Instead of just buying groceries, for example, we might have to put on a mask, wait in socially-distanced lines, make shelf-stable choices, and find a place to stash extra wine. All these “inputs,” says Ballard, quicken our pace. The sense of slowness comes from a density of new demands.

Quarantine is a unique pacing challenge, but Ballard sees parallels to changing jobs. What’s draining is not just adapting to a new workflow or new colleagues, but all the little things—like whether you successfully lined up childcare, mastered a new commute, or discovered some good spots for lunch. Accordingly, Ballard’s lockdown advice is also her new-job advice: Slow down. Get more sleep than you think you need. Do less whenever you can. Keep the social connections that matter. Stop trying to multitask.

Our best new-job advice, old-job advice, or what’s-going-to-happen-to-my-job-advice is to sign up for The Memo, a weekly missive from Quartz at Work (and source of the above wisdom).

Okay, let’s get started.

Banking on it

Lenders are about to get smacked by the coronavirus pandemic. In the past few weeks, some of the biggest US and European banks reported first-quarter earnings, giving us insight into how these institutions are preparing to withstand the malaise.

1️⃣ Executives are bracing for losses—but some more than others.

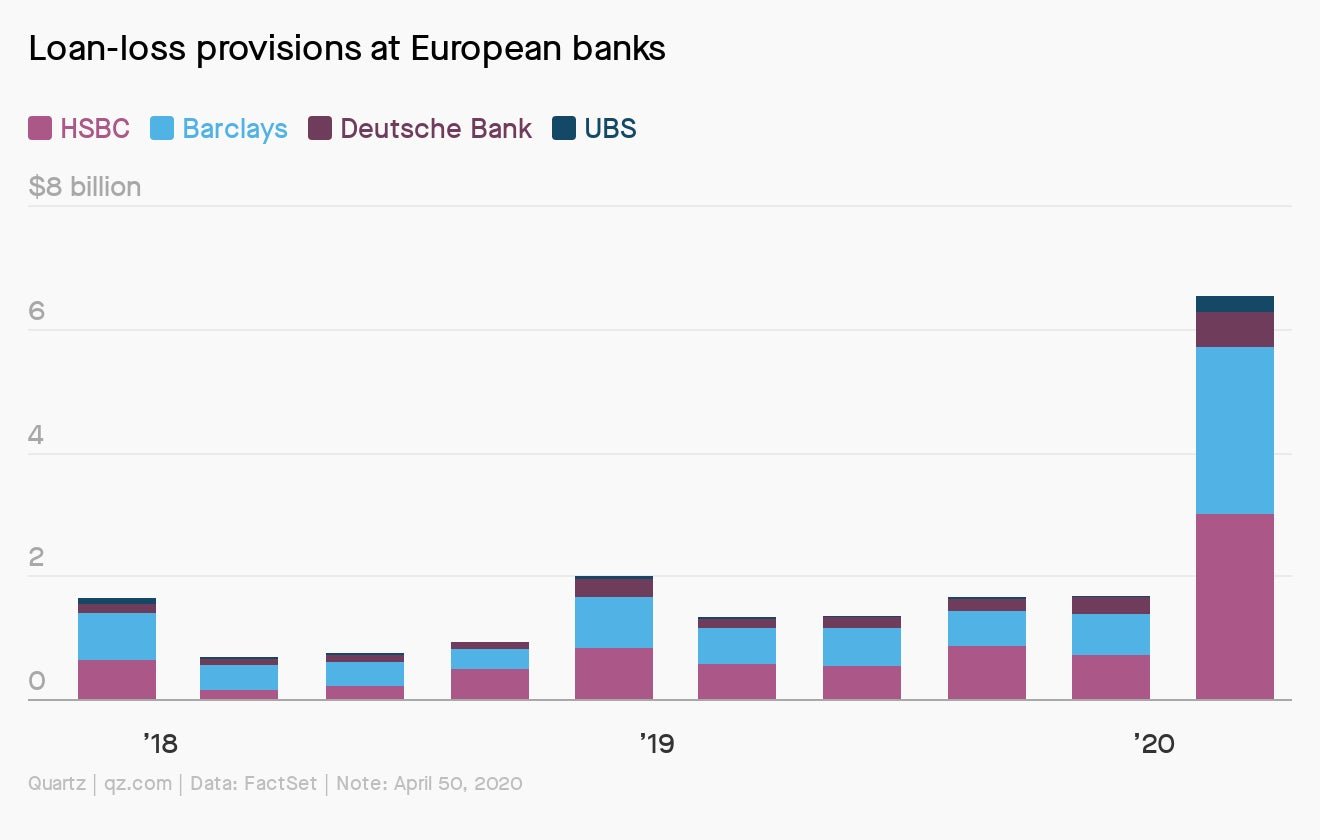

Provisions for soured loans and missed payments at London-based HSBC and Barclays more than quadrupled, while provisions at Deutsche Bank doubled. Some analysts said the money the German bank set aside for losses appears a little light.

What to watch for: European regulators have counseled the region’s banks to be less aggressive in preparing for losses than their US peers, recognizing that the continent’s banks might have to choose between such preparations and continuing to make new loans. Italy’s Unicredit will post results on May 6.

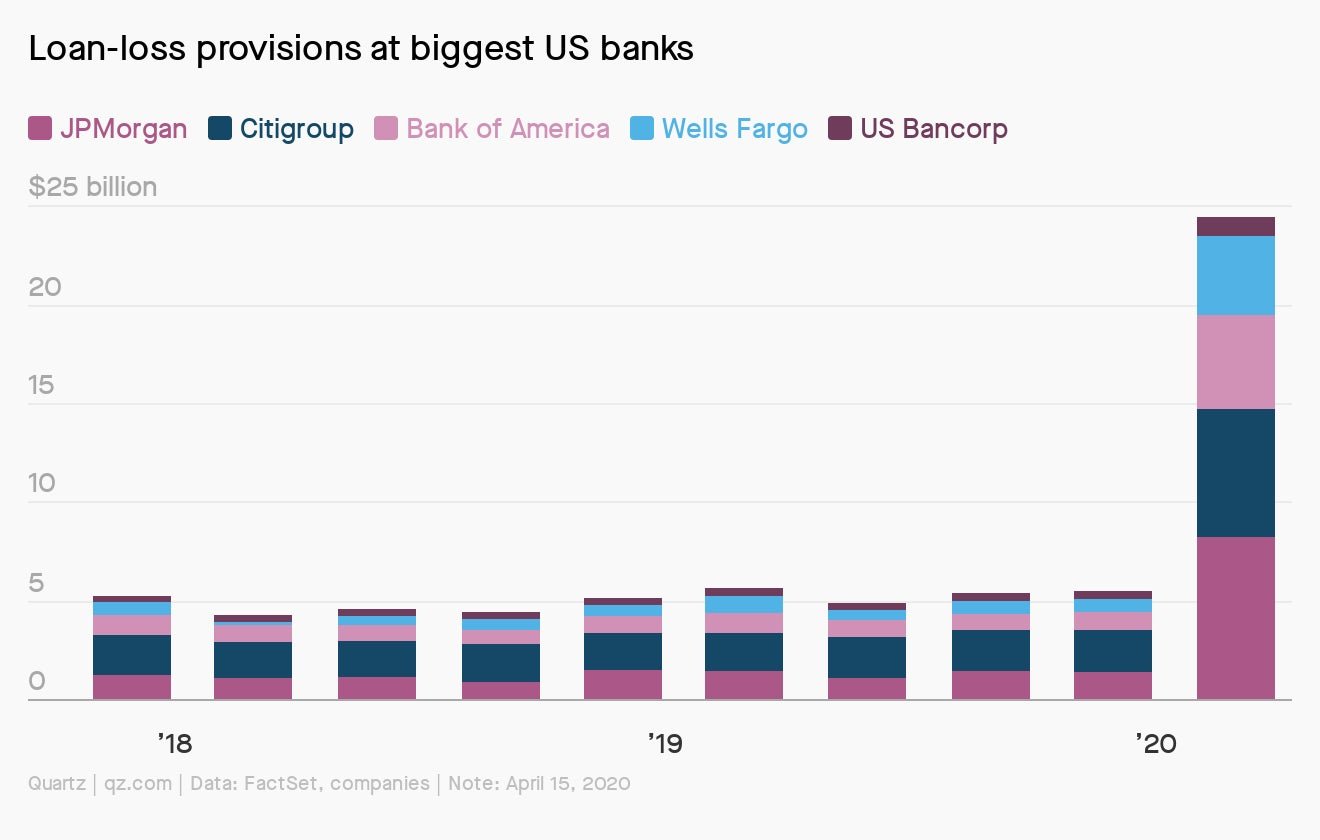

2️⃣ Big US banks stashed away $24 billion of loan-loss provisions in the first quarter.

That’s almost five times as much as in the same quarter a year ago, according to FactSet data.

What to watch for: The banks’ capacity to withstand a deepening recession will depend greatly on the effectiveness of government programs to shore up unemployed workers and businesses.

3️⃣ Deutsche Bank may not have the year it was hoping for.

This crisis comes just as CEO Christian Sewing’s turnaround plan was gaining steam. Quarterly earnings came in above analyst expectations, but turmoil from the coronavirus has put its plan to return to profitability this year in doubt.

What to watch for: Germany’s biggest bank could be facing its sixth consecutive annual loss.

4️⃣ Trading was a bright spot for banks on both continents.

One of the ways these firms make money is by quoting bids and offers on securities, and profiting on the spread between those prices. That spread widened in March as uncertainty and volatility in the markets skyrocketed.

What to watch for: “You’re seeing a radical economic cycle happening in about a month,” Barclays chief Jes Staley said in a conference call with analysts. “We do believe that the wholesale business will continue to offset to a certain degree what we’re probably going to face in our consumer business for the rest of the year.”

Too fast too curious

We’re constantly learning new things over here—just the other day, we discovered (indirectly) that touching a healthy lung feels like putting your fingers in “a bowl of whipped cream.”

But we try to save our most important intel for ✦ Quartz members. Here’s what we’ve learned lately:

- Some countries are offering companies perks to move manufacturing out of China.

- Economists say the US can afford to spend its way out of this crisis.

- Since lockdowns began in Wuhan, China has stockpiled 76 million barrels of oil.

- US airlines are entering an era of less congestion, fewer delays, and higher prices.

Remember, you too can become a Quartz member—think of it as putting your brain in a bowl of whipped cream. Get started with a 7-day free trial or take a 40% discount on our $99 annual plan.

You asked

What’s the deal with remdesivir?

Okay you haven’t asked yet, but we know it’s coming.

Remdesivir is an antiviral originally developed as a treatment for Ebola. It had minimal effect, but researchers later discovered it blocked some coronaviruses—including those behind SARS and MERS—from replicating in animals. Now the drug is being tested in Covid-19 patients; currently, the only way to get access is to be part of a clinical trial.

On April 29, we got the results—but not the data—of one US-run trial. Of 1,063 patients, those given remdesivir recovered in about 11 days, compared with 15 days for those given a placebo. It didn’t show reduced deaths, and, crucially, this is just one study. A smaller remdesivir study found no benefit compared to a placebo.

The US study isn’t peer-reviewed yet—a critical vetting process for research. But based on its results, the US Food and Drug Administration is expected to issue an emergency use authorization, which would let doctors treat patients with remdesivir outside of trials.

Going the social distance

As global lockdowns start to ease up, attention is turning to “everyday life quarantine.” That’s how South Korea refers to the guidelines it’s using to reopen the local economy. By looking at cities, countries, and companies with such recommendations in place, we’re starting to catch a glimpse of life after lockdown.

- Construction workers across the US may be required to wear a device on their hard hats that emits an alarm if they come within six feet of another employee at a job site.

- At US restaurant chain Waffle House, some counter stools and booths are blocked off, and plastic menus must be requested. Every location will enforce its own capacity limit, depending on layout.

- At a Volkswagen plant in Germany, workers use elbows to open doors and must keep socially distant during team meetings and lunch breaks. Tools are no longer passed by hand.

- At 49 soon-to-reopen malls across the US, play areas and drinking fountains will be temporarily closed, mall-provided strollers won’t be available, and regular audio announcements will be made to remind shoppers to social distance.

- In South Korea, restaurant patrons are advised to sit in a row or zig-zag to avoid directly facing each other. At stadiums, fans are asked to avoid cheering too loudly (because of the risk of spraying saliva).

- Around the world, drive-in movies are becoming popular again. In the 1950s, when outbreaks of polio became severe, some drive-ins boasted that their venues were the perfect place to be “flu and polio protected.”

Essential reading

- The latest 🌏 figures: 3,249,022 confirmed cases; 1,008,498 classified as “recovered.

- Global warning: Will Covid-19 stop climate-change protests?

- Men of flu words: Dems and Republicans use different language to discuss Covid-19.

- Your mask looks tights: A layer of nylon can make your mask more effective.

- At least someone’s organized: Organized theft of PPE is a thing now.

Our best wishes for a healthy day. Get in touch with us at [email protected], and live your best Quartz life by downloading our app and becoming a member. Today’s newsletter was brought to you by Lila MacLellan, John Detrixhe, Olivia Goldhill, Mary Hui, and Kira Bindrim.