🌍 Tencent’s scramble

Plus: Crypto domain names are the next crypto.

Good morning, Quartz readers!

Here’s what you need to know

Shares of China’s food delivery giant Meituan fell 9%. The drop followed news from Reuters that Tencent is looking to sell most of its $24 billion stake in the company. (See more about Tencent’s earnings below).

A heat wave forced factories to shut down at one of China’s manufacturing hubs. Plants in Sichuan closed for six days as dozens of cities across the country endure 40°C (104°F) temperatures.

Wall Street geared up for Russia debt trading… After the US Treasury confirmed selling those assets wouldn’t be a breach of sanctions, major banks sought to arrange trades for their clients.

… and was happily surprised by Walmart’s earnings. The retail behemoth said it’s seeing more high-earning customers visit its stores to buy cheaper goods during high inflation.

American Airlines put down a deposit on 20 Boom supersonic jets. The aircrafts, when ready, should cut the travel time of transatlantic flights by half.

BMW disputed the involvement of a self-driving car in a fatal crash. The automaker contradicted a police report describing the accident involving an autonomous test vehicle.

Ted Baker accepted a $255 million takeover offer from Authentic Brands Group. The American retailer is adding yet another brand to its sprawling portfolio.

What to watch for

Whether it’s actually selling most of its shares in Meituan, things aren’t looking great for Tencent. The Chinese gaming and social media giant, which runs the massively influential app WeChat, will post its second-quarter earnings today, and the numbers are expected to be another signal that the country’s economy is struggling to recover from covid lockdowns.

Tencent’s been missing revenue estimates each quarter since the start of 2020, but analysts think the latest results could show the company’s first actual revenue decline, with the figure coming in at 132.2 billion yuan ($19.5 billion), or a 4% year-over-year dip.

Investors will be closely watching how Tencent’s gaming business performs, which makes up about a third of the company’s sales and has been hampered by regulatory pressures. They’re also expecting that Tencent’s other big money maker, advertising, will dry up as brands move to cut costs to offset macro headwinds.

Crypto domain names are hot, crypto itself is not

There’s a crypto land grab afoot, but this time it doesn’t involve shiba inu-themed coins.

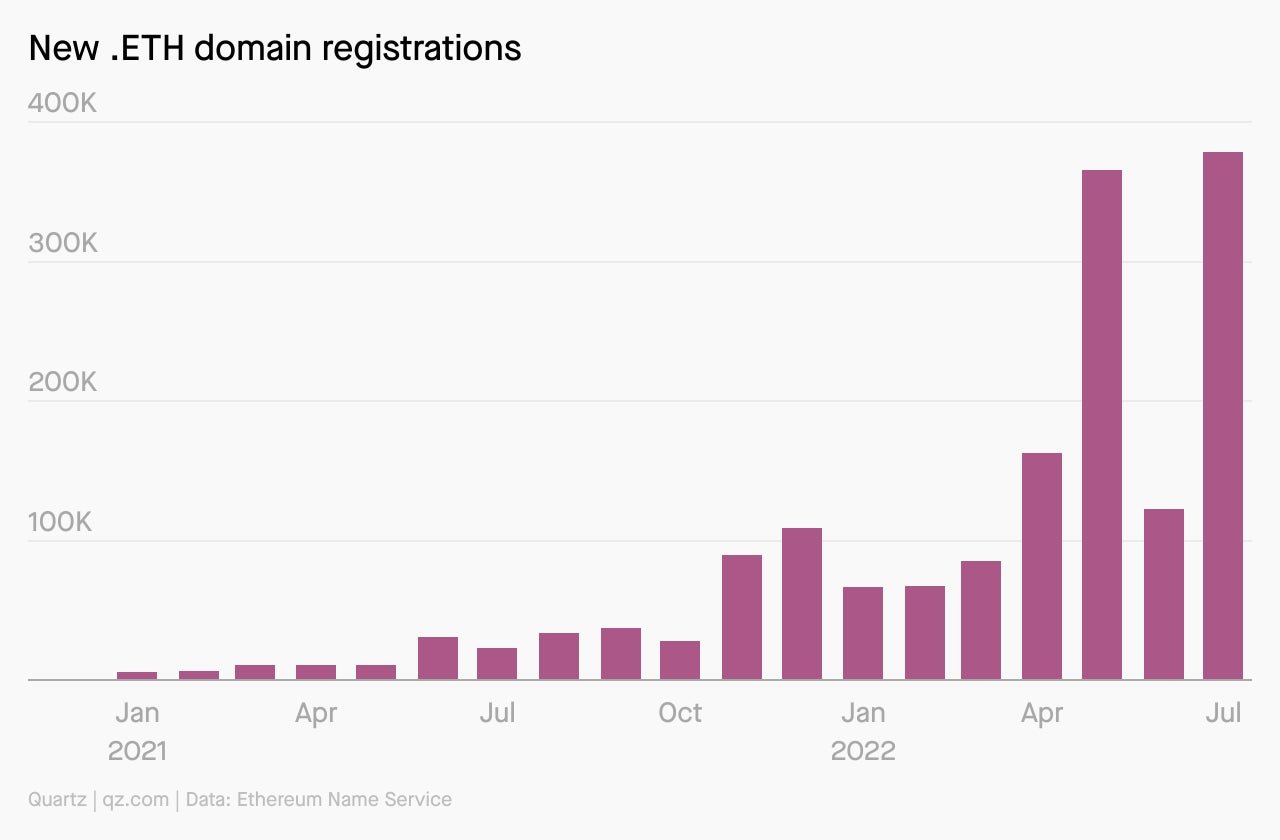

Administered by the Ethereum Name Service, an .eth domain serves as a public profile to showcase one’s Ethereum blockchain transactions and holdings—and it can also be sold as an NFT. In July, the ENS reported record numbers: 378,804 .eth domain names were registered, 25,000 names were renewed, and it made about $3.9 million in net income.

Why bother? A three- or four-digit ENS domain could land you in online social communities and bragging rights arenas like the 999 and 10k clubs. But it’s not cheap: Membership in these clubs could cost you tens of thousands of dollars.

This boom comes at an odd time for the broader crypto industry. While domain sales are up, most crypto assets are down. But this speculative boom is, in a sense, something internet entrepreneurs have been doing for decades: buying up domain names to make a buck.

India’s in hot water with FIFA

Yesterday, FIFA suspended the All India Football Federation with immediate effect due to “undue influence from third parties.” India stands to lose out on hosting the Under-17 Women’s World Cup 2022, which began selling tickets earlier this month.

Ananya Bhattacharya takes a look at the AIFF’s problems and how they reflect a sports industry riddled with corruption and nepotism.

✦ Love stories like this one? Member support helps keep Quartz stories free and accessible to all. Daily Brief readers can take 40% off!

Surprising discoveries

Access to free menstrual products is now a legal right in Scotland. The law is considered to be the first of its kind in the world.

Celebrity investors want to bring the Tasmanian tiger back from extinction. The ambitious project is helmed by a startup whose backers include the Hemsworth brothers and Paris Hilton.

The Florida airspace has gotten too crowded. Military exercises, space launches, private jets, and tough weather are clogging up the skies for commercial flights.

Corneal implants made from pig skin protein may actually work. Restored eyesight in a clinical trial shows promise for a cheaper, more readily available alternative to organ donation.

The UK’s newest museum might hold Britain’s oldest known vertebrate embryo. What to expect when a 180 million-year-old fossil is expecting!

Our best wishes for a productive day. Send any news, comments, pig solutions, and 180 million-year-old baby showers to [email protected]. Reader support makes Quartz available to all—become a member. Today’s Daily Brief was brought to you by Susan Howson, Scott Nover, Sofia Lotto Persio, and Morgan Haefner.