🌎 US debt alert

Plus: Ryan Reynolds’ “Ted-Lasso”-like investment is already paying off.

Good morning, Quartz readers!

Here’s what you need to know

The US debt has reached a new record. The $31 trillion figure is edging closer to the borrowing cap Congress imposed for the year.

Elon Musk renewed his offer to buy Twitter. As a lengthy acquisition drama was about to see its day in court, the billionaire seemingly had a change of heart. Banks that committed debt financing to the deal are now in trouble.

The US lost 1 million job openings in August. The biggest drop since the start of the pandemic suggests the economic slowdown is catching up with the job market, whose tightness has contributed to a plateauing income inequality.

What to watch for

In October 2021, a wave of workers around the globe, from Kellogg employees to South African metalworkers, went on strike in what’s been referred to as “Striketober.” That nickname looks apt for this October too, as rail workers in the UK, pilots in Germany, and Sysco drivers and Amazon workers in the US plan walkouts.

Last year, Striketober arrived at a time when employees were working in overdrive, putting themselves at risk at the height of a public health crisis to meet pent-up demand. Since then, a tight labor market has helped fuel labor action, especially in the US, while a cost-of-living crisis across Europe has driven workers to seek higher pay.

But labor power could soon see a shift, at least in the world’s largest economy. In the US, employers took more than a million job openings off the market in August. Whether workers can maintain momentum amid a softening labor market remains to be seen.

Ryan Reynolds’ “Ted-Lasso”-like investment is already paying off

Marvel’s Deadpool 3 trailer has dropped, and leading man Ryan Reynolds couldn’t miss on the opportunity to plug his recent investment in a struggling Welsh soccer team, Wrexham AFC. In one scene of the video, posted on his personal YouTube channel and already watched more than 13.4 million times, Reynolds is seen wearing the team’s hat.

In 2020, Reynolds and his co-investor, fellow actor Rob McElhenney, injected $2.5 million into the team. They also brought priceless Hollywood star power and filmed the documentary Welcome to Wrexham, which follows their efforts in bringing the soccer team back to its former glory.

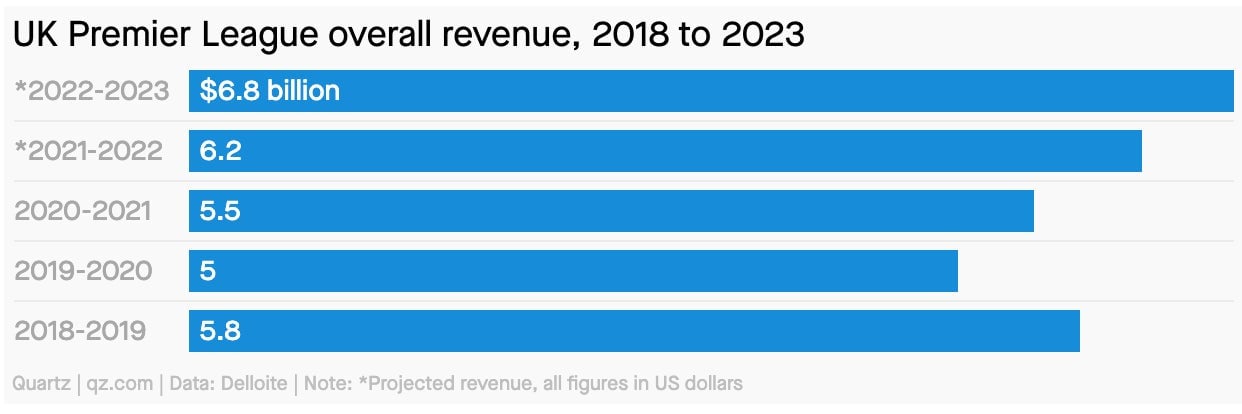

The team hardly needs any more promotion at this point—its merchandise is already selling like hot cakes. Sales have spiked from roughly $67,000 last year to $405,000—not quite the level of Premier League clubs, but not bad for a team whose hometown only counts 136,000 residents.

Would taxes solve rising fuel costs?

“One way or another, there needs to be government intervention. A government intervention that somehow results in protecting the poorest, that probably may then mean that governments need to tax people in this room to pay for it.”

—Shell CEO Ben van Beurden, at the Energy Intelligence Forum in London yesterday, quoted by Bloomberg, on how to deal with the soaring cost of fuel (without price caps, of course)

While Shell later clarified that van Beurden was referring to companies and not wealthy individuals in that statement, his ethos rings clear: authorities should take from the rich to help the poor. His words fall in line with the UN’s stance on taxing oil and gas companies to drive down high prices, but does the policy go far enough?

✦ Love stories like these? Quartz membership helps keep our site free and accessible to all. Become a member today and take off 40% when you do.

Surprising discoveries

Ancient coins were found inside a wall in the Golan Heights. They may have been stashed there in the 7th century.

Paris Métro is bidding adieu to paper tickets. After 120 years, they will join the poinçonneurs in the history books.

A water startup proved there’s a thirst for edgy packaging. Liquid Death is now valued at $700 million.

A particular strain of the flu has not been detected since April 2020. Its disappearance may be explained by the uptick in social distancing and masking that’s been used to stop the spread of covid.

The Onion filed an amicus brief with the US Supreme Court. Their very serious argument in defense of parody is also seriously funny.

Our best wishes for a productive day. Send any news, comments, ancient coins, and edgy water to [email protected]. Reader support makes Quartz available to all—become a member. Today’s Daily Brief was brought to you by Sofia Lotto Persio, Adario Strange, Michelle Cheng, Julia Malleck, and Morgan Haefner.