🌎 Not-so-quiet quitters

Plus: Gautam Adani is poised to get richer.

Good morning, Quartz readers!

Here’s what you need to know

Americans are still quitting at near-record levels as job openings rise. The hot labor market will prompt the Fed to continue raising rates more aggressively, as it has been doing.

The US treasury department has lowered the rate for its I bonds. From a record 9.62%, the interest rate is now set to 6.89% through April 2023.

A major Chinese industrial park went into a weeklong covid lockdown. One of the factories affected is the world’s largest iPhone plant, operated by Apple supplier Foxconn.

US airline pilots demanded better conditions. United Airlines pilots rejected a tentative contract, while Delta Airlines pilots authorized a strike to add urgency to pandemic-delayed contract negotiations.

Elon Musk lowered the price for Twitter Blue while haggling with Stephen King. The author threatened to leave the platform over the proposed monthly fee, initially reported to be $20.

Brazilian president Jair Bolsonaro has yet to formally concede. As his supporters continued a road blockade, the far-right leader neither accepted nor contested his election loss.

What to watch for

Three of Gautam Adani’s businesses in the infra, energy, and utilities sectors are reporting earnings in the coming weeks. If the quarterly performance of companies in the same industries is any indication, Adani, who’s already Asia’s wealthiest person, is looking to solidify his place among the world’s top billionaires.

Adani Ports & Special Economic Zone, India’s largest private port operator, already beat analyst expectations yesterday (Nov. 1) as trade volumes fully recovered from pandemic lockdowns. Adani Green Energy is set to deliver sound results amid increased demand for alternative sources of fuel. And then it’s the turn of flagship Adani Enterprises, a multibagger stock which was recently included in the Nifty 50, India’s benchmark stock market index.

While it’s been a long upward journey for the conglomerate, the chairman’s wealth has skyrocketed this year. Adani has just reclaimed his position as the third-richest person in the world, ahead of Amazon founder Jeff Bezos.

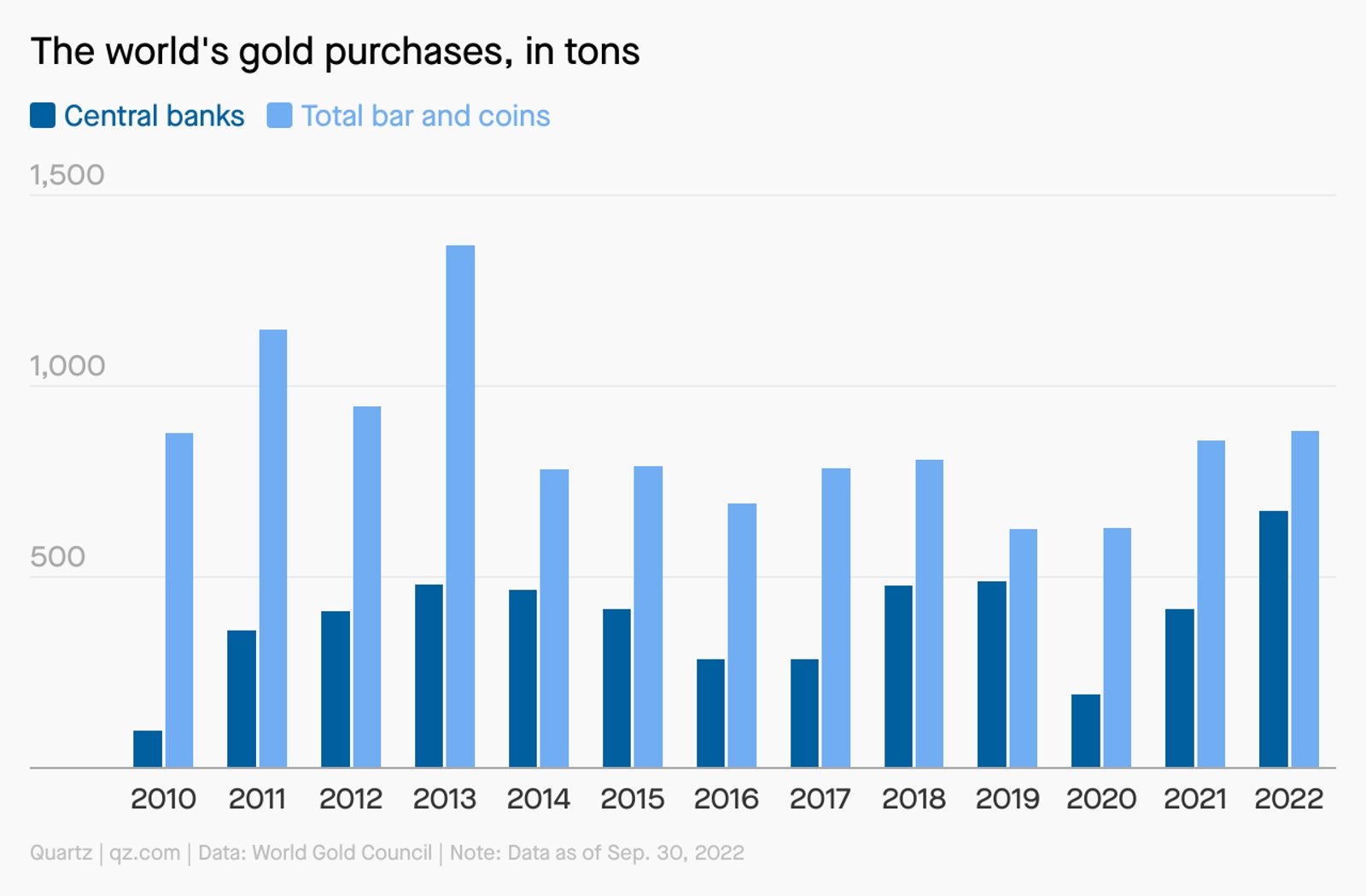

Central banks are having a gold frenzy

It’s the late 1960s. The Beatles’ “All You Need Is Love” is playing, people are deciding what tie-dye shirt to wear, and central banks are just chock full of gold.

Gold is regarded as an effective inflation hedge, although some analysts believe this to be true only over time horizons stretching over a century or more. But scorching inflation is pushing demand higher for safer assets. Central banks in Turkey, Uzbekistan, and India were among the biggest buyers of gold during the last quarter.

Another (safer) investment: Spam

Spam is having a resurgence as shoppers turn to cheap and convenient food during soaring inflation. But in some places, the portmanteau for “spiced ham” never stopped being cool. In South Korea, for instance, Spam is offered as a holiday gift. Part of the luncheon meat’s enduring allure is that it’s more than just something you eat—it’s rooted in tradition, versatility, convenience, and culture.

We’re peeling back the lid on Spam in our next Weekly Obsession. Sign up to get the email in your inbox today! And while you’re at it, grab a Quartz membership at our lowest discount yet (60% off) to support our work.

Quartz’s most popular

🟡 Central banks haven’t bought this much gold since 1967

Surprising discoveries

TSwift swept the Top 10 charts. It’s a first in the Billboard Hot 100’s 64-year history.

An area four times the size of India would be needed to meet land-based carbon removal goals. Totaling about 1.2 billion hectares (2.9 billion acres), that’s not likely to happen.

New Zealand’s tax authority apologized for trying to teach finance on Halloween. Its idea to tax candy was about as popular as its earlier “cow fart” fee.

A first print edition of the US Constitution will soon be up for auction. One of the two copies in existence sold last year for $43.2 million.

Neanderthals went out with a bang. They were probably doing the devil’s tango with too many Homo sapiens.

Our best wishes for a productive day. Send any news, comments, candy fraud, and the other US Constitution copy to [email protected]. Reader support makes Quartz available to all—become a member. Today’s Daily Brief was brought to you by Ananya Bhattacharya, Sofia Lotto Persio, Julia Malleck, and Morgan Haefner.