🌏 Will Nvidia pop?

Plus: Hotels are cool again.

Good morning, Quartz readers!

Suggested Reading

Here’s what you need to know

Nvidia just had its worst day on the stock market since December 2022. The chipmaker reports earnings today to a Wall Street that’s anxiously watching to see if its bubble has burst.

Related Content

Discover stock surged because Capital One wants to buy it. Capital One’s $35.3 billion bet is exciting investors (read about another big number from the deal below).

Elon Musk said Neuralink’s first human patient can move a computer cursor with their mind. The startup is testing how many hands-free clicks the patient can make.

Israel’s war against Hamas is hitting its economy even harder than expected. The country’s economy shrunk at an annual rate of almost 20% at the end of last year.

Hotels are cool again

Fresh hand towels and room service are back, baby! Holiday Inn’s parent company InterContinental Hotels Group did very well last year — so well that its revenue per room (a measure of success in the hotel biz) was up 11% from 2019.

IHG’s really good year is also really good for investors. The company’s CEO, who took over in July, said the company expects to return more than $1 billion to shareholders in 2024. Sounds pretty suite (sorry!).

But it’s not just an IHG party. The whole sector (yes, even nemesis Airbnb) is riding a high of post-pandemic travel. We looked at how the industry’s biggest stocks are performing.

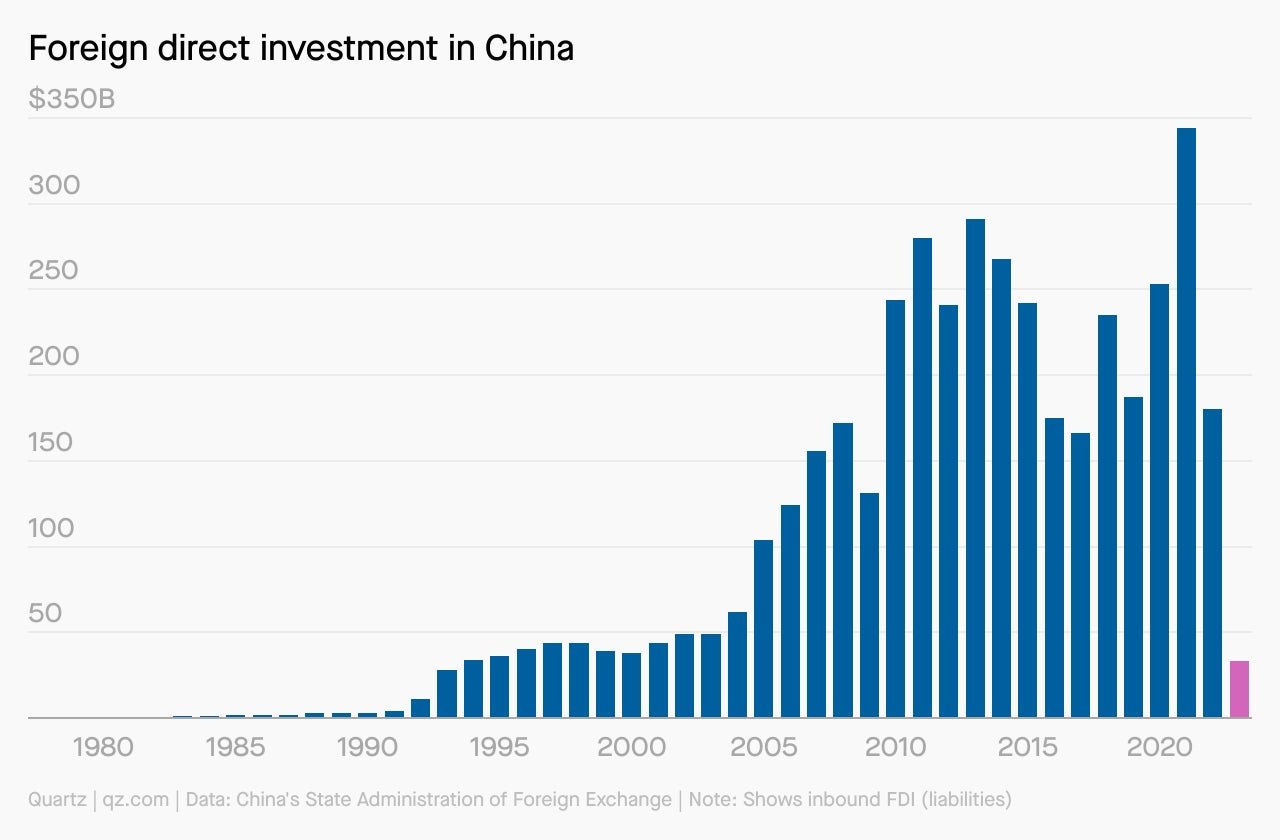

China’s foreign investment went missing

Businesses outside of China are taking a page from their 1993 strategy book and severely curtailing investments into the country.

The money they used to pour into China has now hit a three-decade low. It’s a sign that global commerce is wary of doing business with the country under Beijing’s restrictive and volatile policies… not to mention mounting geopolitical tensions with Washington. Read more about what this means for the global economy.

One big number: $257 billion

Outstanding loans a combined Capital One and Discover would have. The biggest bank in the U.S., JPMorgan Chase, has $211 billion.

Surprising discoveries

Hinge and Tinder have been accused of addicting people on purpose. A lawsuit claims there’s a pay-to-play element and hidden algorithms that users can’t resist.

Older people really love virtual reality. Studies are finding it improves how they feel and how they interact with people.

Speedrunning isn’t just for gaming. It’s also for making rap beats in 10 seconds or less.

Speaking of going fast… a commercial jet topped 800 mph (1,290 kph) crossing the Atlantic ocean. It sure was windy!

A satellite that weighs as much as a Tesla will crash into Earth this week. Don’t worry — we’re good.

Did you know we have two premium weekend emails, too? One gives you analysis on the week’s news, and one provides the best reads from Quartz and elsewhere to get your week started right. Become a member or give membership as a gift!

Our best wishes for a productive day. Send any news, comments, fast beats, and faster planes to [email protected]. Today’s Daily Brief was brought to you by Morgan Haefner.