Historic Belarus crowds, Lebanon investigation, ritzy scam

Good morning, Quartz readers!

Good morning, Quartz readers!

Here’s what you need to know

Massive crowds took to the streets in Belarus… As many as 200,000 people turned up to the biggest demonstration in the country’s history, flooding the streets of Minsk to protest police violence and a disputed election. President Alexander Lukashenko has rejected calls for a repeat vote, and fresh strikes are expected today.

…and Thai protesters demanded government reform. In the country’s biggest demonstrations since a 2014 coup, 10,000 people marched in Bangkok calling for new elections and a revised constitution that would rein in the monarchy. Student-led protests—which began in February, but dwindled during the pandemic—resurfaced in July, and have been held almost every day since.

New Zealand delayed its general election. Prime minister Jacinda Ardern pushed the September vote to Oct. 17 amid a spike in coronavirus cases and a lockdown in Auckland. She insisted there will be no further delays even if the outbreak continued to grow.

Nancy Pelosi called a vote on the postal service. The US House speaker is summoning lawmakers back early from their summer recess to vote on a bill to block operational changes at the postal agency, amid concerns that president Donald Trump is trying to sabotage mail services ahead of the election.

Lebanon launches an investigation into the Beirut blast. A military judge will begin a probe into how the deadly port explosion earlier this month happened. French forensic investigators and FBI officers will also be involved on the invitation of Lebanese authorities, even as the president has rejected calls for an independent probe.

What to watch for this week

Monday: The UK and the EU begin another round of trade talks. The US and Russia meet in Vienna to discuss nuclear arms control.

Tuesday: Lebanon hears the verdict on the 2005 assassination of prime minister Rafik Hariri.

Wednesday: The EU, UK, and Canada release inflation data. OPEC+ is expected to extend current oil production cuts as the pandemic continues to depress demand. Iceland begins testing all arrivals twice.

Thursday: German chancellor Angela Merkel meets French president Emmanuel Macron at his Mediterranean summer residence to discuss topics including Belarus, Lebanon, Brexit, and Covid-19.

Friday: The UK, France and Germany report flash PMIs, providing an update on manufacturing activity. Mahatma Gandhi’s gold-plated glasses go on auction.

Saturday: The US House is expected to vote on legislation blocking changes at the postal service agency.

Sunday: The UEFA Champions League final takes place in Lisbon.

Obsession interlude

Every Quartz Obsession has its million-dollar question. For 🧯 The Climate Economy, it’s this:

Will the disruption of the pandemic hobble or turbo-charge climate efforts?

Economic disruption cratered demand for fossil fuels—some of which might never return. A recent report projected that oil demand won’t bounce back to pre-pandemic levels until at least 2022. Oil companies, sensing the decline, have written down their asset value by tens of billions of dollars. More coal-fired power plants are shutting down than are opening.

At the same time, the clean-energy industry has lost hundreds of thousands of jobs. Many countries are investing in emissions-heavy sectors like airlines and power plants, and the business model for some promising emissions-reductions technology is being upended.

We’ll be keeping track of trends making the planet more livable, or pushing it closer to the brink: from racial justice in flood-prone housing markets, to the crumbling budgets of fossil-fuel-addicted governments, to disposable wipes (they’re not really disposable!).

Here’s how to read more:

- What coronavirus means for climate change

- Coronavirus may get America to pass its biggest climate bill yet

- The world is blowing its chance for a green recovery

- Oil and gas companies might never recover from Covid-19

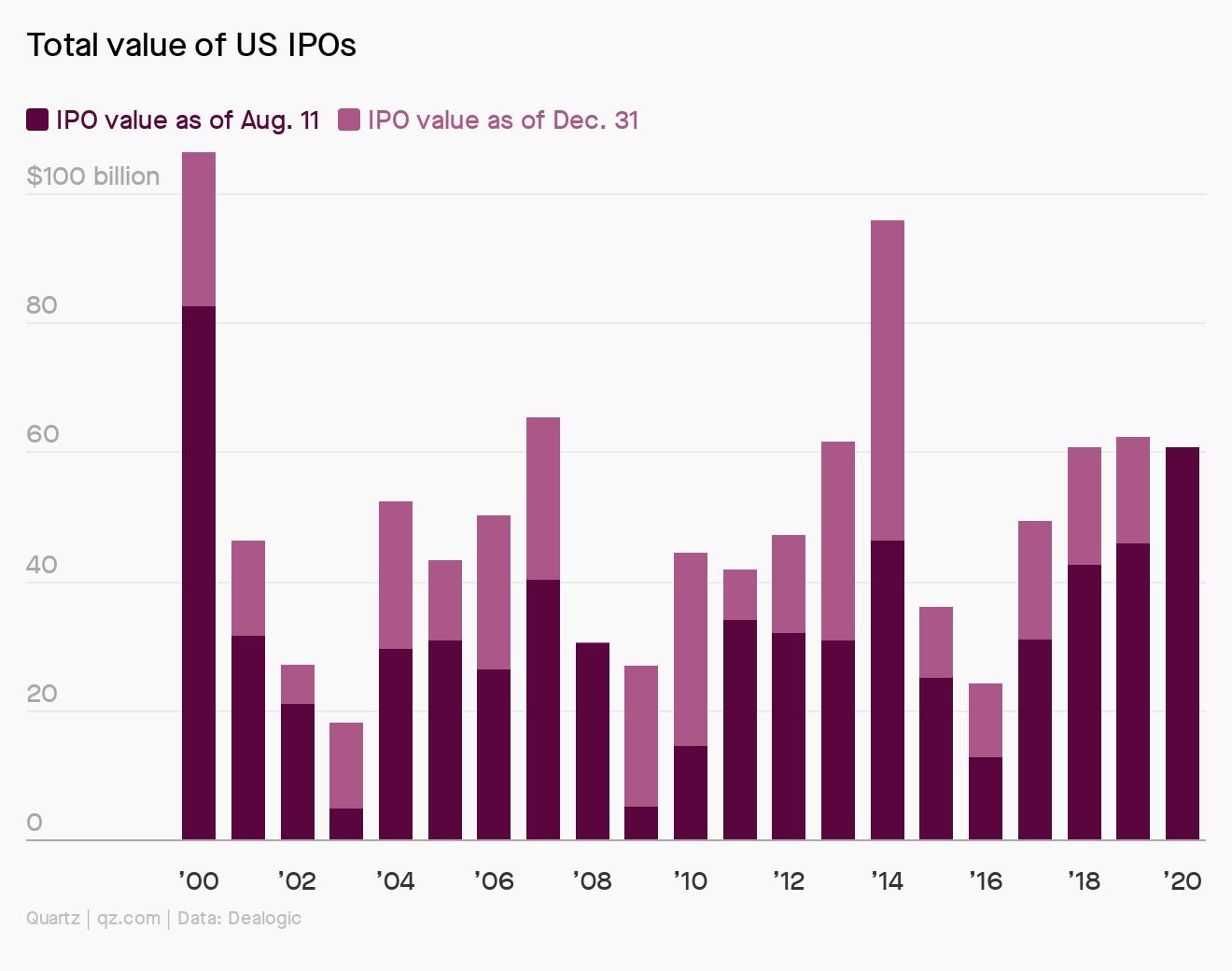

Charting the booming US IPO market

Even amid a global pandemic, 2020 is on pace to be the best year for US IPOs since the dot-com bubble. Listings slowed to a trickle in the first quarter, but are roaring back to their highest year-to-date levels since 2000.

If 2020 maintains its feverish IPO pace, it’ll be thanks in large part to expected listings from buzzy tech firms like Palantir, DoorDash, and Airbnb. The year has already seen B2B software company ZoomInfo raise nearly $1 billion, followed by offerings from insurance tech firm Lemonade and Apple software manager Jamf in July. It may be another sign that the US is building up its next dot-com bubble.

Surprising discoveries

Scammers posed as hotel staff at the Ritz in London. The fraudsters phoned their targets with exact details of restaurant bookings, then stole their payment card details.

Facebook forgot some drilling equipment on the ocean floor. An undersea cable subsidiary abandoned tools, broken pipes, and thousands of gallons of drilling fluid off the coast of Oregon.

A lucky Chinese phone number fetched $300,000 at an auction. The number ends in five eights—which in Mandarin sound like the word for “prosperity.”

Tiehm’s buckwheat could derail the first lithium mine in the US. A swath of Nevada desert rich in lithium and boron is also home to the rare plant, which grows almost nowhere else.

An Amazonian frog engages in cannibalistic love triangles. Each male mates with two females, who sometimes try to eat each other’s offspring to give their kids an advantage.

Our best wishes for a productive day. Please send any news, comments, buckwheat blooms, and drilling tools to [email protected]. Get the most out of Quartz by downloading our app on iOS and becoming a member. Today’s Daily Brief was brought to you by Mary Hui and Isabella Steger.