🌍 Global food supply threats

Good morning, Quartz readers!

Good morning, Quartz readers!

Here’s what you need to know

Ukraine called for international help to end its port blockade. Ukrainian president Volodymyr Zelenskyy said Russia’s blockades and shelling at ports, including Odesa, were a threat to global food security.

Protesters torched the homes of Sri Lanka’s former leadership. Prime minister Mahinda Rajapaksa, who resigned on Monday after weeks of anti-government protests sparked by the country’s dire economic crisis, was forced to flee his residence under military protection.

Ferdinand Marcos Jr. won the Philippines election. The country’s benchmark stock index plunged to its lowest close in nine months on news that “Bongbong,” the son of a former dictator, had achieved a landslide victory.

China’s export growth rate fell to a two-year low. Covid lockdowns continue to interrupt factory production and supply chains. Meanwhile, imports stayed flat as domestic demand remained weak.

Tech giants battled global supply problems. Nintendo said Tuesday it would split its stock from October, in an attempt to counteract weak sales of its Switch console. Sony announced a $1.5 billion share buyback after sales of its Playstation 5 suffered from global shortages and logistics problems.

Nordic inflation soared on energy price hikes. Norway’s inflation hit a 13-year high, and Denmark’s rose to an almost 40-year high, with rising global energy prices a key driver.

What to watch for

Coinbase’s stock has been falling since March, culminating in a roughly 45% drop in the past month. Cryptocurrency was thought to be decoupled from traditional stock price fluctuation, but the decline is mirroring much of the non-crypto market. Likewise, Bitcoin, often seen as the most stable of the volatile cryptocurrencies, saw a nearly 30% drop in the last month, plunging to $30,000—a level not seen since July 2021.

Today Coinbase is expected to report a decline in earnings. The wide launch of its NFT platform could have offered a boost, but it largely landed with a thud, as much of the NFT hype has waned in recent months, despite continued interest from venture capital investors. Nevertheless, during a chat with ARK Invest founder Cathie Wood at last week’s Milken Institute Global Conference, Coinbase CEO Brian Armstrong reasserted his belief that blockchain will be a “foundational technology for the metaverse.”

Americans are deeply unsure about inflation’s future

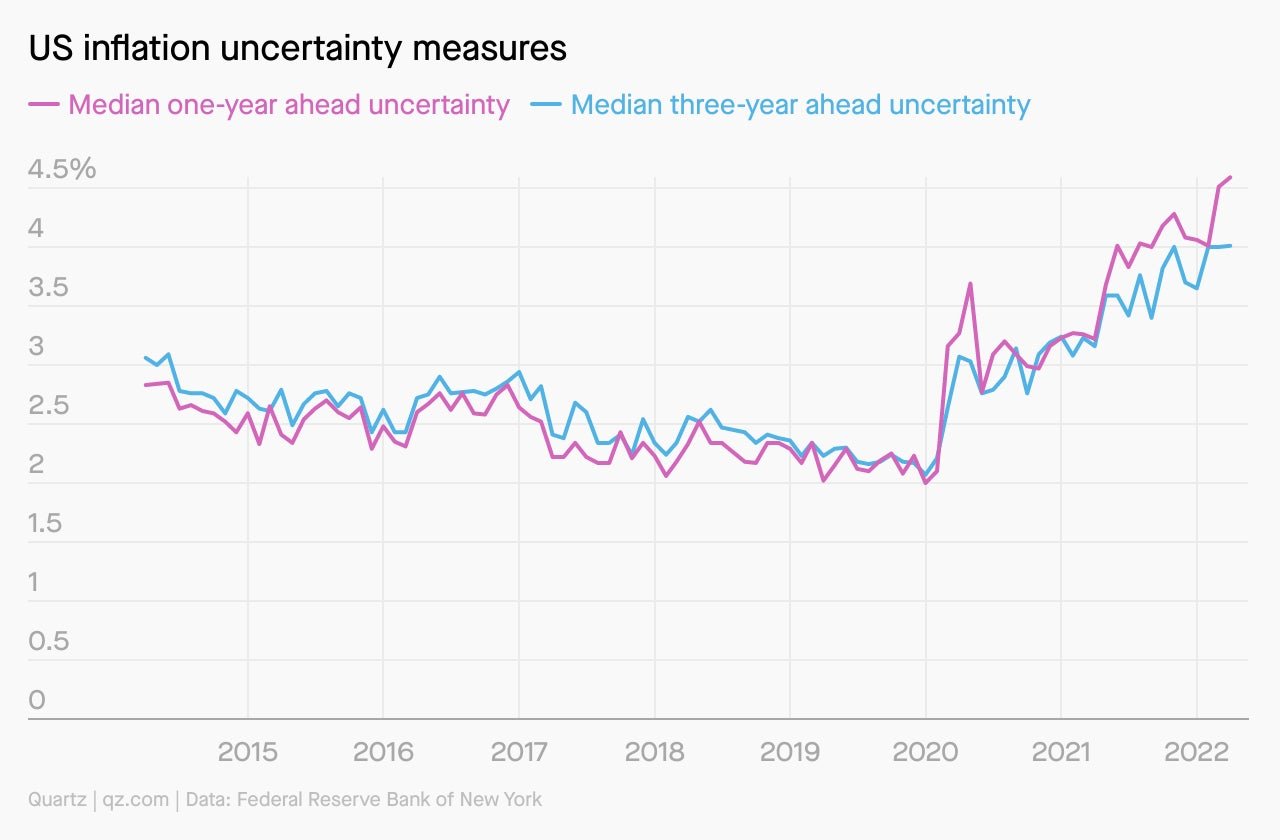

Until the pandemic hit, Americans were pretty sure about where inflation was going—nowhere. Then, lockdowns and supply chain interruptions made it hard to predict how much stuff would cost in the future. Now uncertainty has reached a fever pitch as rising prices, covid lockdowns in Asia, and the war in Ukraine are making the inflation picture even fuzzier.

The Federal Reserve Bank of New York measures inflation uncertainty by asking US consumers how much they think prices will go up over the next year. Why? Fear of inflation has the potential to become a self-fulfilling prophecy.

Fewer Fortune 500 board seats are going to CEOs

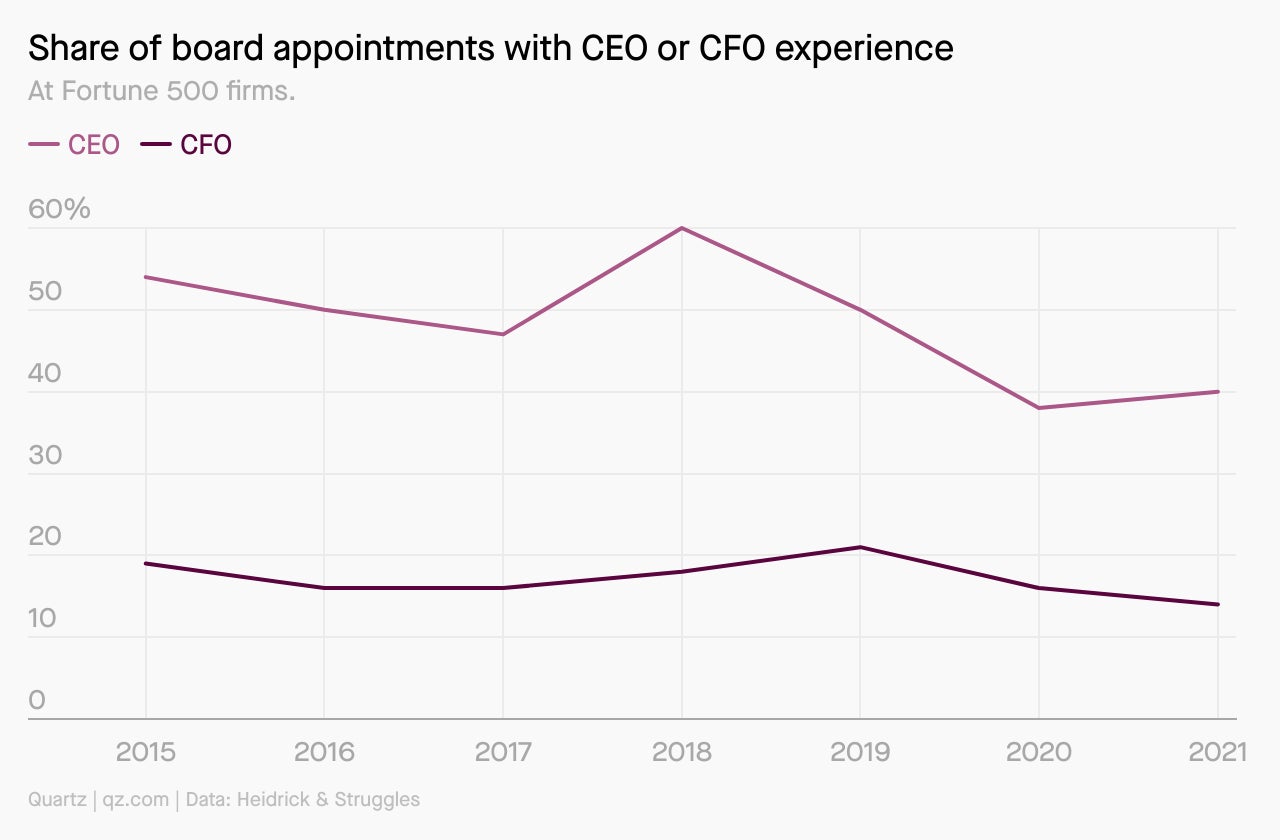

The path to a Fortune 500 board seat is changing. Of the 449 seats filled on Fortune 500 boards in 2021, only 40% went to current or former CEOs, down from 60% in 2018. Quartz executive editor Walter Frick explores what’s changed—and what hasn’t.

Handpicked Quartz

Stories our readers are enjoying this week.

Love stories like these? ✦ Support Quartz journalism by becoming a member today.

Surprising discoveries

The blue people are returning to theaters. The long, long-awaited trailer for James Cameron’s Avatar:The Way of Water is here.

South Korea is reopening mineral mines. Resurrected interest in digging for essential materials like tungsten indicates a growing desire to rely a lot less on China.

Employers can use an algorithm to figure out whether you’re burned out. Consider helping it out by slacking all your work pals with “I AM SO BURNED OUT!”

Going to space changes astronauts’ brains. They come back, but they’re literally never the same.

There’s a right penne and a wrong penne. Early in the pandemic, photos showed Italian store shelves completely bare… except for boxes of ridged penne. Quartz senior reporter Annalisa Merelli explains why pasta opinions are so important in the latest episode of the Quartz Obsession podcast.

🍝 Listen on: Apple Podcasts | Spotify | Google | Stitcher

Our best wishes for a productive day. Send any news, comments, burnout haikus, and penne votes to [email protected]. Get the most out of Quartz by downloading our iOS app and becoming a member. Today’s Daily Brief was brought to you by Adario Strange, Nate DiCamillo, Julia Malleck, Susan Howson and Cassie Werber.