Hello Quartz readers!

Welcome to my weekly dispatch, where I discuss the people, trends, and ideas that are reshaping money as we know it. This week, in particular, reaffirmed the feeling that fintech companies are having a moment. They raised a record amount of capital last year, and valuations are still climbing. As the sector heats up, it’s worth asking whether investors are getting carried away.

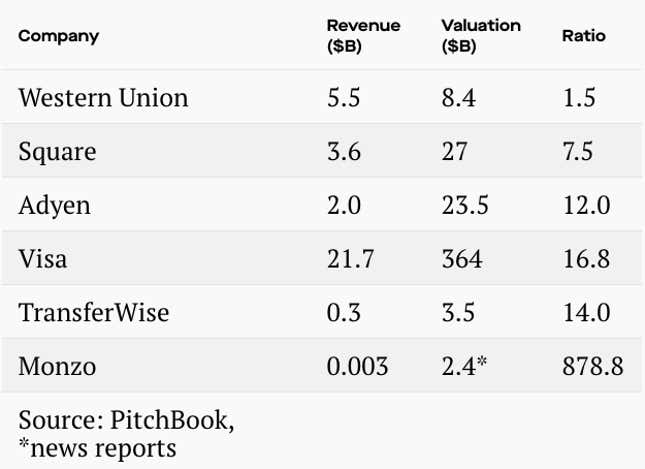

Valuations for fintech firms in the US and Europe vary widely:

This week, London-based TransferWise said its valuation doubled in less than two years, to $3.5 billion. The company raised $292 million to allow existing shareholders, including its founders, to cash out some of their shares in the private company. The share price for Adyen, a Dutch payment company, has risen almost 50% this year. Tradeweb’s stock has rallied more than 20% since the trading platform went public in April.

Robert Le, senior analyst of emerging technology at PitchBook, thinks prices are still tethered to reality. “While payment and fintech valuations do look high, they are not out of line relative to the broader tech market,” he said in an email. “We see a lot of room to grow for new payment disruptors such as TransferWise.”

The international transfers that TransferWise specializes in generate about $200 billion for banks each year, CEO Kristo Käärmann told me, citing McKinsey data. He said the numbers are hard to pin down, but TransferWise is likely the biggest or second-biggest transfer service in the UK, and yet has still only captured about 15% of that market for consumers. “We’re very conscious that we’re still in the early days,” he said.

Something that the likes of TransferWise, Adyen, and Tradeweb also have going for them is that they are profitable (the youngest of that trio is eight-year-old TransferWise). Monzo, a four-year-old British digital bank, has a racy price-to-revenue ratio, but says its customer accounts are profit positive, not including things like taxes, marketing, and investment.

And while the most-hyped startups can raise cash seemingly at will, regardless of their financial condition, there are some signs of investor discretion: a British payment and budgeting app called Loot fell into administration this week while apparently trying to raise more money via crowdsourcing.

This week’s top stories

- Goldman Sachs gave a loan to Nubank when almost no one else would. Three years later, the Brazilian digital banking startup, which takes its inspiration from Capital One, Russia’s Tinkoff Bank, and Tencent’s WeChat Pay, is valued at about $3.6 billion.

- Checkout.com scored a funding round based on a handshake, skipping the term sheet. The payment startup was valued at about $2 billion in the deal, with Insight Partners and DST Global. Most people “do not think this would or should catch on.”

- German unicorn N26 is getting heat from regulators over its money laundering controls. BaFIN gave the digital bank a to-do list that includes improving staffing levels and putting its processes and workflows into writing.

- The US isn’t particularly at risk of going cashless, but never mind: some in Congress want to ban stores from going cashless anyway. (Rather than difficult-to-enforce legal protections, experts in the UK think cash has a better chance if the infrastructure is affordable and efficient.)

- Alipay and WeChat Pay have been banned in Nepal. The country’s central bank said Nepal is losing out on foreign-currency earnings from Chinese tourists because the apps’ actual transactions take place in China.

Heard on headphones

“Interest rates are still very low, and the economy in the United States is still absolutely humming,” said Robert Armstrong of the Financial Times on the FT Banking Weekly podcast. Yet for business loans, “we’re actually seeing an increase, even from a low base, of borrowers who are in trouble.”

The future of finance at Quartz

Contactless payments on the London tube network helped jumpstart a shift to tap-to-pay cards across the UK. Visa and Mastercard are hoping the same will happen with New York’s subway.

German fintech firm Raisin is expanding to the US. Its technology could help American community banks tap into a much bigger pool of depositors.

Half of US stock fund assets are now invested in index funds. Speaking of which, there’s now an S&P 500 index of US stocks without all the bad stuff in it.

Yes Bank may not be the future of finance: India’s fourth-largest private lender is being shunned by investors, amid suspicions that bad loans have been underreported.

Always be closing

American banks are diversifying. JPMorgan bought a healthcare payments company for more than $500 million. CNBC reports that it’s the lender’s largest acquisition since it acquired Bear Stearns and the assets of Washington Mutual at the height of the credit crisis in 2008.

Morgan Stanley invested €300 million ($334 million) in Tikehau Capital Advisors, a manager of alternative investments like private debt and real estate. The money will help the Paris-based company expand in North America.

Goldman Sachs bought Capital Financial Advisors for $750 million, its biggest deal in two decades. It’s a foray into wealth management for rich (but not super-rich) clients. The Wall Street bank also bought a UK insurance broker.

Wealthsimple raised C$100 million (US$74 million) in a deal led by Allianz. The Canadian robo-advisor is also available in the US and UK and oversees $4.5 billion in assets.