Quartz Future of Finance: Out Bloomberg the Bloomberg

This dispatch will take a break next week and return Aug. 16. If you’re also going to the beach on the Costa Brava, give me a wave! If this was forwarded to you, sign up here to receive this free email every week.

This dispatch will take a break next week and return Aug. 16. If you’re also going to the beach on the Costa Brava, give me a wave! If this was forwarded to you, sign up here to receive this free email every week.

Hello readers!

In a previous life, I covered London Stock Exchange Group as a reporter at Bloomberg. So, this week I was naturally intrigued by the 300-year-old exchange’s plans to acquire Refinitiv, the data terminal business previously owned by Thomson Reuters.

The stock exchange has played a role in making London the world’s financial capital. But stock trading isn’t what it used to be—thanks to competition from rival exchanges and banks’ dark pools, there’s not much profit left in it. LSE has diversified into other types of market plumbing, like processing trillions of dollars of derivatives and, perhaps most importantly, collecting financial data.

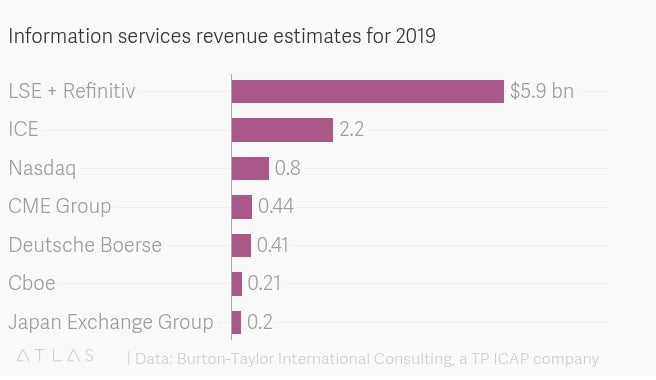

Next to money itself, data is the most important resource in financial markets. If the Refinitiv deal gets the go-ahead from regulators and shareholders, which seems likely, the transaction will make LSE the top dog among exchanges for data services, according to Burton-Taylor International Consulting, part of TP ICAP. A combined LSE and Refinitiv would have more than twice as much yearly revenue from information services as Atlanta-based Intercontinental Exchange, which runs the New York Stock Exchange, and far more than Chicago-based CME Group.

There is, of course, another beast of financial data out there, and that is former New York mayor Michael Bloomberg’s eponymously named company. Bloomberg operates 330,938 terminals that are used by traders and other financial professionals. The company pulls in around $10 billion a year in revenue.

You can convincingly argue that a portion of those subscribers use Bloomberg simply for its chat feature, making the terminal, with its $24,000 annual price tag for a single user, the world’s most expensive social network. (Bloomberg also runs a currency trading platform, and LSE is set to acquire a big one from Refinitiv, as well as a stake in a successful bond venue.) Even so, it looks like New York-based Bloomberg is likely well ahead of LSE in the data game. I argued earlier this week that it’s hard to out-Bloomberg the Bloomberg.

Bloomberg and LSE have been chasing the same industry mega-trends for years. LSE is a stock exchange whose most promising business is perhaps its information-services unit that operates a bunch of financial indexes, and it is now acquiring a terminal business. Bloomberg is an operator of data terminals for traders that acquired a bond-index business from Barclays. The companies are vastly different culturally—Bloomberg is privately held (and has a better cafeteria), while LSE is public; LSE is a serial acquirer, while Bloomberg usually builds internally—but they are looking more and more alike.

Terminals are threatened as banks hire fewer human traders, but the swap prices, bond issuance information, and other sorts of data that power them are still a digital gold mine. LSE can use Refinitiv’s datasets to create new indexes and analytics (this is discussed in an Aug. 1 presentation). Exchange-traded funds—the growth of which is one of this century’s biggest financial mega-trends—are tied to indexes and typically pay fees to use the underlying intellectual property.

As Steve Grob, an independent consultant, points out, owning the intellectual property to just one hit index can be a game changer. Just look at the Cboe’s VIX, which Robin Wigglesworth at the Financial Times called a “rockstar of the index world.”

The Refinitiv deal is “way more sensible than trying to buy another exchange,” Grob says. “It’s a dying business model, and you’re not allowed to buy them anyway.” (LSE’s attempt to combine with Frankfurt’s Deutsche Boerse collapsed under post-Brexit regulator pressure.)

“Whatever industry you’re in,” he adds, “there’s huge value in data.”

This week’s top stories

1️⃣ Amazon, meet your new financial regulator. Amid the deluge of articles about the Capital One hack, the Wall Street Journal (paywall) reports that the Federal Reserve formally examined Amazon’s cloud-computing facility just a few months ago.

2️⃣ It costs about $4 billion a year for banks to run a full-blown global equities business, CNBC says. Only a few top-tier US banks and high-frequency traders can make the math work.

3️⃣ Speaking of stocks, Revolut rolled out trading for US equities by partnering with DriveWealth, a broker. This launch took longer than expected. A smart investor raised this question with me: Why did it take so long if Revolut ultimately partnered instead of building the tech in-house?

4️⃣ JPMorgan is breaking up with OnDeck. The mega bank will no longer originate loans through the fintech firm, which had been providing its tech to JPMorgan. Shares in OnDeck fell about 19% on Monday.

5️⃣ The UK’s first digital bank says it is finally making profits (paywall) on its loans. Atom Bank makes money the old fashioned way, through savings deposits and loans.

The future of finance at Quartz

It’s hard to grow customers and profits at the same time. Digital banks like N26 and Revolut have chosen the former, and a key question is whether bigger, older banks will copy their tricks.

Nigeria’s largest telecoms operator is becoming a bank. MTN Nigeria is closer to rolling out mobile money services in Africa’s largest economy.

Cash in circulation in Sweden increased last year, for the first time in a decade. Swedes may be taking the government’s advice and stashing away a little extra in case of an emergency. But the country is still galloping toward a cashless future.

Always be closing

- Fiserv completed its $22 billion acquisition of payment company First Data Corp.

- Hours later, Bank of America said it was unwinding its joint venture with First Data.

- Montreal payment firm Nuvei completed its buyout of SafeCharge for $889 million.

- Square is selling food delivery company Caviar to DoorDash for $410 million.

- Brazil’s Nubank raised $400 million, valuing the digital bank at $10 billion.

- Another Brazilian fintech, Banco Inter, raised about $330 million in additional stock, most of which was purchased by SoftBank.

- Toronto’s Clearbank, which funds Instagram and Facebook ad buying, has raised $300 million.

- Natwest is providing a £100 million ($122 million) senior debt facility for Manchester-based Evolution Money, an online consumer lender.

I hope your weekend is invigorating and profitable (pick your own metric). Please send beach music mixes, tips, and suggestions to [email protected].