Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

You may have heard that a Danish lender launched the world’s first mortgage with a negative interest rate. I called Jyske Bank and am here to tell you that it was not the first negative-rate mortgage—that title goes to a borrowing instrument rolled out at least two years ago.

What Denmark’s third-biggest bank launched this month was the first 10-year mortgage with a fixed negative rate of -0.5% (previous mortgages with negative interest rates were shorter term), according to Jyske housing economist Mikkel Høegh. The way it works is that, practically speaking, the borrower’s monthly payments add up to less than the principal on the loan.

A banker told the Financial Times (paywall) that dealing with negative rates is like “learning to drive a car backwards.” More than $13 trillion worth of bonds are now offering negative rates, which means debt investors receive less than they put in, provided they hold bonds to maturity.

Mortgages with negative rates have gotten a lot of attention, and it made me wonder how a bank makes money on them. In Jyske Bank’s case, it does it by issuing a 10-year bond at a negative interest rate, and issuing the mortgage at the same rate. Høegh says this is the typical structure in Denmark. The lender then makes money through fees, such as an upfront charge of around 20,000 Danish krona ($2,791).

“Here there is no problem making an income for the banks, because the income will be the same if the interest rate is plus 0.5 or minus 0.5,” Høegh said.

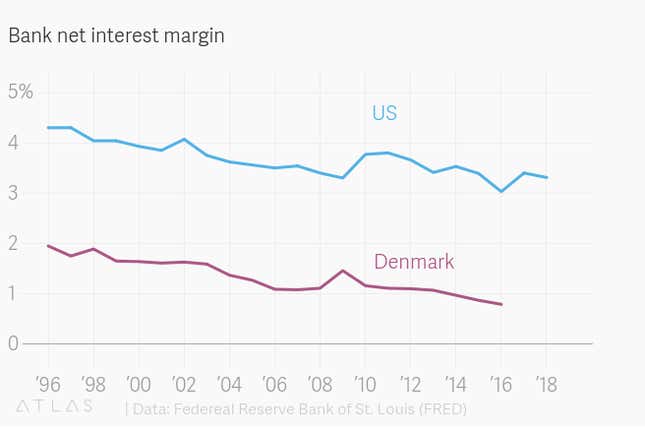

The usual way banks make money is by taking in cheap funding (deposits or bonds) and making loans like mortgages at a higher interest rate. They profit from the gap between those rates. (Danish banks also do this, primarily for consumer borrowing like car loans, Høegh said.) But as interest rates decline, as they have been doing for years, this gap, or net interest margin, has been getting narrower.

Negative interest rates are a serious threat to the many banks that rely on net interest margin. That’s because it’s not easy to charge your depositors a negative interest rate, such that their savings take a haircut each month (although, this happens invisibly through inflation even when interest rates are positive). This puts a limit on the short-term rates at which banks can borrow, while the long-term rates on which they base customer loans drift inexorably downward.

Banks are experimenting with negative deposit rates in some instances, but it has mostly been at the margin. Savers can rebel by stashing their money in cash, gold, or something riskier like stocks or bonds. For banks, negative rates on savings accounts attract a lot of unwanted attention.

That puts them in a tough spot. Unless savings accounts with negative interest rates become more acceptable, net interest margins could continue to get squished until they vanish altogether. One way out is for commercial banks to cut back on lending and focus on more profitable businesses like payments (provided they can fend off growing competition from fintech upstarts). Or, central banks can provide a subsidy to commercial lenders, in order to keep lending from drying up.

Banks could also copy the Danish model, forgoing net interest income altogether and focusing on fees. No matter what they do, as long as negative interest rates persist, lenders are going to have to look for new ways to make money.

This week’s top stories

1️⃣ Goldman Sachs is hiring around 100 people for its trading division. However, as Bloomberg reports, the Wall Street bank is mainly looking for coders.

2️⃣ JPMorgan is closing down Chase Pay. The bank spent more than $100 million trying to bring QR codes to the American masses but had little to show for it after four years of effort, Finextra reports.

3️⃣ Shares in Adyen, a darling of the stock market, slumped 5% even after reporting a 79% increase in profit. The Dutch payment company’s founders said they were selling part of their holdings, worth around €320 million ($354 million), to diversify their risk.

4️⃣ Europe’s antitrust regulators are scrutinizing Facebook’s Libra cryptocurrency, according to the Financial Times (paywall). Watchdogs have sent questionnaires to institutions that are involved to see whether Libra could unfairly disadvantage rivals.

5️⃣ Microfinance can backfire on the vulnerable. A number of Sri Lankans, many of them women, have no idea the interest rate on their loans, struggle for years to pay them off, and are beset by weekly collectors demanding payments, according to The Economist (paywall).

The future of finance at Quartz

New York City is embracing contactless payments, catapulting itself into the brave new world of 2012. My colleague Mike Murphy thinks Apple will kill off the physical wallet once and for all. (The popularity of contactless payment cards in the UK suggests this could be a challenge.)

The US should issue a 100-year bond. The world’s biggest economy could lock in crazy low rates, and pension funds and insurance companies would hoover them up.

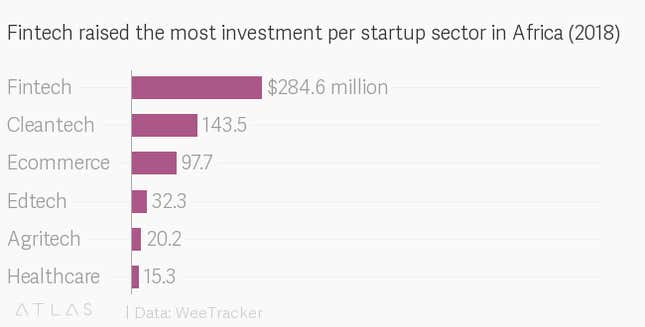

Lagos-based tech group Jumia is pivoting to payments as its e-commerce business stumbles. Fintechs raised more than any other startup sector in Africa last year:

Always be closing

- PayPal-backed Tala raised $110 million. The credit-profiling company plans to use the money to expand in India.

- Numbrs Personal Finance was valued at $1 billion. The Zurich-based account aggregator app, whose investors include Josef Ackermann, raised $40 million.

- Lunar Way raised €26 million. The Nordic neobank also got a European banking license from the Danish regulator.

- Experian acquired Look Who’s Charging, an Australian startup that verifies merchant transactions.

If you’d like to support my work, and read our upcoming series on the future of banking that publishes on Sept. 2, you can become a Quartz member here. You’ll get 50% off Quartz’s annual subscription if you use the promo code JD2912 at the checkout. That’s a better deal than buying a negative-rate bond.

Please send mortgage prospectuses, tips, and suggestions to jd@qz.com.