Quartz Future of Finance: We still don’t know if Apple Card is sexist

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

For a week now, an internet dumpster fire has been burning over a relatively simple question: Why does Jamie Heinemeier Hansson’s Apple Card have a much lower credit limit than her husband David’s? This question, as you probably know, went viral on Twitter and is now being investigated by New York financial regulators.

To sum up, Jamie says she has a higher credit score than her husband, as well as quite a few other solid credit risk metrics. When she asked why her limit was set lower than her husband’s, she says customer service at Goldman Sachs, the bank behind the credit card, told her it was the algorithm, and that they couldn’t explain it.

Many think this shows that Goldman’s credit algorithms are sexist. But the most sober comment I’ve seen is from Cathy O’Neil, author of Weapons of Math Destruction, who told Slate: “We don’t have enough information to know what was really going on there.”

In its humble way, this comment is extraordinary. In an age of highly connected information overload, we cannot answer a simple question about a credit card limit that thousands of people are scrutinizing. People who work in the industry tell me that the information reported so far still doesn’t add up.

You can’t necessarily tell very much about algorithmic bias from isolated anecdotes, even if they also come from Apple co-founder Steve Wozniak and his wife. A way to test for discrimination, according to researchers, is to analyze the outputs to see if certain categories are being excluded or otherwise adversely impacted. Goldman Sachs Bank exec Carey Halio told Axios that the lender had done this, and used a third party, Charles River Associates, to look at its credit process. She says there were no signs of unintended bias.

But as this controversy rages on, it’s becoming obvious that a lot of credit decisions don’t make much sense. My FICO score dropped after I paid off my student loans. This might make sense to an algo designer—a lack of data results in a lower score—but it seems silly to everyone else. Algos may perform well at scale, but they can leave a lot to be desired at the individual level.

So, what to do when the machines don’t make sense? One thing could be to trace through the process and figure out what went wrong. If there was an easy explanation for this, I’m sure Goldman would have provided it already. Halio admitted to Axios that more transparency was needed.

This leads to one of the paradoxes of modern finance: credit algorithms are often seen as a solution to biased humans. In previous years, loan officers made lots of flawed, discriminatory decisions that were advantageous to white men and bad for everyone else.

And yet, people aren’t thrilled with the algorithms. In the UK, where the shift from loan-officer decisions to centralized algos has been underway for decades, the percentage of Brits who think banks are well run fell from 90% in 1983 to 19% in 2009.

These questions are bigger than Goldman Sachs and its Apple-branded credit card. Even so, the episode shows that algos have made banks appear aloof. They can make lenders more profitable, but can spur customers to trust them less. One answer could be to spend money on hiring (and training) human employees capable of explaining their algorithms, and overriding them when needed. Or, lenders can settle for being unpopular with customers but profitable and popular with shareholders.

This week’s top stories

1️⃣ Checking accounts from Citigroup will be available on Google Pay, the Wall Street Journal reported (paywall). It’s being described as a tech “invasion,” but it looks more like another sign that financial companies still do all the finance in the US.

2️⃣ Deutsche Bank’s payment systems were disrupted on 10% of business days in October, per the Financial Times (paywall). The German lender has been in remediation for payment discrepancies for three years.

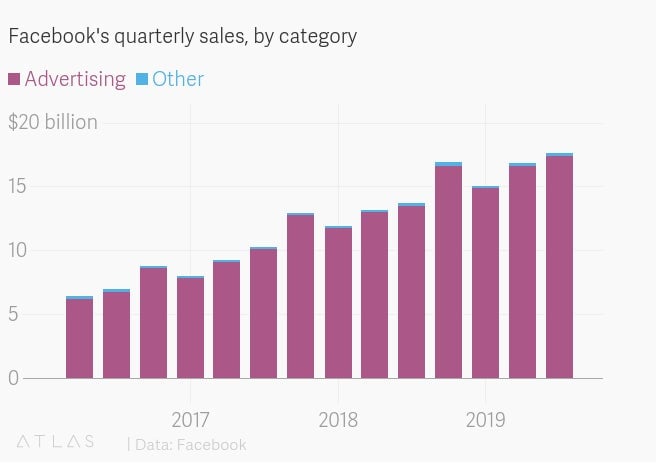

3️⃣ Even as Facebook rolls out its unified payment plans, the social network is still an ad company. Mark Zuckerberg has signaled that the company will monetize payments and commerce through advertising for the foreseeable future.

4️⃣ Lending Club may partner with an existing bank while it’s applying to become one, according to Crowdfunding Insider. The marketplace lender reported its first profitable quarter in years. Being able to take deposits would lower its cost of capital, which could further boost profitability.

5️⃣ China’s OneConnect has decided to list in the US instead of Hong Kong. The fintech arm of Ping An Insurance, which is backed by SoftBank, reported a net loss of $147 million in its latest quarter.

The future of finance on Quartz

Finance is changing rapidly in Africa: Zimbabwe is rolling out a new currency, which will face a big test this weekend when its mobile money system is shut down for an upgrade.

Chinese fintech companies are going head-to-head in Nigeria. Transsion Holdings is launching PalmPay, which will be up against OPay. Also in Nigeria, Jumia’s e-commerce ambitions still haven’t worked out, but its pivot to Jumia Pay could still work.

Cashless payments are growing faster in India than pretty much anywhere else in the world. As digital transactions rise, the competition between Paytm and US tech giants is heating up.

China’s digital currency is all about control. Harvard professor Kenneth Rogoff argues that the government will be able “to see anything and everything.”

Next week, Quartz is publishing a deep dive into ETFs for members, and next month I’ll be posting a guide to world’s highest-valued fintech companies. If you’re not already a member, you can support our journalism and sign up here. Use the promo code JD2912 to get 50% off an annual subscription.

Always be closing

- Ireland’s Prepaid Financial Services is being bought by an Australian payment company for as much as A$526 million ($356 million).

- A North Carolina-based payment tech startup called Spreedly got $75 million in investment.

- Eigen Technologies, a London machine-learning engine, raised $37 million led by Lakestar and Dawn Capital, valuing the company at as much as $180 million.

- Cardlay got $10 million in funding. The provider of expense management and automated VAT reclaims also signed a deal with Eurocard, the largest card issuer in Scandinavia.

- Acatus, a debt capital-market platform, raised €5.5 million ($6.6 million).

- Alpaca, which builds the backend for stock brokerage apps, got $6 million of investment.

- Vietnam’s central bank is considering a limit on foreign ownership of domestic payment companies.

I hope your week has been a profitable one (pick your own metric). Please send any credit card disclosures, tips, and other ideas to [email protected].