Quartz Future of Finance: PayPal bought 13 million female users

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

You may have read that PayPal, the serial-acquisition vehicle that also does payments, is buying a company called Honey. PayPal is paying $4 billion for the Los Angeles-based enterprise, which provides a platform for coupons, rewards, and price-tracking.

I had never heard of Honey, which is perhaps not surprising since I’m a forty-something man. PayPal said during an analyst call on Wednesday that 79% of the startup’s 17 million active users are female, and they are 70% millennial. Lisa Ellis, a senior analyst at MoffettNathanson, noted during the call that her 13-year-old daughter and friends are “obsessed” with the app.

Honey says it automatically finds and applies coupons on more than 40,000 sites. It can also show an item’s price history, helping a customer make an educated guess whether the price is likely to change, and to compare Amazon sellers by how much they charge for an item. The seven-year-old company gets paid a commission when a member makes a purchase from one of its merchants.

Startups that make money instead of burn it are the new, fashionable thing these days. PayPal execs say Honey generated some $100 million in revenue last year, a figure that is growing at a rate of 100%. They say Honey is profitable, but declined to say how profitable, which usually suggests it’s not something to brag about. PayPal expects the acquisition to be “accretive” to non-GAAP earnings per share in 2021.

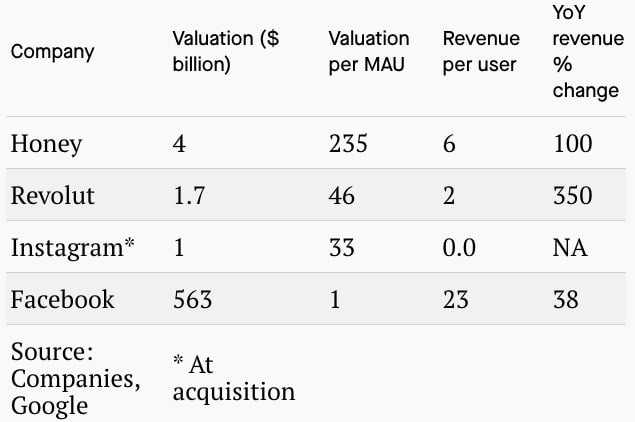

A $4 billion price tag, as one of my contacts said, “is bloody expensive.” It’s also PayPal’s biggest takeover to date and is four times the amount Facebook paid for Instagram in 2012. By some measures, that is more expensive than Revolut, based on the valuation from the UK financial apps’ last funding round (which could soon be out of date). Honey’s valuation in terms of monthly active users (MAU) is also higher than Instagram’s in 2012, but then again Honey actually has revenue.

Shares of PayPal, which is buying Honey using its cash reserves, have fallen slightly. CEO Dan Schulman says the deal will be “transformative” for the payment company, and that Honey will move the PayPal and Venmo apps higher up in the shopping process. Consumers could presumably go to Venmo when they are just beginning to look for an item or service. “We think this is going to drive many more transactions though our branded checkout,” Schulman said during the conference call.

The transaction could arguably blur the lines between PayPal and an actual marketplace, and give users a reason to tap the app more often. The company says it has around 300 million “active” users, but it sets the bar low—they only have to use PayPal once a year to meet the active threshold.

It also shows that profit is sexy, and investors (or serial acquirers) will pay handsomely for it.

This week’s top stories

1️⃣ Aspiration, a digital bank that allows customers to choose how much they pay for services, is having trouble raising funds, according to CNBC. It’s another sign that money-burning companies are facing more scrutiny.

2️⃣ Big tech is taking a close look at finance, but The Economist (paywall) notes that these efforts haven’t had much success. A western version of WeChat Pay or Alipay doesn’t seem likely.

3️⃣ Charles Schwab’s acquisition of brokerage TD Ameritrade would give the company some serious heft, as commission fees evaporate. Bloomberg reports that the deal could run into anti-trust scrutiny. Etrade shares fell.

4️⃣ US banks are pushing back against the Federal Reserve’s instant payments system, out of fear it could enable tech companies to get more involved in payments. Lenders are also lobbying to block fintechs from using the system, according to Roll Call.

5️⃣ Ant Financial is actively seeking a banking license in Singapore. The Monetary Authority of Singapore is offering up to five digital-banking permits to non-banks to boost competition.

The future of finance on Quartz

When Robinhood goes live in the UK early next year, it will use payment for order flow (PFOF) to make money. British regulators greatly dislike PFOF, as they think it creates conflicts of interest.

Here’s everything you need to know about African fintech, which has been the continent’s most sought-after sector for startup investment for the past three years. OPay, a Nigerian payments service, recently raked in $120 million.

German lawmakers voted to make Apple open up access to the iPhone’s NFC chip, which could create more competition for Apple Pay. US diplomats lobbied, unsuccessfully, to intervene.

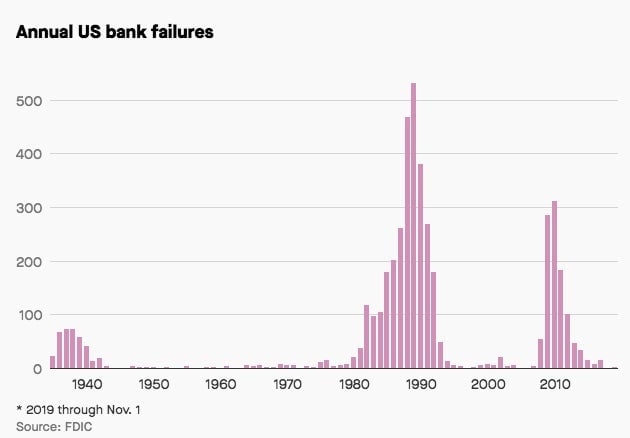

Four US banks have failed this year, up from zero in 2018. It’s a fairly typical number of bank failures, though smaller lenders could struggle if interest rates decline in the coming months.

This week, Quartz published a deep dive into ETFs for members, and next month I’ll be posting a guide to the world’s highest-valued fintech companies. If you’re not already a member, you can support our journalism and sign up here. Use the promo code JD2912 to get 50% off an annual subscription.

Always be closing

- US Bank-owned Elavon is buying Sage Pay for £232 million ($300 million). The deal for the payments gateway will help with expansion in Ireland and the UK.

- BlueVine, a small business banking vendor, got $102.5 million in equity financing.

- Neon, a neobank in Brazil, raised $93.5 million led by General Atlantic and Banco Votorantim.

- Capital markets tech company Capitolis got $40 million in financing.

- CyberCube Analytics, which does cyber risk analysis for the insurance industry, got $35 million in funding.

- Houston-based supply chain and analytics company GoExpedi raised $25 million.

- Tymit, a London-based, mobile-enabled credit card startup, got £4 million in funding.

- Shield Compliance raised $5 million. Its platform is for financial firms serving the legal cannabis markets in the US.

- Lemonade, a money-losing insurance startup backed by SoftBank, delayed its IPO, according to Business Insider.

- Plaid has landed Cleo and Pandle—two fintechs—as clients since launching in the UK.

I hope your week has been a profitable one (pick your own metric). Please send any coupons, tips, and other ideas to [email protected].