Quartz Future of Finance: Is there a fintech bubble?

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

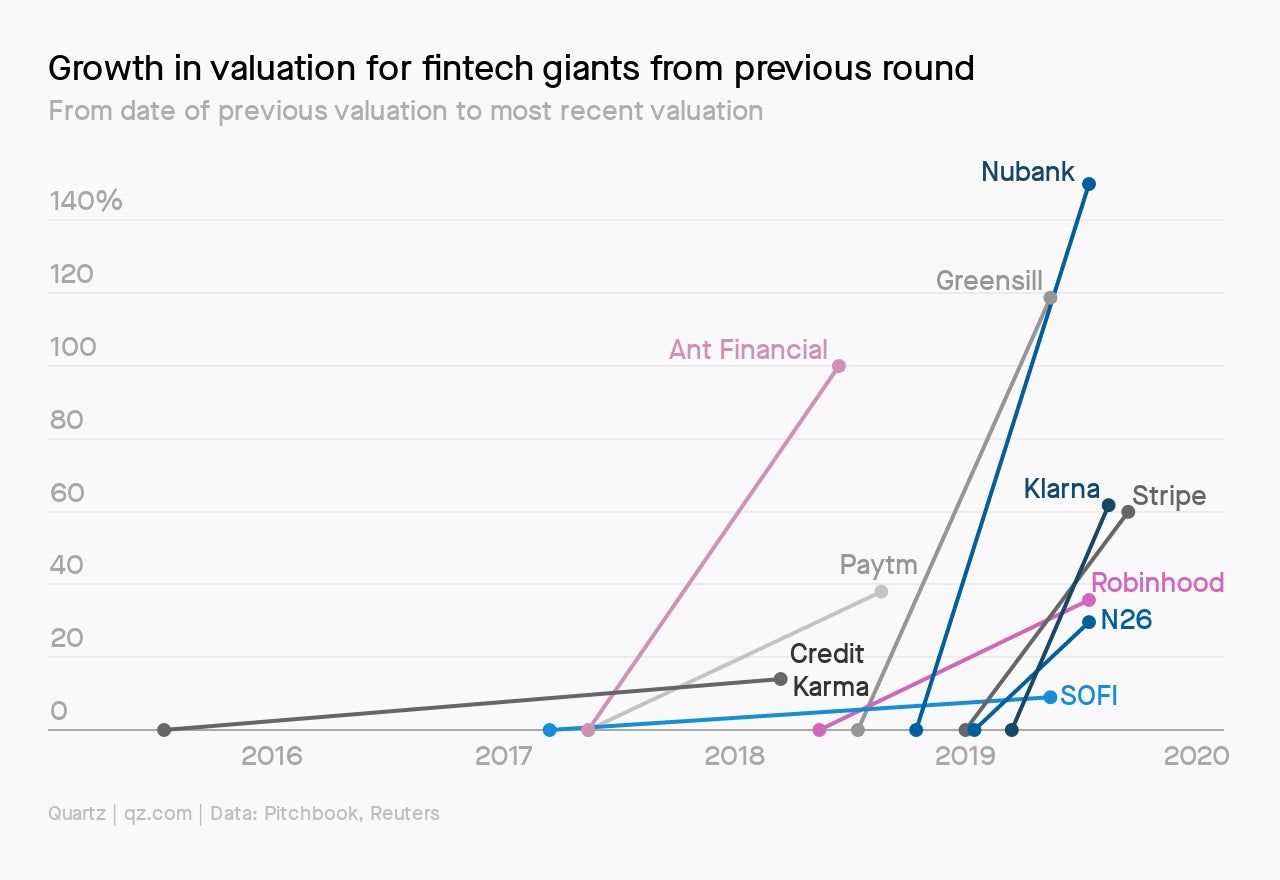

This week I finished working on Quartz’s guide to fintech, which will publish on Monday. We almost called it “Fintech after the bubble,” but I wasn’t sure about the headline. There’s a lot of hype, plenty of money sloshing around, and not much in the way of profits. But bubbles imply a special degree of mania. I’m not sure taxi drivers and hairdressers are looking for ways to speculate on fintech yet.

It’s not clear that there’s a fintech bubble, but I know what the fear of missing out looks like:

Yale economics professor Robert Shiller wrote the book on bubbles, and he says one of the key ingredients in a buying frenzy is a great story, usually featuring some kind of “new era” thinking. During the dot-com mania it was the internet. For subprime, it was financial innovation.

I was looking for that “story” when I was reporting the fintech guide, which is focused on the top 10 most valuable financial upstarts. One theme that came up has already been going around for a while: that technology is going to disrupt finance. Former Square CFO Sarah Friar told me last year that she looks at “largely undisrupted” financial companies and considers the “market cap that’s sitting there.”

Another story is that tech and smart phones are going to finally bring financial services to big populations that have historically been overlooked. There’s a template for that one, which is called Ant Financial (Quartz member exclusive). Around 900 million Chinese people now have access to a wide range of financial services through Ant’s app.

Ant Financial is among the firms that are pouring money into India’s Paytm, which is using the same playbook. Nubank’s CEO told me that he and his team visited China to get ideas, and what he saw transformed the Brazilian bank he co-founded.

These are great stories, but I’m not sure they have the kind of viral, intoxicating qualities that bitcoin had in 2017. And there are reasons to doubt these tales, of course. Fintech startups in developed markets may be easier to use that their predecessors, but are they 10 times better? Not everyone is sure. And peer-to-peer lenders, some of which have either shut down or are seeking to become banks, have shown that re-inventing finance isn’t so easy.

Emerging-market banking systems, meanwhile, have a tendency to blow up every once in a while. Some investors are new to investing in Latin America and other locales. Will they keep their faith in fintechs if these economies go into a tailspin?

Another thing the reporting brought to mind is how ordinary many of these companies are. During and after the dot-com boom, the world was introduced to things like internet search, social media, and e-commerce. Bitcoin was a genuinely new invention in 2009. The most valuable fintechs are, for the most part, payment companies, brokerages, and banks. Their business models aren’t necessarily new—card network Visa started out in the 1950s, Merrill Lynch in 1914, and banking goes back several millennia.

That suggests some of these upstarts may have to settle for the valuations of traditional financial companies, instead of loftier tech-company price tags. That’s why we ended up calling next week’s report “Beyond the fintech hype.”

This week’s top stories

1️⃣ US watchdogs endorsed alternative measures of creditworthiness. While it could help more people get financing, there are questions about the fairness of using things like educational background as inputs, according to the Wall Street Journal (paywall).

2️⃣ Xiaomi, a Chinese smartphone maker, launched its lending service in India, where the loan market is forecast to be worth $1 trillion by 2023. The service connects borrowers with shadow lenders and fintechs.

3️⃣ Remember when peer-to-peer lending was going to disrupt banking? Zopa, one of the UK’s first such lenders, has raised capital to become a bank. Marketplace lending, meanwhile, is forecast to grow substantially, but the Economist (paywall) points out that challenges remain.

4️⃣ Goldman Sachs is slowing down Marcus, its retail brand, in the UK. The company wants to avoid onerous regulations that kick in once it has £25 billion ($33 billion) in deposits, the Telegraph reports (paywall).

5️⃣ One-third of millennials in the UK mainly use a challenger bank, according to AT Kearney. But they still use traditional institutions for their most important transactions.

The future of finance on Quartz

Funding for African fintech is on fire: Migo, a Nigerian credit scoring service, is among the latest to raise money. Upstarts offering small loans have been gaining traction, winning over customers with the promise of quick, collateral-free credit.

Finance is Africa’s best-funded sector for startups. The boom isn’t disrupting traditional financial services, but rather is building up a historically underdeveloped industry.

Bill.com is a refreshingly boring IPO. The small business payment company (Quartz member exclusive) isn’t touting an exaggerated market size, made-up metrics, or crazy founder control, and appears to have a path to profitability.

Next week’s guide to the world’s highest-valued fintech companies will include profiles of Nubank and Paytm, and a Q&A with Stripe’s Matt Henderson, formerly of Google and Amazon. If you’re not already a member, you can support our journalism and sign up here. Use the promo code JD2912 to get 50% off an annual subscription.

Always be closing

- Accel, a prolific fintech investor, has closed a $550 million fund for Indian investments.

- Hastee, a UK payroll financing company for employees, got €243 million ($270 million) in funding.

- Konfio got $100 million from SoftBank. Goldman Sachs earlier lent the Mexican financial firm $100 million.

- FinAccel, which operates a lending service in Singapore, raised $90 million.

- Rapyd, a UK finance-as-a-service provider, raised $20 million.

- Cora, a banking service for small businesses in Brazil, lured $10 million of investment.

- Uncapped received £10 million in funding. The working-capital financier is based in Warsaw.

- Rebel, a credit startup for Brazilians, raised $10 million.

- Bokio got €4 million. The Swedish startup uses AI for small business bookkeeping.

- Salv received $2 million in seed funding. The anti-money laundering startup was startup by former Skype and TransferWise employees.

I hope your week has been a profitable one (pick your own metric). Please send any term sheets, tips, and other ideas to [email protected].