Future of Finance: Bank of England “hacked,” PayPal’s unspent billions

Welcome back! If you’re new, sign up here to receive this free email every week. This newsletter will be on hiatus until January 10. Happy holidays!

Welcome back! If you’re new, sign up here to receive this free email every week. This newsletter will be on hiatus until January 10. Happy holidays!

Hello Quartz readers!

Officials in London are looking into a Times report (paywall) that traders were getting a few seconds head start on the news from Bank of England press conferences. It’s still not clear who did anything wrong, and the blame could even rest with the central bank itself.

Some headlines said the video feed of the central bank’s press conferences had been “hacked” or “hijacked.” That’s probably misleading. According to a report, someone figured out that it was faster to compress and broadcast the audio feed of the public conference than it was for the video feed. They could provide information as much as eight seconds faster, giving traders a juicy edge, and charged as much as £5,000 ($6,500) for access to the feed for each press conference. (An unanswered question is why they were charging so little for something so valuable.)

The Bank of England says the audio feed was only supposed to be used if the video stopped working:

“Following concerns raised with the Bank, we have recently identified that an audio feed of certain of the Bank press conferences— installed only to act as a back-up in case the video feed failed—has been misused by a third party supplier to the Bank since earlier this year to supply services to other external clients. This wholly unacceptable use of the audio feed was without the Bank’s knowledge or consent, and is being investigated further.”

A key question is whether the bank made clear that the audio feed was off limits. If the central bank told news providers that the audio was only for an emergency, and not to be monetized, then selling that feed to high-frequency trading firms sounds like breaking the rules. But if the bank never really thought about it—assuming people would rather watch a video without realizing that the audio could be transmitted more quickly—then perhaps the central bank should own this problem. I asked the Bank of England this straightforward question and it declined to comment.

Until this terms-of-service question is resolved, it’s not clear to experts I’ve spoken with that any traders, or even the news provider, did anything wrong. Knowing things before other people do is how Warren Buffett, as well as high frequency traders, try to make money. That can be through analysis (Buffett), which is seen as smart, or through a better data feed (HFTs), which is seen as sneaky.

Some reports have compared the audio feed to insider trading, which could also be misleading. Insider trading can refer to buying and selling based on nonpublic information, while the Bank of England governor’s spoken words at a press conference are public information. Statisma News helpfully posted a statement yesterday saying “it is impossible to ‘hack’ or ‘eavesdrop’ any live public event or press conference,” suggesting that it has been getting a question or two about its possible role in the kerfuffle.

PayPal’s $24 billion

This week, I also spent some time reading about PayPal’s lawsuit (pdf) versus the US Consumer Financial Protection Bureau. The CFPB is making PayPal abide by the same fee disclosure rules as prepaid cards; regulators presumably want to make sure card users, who may be younger or poorer, can tell whether they are getting a good deal or not.

PayPal has been swept up in the rule and has to show things like the highest possible fee under a worst-case scenario, which could confuse some customers. And in a world where investors are obsessed by active user metrics, any kind of friction puts PayPal’s wallet at a disadvantage to other digital apps.

PayPal’s lawyers say there are several reasons why this is unfair: It’s a violation of PayPal’s First Amendment rights of speech, they say, and the rules are “extremely prescriptive and rigid.” PayPal also says the digital wallet isn’t a prepaid card—customer funds stored there are only “occasional” and an “incidental feature.”

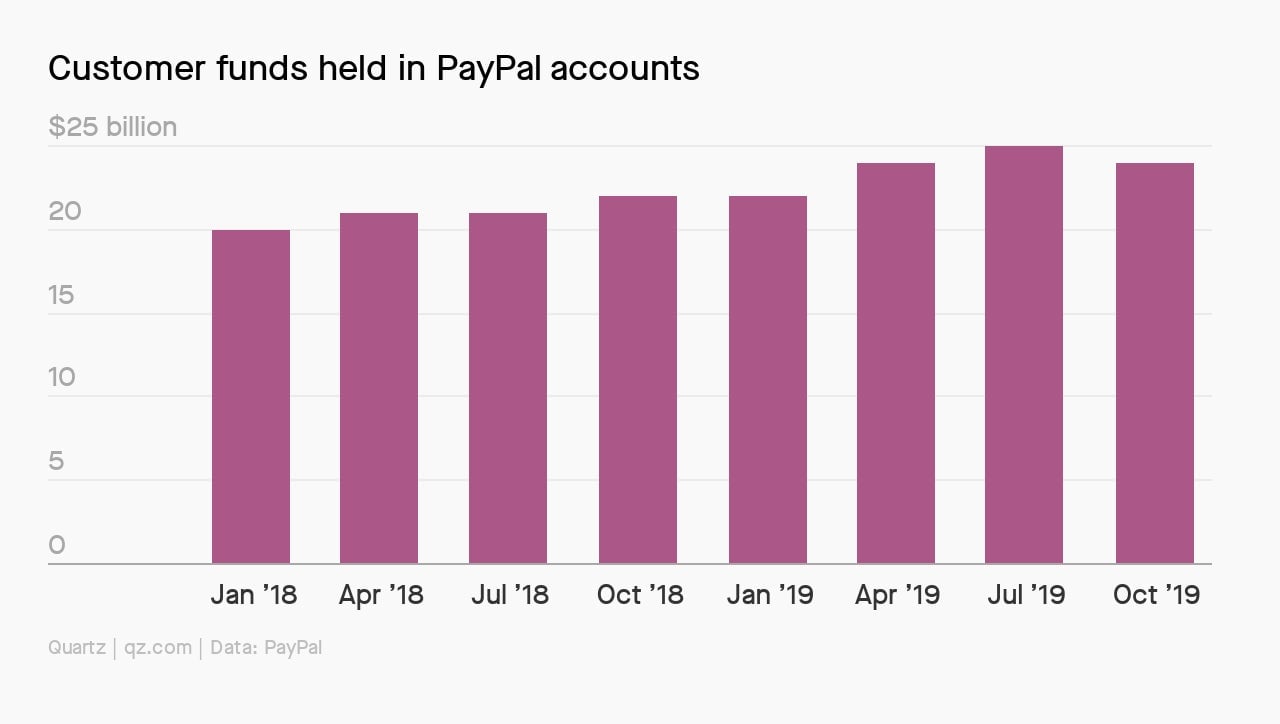

If you look at PayPal’s financial filings, its customers have occasionally and incidentally stored around $24 billion in their digital wallets. That’s more than a lot of US banks have in deposits, and is more than robo-advisor Wealthfront had in September. Some older studies have put the amount of unused money on gift cards at around $1 billion.

This is not an entirely apples-to-apples comparison, of course. PayPal has around 295 million active customers around the world, and many of these users are merchants. The amount of customer funds averages out to around $82 per customer.

Even so, PayPal’s spat with the consumer protection agency inadvertently highlights that there are billions of dollars sitting in the company’s accounts, without the type of government deposit protection you expect from a savings account, and not earning any interest for customers.

This week’s top stories

1️⃣ MoneyLion, a banking startup, is rolling out commission-free stock trading, according to Business Insider (paywall). It’s another sign that the product offerings of financial startups are converging. (Also, see our story on the fine levied against Robinhood, another commission-free brokerage.)

2️⃣ PNC and Venmo are in a scuffle over access to customer accounts. The Wall Street Journal (paywall) report highlights the debate over who should control customer data.

3️⃣ The CFPB has cracked down on prepaid card disclosures, but the agency has gone silent on fair lending. The organization hasn’t referred any Equal Credit Opportunity Act violations to the Department of Justice in the past two years, according to American Banker.

4️⃣ The Bank for International Settlements published a report about digital finance in India. The government has created payments infrastructure as a public good that financial startups can tap into.

5️⃣ Scotland needs hundreds of ATMs to stem its cash crisis. The Herald reports that free cash machines were the second-most requested commercial asset in a survey, behind general practice doctors.

The future of finance on Quartz

Alipay will offer automated financial advice, a first for ordinary Chinese consumers, via a venture with Vanguard. A series of announcements have signaled that American financial institutions are getting more access to the world’s second-biggest economy.

India’s payment apps are hard to use. Walmart’s PhonePe has the smoothest transaction experience, according to a Forrester Research analyst, who argues that most of the country’s payment apps are flooded with features and jargon.

Also in India, payment company MobiKwik‘s entrepreneurial mafia has become a fountainhead of startups. They’ve set up ventures across health care technology, meat delivery, dockless bicycles, financial consulting, and public relations.

Bill.com‘s IPO has been successful—maybe too successful. Its red-hot financial metrics suggest traders expect the accounting and payments software company will get acquired.

Is there a fintech bubble? Quartz members can use and reuse PowerPoint slides based on last week’s field guide, Beyond the fintech hype.

What to give the entrepreneurs in your life. Quartz membership is an essential toolkit made up of in-depth field guides, conference calls, video series, and ready-to-use presentations on the industries and phenomena changing our world. Set someone up for success with the gift of Quartz.

Always be closing

- PayPal completed its acquisition of China’s GoPay, after receiving approval from the PBOC.

- ZestMoney, an Indian consumer lending startup, raised $15 million of funding led by Goldman Sachs.

- Rebank, a startup bank, got $2.8 million.

- Genesis, a capital markets software company in London, raised $1.8 million.

I hope your week has been a profitable one (pick your own metric). Please send any prepaid cards, tips, and other ideas to [email protected].