Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

You know who banks are discriminating against? Chatbots.

The top-rated banks in the UK for customer service are anti-robot. First Direct advertises on its website that you can talk to “real people.” A spokesperson for Starling Bank said the six-year-old company’s customer service team “is 100% human.” Starling is digital-only, so it doesn’t have physical branches or bank tellers, but the bank still employs a bunch of people for customer service.

This suggests several things. One is that Blade Runner-style robot discrimination is rampant. It also signals that entry-level banking jobs could be more resilient than expected. There’s precedence for this: the number of bank teller jobs increased after the ATM was invented. Banks began employing fewer tellers at each branch, according to an oft-cited academic study, but they became more profitable and were able to open more branches. Thanks to automation, the number of bank tellers went up for decades.

Something similar could happen as mobile banking becomes the norm and branches decline. Simple stuff is handled by app automation, while the leftover questions for call center workers will be more challenging and complex. As the banks’ cost base goes down, they can serve more customers, and potentially hire more people for customer service.

Or maybe the robots will fight back. While commercial chatbots have improved at speech recognition, says Björn Schuller, professor of artificial intelligence at Imperial College London, they are still “lacking in social skills, at recognizing your anger or satisfaction or that you’re surprised.”

That’s not because tech that mimics social responses doesn’t already exist. Schuller says it has been demonstrated in research, but there can be a surprisingly long lag between what’s possible in the lab, and what is rolled out for consumers. Amazon’s Alexa personal assistant debuted in 2014, but Schuller says much of the tech was developed a decade or more before that. Likewise, social-skill technology was demonstrated in 2010. (You can watch a video of a researcher chatting with a robot on YouTube here.)

“The tech is more or less ready,” Schuller said in a telephone interview.

He argues that people may eventually prefer the robots. You don’t have to wait in line, or question the competence and training of the customer service person you’re dealing with. AI could could have a full resolution of speech signals, would remember everything you told it over the years, and could imitate you better. Some people might be less embarrassed talking about a missed payment or default if they can discuss it with a chatbot.

Another view of the future is that, like the ATM before it, AI helps support bank workers instead of replacing them. Even as chatbots become more refined, some people could have a cultural aversion to trusting a machine’s advice when making a big decision about a mortgage or sharing personal data. A customer service agent equipped with AI could handle questions more quickly and precisely.

“There’s a general vision in AI to have symbiosis,” Schuller said. “When you have customers, they probably would want assistance with a personal touch, even if they were AI-empowered or aided.”

This week’s top stories

1️⃣ China’s peer-to-peer lending sector is shrinking rapidly (paywall). The government was once a supporter of this type of financing, but aggressive regulation could be killing it off, the Wall Street Journal reports.

2️⃣ Goldman Sachs is in advanced talks to offer small-business loans through Amazon’s platform, according to the Financial Times (paywall). It’s another sign that Big Tech is avoiding heavy financial regulation by partnering with Wall Street.

3️⃣ Speaking of Goldman, the investment bank is contemplating a cloud offering that’s specifically for the financial industry, according to Yahoo Finance. An internal memo about its potential was written by an Amazon Web Services alum.

4️⃣ Japan is concerned about China’s planned digital yuan, Bloomberg reports. Lawmakers are urging the US to cooperate with other big central banks to counter its influence.

5️⃣ The world’s biggest asset managers are flexing their muscles. BlackRock, which has said it’s going to make sustainability a key focus, reprimanded German conglomerate Siemens (paywall) for its role in an Australian coal mining project. Vanguard, meanwhile, will offer private equity investments to its institutional clients.

The future of finance on Quartz

The US Secret Service arrested the “Michael Jordan of algorithmic cryptocurrency trading.” Authorities say more than 100 investors, including former professional baseball players, were swept up in the scam.

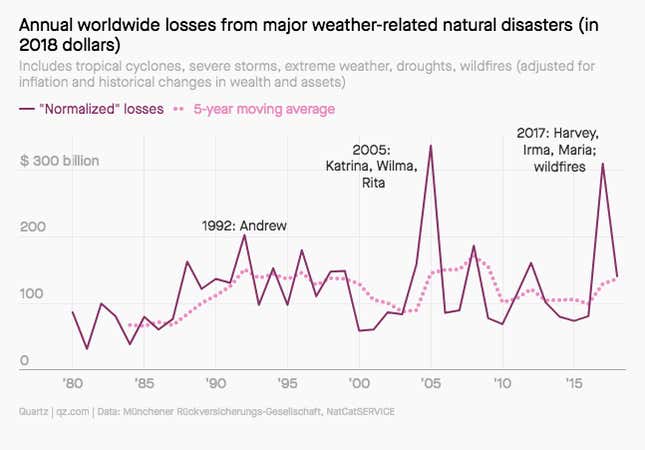

Central bankers are preparing for the catastrophic costs of climate change (Quartz member exclusive). A weather-related disaster severe enough to start a full-blown recession in an advanced economy is already a possibility.

Elsewhere on Quartz

By nearly every measure, the venture industry has boomed. Venture capital has evolved from small-scale, hyperlocal deals to a global industry that invests $250 billion each year. Quartz contributor Dave Edwards reports on the forces that transformed VC—and lays out what the explosion of private investment means for all of us.

Always be closing

- Worldline is buying rival European company Ingenico for $8.6 billion, creating the fourth-largest payments firm in the world.

- Grab, the ride hailing “super app,” is buying wealth management startup Bento.

- The Zebra, an insurance startup, received $38.5 million of investment. The deal was led by Accel.

- Finix got $35 million of investment. Sequoia led the round in the payment-technology business.

- Kasisto, a chatbot developer, received $22 million in financing. JPMorgan and Mastercard are among its investors.

- Azimo raised €20 million ($22 million) in debt financing from the European Investment Bank (EIB).

- Rimilia, a finance software company in the UK, received $15 million in funding.

- Receeve, a debt servicing platform, raised €4 million from Mangrove Capital Partners and Speedinvest.

- Visa is selling the corporate foreign-exchange unit of Earthport to Foreign Currency Direct.

- Antler, a startup investor, raised an undisclosed sum from investors including Schroders.

- Microsoft is partnering with Australia’s Commonwealth Bank for a project, called X15 Ventures, to develop financial startups.

I hope your week has been a profitable one (pick your own metric). Please send chatbot messages, tips, and other ideas to jd@qz.com.