Future of Finance: Digital renminbi fears, Robinhood not out of the woods

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

A few weeks ago the Financial Times wrote about China’s plans (paywall) to develop a digital currency, reporting that the People’s Bank of China has filed more than 80 patents to digitize the renminbi. The newspaper says this could give the country and its currency an edge internationally:

“The revelations come as central banks around the world step up their efforts to develop digital currencies amid fears that China might become an unstoppable force in financial innovation and global influence.”

Personally, I have this old-fashioned sense that a currency’s importance is underpinned by things like credit worthiness, rule of law, transparency, and deep capital markets. Technology seems like a second or third order concern.

And, not that long ago, many were dismissive of the central bank digital cash. Last year, the president of the (paper) cash-loving Bundesbank shot down the idea, citing research showing that distributed ledger technology was more cumbersome than other systems, while noting the risks that digital cash could undermine the commercial banking system. A Bank for International Settlements (BIS) survey of central banks found that “a majority still consider this move at least somewhat or very unlikely.” Federal Reserve researchers have argued that policy makers should never issue an anonymous digital money.

Then Facebook’s Libra came along. The social media company’s proposal to make a cryptocurrency available to its billions of users around the world wasn’t well received by officials, who reportedly worry that it could interfere with their control over their own currencies. Central bankers have pushed digital money higher on the agenda again, according to some reports, because they’re afraid China and Facebook could leave them behind.

Or have they? The BIS published another report on Sunday citing a different reason:

“Today, even consumers who normally prefer to pay electronically are confident that, if an episode of financial turmoil were to threaten, they could shift their electronic money holdings into cash. This flight to cash has been seen in many crisis episodes, including recent ones. The main concern is that if, in the future, cash were no longer generally accepted, a severe financial crisis might create further havoc by disrupting day-today business and retail transactions.”

Coincidentally, if you look at the countries that seem the most advanced in this kind of research—Sweden’s Riksbank and the PBOC—they are also the countries where non-cash transactions are among the most pervasive. The motivation here seems to be more out of concern that consumers could lose something valuable, which is access to the safety of central bank money. Fear of China or Facebook could be a lesser concern.

I brought this up with Accenture, which is working on the Digital Dollar Project, a central bank digital currency initiative in the US, as well as Sweden’s e-krona research.

David Treat, global blockchain lead at Accenture, argues that the most usable, functional currencies are the ones that become dominant for transactions. An upgraded system of central bank digital currency would be more efficient than the slow and expensive electronic systems and correspondent banking in place today, he says. And there’s another issue:

“There is a window of time now where whichever countries move first, they will be defining the processes, standards, and asserting a degree of influence as to how this will play out,” he said.

Do you agree? I’d love to hear your thoughts.

Robinhood

Robinhood’s brokerage app went down on Monday, a heavy US trading day, and it stumbled again the next morning. I admire the humblebrag in the company’s explanation, which cited “record account sign-ups,” among others things, that overwhelmed its brokerage systems.

I published a list of other high-profile tech mishaps that have happened at companies like Visa, Goldman Sachs, and Nasdaq. Those episodes were embarrassing, and some companies on the list got sued or fined. But with one notable exception, all of those enterprises are still around and seem to have put those episodes far behind them.

The notable exception on my list is Knight Capital, which lost around $450 million from a computer trading error in 2012. Knight was rescued by a group of investors who injected $400 million into the trading company, and it was eventually acquired by Getco, an electronic trading firm. One lesson here is that, unless you blow a half-billion dollar hole in your company, embarrassing technology errors are a survivable part of modern life.

This week’s top stories

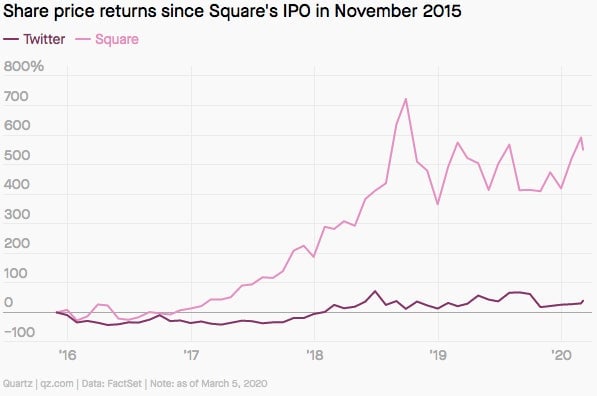

1️⃣ Activist investor Elliott Management bought a big chunk of Twitter and is looking to push out CEO Jack Dorsey, according to Bloomberg. But maybe Elliott should have invested in Dorsey’s other firm, the payment company Square?

2️⃣ Intuit’s $7 billion acquisition of Credit Karma could run into antitrust concerns, Wired reports. Regulators are looking much more closely at companies’ control over mountains of user data.

3️⃣ European banks mainly rely on American tech companies like Microsoft, Google, and Amazon for cloud computing. The lenders would like to have a domestic champion for this service, Bloomberg writes, but one seems unlikely to emerge.

4️⃣ The US supreme court is hearing arguments about the constitutionality of the Consumer Financial Protection Bureau. The agency was abandoned by its own director on the matter, and supreme court justice Brett Kavanaugh doesn’t like the CFPB either.

5️⃣ Corporate bond trading has slowly moved into the electronic era. The big question is whether that market will remain smooth (paywall) when companies are hit by downgrades and selloffs quicken, according to The Economist.

The future of finance on Quartz

- You can look up any US broker in the BrokerCheck database, but the picture isn’t complete. The most critical information can be the institutional context—the misconduct histories of a broker’s colleagues.

- Consumers are looking to Reddit, the sixth most popular website in the US, for personal financial advice. What could possibly go wrong.

- Indian banks can work with cryptocurrency exchanges again. The country’s supreme court said the Reserve Bank of India (RBI) order blocking this activity was “unconstitutional.”

Elsewhere on Quartz

A college education can’t guarantee success in the digital economy So what can? Quartz’s Michael J. Coren reports on the challenge to transform education and close the widening gap between a slow-moving higher ed system and a fast-moving economy—without miring students in debt.

Always be closing

- SBI Cards and Payment Services, the credit card arm of State Bank of India, had a $1.4 billion IPO.

- Thought Machine, the maker of cloud-based software for banking, raised $83 million.

- Oriente Investment received $20 million in debt financing. The company runs online lending platforms in Southeast Asia.

- Public.com got $15 million of funding. The social investing app raised money from Accel and some celebs.

- Refinitiv bought Scivantage, a digital wealth management company. Deal terms weren’t disclosed.

- Ant Financial, the Chinese payment giant and financial conglomerate, bought a 1% stake (paywall) in Klarna, the Swedish lending upstart.

I hope your week has been a profitable one (pick your own metric). Please send (digital) central bank currency, tips, and other ideas to [email protected].