Future of Finance: Coronavirus is killing cash, trade like it’s 1929

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers.

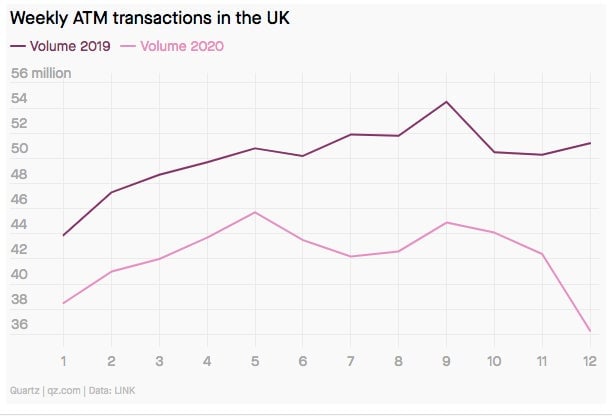

Some people in the payments business think the Covid-19 pandemic is going to be the death of cash. ATM withdrawals in the UK have collapsed as commerce in Britain has been shuttered, leaving people with fewer places to spend notes and coins. Some are probably avoiding the germs that can stick to physical money.

While you might have thought people would be hoarding paper money along with their toilet rolls and pasta, so far it looks like they’re doing the opposite.

Notes and coins, you may have noticed, are getting some bad publicity, and not all of it is deserved. Earlier this month the Telegraph reported that the World Health Organization was urging people to use contactless payments instead of cash to avoid infections from the new coronavirus. That isn’t quite accurate—the group didn’t single out paper notes and metal coins, and a spokesperson later told MarketWatch that the organization has been misrepresented. The WHO says people should wash their hands after touching money, the same as with other surfaces that could be harboring the coronavirus.

Some central banks have also given banknotes a bad name. The Federal Reserve has quarantined money that was repatriated from Asia, while the People’s Bank of China has used ultraviolet light or high temperatures to disinfect cash.

Contactless payments, meanwhile, are getting positive publicity and a boost from increases in payment limits. Greece, Ireland, Malta, Poland and Turkey have hiked the amount that can be spent with contactless, and the threshold will be raised in Britain from April 1.

Barclaycard said in an emailed statement that it was supporting the increase in the UK “to help prevent the spread of coronavirus.” Trade group UK Finance, however, said there “is no scientific evidence that there is an increased risk of spreading the coronavirus through the use of cash.”

Trade the dip

Who would have thought a grizzly stock market would entice new brokerage customers?

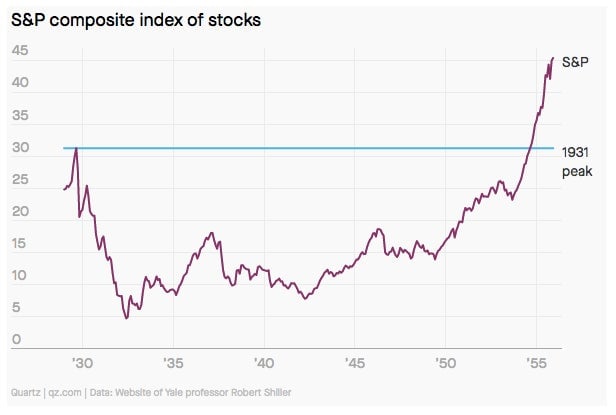

It took the S&P 500 Index of stocks just 16 days to plunge into a bear market—even faster than the 1929 crash that set off the Great Depression. Some of that steep decline was probably because of speedy trading algorithms, sure. The other part is that this collapse in economic activity was premeditated. There’s not usually a press conference warning investors that commerce and spending will halt, but this time there was.

You know who isn’t scared? The people who are signing up like mad for online brokerages. In the UK, Freetrade says it has had record account openings almost every day, with 125% more accounts opened on March 20 than the daily average of the previous few weeks.

Freetrade doesn’t seem to be an anomaly. In the US, a spokesperson for Charles Schwab told me the brokerage is seeing “strong, above average asset and account growth during this period of volatility relative to normal periods.” EToro’s CEO says first-time depositors have increased by 300% this year, and Square CEO Jack Dorsey said in a conference call that company’s Cash App has had “strong engagement and volume for bitcoin and investing throughout this.”

Maybe they’re following that Warren Buffett saying that you should be greedy when others are fearful. That said, stocks don’t always roar back to life after a collapse. Some people dispute this way of looking at things, but it’s worth remembering that it took US equities some 25 years to climb back up after the Wall Street Crash in 1929.

This week’s top stories

1️⃣ Big banks, from Morgan Stanley to Deutsche Bank, have reassured employees that job cuts aren’t imminent. Unlike the 2008 crisis, these financial giants aren’t at the center of the recent panic, and executives are sensitive to the politics of cutting workers, Reuters reports.

2️⃣ Europe’s coronabonds, pooled debt securities to provide funding amid the pandemic, still face opposition from Germany and the Netherlands, according to Politico. Divisions over risk sharing have long blocked deeper EU integration.

3️⃣ British banks have been hit with criticism for the high rates they’re charging for some emergency small-business loans, Bloomberg reports. The British Business Bank is guaranteeing 80% of the debt for lenders.

4️⃣ The US Treasury market has shown signs of malfunctioning. It was partly as a result of Wall Street traders working from home, inflexible bank balance sheets, and arbitrage trades, according to Josh Younger, a managing director at JPMorgan, on Bloomberg’s Odd Lots podcast.

5️⃣ Tech lenders in the US say they can get emergency government funding to small businesses faster than traditional banks can. Trade group Financial Innovation Now says its members have direct-deposit connections with more than 20 million small enterprises. UK digital banks are waiting to find out if they can participate in the UK’s government lending program.

The future of finance on Quartz

For the first time in 228 years, the New York Stock Exchange opened without humans on its trading floor. Most of the action already took place in a data center, and now, temporarily, all of it will.

Governments around the world are gearing up to spend and lend at least $4.4 trillion. That number will get even bigger, and economists have mixed opinions on whether the recovery will be quick or more protracted.

You Need a Budget, the personal finance app, is part media platform, part cult. It’s become the Goop of the budgeting world.

Elsewhere on Quartz

Changing the pitch. Y Combinator, the prestigious Silicon Valley accelerator, was forced to move its recent demo day online. Like so many other things that coronavirus has affected, it could permanently change the way new businesses raise money. Startups already face numerous risks, but experiments like these could help it weather the storm.

Always be closing

- Fast raised $20 million. Payment company Stripe led the investment in the online checkout company.

- Tink, the Swedish open banking platform, acquired Eurobits for €15.5 million ($17 million).

- NatWest, the UK bank, invested £5.5 million ($7.2 million) in VoxSmart, a maker of surveillance technology for financial markets.

I hope your week has been a profitable one (pick your own metric). Please send tips, advice for sterilizing debit cards, and other ideas to [email protected].