Future of Finance: Hybrid home ownership, virtual venture capital investing

Welcome back! If you’re new, sign up here to receive this free email every week.

Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

Last week a lot of you clicked the article that economist Issi Romem wrote in the UpShot. Romem, who is also a fellow at the Terner Center for Housing Innovation at UC Berkeley, says the pandemic could change how homes are owned and rented. I spoke with him to ask a few follow-up questions.

As the cost of home ownership slips out of reach for even affluent people in cities like Sydney and London, some are seeking out a hybrid owner-renter arrangement. Romem writes that Haus, a co-investing firm in San Francisco, has eliminated the need for a mortgage—customers make monthly payments and their share of ownership in the home can be adjusted.

Romem’s article is timely. One of the ways people get through financial difficulties is through a home equity loan, which is personal borrowing that uses a property as collateral. That option is drying up. In the US, Wells Fargo stopped offering them and JPMorgan is doing the same. “They’re worried people won’t be able to pay it back and they’re probably right about that,” Romem said in a phone call .

Co-investment, he said, offers a way to do something similar to a home equity line of credit:

“This notion of having a co-investor buy part of your house and give you money for it now is simply another way of doing that, and it’s a timely one in the sense that I think the investment world is eager to find real estate assets to buy. Even now in the time of coronavirus, it’s one of the assets that’s not as overtly problematic as some assets. There’s more hope that real estate will weather this well than some other assets.”

Investors have poured money into rental housing, but owner-occupied property, which is seen as a safer class of real estate, has by definition been out of reach for institutional investors. Co-investment could be a conduit for it. But unlocking this wealth is still tricky, Romem said, because the individual homeowner needs a way to repurchase the stake that was sold to the company, and on fair terms:

“My suspicion though is no company is going to want to offer homeowners this amount of cash in exchange for an equity stake if the terms aren’t clearly profitable. And that drive for profitability is kind of a no-win situation. If you don’t get the profit, you’re screwed as an investor, and if you do make a profit, you’re screwed because you will be perceived as being predatory. And that’s probably true whether you make a small profit or a large one.”

Even so, Romem thinks this model is coming. “Someone will try this,” he said.

Virtual venture capital investing

This week my colleague Alison Griswold and I had a Zoom call with Accel partner Andrei Brasoveanu. He said the venture capital firm recently invested in a company whose team they’ve only met remotely (he declined to say which company). While going all digital felt normal since the startup is “remote native,” Brasoveanu said with some teams you’re still going to need flesh and blood meetups.

Accel isn’t the only financial firm finding business can go on relatively smoothly under lockdown. Executives at some of the world’s major banks have been pleasantly surprised how well their staffs have performed while WFH.

- The CEO of Deutsche Bank, the profit-challenged German lender, is rubbing his hands together: “We have a chief transformation officer, who is doing nothing else and looking at the chances and opportunities of that what we have experienced over the last four weeks and actually thinking about what can we implement now long term, and that will also result in cost reductions,” Christian Sewing said in a conference call this week.

- The CEO of London-based Barclays has realized that staff can get the job done “from their kitchens.” Jes Staley suggested in a call with reporters this week that retail branches could be used by investment bankers and call center workers, shortening their commutes. “The notion of putting 7,000 people in the building may be a thing of the past,” he said.

- “The experience so far has been rather good,” said Standard Chartered’s chairman Jose Vinals. “It may be that going forward you don’t need to have 100% of the people in the office, 100% of the time.”

- The chief exec of Freedom Mortgage in New Jersey told the Financial Times that the boom in refinancing (paywall) has gone more smoothly than expected, given the WFH arrangements. “It’s making me rethink whether or not I need all these buildings,” he said.

Will going to an office become a perk?

More top stories

😨 Online lending in Indonesia, a hotspot for fintech investment, could be headed for a meltdown (paywall). Chinese companies have poured investment into peer-to-peer lenders that are now under pressure, the Financial Times reports.

📱 Facebook and Reliance Industries launched a pilot that allows Indian consumers to shop through WhatsApp. They are expected to pair it with online payments in the coming weeks.

💳 Mastercard says contactless payments jumped 40%. The company’s weekly transaction data signals the drop in spending may have bottomed out.

😡 Eight executives have left Revolut since March. Financial News reports that the British financial startup is still aiming to reach profitability this year despite the ongoing pandemic.

💷 Royal Bank of Scotland is shuttering Bó, its digital-only startup bank for consumers. Chief executive Alison Rose says RBS will focus on Mettle, its digital-only brand for small businesses.

The future of finance on Quartz

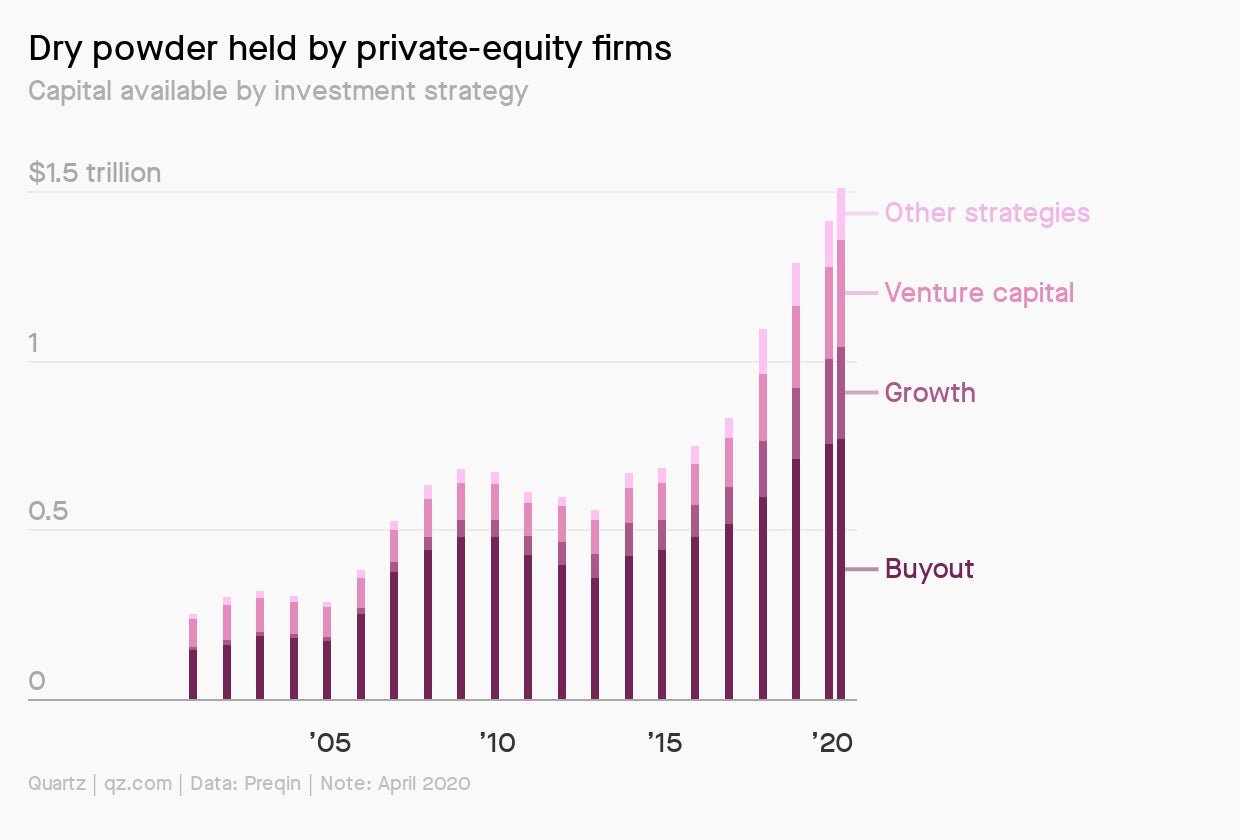

This could be a bumper year for mergers and acquisitions, as stronger companies snap up their weaker rivals, and private equity firms deploy some of their record holdings of dry powder. Chinese firms, despite concerns from some officials, are likely to be less acquisitive abroad.

Collapsing oil prices could put Canada’s carbon-intensive oil sands into long-term decline. In the US, now that storage in Cushing, Oklahoma is sold out, producers are getting creative, filling up everything from Swedish salt caverns to parked trucks with the black liquid.

Some African countries spend five times as much on interest payments as they do on their health budgets. Discussions are taking place to potentially pause debt repayments so they can focus on the ongoing health crisis.

Elsewhere on Quartz

The global transition to home fitness is fraught with injury, but fitness experts say staying healthy and safe is easier than it sounds. In our latest field guide on the home fitness boom, we share their advice on working out safely.

Always be closing

- FIS set up a venture arm to invest $150 million in fintechs.

- Stash, an investing and banking startup, got $112 million in funding.

- Oriente raised $50 million. The company lends to consumers and small enterprises in the Philippines and Indonesia, and is expanding to Vietnam.

- Wise, a challenger bank for small businesses, received $5.7 million of investment.

I hope your week has been a profitable one (pick your own metric). Please send tips, home office suggestions, and other ideas to [email protected].