Hi Quartz members,

The biggest economic story in 2022 will be the same as last year and the year before that: Can the world finally get covid-19 under control? Speaking of repeats… inflation, crypto, and Evergrande each also make our list of the biggest economic trends to watch this year.

But the world isn’t stuck in a loop—global immunity to covid-19 continues to rise, supply chains should slowly untangle, and inflation will likely get under control this year. 2022 may not be “normal,” but it will be different. Think of it less as 2020: Rebooted than as the (hopefully) final installment of The covid trilogy.

Meanwhile, there are new dangers looming: from crypto’s collision course with regulators to a buildup of Russian troops on the Ukrainian border. Here’s what we’re paying attention to in the new year.

FROM PANDEMIC TO ENDEMIC

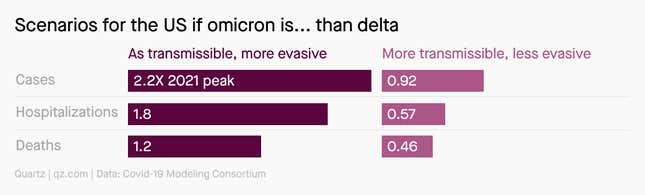

Just a few days into its third year, the covid-19 pandemic is already setting new records. It’s not yet clear whether the new onslaught will translate into the same level of death and hospitalization as previous waves. While omicron appears (for now) to be less lethal than delta, the blistering pace of its spread could result in more severely ill people.

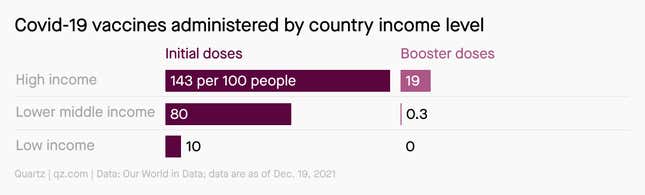

Regardless of what omicron’s epidemiological math turns out to be, whether the world will be facing another crisis come January 2023 will largely depend on policymakers. The more cases there are, the more opportunities for the virus to mutate. To stop it, rich countries will have to do a lot better in helping the rest of the world get jabbed.

Though each variant is different, two years of living with the virus means we know enough to control it, researchers say. At the top of public health experts’ wish list for politicians is upping vaccine distribution around the world, though masking, social distancing, and widespread testing are also needed. “The challenge before us today isn’t a scientific problem,” said Akshita Siddula, co-founder of Right to Health Action, an advocacy group, during a recent online conference. “What we have here in front of us is a problem of politics and power.”

SUPPLY SIDE

In 2021, global supply chains reached their breaking point, spawning shortages, price hikes, and maritime traffic jams that could be seen from space. But in 2022—if all goes well (and that’s a big if)—supply chains will have a chance to slowly recover, and the worst economic impacts will be behind us.

In February, after Christmas and the Lunar New Year have passed, the holiday shopping rush will subside. Normally, this post-holiday lull is a moment of calm, when activity at the world’s ports dwindles and everyone gets a chance to catch their breath. That won’t happen in 2022. Logistics companies will strain at full capacity year-round in hopes of clearing the bottlenecks in time to avoid another disastrous holiday season next year.

But that’s assuming that another mega-ship won’t block the Suez Canal, and that outbreaks of the omicron variant don’t shutter factories and ports like delta did, and that no other unforeseen disasters strike that will gum up the works of global trade. Every time another calamity happens, it pushes a return to normal back a little farther. Analysts are predicting that it may take two years for shipping rates to fall back to normal levels. No matter what, expect slow progress.

PRICE CHECK

Last year’s inflation was driven by sharply increased demand and limited supply, both of which were caused by covid-19. This year inflation should ease.

During the pandemic, people everywhere wanted more stuff because they couldn’t spend as much money on experiences. In some months of 2021, demand for goods soared 20% above pre-crisis levels. Meanwhile, the problems in the supply chain went well beyond long lines at ports. They started with raw material producers, which, because of covid rules and limitations, could often only have a certain number of people on site. But both supply- and demand-side issues should ease as the pandemic does.

The danger with inflation is that it can become a self-fulfilling prophecy: Higher prices lead people to expect even higher ones, which leads to demands for higher wages, which causes even higher prices, and so on. The US Federal Reserve pays close attention to long term inflation expectations among American consumers, which haven’t budged even though short term expectations continue to rise. But the Fed isn’t taking any chances: Recently, US Fed chair Jerome Powell accelerated the pace of reducing its bond purchases which were stimulating the stock market and other assets, giving the central bank the ability to raise interest rates as soon as March of next year instead of June.

There are also structural reasons to doubt that inflation in the 2020s could be like the 1970s—what economic forecasting firm Oxford Economics calls a “structural lid” on inflation in the long term. This lid is caused by an aging population which reduces spending and increases saving, advances in technology that make everything cheaper, globalization which makes trade cheaper, and productivity growth after the pandemic subsides.

WILDCARDS

What else could define 2022? Here are other economic stories we’re watching closely:

- Evergrande as we knew it may cease to exist

- Will hybrid work get hacked?

- The tech boom can’t go on forever

- Regulators crack down on crypto

- The threat of war looms over 2022

Keep learning

Read our entire field guide on the Economy in 2022:

- What to expect from the pandemic in 2022

- What inflation will look like in 2022

- What should we expect of supply chains in the next year?

- Workers won’t have as much leverage over their employers

- Who will pay the tab for climate change in 2022?

- What Evergrande’s 2022 can tell us about the future of the Chinese—and the global—economy

- The wildcards that could shock the economy in 2022

Sound off

In 2022…

The world will finally emerge from the pandemic

The tech bubble will finally burst

Wars (hot and cold) will define the year

In our last poll about the changing role of the CEO, 37% of respondents said our future corporate leaders will be stuck in meetings. That’s the grimmest prediction here so far.

Survey says

We need your feedback!

Tell us about yourself, why you read Quartz, and what you’re obsessed with by taking our audience survey.

Have a great week,

—the Quartz membership team (trying to stay optimistic)

Ana Campoy, Nate DiCamillo, John Detrixhe, Walter Frick, Tripti Lahiri, Alex Ossola, Nicolás Rivero, Samanth Subramanian, and Jasmine Teng contributed to this email.

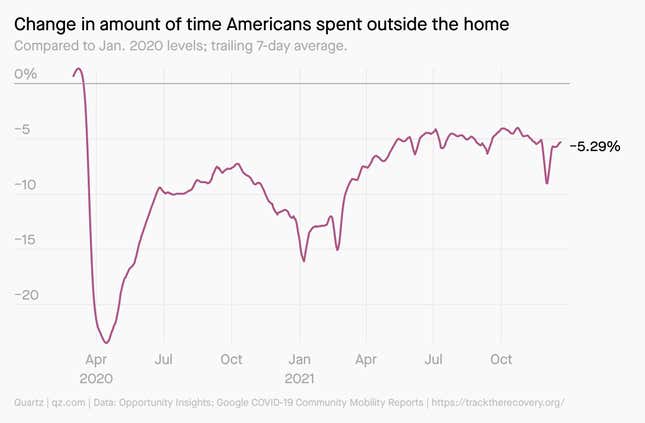

One 📈 thing

In 2021, US GDP and consumer spending recovered to pre-pandemic levels. One metric that hasn’t yet returned to its Jan. 2020 level: time outside the home. Even as restrictions eased (pre-omicron), Americans continued to spend more time at home in 2021 than they used to.

Given the spread of remote work, we’re wondering if time outside the home will ever return to where it was before covid-19.