For Quartz members—India’s most valuable tech unicorn

Hi [%first_name | Quartz member%],

Hi [%first_name | Quartz member%],

In 2011, Paytm was a little-known company providing mobile-based consumer services such as TV channel subscriptions. Cut to 2020: Paytm is India’s most valuable startup, processing 10 million transactions each day, with investors that include SoftBank, Alibaba, and Warren Buffett. Now the company must do battle on multiple fronts (including with Google 😬) to stay relevant as India’s fintech space heats up.

But first, a recap: America’s V-shaped recovery could become a ___-shaped recovery, the EU-China agreement is going nowhere, and dishwashers are selling out in India. We read the 450-page antitrust report, chart-jammed on Trump’s economic record, and published a must-read series on how reparations could work today. Should you wish to peruse any of that off-screen, just buy a dang printer already.

Your most-read story this week: The history of the pivot table, the spreadsheet’s most powerful tool. And a special member apology goes to all of you for the email today suggesting you become members. We got our wires crossed—not enough coffee—and really appreciate your support.

Okay, unlock your phone and open your digital wallet. We’re talking about Paytm.

Sticker shock

In a massive report this week (pdf), US congressional leaders alleged a lack of competition in digital markets, referring to Google specifically as an “ecosystem of interlocking monopolies.” That description is probably inspiring a lot of nodding over at Paytm.

On Sept. 11, the digital and financial services app launched a campaign where users could collect cricket stickers and scratch cards, and win cash back, by making transactions. A week later, Paytm was abruptly removed from the Google Play Store in India. Google said the app was promoting a sports fantasy league that violated its anti-gambling policies. Paytm said Google removed its app for no reason and without notice.

The issue was resolved within a few hours, but the aftershocks of that brief eviction continue to play out in India’s internet space. In a statement on Sept. 20, Paytm accused Google of trying to suppress it as a competitor, saying all Indian internet companies “face similar arm-twisting and fear of Google’s dominance over India’s digital ecosystem.” On Oct. 5, Paytm even launched a mini app store to compete with Google Play directly, and soon after said it would fund grants for developers.

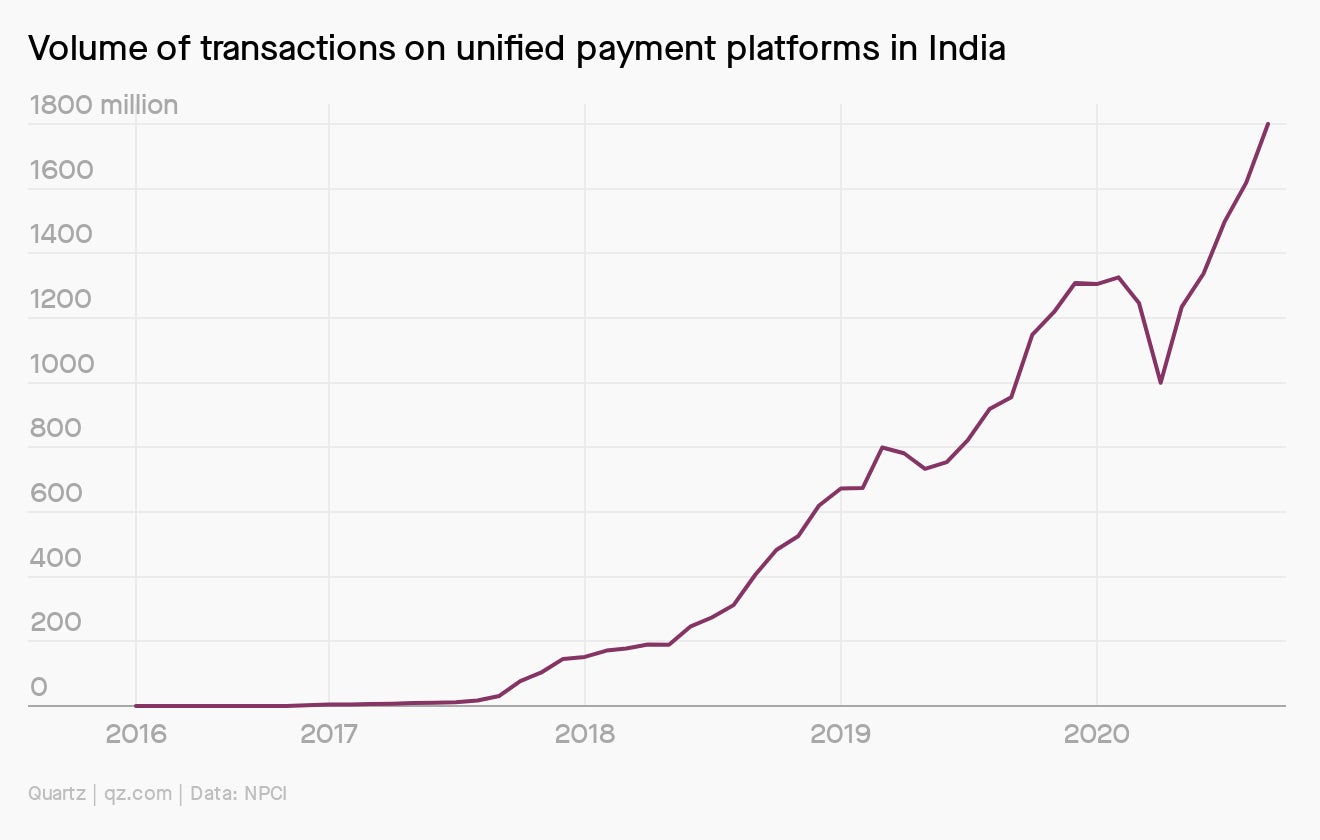

The clash puts Paytm on well-trod ground: In the US, Google is facing multiple accusations of anticompetitive behavior, and other Indian startups are pushing back on the search giant’s hold over India’s smartphone market via its Android operating system. But the skirmish also puts a spotlight on India’s rapidly growing digital payment sector, where erstwhile leader Paytm faces major competition, including from Google Pay.

The Paytm universe

✈️ Paytm Wallet: Provides services such as booking tickets for movies, events, and travel

👛 Paytm Mall: An online platform for buying clothes, accessories, gadgets, electronic items, and grooming and beauty products

📈 Paytm Money: Can be used to buy into stocks and mutual funds

💰 Paytm Bank: Offers products and services such as savings accounts, debit cards, and fund transfers

💼 Paytm Financial Services: Sells insurance and gold, and provides loans and foreign exchange services

🏏 Paytm First Games: Sport fantasy app for winning cash prizes and rewards

💬 Paytm Inbox: Instant messaging platform similar to Facebook’s WhatsApp

☁️ Paytm AI Cloud: Meant for developers, companies, and startups to store data and automate workflow

📱 Paytm Mini App Store: For Indian startups and companies to list their apps

Once a leader, now a follower

On Nov. 8, 2016, Paytm founder Vijay Shekar Sharma was attending an industry event in Mumbai when his phone started buzzing nonstop. Every media outlet in the country was trying to reach him: Prime minister Narendra Modi had announced the scrapping of Rs500 and Rs1000 notes, a move expected to “nudge” people toward digital transactions. Paytm, along with a handful of other fintech startups, was viewed as the biggest beneficiary of the decision.

Sharma was up most of that night, speaking to reporters. “I believe that our dream run is going to start now,” he told Quartz in an interview conducted well past 1am.

Between Nov. 10 and Dec. 20 of that year, Paytm added over 20 million new users, taking its total user base to 170 million. By 2019, it had become the leader in India’s digital payment service space, processing 400 million transactions a day. Bankrolled by prominent investors like China’s Ant Financial and Alibaba and Japan’s Softbank, Paytm was scaling new heights.

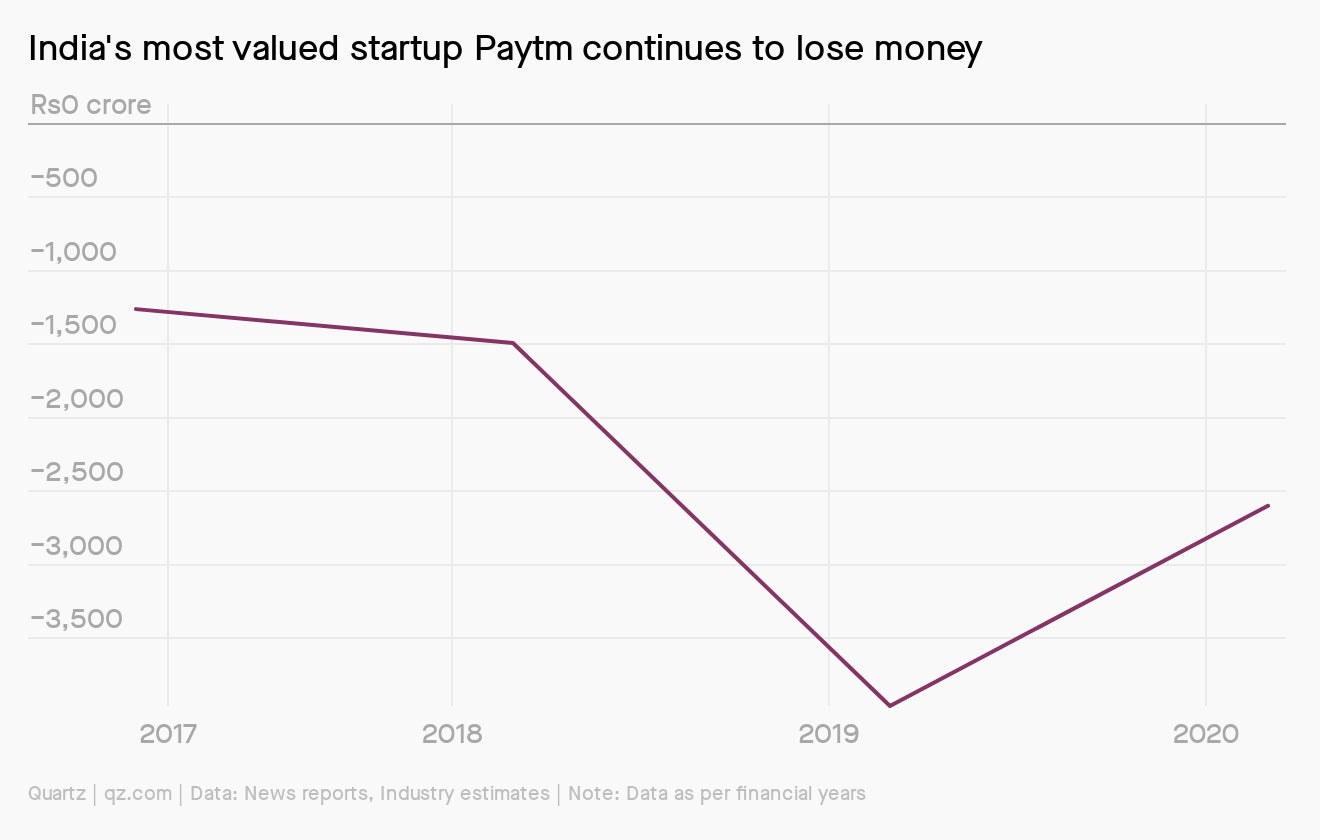

But the dream didn’t last: Now 10 years old, Paytm is struggling to maintain its market dominance. The company has been burning cash on marketing and discounts while diversifying rapidly, which is taking a toll on its bottom line. Paytm also faces both regulatory hurdles and intense competition.

Google Pay and an array of similar apps are eating into Paytm’s pie, as is Unified Payment Interface, a fund-transfer platform regulated by the Indian central bank. According to money management firm Bernstein, Google Pay now leads in India’s digital payment space, followed by Walmart-owned Phone Pe and Amazon Pay. Paytm is ranked fourth, with 15.1% market share.

Rs 2,597 crore: ($350 million) Paytm’s net loss for the fiscal year ended in March

Rs 3,629 crore: ($480 million) Paytm’s revenue for that year

Rs 3 crore: ($400,000) Sharma’s compensation in 2019

$2.6 billion: Total funding received by Paytm since its inception

(Not an Indian numeral expert? We got you. Lakh = 100,000 and crore = 10 million. So for example: 45 lakh crore is 45 x 100,000 x 10 million = 45 trillion. Rs 45 lakh crore would be 45 trillion rupees, but there could also be, say, 45 lakh crore stars in the sky.)

Indian on the outside

Despite receiving a spate of investments from major Chinese players, Sharma brazenly plays the nationalism card. When the Indian government banned 59 Chinese apps in June amid growing border tension with China, he took to Twitter, calling it a “bold step.”

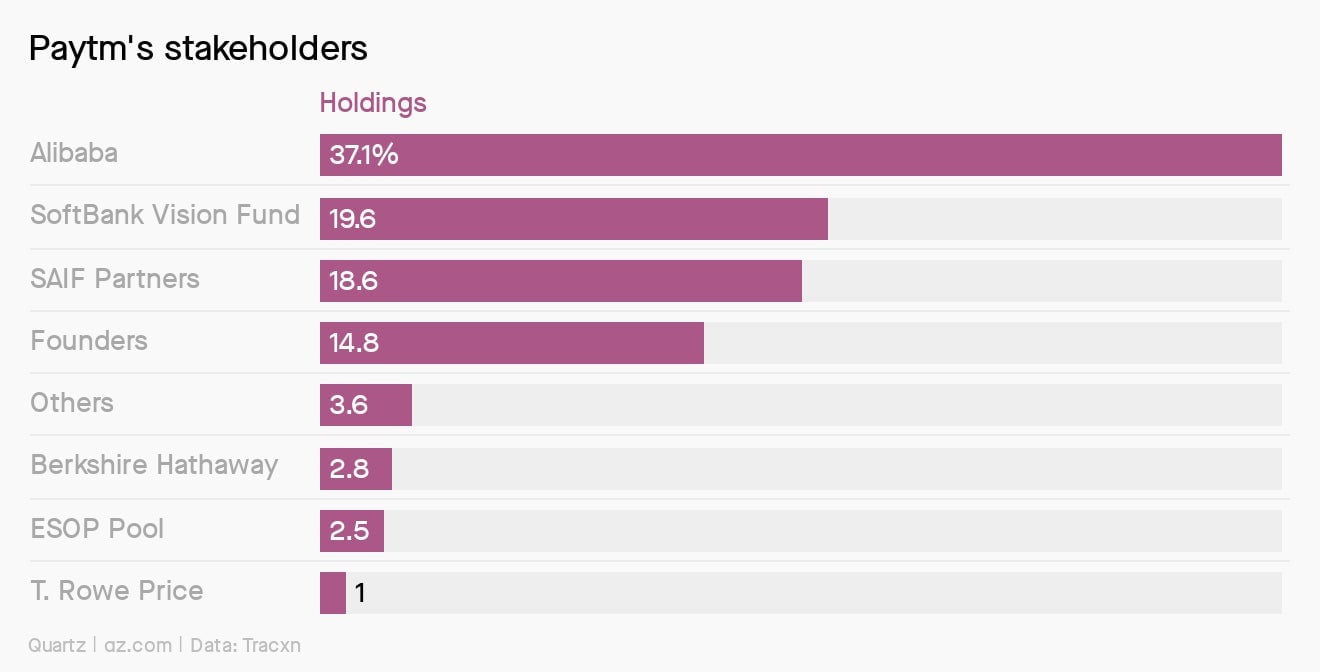

That dichotomy is a bit of a double-edged sword for Paytm. While Sharma holds a 14.7% stake in the company, Alibaba owns 37.1%. And even as Sharma has repeatedly insisted that Paytm stores users’ data locally, Chinese investors’ outsized clout raises fair questions.

🍿 One more thing

In October 2018, police arrested Paytm corporate communications VP Sonia Dhawan, her husband Rupak Jain, and another employee from the company’s administration department for allegedly blackmailing Sharma. The accused allegedly stole company and personal information in a bid to extort Rs20 crore ($2.6 million) from the founder.

And that’s not even the plot twist. A few months later, Dhawan re-joined the company, raising serious questions about corporate governance.

Keep reading

- India’s most-valued unicorn accuses Google of misusing its dominance

- Threatened by Walmart, WhatsApp, and UPI, Paytm is trying something new

- Can Paytm make every cent of its $1 billion funding round really count?

- Indian startups funded by Alibaba and Tencent are backing India’s ban on Chinese apps

- India needs stronger data protection laws for its Chinese-funded fintech startups

- The US antitrust hearings on big tech have an important lesson for India

- WhatsApp is a step closer to disrupting India’s fintech space

Thanks for reading! And don’t hesitate to reach out with comments, questions, or companies you want to know more about.

Best wishes for a prosperous end to your week,