For members: Tesla takes on the world

[qz-guide-hero id=”434622716″ title=”💡 The Big Idea” description=”Not every automaker is going to survive the shift to electric cars. Tesla redefined the competitive advantage.”]

[qz-guide-hero id=”434622716″ title=”💡 The Big Idea” description=”Not every automaker is going to survive the shift to electric cars. Tesla redefined the competitive advantage.”]

$844 billion: Tesla’s valuation on Jan. 8 2021, a record at the time

$38,190: Base cost of the Model 3, the cheapest car Tesla has on the market

21%: Battery pack’s share of an EV’s total cost relative

450: EV manufacturers in China

$6.7 billion: Tesla’s 2020 sales in China, one fifth of the company’s sales

The billion-dollar question

What will happen when Tesla sets up shop in India?

EVs represent less than 1% of vehicle sales in India, but the industry’s proponents are hoping that will change after Tesla arrives. It’s not yet clear when that will be. But Tesla registered its first Indian subsidiary this January, and there are signs the company is preparing to set up factories in the country.

When Tesla does truly break into the Indian market, it will face numerous challenges to gain a foothold from homegrown competition to affordable pricing. But if it can overcome them, Tesla can further extend its dominance by opening itself up to millions of new customers—plus, experts suspect, accelerate the growth of India’s EV industry as a whole.

“Tesla will bring a paradigm shift in the EV industry as a whole in India,” said Deb Mukherji, managing director at Omega Seiki Mobility, a New Delhi-based EV startup.

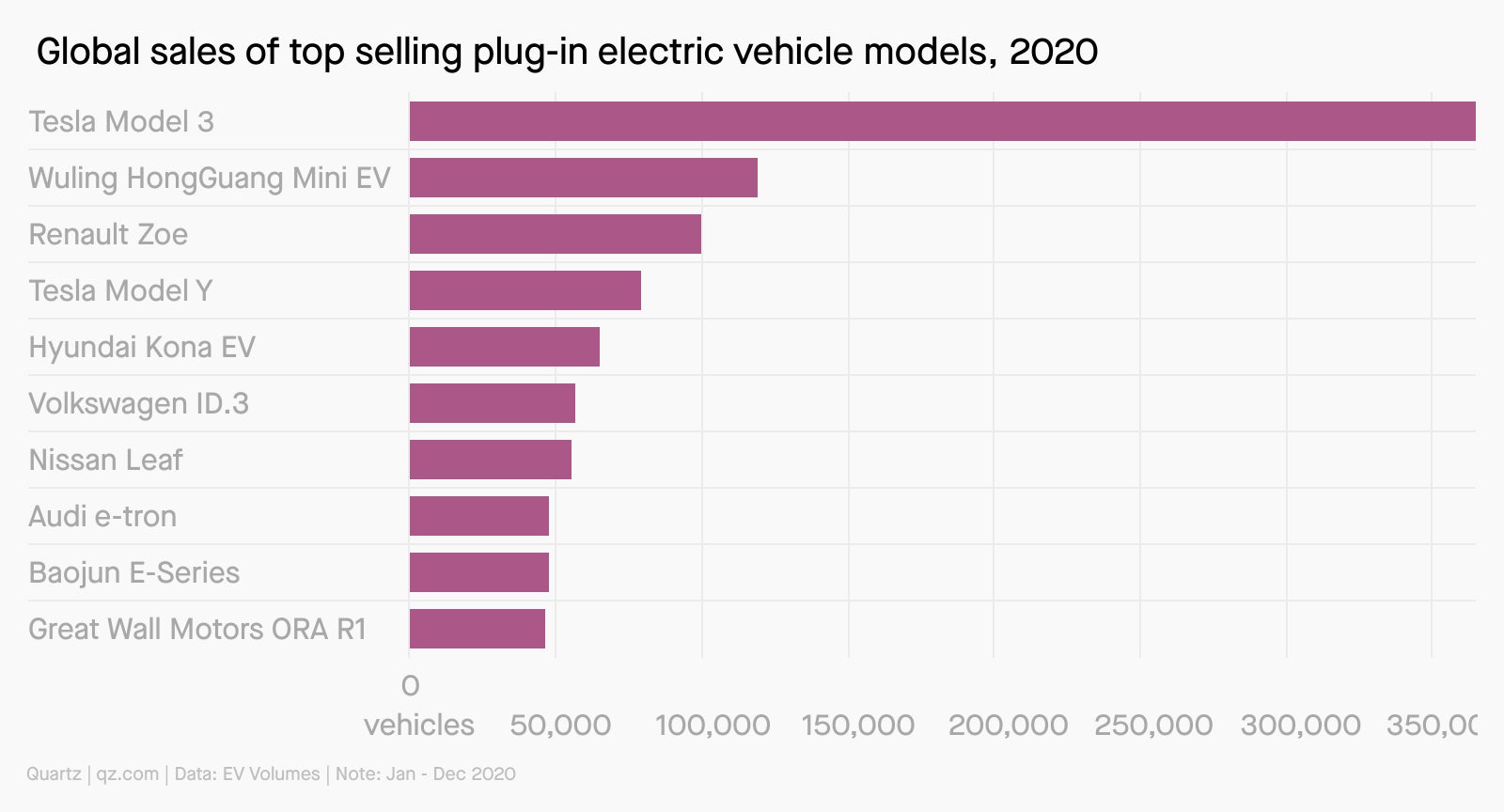

Charting the world’s most popular EVs

No company has had a bigger impact on expanding the global EV market than Tesla. The company sold almost 500,000 vehicles last year, about one of every six EVs sold anywhere in the world. Most were the Model 3 sedan, the world’s most popular electric model, which outsold every other model by a factor of three.

Commonly held question

What will it take to finally have affordable EVs?

Today, the EV market remains small. In the US, only 1.8% of new sales are electric. Even in an optimistic scenario, only a quarter of the new cars in the US will run on electricity by 2030. Tesla’s cheapest model starts at $38,190, just under the average price of a new car in the US. To push EVs even cheaper, though, the company is betting on its innovative manufacturing practices, which cost less and produce new vehicles quickly; cheaper, longer-lasting batteries; and consistently better software to make the cars more efficient.

Quotable

“I keep pestering the firm with my emails to get an update, [but] so far there hasn’t been any.”

—Arun Bhat, a 34-year-old manufacturing professional from Bengaluru. He ordered a Tesla in 2016, when they went on sale in India; five years and thousands of dollars later, Bhat is still waiting for his car.

Fun fact

Though auto sales fell worldwide by 14% in 2020, EVs had a surprisingly good year: Global sales surged 40%, despite the pandemic.

Buy now pay later—does it make business better? Discuss the hottest trend in consumer borrowing with senior reporter John Detrixhe, along with Affirm exec Chung-Man Tam and fintech expert Jason Mikula on Clubhouse on Thursday, March 25 at 11 AM EDT.

2008: Tesla releases its first car, the Roadster

2014: Tesla sells its first car in China

2017: Musk promises Tesla’s cars will be able to autonomously drive across the country without a human taking a wheel

2018: Musk admits that automating his factories wasn’t the best plan

2019: Tesla builds a factory in Shanghai

Jan. 8 2021: Tesla’s valuation eclipses that of all other automakers combined

2028: Musk predicts humans will arrive on Mars

Tesla’s competitive advantages

Tesla has already changed the automobile industry, and is poised to change it further. Here’s what it has going for it.

🏭 Innovative, efficient manufacturing. Tesla’s great innovation hasn’t just been in its cars—it’s been in its factories. Its latest advance involves a die cast machine that allows it to replace 70 pieces of welded metal with a single slab of cast aluminum, resulting in huge savings.

🤑 Access to capital. Tesla’s stratospheric valuation means the company is essentially minting money and throwing it at anything they want—at least, while it lasts.

💻 Systems engineering. Unlike legacy automakers, which focus on the hardware and outsource their software, Tesla took a page from Apple’s playbook: it builds it software in-house on top of custom hardware. This ensures its vehicles are a single, integrated system.

🚀 The Tesla fan club. Tesla’s most durable competitive advantage may be the legions of fans who bought its cars and rallied behind its stock during the hard times. Whether or not they formed a lifetime allegiance to the brand, only time will tell.

📣 Sound off

Would you buy a Tesla?

In last week’s poll about the joy of sobriety, 62% of respondents said they had experimented with sobriety. Cheers to you!