Europe's discontented winter

Dire gas shortages may result in blackouts and industrial shutdowns. Is Europe prepared?

Hi Quartz members,

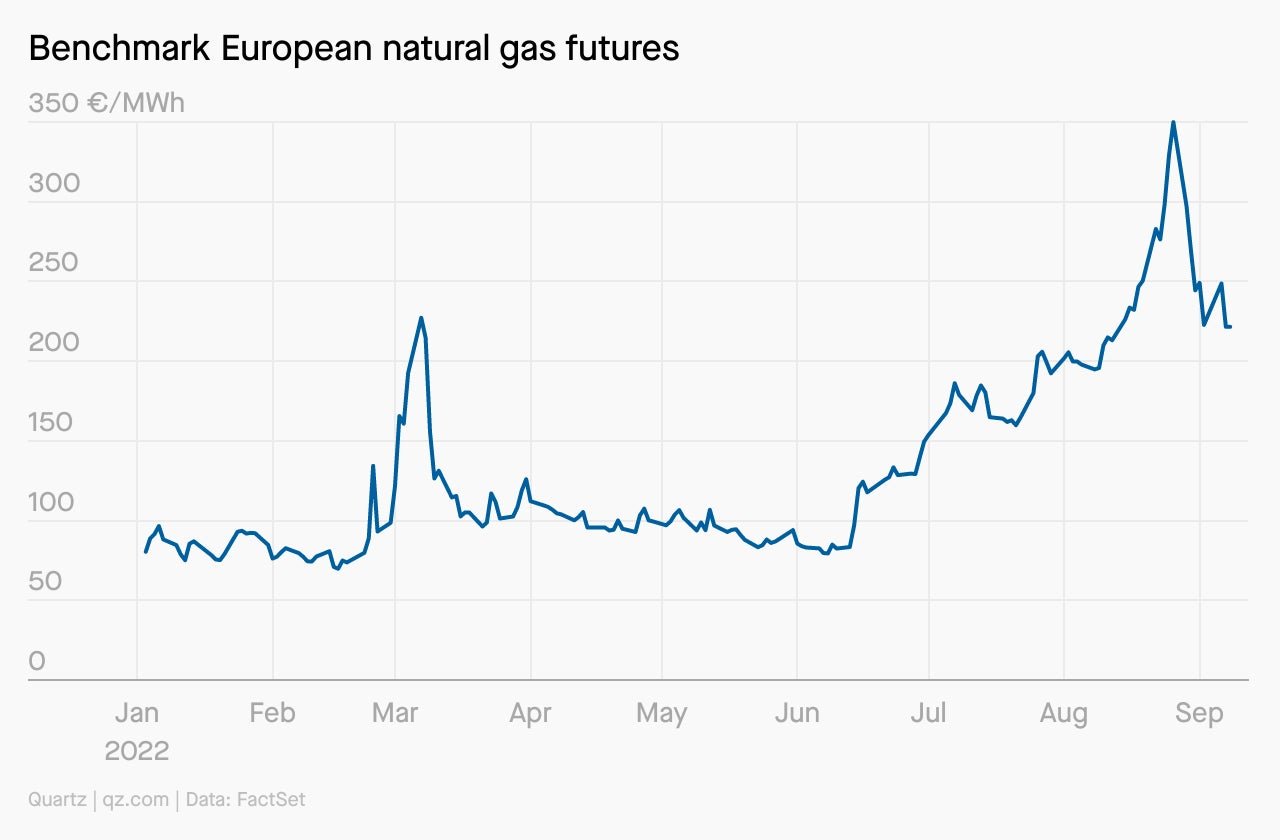

On Friday, the EU’s energy ministers met in Brussels to bicker and worry over a burning question: How to heat their countries this winter. The cost of gas is skyrocketing, Russia is squeezing supplies to Europe, and consumers are hurting even as energy companies are swimming in profits. If heat and light cost too much in a couple of months, cities may be hit by rolling blackouts, and industries may have to slow down or shut shop altogether.

But the upshot of Friday’s meeting was: There was no upshot. No new measures were proposed, and no real progress made on an existing idea to cap prices.

Perhaps this isn’t surprising. The EU is a complex creature, so finding common ground is always hard. “There are 27 states with completely different energy mixes, with completely different geographical positions, meaning heavier or less heavy summers and winters, with completely different interconnections,” Roberto Cingolani, the Italian minister for ecological transition, said in Brussels.

But things are becoming urgent. August was the most expensive month on record for electricity in Europe, according to the research firm Rystad Energy. On Aug. 29, electricity futures in Germany (the European benchmark) jumped above €1,000 ($998) per megawatt-hour, more than 10 times the normal rate during the last decade. Winter is coming.

The next few weeks are likely to see a spate of actions. One of Liz Truss’s first moves as the UK’s new prime minister was to freeze household energy bills at £2,500 ($2,895) per year. The EU’s leaders are also cooking up a plan to separate gas and electricity prices. That could involve a price cap like the UK’s, in which governments pay the difference between the real market price of gas and how gas is priced in the power and heating markets. Governments could also cut checks to low-income households or critical industrial users to offset their high energy costs.

The risk of a price cap is that it is effectively a fossil-fuel subsidy that removes any incentive to curb consumption and gives gas an unfair leg up on clean energy. But if the alternative involves blackouts, cold buildings, and shuttered factories, that might be a risk Europe has to bear.

🇺🇳 As business leaders and heads of state convene at the United Nations in New York, we’ll keep you up-to-date on the discussions setting up next year’s political and humanitarian global agenda. Count on us for coverage of the policymaking, and for breakdowns of the head-spinning jargon at the 77th session of the UN General Assembly (UNGA 77). Sign up for our special UNGA newsletter here.

KEEPING EUROPE AFLOAT

In the port at Eemshaven, on the northern coast of the Netherlands, two floating storage tankers have dropped anchor, ready to take in reserves of gas to help see Europe through its winter. A shipful of liquified natural gas (LNG) will approach the tanker and transfer its cargo; then the tanker stores the LNG, and turns it into high-pressure gas as required. The tankers, called the Golar Igloo and the Eemshaven LNG, can together hold nearly 200,000 cubic meters of LNG. Their “regasified” output will be fed into the Eems Energy Terminal, which can hold 8 billion cubic meters—equivalent to the gas consumed by all the homes in the Netherlands in a single year.

CONSIDER THE MARKET

Normally, if a supply shortage causes the price of gas to rise, other suppliers would step in to fill the gap. That’s happening to some extent in Europe; shipments of LNG from the US, Egypt, and other exporters are surging.

But Europe lacks the LNG import capacity to fully make up for lost Russian pipeline deliveries. And regardless of how high prices soar, new supply chains and alternative energy systems can’t be constructed fast enough to completely solve the problem for at least a couple of years.

This is a problem for electricity users because of how the power market is designed. Europe’s grid solicits bids from power generators—operators of gas, nuclear, or coal-fired power plants, or of wind and solar farms—to sell the power it expects to need. Generators line up in order of production cost. Those with the cheapest cost of production get to sell first, followed by those with higher costs, until the supply request is filled. Typically, renewables are at the front of the line; with gas prices soaring, gas plants are at the back of the line.

The wholesale electricity price for a given day is pegged to the last, highest-cost generator in line—now usually a gas plant. This design creates an incentive to drive down production costs, since the lowest-cost generator will have the biggest profit margin. But it exposes power users to commodity market volatility. Normally, that’s hardly noticeable. But when a dictator hell-bent on sowing geopolitical chaos is running the taps, the market can’t fix sky-high electricity prices, giving Putin the power to drag down Europe’s economy.

BY THE NUMBERS

One of Europe’s simplest energy-saving solutions is to waste less electric light, something that governments and businesses are now scrambling to do by turning off or dimming lights on streets, monuments, offices, and shops–particularly at night. That habit is ingrained in poorer countries, where people keep close tabs on their electricity bills. But in the West, as LEDs have become more common, lighting has accounted for a smaller and smaller fraction of energy bills. It has led to a habit of waste that, in the current crisis, is quickly becoming unaffordable. The following data is from Georges Zissis, physicist at the University of Toulouse, except where linked otherwise:

13-14%: Average share of global energy use that is dedicated to lighting

86%: Lighting’s share of energy in Tanzania; in Germany, the figure is 9%.

1.2 billion: In metric tons, the CO2 emissions from the electricity used in lighting in a year, equal to about 280 million cars.

30 billion: Electric lights in use worldwide.

~45%: Share of lights globally that are LEDs, up from less than 1% in 2010.

49,000: Number of lightbulbs running for one hour that would equal the amount of electricity Deutsche Bank hopes to conserve by turning off lights at night and other measures.

ONE 🇨🇳 THING

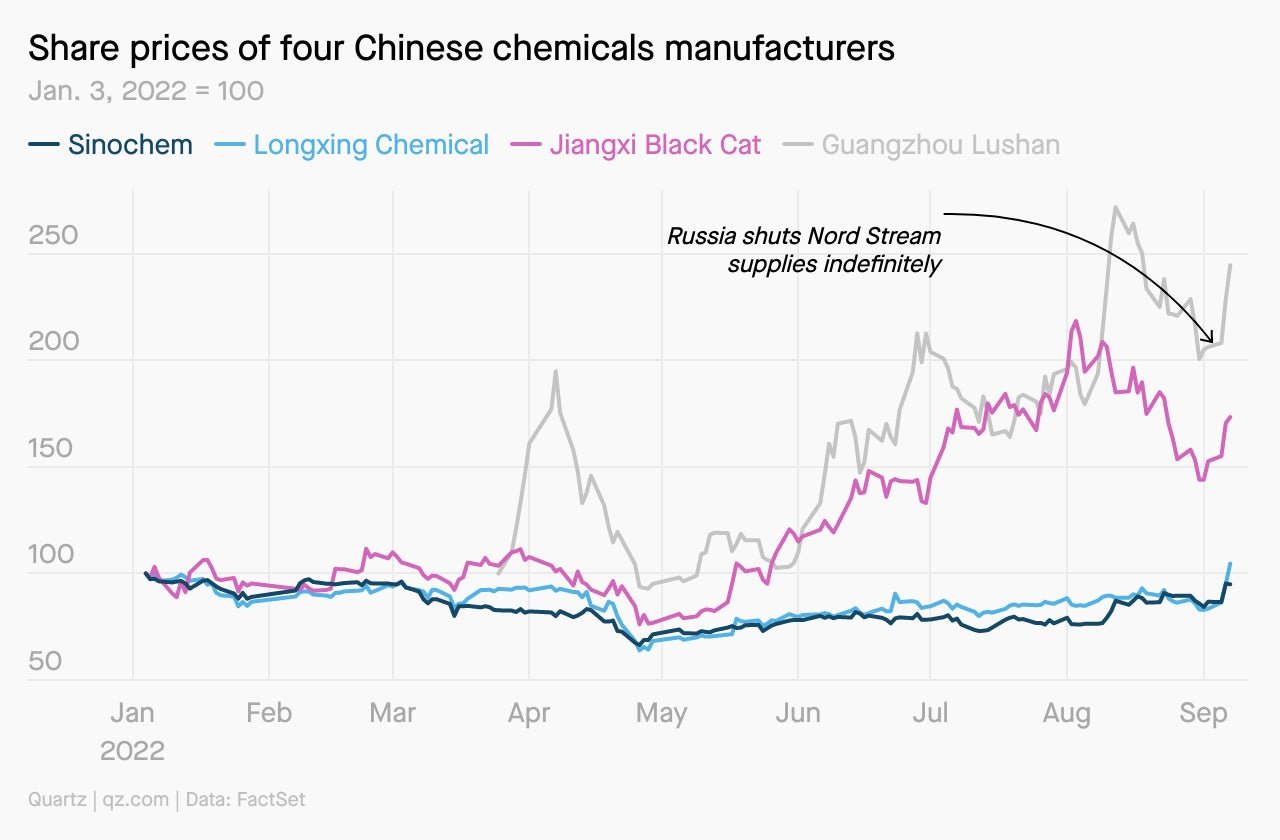

In the midst of Europe’s gas woes, China’s chemicals sector is rallying. An ETF tracking the sector jumped over 3.5%. The stock of state-owned Sinochem surged more than 10%. Several other chemical companies notched double-digit share price increases.

If European—and in particular German—chemical plants slow or shut down production due to uncertain and unaffordable energy flows, Chinese chemicals companies are well-placed to swoop in, increasing exports in the short run and production capacity in the longer term. Analysts at Donghai Securities put it poetically in a recent report (link in Chinese) on China’s chemicals sector: “The sun is rising in the East as it rains in the West.”

QUARTZ STORIES TO SPARK CONVERSATION

- An obscure UN agency okayed the first industrial sea floor mining project

- The US dollar is decimating world currencies. Here’s how other countries are responding.

- A combative African postmortem of Queen Elizabeth II’s legacy is inevitable

- What happens after the Queen dies?

- Is “quiet quitting” actually a problem?

- The head of the SEC says most cryptocurrencies are operating illegally

5 GREAT STORIES FROM ELSEWHERE

👑 So long, Elizabeth. The plans for the days following Queen Elizabeth II’s death were carefully laid out years in advance. In a piece from The Guardian’s archives, Sam Knight weaves together history, interviews, and insight into the procedures that will unfold now that the monarch has passed. Knight also reflects on how the public will cope with the loss of a figure so deeply linked to its national identity and psyche.

🐋 Ocean song. Britt Selvitelle and Aza Raskin, co-founders of the Earth Species Project, set out on an ambitious goal several years ago: applying the AI behind Google Translate to decode animal communications, such as whale songs. In a story from the Daily Beast, naturalist Tom Mustill explains how modern machine learning, including neural network technology, could help identify patterns in animal speech and unlock languages from the deep.

😒 Why so rude? People are getting ruder at work, according to Callum Borchers in the Wall Street Journal. From pottier mouths to flakier clients, workplaces seem to have lost some of the business etiquette of the past (although enrollment for LinkedIn’s courses on that topic are up 127%). The shift in manners may have to do, in part, with the tight labor market following the peak pandemic years, as workers no longer need to mince words to get ahead.

💸 The funeral racket. The US funeral industry, largely unregulated, is rife with price gouging. Covid only exacerbated the problem, with companies like Service Corporation International raking in billions as death rates soared. In an interview with ProPublica, consumer advocate Joshua Slocum explains what rules exist to protect buyers, and how one can approach funeral options to avoid getting swindled at the casket.

🪨 Dirt, gratis. Dirt removal can be a bureaucratic, expensive process. As a result, Craigslist has become a platform where individuals seek out others to help remove soil from their building sites, effectively becoming a marketplace for “free dirt.” Angella D’Avignon has been keeping tabs on the niche world of free dirt ads, including its common vocabulary and the amateur, honest charm of its photography in a story from The Paris Review.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Have a warm, energetic weekend,

—Tim O’Donnell, climate reporter, and Mary Hui, China reporter

Additional contributions by Alex Citrin-Safadi, Julia Malleck, and Samanth Subramanian