The unstoppable dollar

Does the world need a Plaza Accord 2.0?

Hi Quartz members,

The past week brought back memories of 1985: the last time the British pound nearly crossed the psychological barrier of trading at $1.

Much like today, the pound and other major currencies back then were being pummeled by a muscular dollar, the result of a hawkish Federal Reserve and a strong US economy. So, it’s no surprise the Plaza Accord is popping up again in conversation. On Sept. 22, 1985, the finance ministers of Japan, France, Germany, the UK, and the US gathered in the golden room of New York City’s Plaza Hotel and agreed to collectively intervene in currency markets to weaken the dollar. The operation was a success—such a success, in fact, that two years later, the same countries had to hammer out another agreement, this time to prop up the US currency.

Could a similar approach work this time around? In short: No, mainly because a key player, the US, has expressed zero interest in such a deal. Back in 1985, it was US policymakers who spearheaded the accord, to help American manufacturers compete with Japan and other exporters. Today, their main worry is inflation, which is alleviated by a strong dollar.

A Plaza 2.0 would also require buy-in from a lot more than five countries, including China. Given US-China tensions, it’s unlikely Beijing would want to join.

So for now, expect countries to act on their own to defend their currencies individually, as several have already been doing. But if the dollar’s value keeps rising, everyone, including the US, might feel more prone to cooperation. As much as the dollar has risen this year, its climb is not yet as steep as ahead of the Plaza Accord.

THE BACKGROUND

The dollar is stuck in a doom loop. Given its status as a safe haven currency, the more the global economy sours, the more investors pour into the dollar, and the stronger it becomes. And lately, the US economy—and the greenback—are looking particularly robust compared to Europe, in the midst of an energy crisis with no end in sight, and China, still struggling with the shocks of its zero-covid policy.

Meanwhile, the Fed has been raising interest rates at a faster pace than any other central bank in the world, delivering three percentage points worth of hikes since March—another factor making the dollar a powerful lure.

As the dollar squeezes other countries’ currencies, it’s weakening their economies further by making imports more expensive and fanning inflation. This is pushing the value of these currencies even lower against the dollar… and so on.

This dynamic has some analysts calling the dollar a wrecking ball, and others warning its strength could trigger a global recession.

TUMBLING CURRENCIES

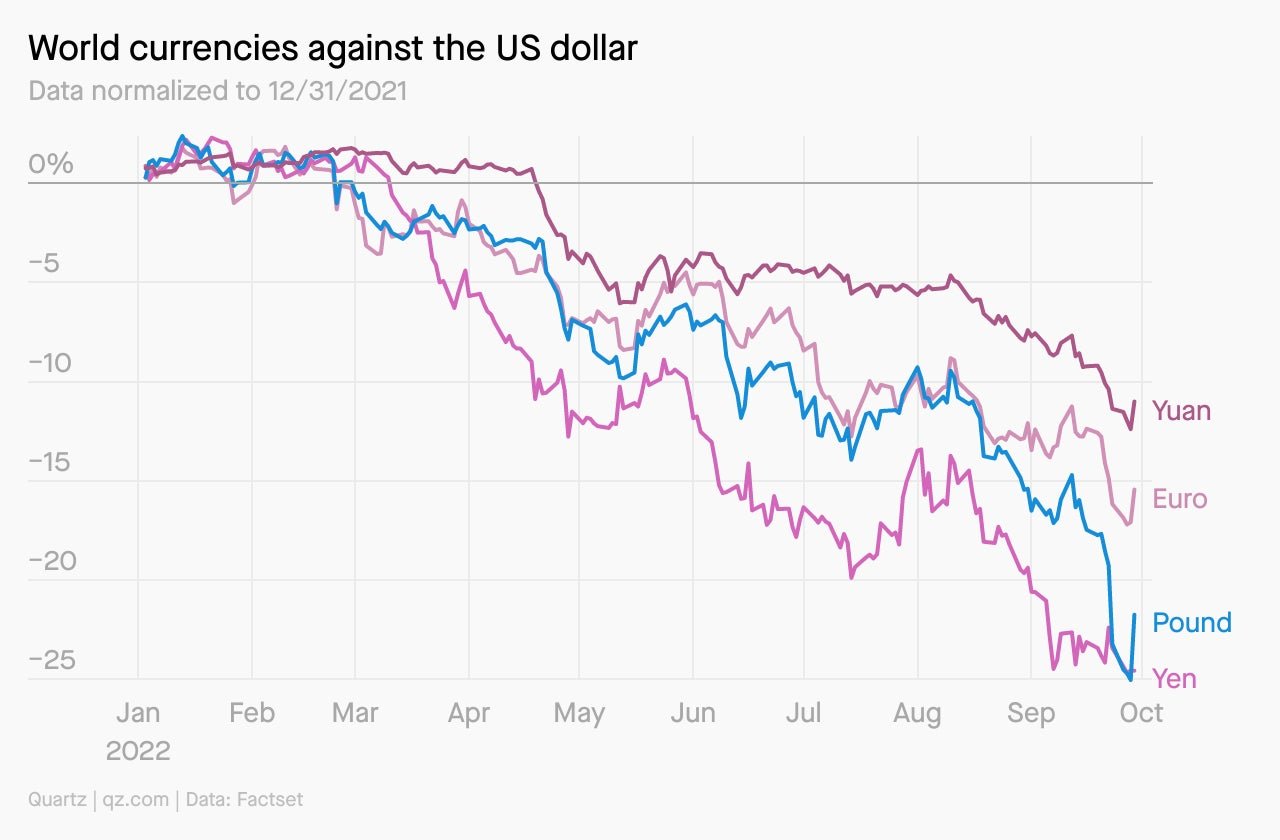

The stronger dollar is already squeezing other countries, including the world’s richest. Major economies have seen their currencies slide dramatically since the beginning of the year.

Policymakers in those countries are fighting back. In the past few days alone, Japan, China, and the UK have rolled out a series of measures to boost their currencies. But such interventions are unlikely to provide much more than short-term relief. About 90% of the world’s forex transactions involve the greenback, amounting to trillions of dollars in trades a day. An individual country’s foreign exchange reserves are no match for that.

WHAT CAN STOP THE DOLLAR?

What will it take, then, to curb the dollar’s rise? Theoretically, there are several scenarios under which that would happen: The US goes into a recession, for example, or other economies bounce back.

Political instability could also do it. As we saw in the UK this past week, if a government’s economic policy makes global investors lose faith in the country’s future prospects, its currency will weaken. Because the US is an oil exporter, a dramatic drop in oil prices would also weigh down on the dollar.

Or the Federal Reserve could loosen monetary policy—although its officials don’t expect that to happen until sometime after 2023. For now, inflation is nowhere near where the Fed wants it to be, and the US labor market remains strong.

As Jon Turek of JST Advisors told Bloomberg: “The whole global economy is basically waiting for the US unemployment rate to tick up.”

ONE 🍷 THING

The Plaza Accord has been hailed as a milestone in international cooperation, but in the beginning “there was predictable skepticism,” according to James Baker, who orchestrated the plan as US Treasury secretary. It took months of ultra secret negotiations, sometimes lubricated by wine and cigars, to enlist his counterparts.

On the 30th anniversary of the deal, in 2015, Baker admitted that kind of economic policy coordination would be tough to pull off in a more globalized economy, but not impossible.“Yes, we are living in a new economic world with a lot more players, with more complex markets, and with gigantic capital flows, but I don’t think that’s any reason not to make the effort,” he said.

QUARTZ STORIES TO SPARK CONVERSATION

- The next phase of mobile technology will be dominated by smart glasses

- Brazil’s Bolsonaro has his same old election fraud excuse ready if he loses

- Jack Dorsey texted Elon Musk to say Twitter never should have been a company

- What the UK should do instead of tax cuts

- SpaceX is offering to service the Hubble Space Telescope for cheap

- Every season is now iced coffee season

5 GREAT STORIES FROM ELSEWHERE

💼 #Overemployed. A new workplace phenomenon called “overemployment” has been on the rise since the start of the pandemic. As Wired reports, with more opportunities for remote work, some enterprising individuals have picked up two or even more jobs to meet financial goals. The ethos behind the movement, however, isn’t about “hustling” or career-building, but rather about using jobs to achieve fulfillment outside of the office.

🎧 Pod fraud. In the highly saturated podcast market, expanding one’s audience is no easy task. But some podcasts have discovered that a certain advertising trick allows them to beat out the competition, and gain millions of downloads. Bloomberg gives us the scoop on how mobile gamers have become central to inflating podcast metrics, even if they never listen to a single episode.

🔍 Eel-usive. For decades, researchers have sought to discover where and how eels spawn. The presumed breeding location for European and American eels is the Sargasso Sea, a subtropical gyre that sits in the Atlantic Ocean. But how they are able to migrate there, traveling thousands of miles, is a mystery. Smithsonian Magazine goes into the history of the slippery, elusive fish and why the search for their origin is critical to their future survival.

😐 Urbanism gone bland. “Sohofication is strangling our city centers,” writes Jonathan Nunn for Dezeen. The author of London Feeds Itself argues that food scenes in metropolitan centers are becoming homogenized, catering to upwardly mobile urbanites seeking just the right amount of “exotic,” but in a comfortably sanitized way. He warns that this trend, a property developer favorite, is quashing the vibrancy of cities in exchange for marketable, touristic experiences.

🦷 Teeth makers. In the heart of Kandahar, Afghanistan is a family business that has operated for 80 years hand-making dentures. Haji Muhammad Sultan, the current owner, is now passing down the profession to his sons. A story from Al Jazeera paints a portrait of the shop and the four generations that have steadily continued their craft, even through the country’s economic and political upheaval.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Have an overvalued weekend,

— Nate DiCamillo, economics reporter, and Ana Campoy, deputy economics and finance editor

Additional contributions by Amanda Shendruk, Clarisa Diaz, and Alex Citrin-Safadi