Quartz's Predictions for 2023

Our reporters gaze into the future of Tesla, supply chains, and modular housing

Hi Quartz members,

Of late, the world has made us all feel that forecasting the future is a mug’s game. It would, for instance, have been impossible to guess that one of the the final big stories of 2022 would involve a former kickboxer being arrested for human trafficking after Romanian police discovered he was in their country from a pizza box in his video response to Greta Thunberg. If you had all those on your bingo card, buy a lottery ticket today.

Still, at Quartz, we track industries and companies so closely that we can make educated guesses about the next 12 months—always assuming, of course, the absence of black-swan events like a pandemic. For a full roster of Quartz’s predictions, watch out for the Daily Brief newsletter on Monday, Jan. 2. (Mild spoilers: an Oscar for a pop star, the unseating of a president, and a big retirement in banking.) By way of prologue, Weekend Brief asked five reporters to lay out the big stories they expect to cover over the coming year. And so: 2023, our reporters think, will be the year we...

...FORGET ABOUT THE SUPPLY CHAIN

If a good supply chain is one you never talk about, as the industry saying goes, in the last couple of years supply chains have been very bad indeed. Shipments were delayed in ports for months. Costs soared. Logistics worries infected the general population so acutely that the term “supply chain” was included for the first time in the Merriam-Webster dictionary. S&P 500 companies hit a record high in mentions of “supply chain” during their earnings calls.

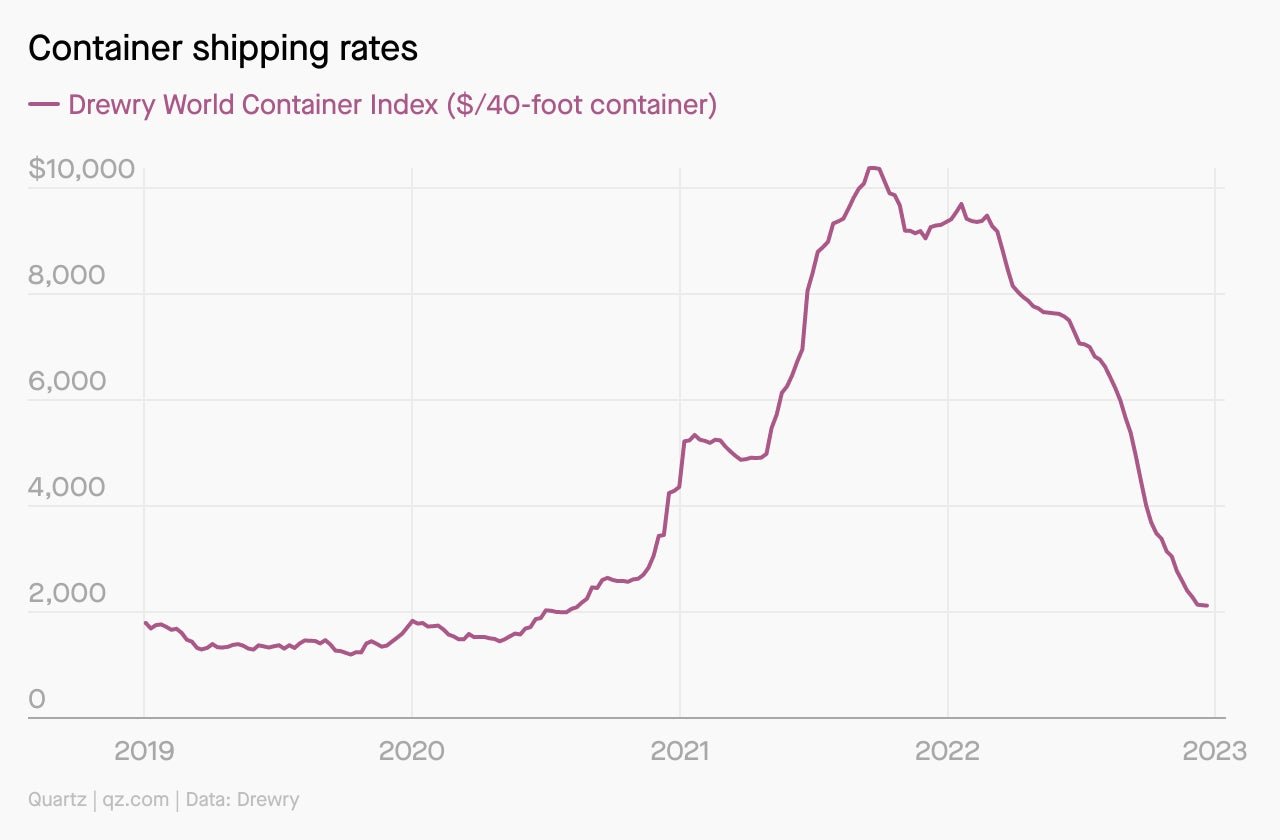

But 2022 is ending with 42 consecutive weeks of decline in Drewry’s container price index, starting from a high of $10,377 per 40-foot container in September 2021 and plummeting 77% to $2,120 by Dec. 22, 2022. It remains to be seen whether container prices will bottom out below the pre-pandemic average rate of $1,420, but there’s no doubt the crisis is unwinding.

Retailers, many of whom had scrambled to find space on any cargo ships during the worst of the supply chain crunch, have begun to pull back on chartering their own vessels. Shipping companies have canceled sailings to prop up container prices, but with little success. Maersk, the shipping giant, continues to post record profits for now, but it has warned that earnings from ocean freight “will come down in the coming periods.”

The demand for durable goods in the US, which set off the supply chain chaos, has slowed. Congestion in ports, docks, and railways—caused not just by the sheer volume of goods being shipped, but also the crumbling infrastructure the US was trying to push them through—has eased. Indicators of congestion, from the number of ships backed up at the Port of Los Angeles (pdf) to Flexport’s Ocean Timeliness Indicator, a measure of how long it takes for cargo transfers, have dropped.

But there’s one legacy effect of skyrocketing container rates that hasn’t abated yet: inflation. While the supply chain crunch was an early contributor to pushing up prices, multiple food and energy crises have since kept prices high. Which, in turn, will push people to spend and buy less, relieving the pressures on supply chains further still, until the great pandemic disruptions resemble an aberration fading into the past.

— Aurora Almendral

...FRET ABOUT HIGH RATES

In 2022, US interest rates underwent something of a convulsion, going from near-zero to 4.5% in a span of nine months. The economy flinched. Markets withered. And it isn’t over yet. The federal open market committee (FOMC), which sets interest rates at the Federal Reserve, predicted in December that rates will top out at 5.1% in 2023.

Of course, hawkishness is in the air. If Fed officials aren’t satisfied that the prices of consumer goods are coming down, rates could go higher still. Fortunately, inflation cooled significantly in November; further, prices in many categories of the consumer price index declined not in response to Fed rate hikes but because of other economic factors. And there’s a momentum to this trend now: goods deflation is setting in, rents are backing off, and gas prices are slumping.

How to convince the Fed, though? In its latest meeting, the FOMC slowed the pace of its rate hikes: from the chunky, 75-basis-point increases it had been pursuing to a slightly slimmer 50 basis points. But Jerome Powell, the Fed’s chair, made it clear that this wasn’t a pivot, and that the Fed wasn’t quite persuaded that inflation is truly winding down.

Now the FOMC has to decide how far it will push interest rates before hitting pause, and then how long it will hold the rates high. If its December projections are to be believed, the Fed won’t start cutting rates again until 2024.

This means the US is in for a year of struggle. New homebuyers will be priced out because they won’t be able to afford the mortgage rates. Defaults will rise, as banks hike the cost of financing across several products. Even now, the Fed could send the US into a recession if high interest rates and weaker consumer demand push employers to shed workers. Things will get worse before they get better, the Fed seems to believe. But how much worse? That question will be the leitmotif of 2023.

— Nate DiCamillo

...WATCH TESLA FADE AWAY

In 2022, Tesla bears finally got their vindication.

After Tesla shares fell nearly 70% through the year, bettors against Elon Musk’s EV firm are sitting on over $15 billion in gains. But Musk’s cultivated image as an eccentric troll genius is still convincing some investors—especially retail ones—to hang on to their shares despite recession fears, supply chain disruptions, greater competition, and Musk’s chaotic purchase of Twitter.

Some think Tesla still has plenty of room to fall next year, arguing that the fundamentals of the business don’t make sense. “Tesla is currently valued at more than the next three largest automakers combined, despite selling just 5% of the cars that those automakers sold in 2021,” noted Gordon Johnson, an investor who has been shorting Tesla for four years.

Disruptions in supply chains have hampered Tesla’s effort to ramp up production in Austin and Berlin; its Shanghai factory has been subject to repeated covid shutdowns. More troubling than these production issues, though, are the signs of weakening demand. Although revolutionary when they first debuted, Tesla’s vehicles are starting to look less impressive next to the competition. The company recently slashed the prices of its cars in the US, China, and Europe, and the wait for Tesla’s cars, once running to months, has shrunk to days.

In July, China’s BYD passed Tesla as the largest EV maker by sales. Admittedly, BYD’s product range includes hybrids, which Tesla doesn’t make. Nonetheless, competition is intensifying, with legacy automakers intent on displacing Tesla. General Motors, for example, has said it expects to overtake Tesla by mid-decade.

At this crucial juncture, though, Tesla is unable to hold the attentions of its CEO. Musk has sold around $40 billion in Tesla shares to finance his purchase of Twitter, and although he has said he will resign as Twitter’s chief executive, he still wants to manage its software and servers. Musk’s distraction aside, his brand is also souring among liberals, the customers most interested in EVs, because of his frequent espousal of far-right conspiracies.

Perhaps the ship will right itself, in kinder economic waters. (Tesla bulls are counting on a sales surge when a federal tax credit for American-made EVs arrives and Tesla launches its long-promised Cybertruck.) Equally, though, we may find that 2022 was not just Tesla’s year from hell but the beginning of a deep correction. If that happens, Tesla will go from being a glittering, highly valued company on the cutting edge of its sector to just another contender with a vexing CEO.

— Tiffany Ap

...LIVE DIFFERENTLY

The supply of housing in the US may be dwindling, but the demand is not. As prices rise, more Americans need affordable housing. And as interest rates climb, many would-be first-time homebuyers are finding themselves sidelined.

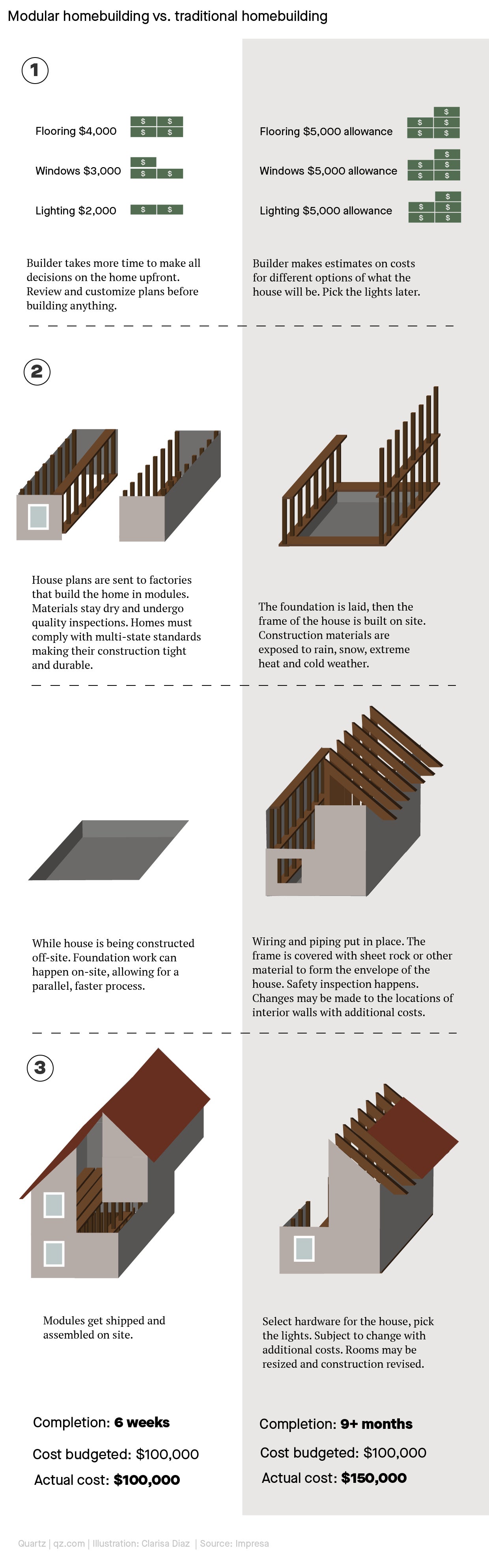

A modular home, however, fabricated off-site in a factory, can be built in six weeks at a lower cost than building a new home on-site from scratch. And for those who aren’t ready to buy one, renting is increasingly an option. If house prices stay high, 2023 will be the year of the modular home.

In 2021, build-to-rent properties made up just 5% of the market but are on the rise. On average, 31,000 build-to-rent homes were built each year prior to the pandemic, but 50,000 were built from September 2019 to September 2020 alone, according to the National Association of Realtors.

“We’re seeing a lot of growth in the build-to-rent customer, which isn’t an individual homeowner. It’s a company, a corporation, or a group of people,” said Ken Semler of Impresa, one of the largest custom modular home companies in the US. This means that the real estate that companies bought up during the pandemic may be developed into residential rental properties.

Semler thinks a shift in the market could soon see him building for more build-to-rent investors than single-family homeowners. “We’ve been told to lease a car for so long you don’t buy a car,” Semler says. “In three years or so, you’re going to trade it in and get a new one anyway, at the end of your lease. And I think people are starting to treat housing like that to a degree.”

— Clarisa Diaz

...START A GIANT ENERGY TRANSITION

In 2023, one of the world’s most populous countries will kick its transition to clean energy into a higher gear—which, in turn, will have tremendous implications for climate change and the future of the Paris Agreement.

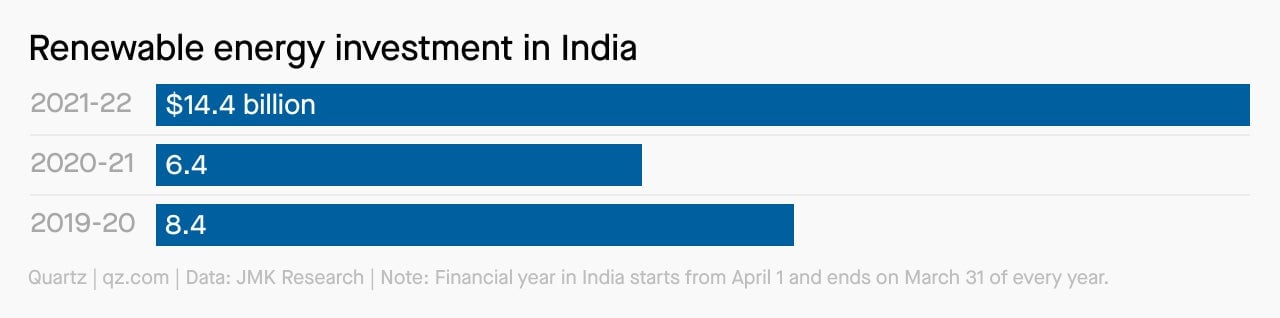

Over the coming year, India will attract close to $10 billion in green energy investments, Kaku Nakhate, the India chief of Bank of America, told Bloomberg in December. Investment interest will particularly cluster around electric vehicle and green hydrogen projects, Nakhate said.

But even that will just be a start. The Indian government expects investments in the sector to reach $25 billion in 2023, largely driven by private acquisitions. During the financial year that ended on March 31, 2022, India saw $14.5 billion invested in renewables, out of which bonds and acquisitions accounted for 75% of the total deal value.

India’s renewable energy investments have already recovered from a pandemic-triggered slump, and the government’s plans in this sphere are ambitious. Currently, India has a total renewable energy generation capacity of 165 Gigawatt (GW), but it aims to increase this capacity to 500 GW by 2030. At present, India has investment opportunities worth $181 billion in its renewable energy sector alone, with an ongoing 420 projects across several states.

A report released at the COP27 summit in Egypt revealed that India’s emissions are growing faster than those of any other major contributor to global warming. Indian emissions made up roughly 8% of the global total in 2022. For the world, and for India as well, bending those emissions downwards will be an indispensable part of fighting climate change. The green energy investments of 2023 cannot come too soon.

— Niharika Sharma

QUARTZ STORIES TO SPARK CONVERSATION

- Southwest Airlines, born of airline deregulation, could inspire re-regulation

- To come up with more creative ideas, try talking to a stranger

- Kafka, Metropolis, and the Hardy Boys enter US public domain in 2023

- Oil investors could be in for another good year in 2023

- The future of global music is African

- The new CEOs on the block in 2023

- The new US defense bill includes a budget for music diplomacy

5 GREAT STORIES FROM ELSEWHERE

💨 POOF! In 2022, billionaires lost $1.7 trillion in wealth. Most of the wipeout had to do with fraud, war, or Musk-style clownery. However, not everyone in the jet set had a bad year. India’s Gautam Adani leapt over Bill Gates and Warren Buffet on the rich list, and sports franchises continued to score. Bloomberg goes month-by-month through the financial throes of the 0.0001%, including the falling fortunes of several tech moguls, the cohort that took the biggest hit.

🎨 Color everlasting. When it comes to making colors, British zoologist Andrew Parker sees pigments and dyes as a thing of the past. Instead, he’s a believer in “structural color,” a method of producing hues that arranges nanostructures to reflect different wavelengths of light. Smithsonian narrates the story of how this $36 billion industry may revolutionize how we paint everything from cars to planes, and ensure their color never fades.

🤖 AI in Ed. “Riiid” is a South Korean startup integrating AI with education. The company has already seen success in the Asian test prep space for standardized English-language assessments, and is now poised to enter the US market for SAT and ACT prep. Although AI tutors can be helpful in the classroom, the New York Times reports, they also require the collection of student data, raising privacy concerns.

🇮🇩 Off the pitch. Indonesia, the fourth-largest country in the world and a rising economic powerhouse, has yet to produce a competitive soccer team; in fact, the nation hasn’t made the World Cup since 1938. But it’s not for a want of talent. The Diplomat explains how politics and corruption have plagued the Indonesian Football Association (PSSI) for decades. Now, with calls for a “complete overhaul” of the institution, the team might finally have a shot.

👃 Smells like travel. From Museum Ulm’s “Follow Your Nose” exhibition, in which you can take a whiff of a 16th-century painting, to Paris’s soon-to-launch “olfactory tours,” the worlds of art and tourism are increasingly incorporating scent into experiences. National Geographic sniffs out the story on “smellscapes,” and why the sense closest linked to memory might be the perfect way to enhance our understanding of art and history.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Have a banger of a weekend and a 2023 as clear and shining as crystal,

— Nate DiCamillo, reporter; Tiffany Ap, reporter; Niharika Sharma, reporter; Aurora Almendral, senior reporter; and Clarisa Diaz, reporter.

Additional contributions by Julia Malleck and Samanth Subramanian