Hit me with your meme stock

What's the next brand memers may be swarming next?

Hi, Quartz members!

If you were watching the stock market this week and suddenly felt transported back to the pandemic winter of 2021, there’s a reason for that: meme stocks returned, if only briefly.

It all appeared to start on Monday, when a day trader named Keith Gill, who posts online as Roaring Kitty, came back with a meme that got day traders and meme traders stoked to make the kind of cash they made when they pumped shares in struggling video game chain GameStop from about $4 to $80 in a matter of days back in 2021. That rally was started on Reddit, where Gill posted videos arguing the chain was undervalued and not losing as many of its customers to online stores as some analysts had assumed. Millennial gamers got angry with short sellers aiming to bring down one of their favorite hangouts, and bought the stock, squeezing some $6 billion from the shorts, who had hoped to profit by tanking it.

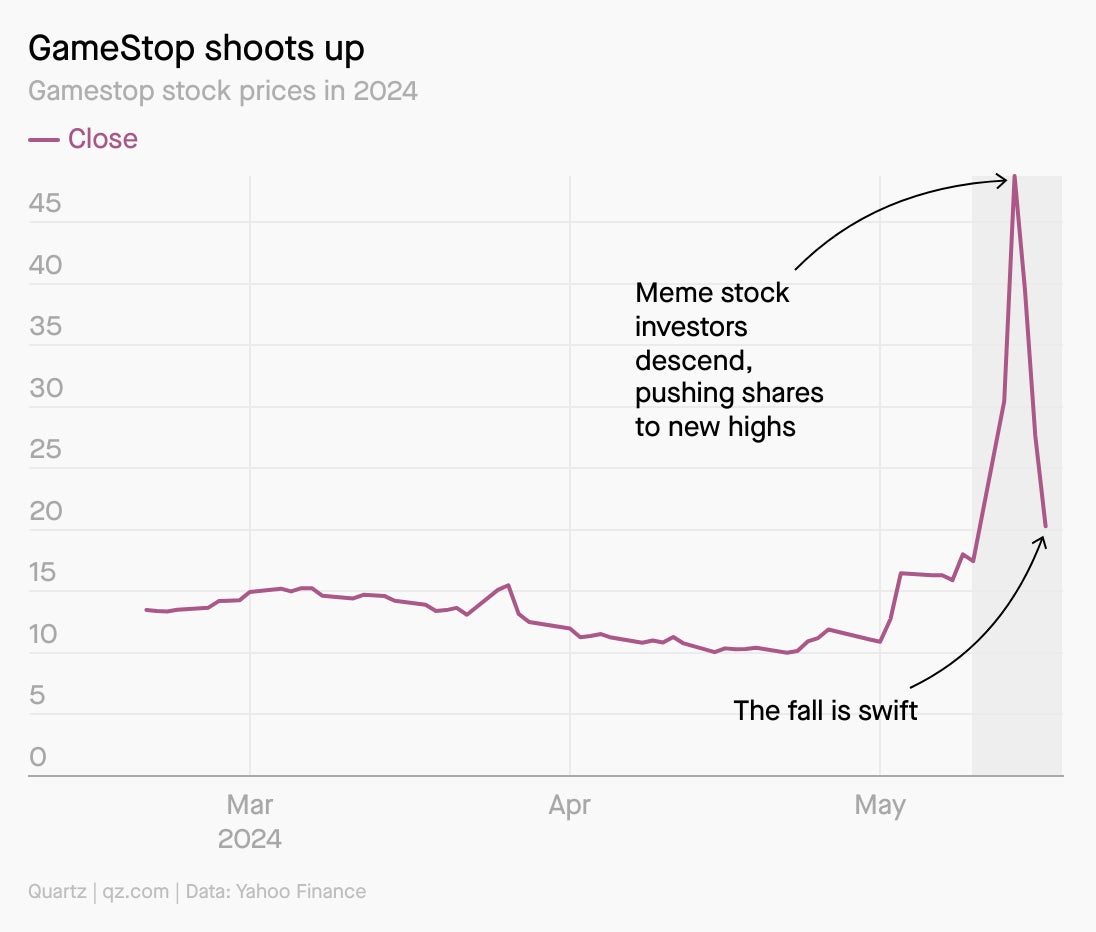

This time, the rally lasted only two days, and by Friday GameStop and other meme shares had lost most of their gains during the week. The shorts, for their part, had lost about $1 billion by some estimates.

Gill has been leading the meme swarmers through, well, memes. For one, Monday’s rally started when Gill posted a gif of a man in a chair leaning forward, followed by more posts of excerpts from video games. GameStop rose 75% on Monday, but by late morning Gill posted a short clip from the end of the 1986 hit movie, Ferris Bueller’s Day Off, when Matthew Broderick’s Bueller looks at the camera and asks a fourth-wall-breaking question.

Meme watchers saw that as a clear sign the rally was over. But oddly, it wasn’t. On Tuesday, more people piled into the stock — and some other memes, including money-losing movie chain AMC and one-time smartphone maker BlackBerry. GameStop rose another 60%, topping out at $48.75 a share.

The rise of GameStop, at least, did not come completely out of the blue. Starting in late April, in fact, the shares began rising from $10 to $17 on the Friday before the meme rally began.

But by Friday, the game had clearly stopped. GameStop had lost everything it had gained in the week, down to about $20 a share, after the company announced it was going to issue more stock — a sign management thinks the shares are fairly priced or overvalued — and that it expected to post more losses in the second quarter. AMC was also down, from a peak of $11.82 on Tuesday morning to $4.54 midday Friday. But that’s still a 30% rise from Monday’s $3.52 open.

Charted: GameStop’s ride

Winners and losers, FOMO, and the pitfalls of being late to the game

So who’s winning from the meme stock rallies? First of all, Gill himself may have made a killing on the stocks’ climb. The last time he posted about his holdings in GameStop, back in April 2021, Gill said he held 200,000 shares (now 800,000 after a split). Assuming he bought them just before the original “levitation,” as Interactive Brokers Chief Strategist Steve Sosnick calls the rise in meme stocks, he could have made somewhere between $30 and $40 million.

Algorithmic trading firm Renaissance Technologies appears to have noticed the short action and rising share price, as it piled into the stocks, making what could have been as much as $20 million on GameStop’s jump and $14 million on AMC, the New York Post reported.

And surprisingly, both AMC and GameStop may have profited. AMC had been at the tail end of a share sale when its price zoomed 78 percent on Monday. The company wrapped the sale up that day, and while most of the shares had been sold before the levitation, it may have been able to cash in.

GameStop, whose shares are still worth nearly twice what they were a month ago, may also profit as it plans a sale of 45 million shares at market prices. According to Sosnick, the levitation barely lasted a day, and anybody who’d bought in was smart to sell out. In fact, he says Monday’s jump may have been a fairly logical play to squeeze shortsellers into paying high prices to cover their positions, but by Tuesday, he says, FOMO kicked in, creating what he called “a suckers’ rally.”

“That was just pure illogic,” Sosnick said, “especially if you’ve been following the signals this guy is sending and he more or less told you it was over,” — via meme, of course.

What makes a meme stock meme?

So what makes a stock a meme stock? Usually two things: A passionate attachment to the company that’s visible on social media, and the kind of bad underlying fundamentals that cause short sellers to think they can make money on the stock.

This week, both GameStop and AMC were back, which may be attributable to millennial nostalgia for the brands of their youth. BlackBerry and Build-a-Bear were also considered meme stocks, along with Bed Bath & Beyond, which went out of business in 2023.

One 📉 thing

Another company might be about to join the memers — one currently embroiled in the U.S. election: Could Donald Trump be meme-ing?

Sosnick says he recently added Trump’s conservative social platform Truth Social to his list of memes. “It fits the criteria,” he said in an interview with Quartz. “No viable underlying business, but a passionate attachment by its followers on social media.” The company dropped 7% this week to almost $50 on Friday, and while it’s up 185% since its January launch, the price has ricocheted between $22 and $80 on revenue of just a few million dollars a year.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Meme-while, enjoy your weekend!

— Peter Green, Weekend Brief writer