Sunday Reads: Semaglutide side effects and cheap missiles

Plus: The missing ingredient in making American computer chips again.

Hello, Quartz members, and welcome to Sunday Reads!

Suggested Reading

This was the week that may have changed the course of American history. And we’re not talking about the presidential debate between Former President Donald Trump and Vice President Kamala Harris. No, readers, we mean Harris’ endorsement by the most important American of this era: Taylor Swift. Whatever else happened this week, you can probably just shake it off.

Related Content

But it’s Sunday, and time to shift your gaze to some hand-selected reads. Here are some of our favorite Quartz stories from the week, plus a sneak peek at one story coming next week to get your day started.

Enjoying this newsletter? Let us know. We’d love to hear from you.

5 things we especially liked on Quartz

💉 Does semaglutide have a link to suicidal thoughts? That’s the question pharmaceutical regulators and health agencies around the world have been asking amid continuing, and little-documented reports that people on semaglutide (the main ingredient in Ozempic) have a higher rate of suicidal thoughts than those not taking the drug. Scientist’s can’t agree. Quartz’s Bruce Gil takes us through the studies with a welcome dose of skepticism.

📉 Is bankruptcy the new black? Bankruptcy filings rose nearly 17% last year over 2022, and this year a slew of consumer-facing companies are taking a chapter from the Bankruptcy Code (chapters 7 and 11 appear to be the favorites.) This year a surprising number of retailers are handing over the keys, including Red Lobster and 99 Cents Only Stores. Francisco Velasquez takes us on a tour of the retail valley of death.

🏠 Home, sweet wait-another-month. With interest rates expected to drop next week, mortgage rates are already dropping. But walk, don’t run to your broker, and wait til the end of the month: The last week of September is usually the most favorable for buyers. As Madeline Fitzgerald writes, buyers have less competition once the school year starts.

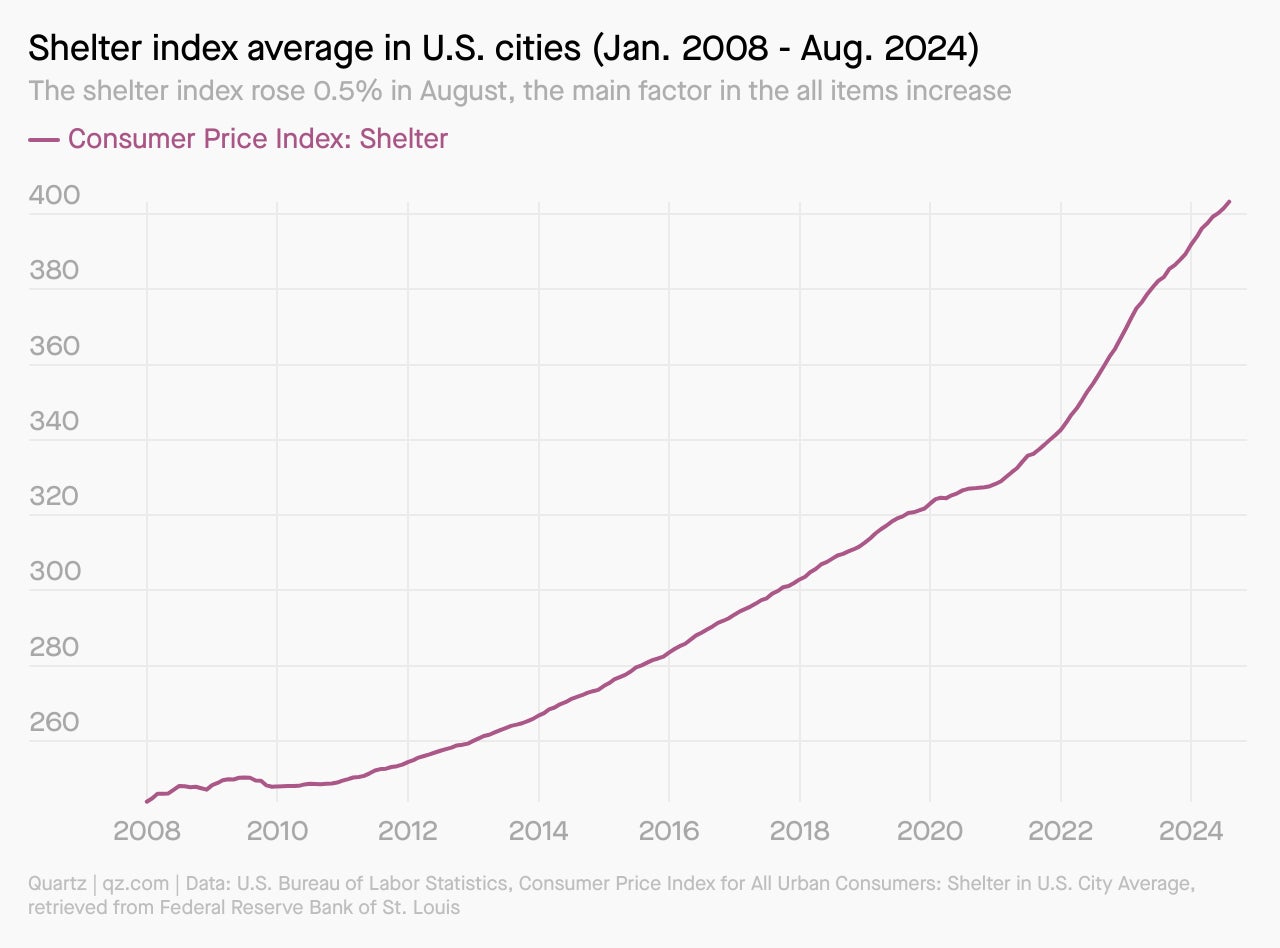

🏦 Speaking of houses... why don’t other prices feel normal? When the Federal reserve sets interest rates based, in part, on the Consumer Price Index, there’s one big item that can skew everything: Housing. And housing costs keep rising — and skewing — the country’s inflation main gauge. There are deep technical and historical reasons for this, and Rocio Fabbro will explain.

🚀 A defense startup launched a cheaper missile. Brand-new U.S. arms maker Anduril, named after a legendary sword in J.R.R. Tolkien’s Lord of the Rings, has unveiled a line of cruise missiles it says is 30% cheaper than its competitors’. The newly launched company says it’s munitions are made of readily available parts, avoiding supply-chain pressures. Quartz’s Will Gavin explains.

1 smart chart

Shelter costs climbed a whopping 5.2% over the last year and 0.5% in August, accounting for over 70% of the total 12-month increase in inflation for all items excluding food and energy, according to Bureau of Labor Statistics data released Wednesday. (The shelter index includes rent costs and a metric known as owners’ equivalent rent, which measures how much money a property owner would pay in rent equal to their cost of ownership.)

1 sneak peek

Two years after the Biden-Harris administration signed the CHIPS and Science Act into law, more than half of the $52 billion in subsidies designated for semiconductor manufacturing has been earmarked for 15 chipmakers. But that’s not the whole story. Britney Nguyen gives us a tour of what else the U.S. needs to get back in the game.

What we’re watching this week

- Monday: Microsoft unveils the next phase of its AI office assistant Copilot.

- Tuesday: U.S. retail sales numbers drop at 8:30 am ET, and the Fed’s Open Market Committee begins its two-day huddle where it’s expected to cut interest rates by half a percentage point.

- Wednesday: The Fed will reveal all, or at least its benchmark interest rate at 2:30 pm ET. Netflix Co-CEO Ted Sarandos and Microsoft CEO Satya Nadella speak at a meeting organized by Fast Company magazine.

- Thursday: Business and finance figures have a lot to say today, as JetBlue CEO Joanna Geraghty, JPMorgan Chase CEO Jamie Dimon, and Federal Trade Commission Chair Lina Khan all make widely anticipated speeches at various events.

- Friday: Donald Trump and other insiders can start cashing out their Trump Media shares, even though the company has shed nearly three-fourths of its value since it launched in March.

Thanks for reading! Here’s to the week ahead, and don’t hesitate to reach out with comments, questions, feedback, joy, or bankruptcy-black attire. Sunday Reads was brought to you by Peter S. Green and Morgan Haefner.