The Race to Zero Emissions: dueling disasters, dwindling distributions, and dropping demand

Here’s what happened over the past week that helped or harmed the world’s chances of cutting greenhouse-gas emissions to zero.

Here’s what happened over the past week that helped or harmed the world’s chances of cutting greenhouse-gas emissions to zero.

Decreases emissions

1️⃣ Europe is breaking renewables records, generating more clean power than forecast. A record-breaking day in May saw 55% of Europe’s power generated by wind, solar, and hydro.

2️⃣ Germany will require all of its 20,000 or so gas stations to charge EVs. An exact date was not set, but the move would nearly double the number of charging stations in the country.

3️⃣ OPEC and Russia extended oil production cuts of about 10% of normal volumes. Global oil demand was forecast to fall to its lowest point since 2014.

4️⃣ Despite a dramatic drop in energy investment, low-cost renewables have proven resilient during the Covid-19 pandemic. In the US, wind and solar output rose 10% over 2019.

5️⃣ The oil bankruptcies continue. Oil firm California Resources Corporation rebuffed creditors and prepared for bankruptcy, while US “shale star” Chesapeake Energy appeared to be headed for the same fate.

One-two punch

As the Atlantic hurricane season began on June 1, forecasters said it could be one of the most active on record. Add climate change-fueled extreme weather to the coronavirus pandemic, and disaster response could be in trouble, from emergency aid to reconstruction of homes and economies. Just ask the mayor of an Arkansas town that weathered floods, a tornado, and its first Covid-19 death on the same day. Of course, disaster response is a long game—which means the coronavirus is already disrupting recovery from storms in the rearview mirror. Florida families who lost their homes in 2018’s Hurricane Michael are still living in FEMA housing, as coronavirus stalls rebuilding efforts. You can read these stories and more with a Quartz membership; go ahead and start with a seven-day free trial.

Net-zero (for now)

1️⃣ Environmental liabilities are hitting oil and gas investors. On June 2, Pacific Coast Oil Trust said it would end all cash distributions “for the foreseeable future” to ensure it could pay off the costs of retiring its infrastructure.

2️⃣ Dismal oil prices have forced oil supermajors to lay off even more staff. BP is cutting 10,000 jobs, about 14% of its workforce. CEO Bernard Looney emailed employees to say “we are spending much, much more than we make—I am talking millions of dollars, every day.”

3️⃣ It’s a bad time to be a car dealer in the UK, which endured one of its worst sales months since 1952. Other countries, especially the US, are starting to see personal vehicle demand slowly pick up again.

4️⃣ Beijing will let drivers trade credits for using electric vehicles, or not driving at all. The city’s “1-ton campaign” credits drivers who reduce emissions from driving, and lets companies buy these low-carbon credits.

5️⃣ French oil supermajor Total acquired Scotland’s largest offshore wind project, with more such deals reportedly in the works. Yet oil and gas investments in renewables overall remain anemic.

Overpriced

Equity investors aren’t pricing climate risk into stock prices. The reason, notes The Economist, remains a mystery. The International Monetary Fund studied how investors responded to 6,000 climate-related disasters in dozens of countries over the last 40 years. Such disasters, it found, only moved share prices by about 1%. A correlation between future climate hazard and share price wasn’t detected either. That’s strange, as a strong climate signal is already clear in the real estate market (bye Miami 👋), and carbon-intensive fossil fuel sectors. Researchers speculated a lack of data, time horizons, or simply willful disregard might explain what’s going on. A reckoning may be in store.

🔼 Increases emissions

1️⃣ CO2 levels barely paused for the coronavirus. Concentrations in May hit 417.2 parts per million, the highest on record.

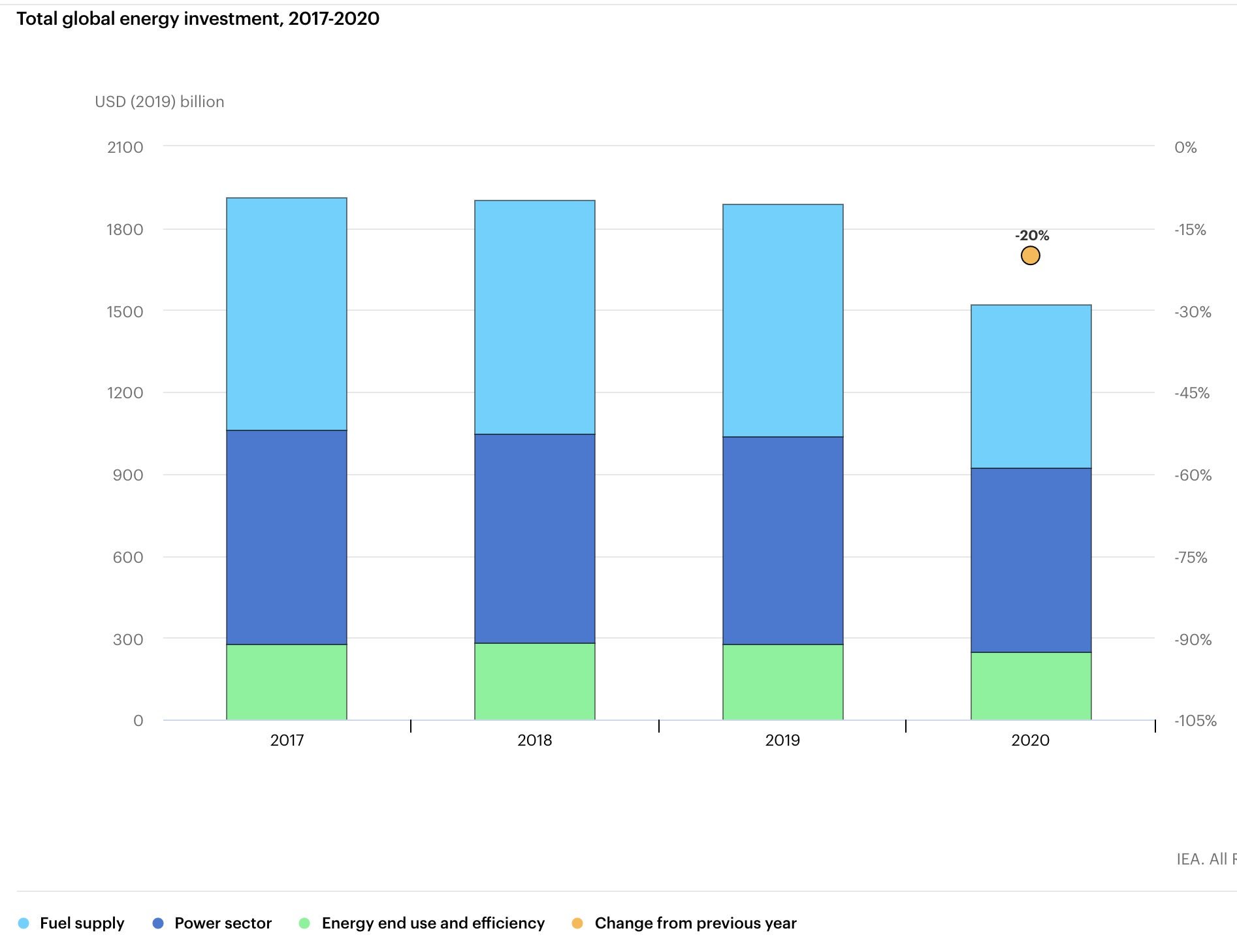

2️⃣ The IEA says energy investment will fall an unprecedented 20% this year compared to 2019. Oil spending was the worst-hit (a 50% decline), but clean energy investment has remained flat or seen delays, far below the spending needed to meet emissions targets.

3️⃣ The United States’ environmental laws no longer apply. Trump’s emergency executive order this week removed environmental review for major infrastructure projects under the Endangered Species Act and Clean Water Act, fast-tracking potential new fossil fuel projects.

4️⃣ Russia declared a state of emergency after ruptured fuel storage tanks dumped 20,000 metric tons of diesel oil into a river within the Arctic Circle. Melting permafrost is likely to blame for destabilizing the storage tank’s foundation, leading to its collapse.

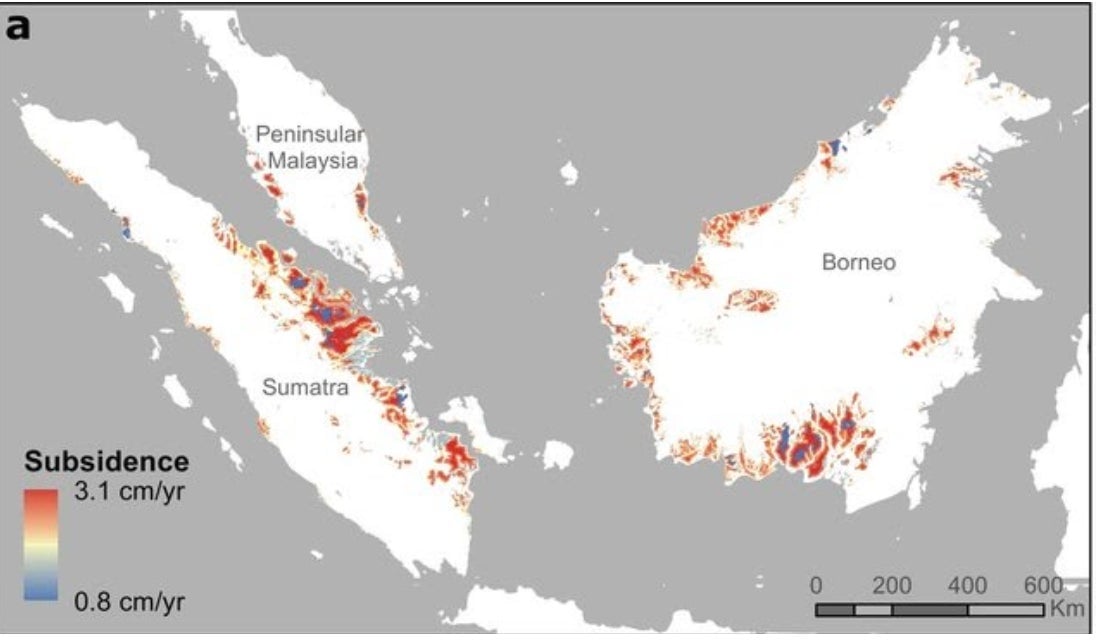

5️⃣ One of nature’s biggest biological carbon sinks, peatlands, are being burned and drained at an alarming rate, according to a study in Nature. More than 90% of peatlands in the study in Southeast Asia were subsiding by about an inch per year, releasing carbon dioxide into the atmosphere.

Stats to remember

As of June 7, the concentration of carbon dioxide in the atmosphere was 416.35 ppm. A year ago, the level was 414.42 ppm.

Have a great week ahead. Please send feedback and tips to [email protected].