The Race to Zero Emissions: reopening economies, jaded students, Vatican activism

Fossil fuels have always cycled through booms and busts. But the coronavirus pandemic triggered the most dramatic upheaval in the oil industry’s 150-year history. Almost overnight, the world’s most valuable commodity became nearly impossible to sell. The price of oil has recovered a bit, but even if demand approaches pre-pandemic levels, it’s clear that the industry will never be the same.

Fossil fuels have always cycled through booms and busts. But the coronavirus pandemic triggered the most dramatic upheaval in the oil industry’s 150-year history. Almost overnight, the world’s most valuable commodity became nearly impossible to sell. The price of oil has recovered a bit, but even if demand approaches pre-pandemic levels, it’s clear that the industry will never be the same.

This week at Quartz, Michael Coren and I dive into the challenges and opportunities presented by the coronavirus pandemic. Global supermajors are split along a trans-Atlantic divide about whether the profits of the future will derive from fossils or renewables. Meanwhile, many of the smaller shale companies that drove a mid-2010s boom are facing bankruptcy and the turned backs of investors who are tired of getting burned.

You can follow us down the rabbit hole in our field guide on fossil fuels going bust, for Quartz members. (There are a couple more carrots ✦ later on in this email.) In the meantime, here’s what happened over the past week that helped or harmed the world’s chances of cutting greenhouse-gas emissions to zero.

Decreases emissions

1️⃣ Global investment in renewable energy is set to surpass that in fossil fuels for the first time ever. By 2021, it will account for one-quarter of all energy investment, according to Goldman Sachs.

2️⃣ The number of oil and gas rigs in North America continues to plunge to record lows, reaching 72% below the level this time last year.

3️⃣ Wind energy is breaking records in Latin America, growing 126% from 2018-19. Its biggest competitor? Solar.

4️⃣ Denmark, home to the world’s largest offshore wind companies, adopted a new legally binding commitment to cut its emissions 70% below 1990 levels by 2030.

5️⃣ A major Midwestern power company will reduce its reliance on coal from 78% to 12% by 2025 and replace most of the difference with renewables. The company said the transition will save its customers $300 million.

✦ After the pandemic ✦

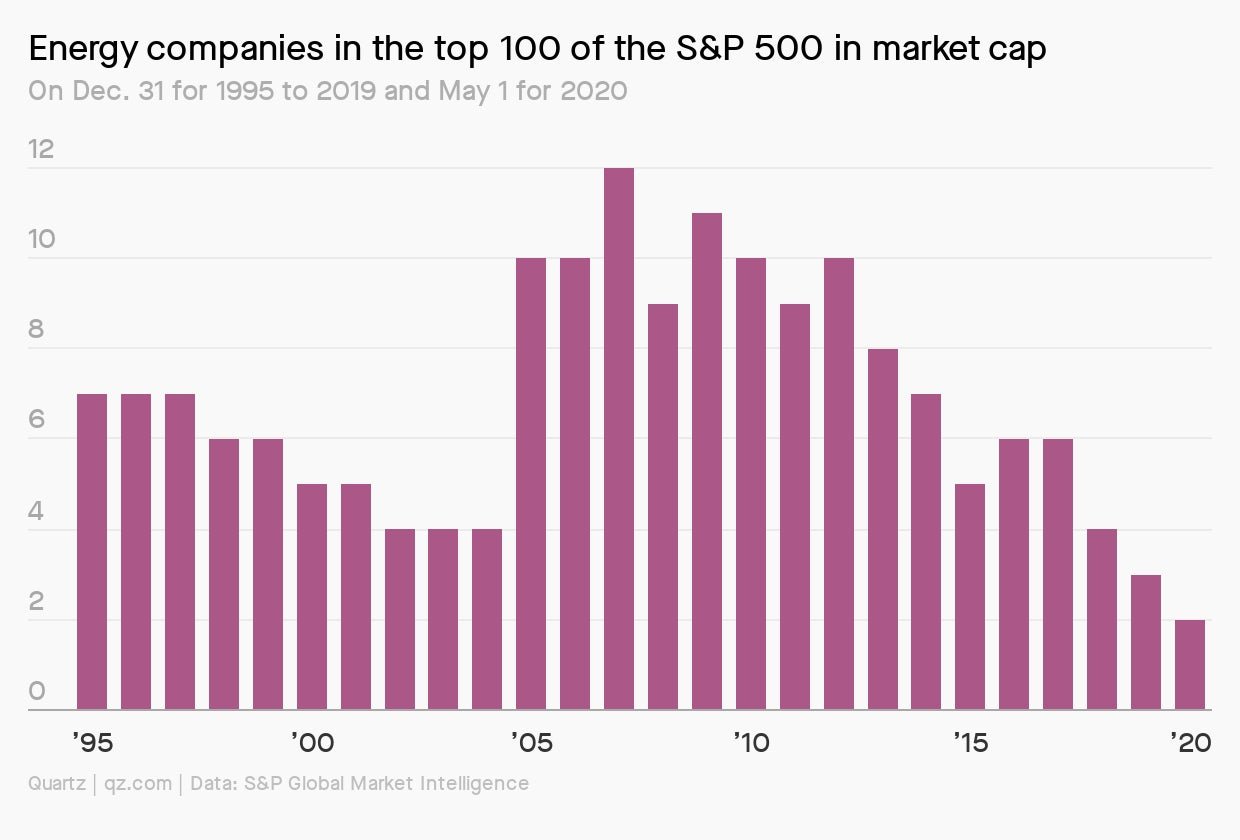

Even before Covid-19 sent oil prices spiraling, global supermajors were facing a rough road ahead. Battered by successive price crashes, facing mounting public scrutiny, and shoved aside by ascendant tech companies like Facebook and Google parent Alphabet, the power wielded by oil companies in the US is rapidly waning. In 2007, 12 of the 100 largest companies in the S&P 500 by market capitalization were oil companies. Today, there are just two.

To read more about the fall of companies like ExxonMobil from the S&P, you can try being a Quartz member for seven days free. Or dive right in with a half-off yearly subscription with the code SUMMERSALE.

Net-zero (for now)

1️⃣ Lyft promised to make its fleet of vehicles 100% electric by 2030. While drivers will still need to buy their own cars, the company said it will negotiate discounts with automakers.

2️⃣ The US Congress is working on another coronavirus stimulus package, and this time it finally includes money—$75 billion—for clean energy.

3️⃣ For the fifth anniversary of Pope Francis’s climate change encyclical, the Vatican is urging Catholics to divest from fossil fuels.

4️⃣ India is shopping for investors to open up 41 new coal mines. Prime minister Narendra Modi said coal revenue is key to the country’s coronavirus recovery.

5️⃣ Major European investors are threatening to pull funding for agricultural enterprises in the Brazilian Amazon if companies don’t work harder to curb deforestation. According to satellite data, 2020 is on track to see the highest rate of deforestation there on record.

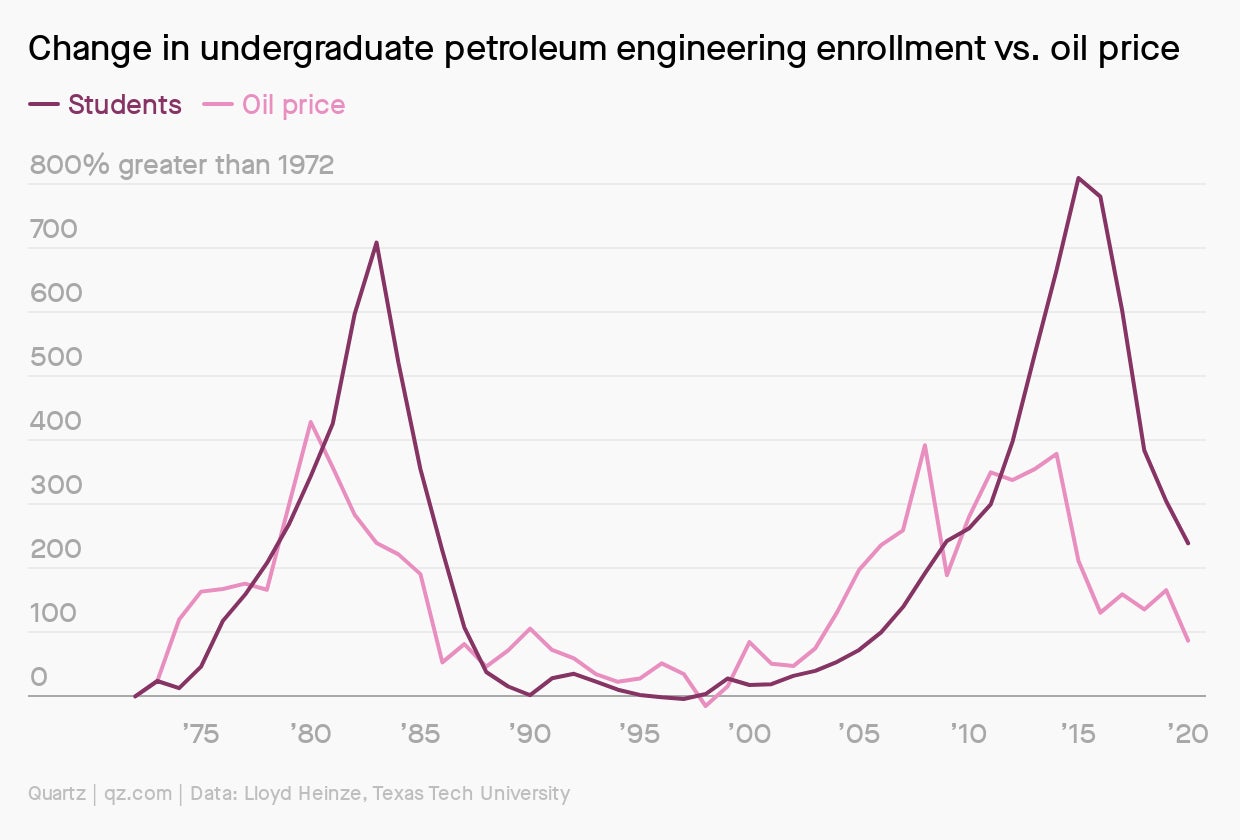

✦ The oil and gas industry has a recruiting problem ✦

Concern about climate change runs high among millennials and teenagers, and many of those with math and science smarts who might once have gravitated to a lucrative career in extractive industries are now turning away. “I have conversations all the time with friends who agree that they’d rather not work for an oil and gas company even if there were lots of jobs,” one engineering student told Quartz. And right now, there definitely aren’t.

Three numbers from our field guide that illustrate the problem:

- 78%: proportion of of US millennials surveyed by Pew in April who believe in supporting alternative forms of energy over fossil fuels

- Two-thirds: proportion of of teenagers surveyed by Ernst & Young in 2017 who believe the oil and gas industry “causes problems rather than solves them”

- 44%: proportion of millennials who told EY that they found a career in the industry “unappealing”

🔼 Increases emissions

1️⃣ Global emissions are quickly rising as countries reopen. In China, they’re already back to pre-pandemic levels, while US shale companies have brought back one-quarter of the production they cut at the height of the pandemic.

2️⃣ To help kick-start its economic recovery, China is letting automakers off the hook for electric vehicle production requirements. The country is already losing its dominance in the EV space: In May, the EU outpaced China as the world’s top destination for EV investment.

3️⃣ A new report finds that global efforts to retrofit commercial buildings to improve their energy efficiency are decades behind schedule. Progress on homes is even slower: At the current rate, it will take five centuries to upgrade the world’s housing stock.

4️⃣ Oil drillers in California are turning to increasingly carbon-intensive methods—like injecting steam from gas-fired boilers—to extract the last barrels from century-old wells.

5️⃣ Meanwhile, millions of abandoned oil and gas wells around the world are spewing huge amounts of methane, creating a climate menace and a major expense for taxpayers. The problem is likely to worsen as more wells are abandoned in the wake of the pandemic.

Stats to remember

As of June 18, the concentration of carbon dioxide in the atmosphere was 416.28 ppm. A year ago, the level was 413.26 ppm.

Have a great week ahead. Please send feedback and tips to [email protected].