How history repeats itself: 4 plausible scenarios for global business in 2027

The future may be uncertain, but understanding the past can help leaders prepare.

The push toward globalization that’s dominated business growth for the last two decades is shifting. In tandem, recent upheavals—war in Ukraine, rising US-China tensions—are creating the greatest geopolitical reverberations since the end of the Cold War.

Suggested Reading

Between the geopolitical strain and slowing economic growth, companies are confronted with several significant challenges — rising inflation, energy insecurity, disrupted supply chains — all at once. So how can business leaders plan for the future when so much is up in the air? Looking to the past can give some clues about what to expect.

Related Content

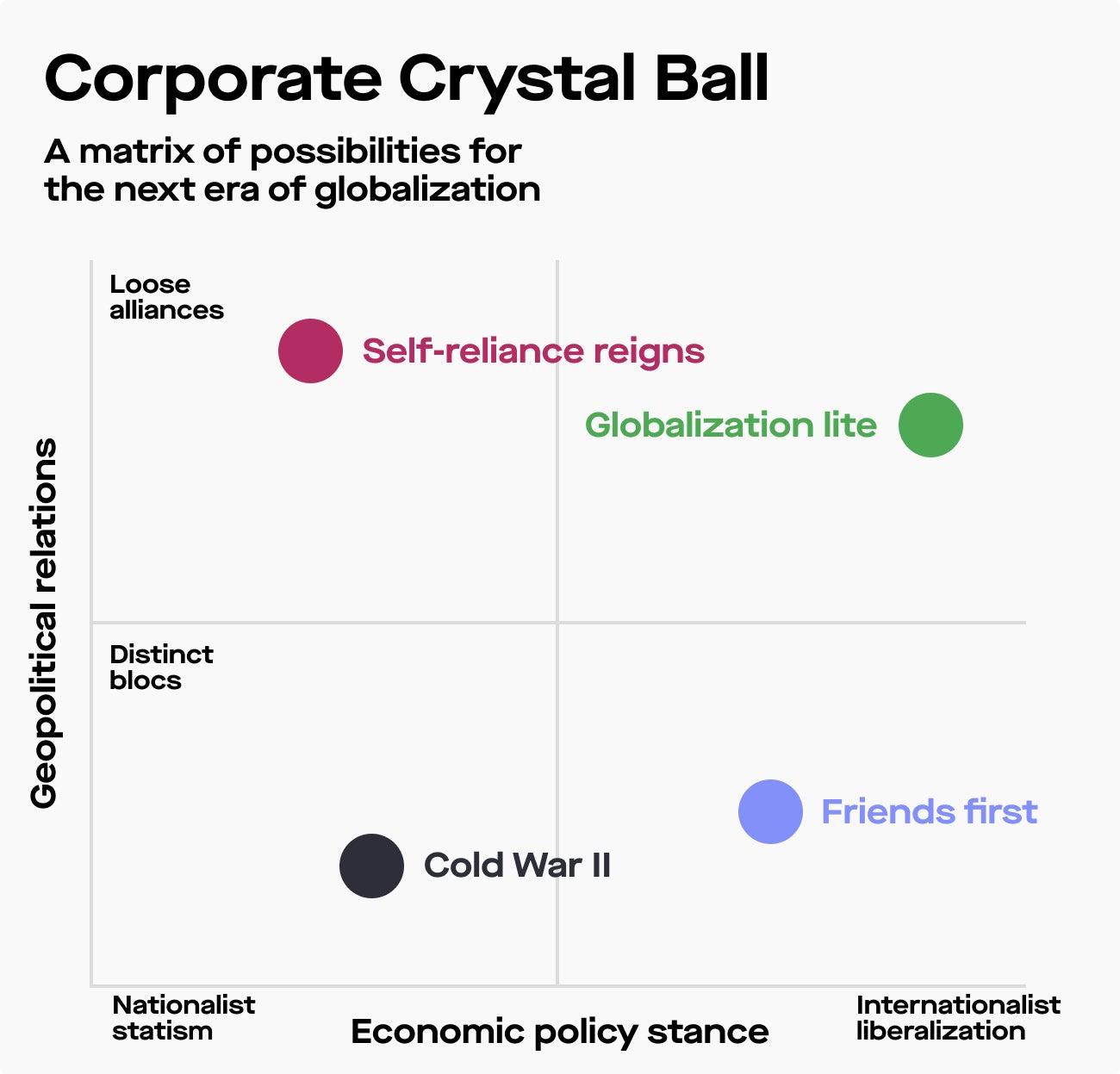

The experts at EY-Parthenon have conceived of four plausible scenarios for the next five years, but preparing for these potential futures requires taking action now.

Using scenario analysis, businesses can build agile strategies and operations to prepare for all potential outcomes. Ready to predict the future?

Scenario 1: Self-reliance reigns

Looking to 2027, isolationism could take center stage.

National leaders could turn their backs on old alliances and international engagement to focus on domestic self-sufficiency and economic security. Those fraying political pacts would then create an unpredictable geopolitical environment, while isolationist economic policies make trade more volatile and cross-border supply chains more expensive and thereby raise prices for the end consumer.

M&A opportunities would be limited to domestic companies, while the cost of labor would increase as nationalism limits international migration. Lower growth and innovation lead to stagnant living standards, fueling political instability and spiraling into more isolationism.

It’s a return to conditions in the 1930s — a century later.

In this scenario, companies in large markets could have sufficient growth prospects, but those in small ones would be destined for slow or no growth. Isolationism would also challenge international firms as some sectors and regions provide growth opportunities, but others do not.

While these external factors are outside of companies’ control, leaders can prepare by looking for ways now to offset higher costs by improving energy efficiency, introducing automation, and enhancing cross-border models. Companies can also evaluate and potentially diversify supply chain ecosystems—a trend that kicked off during the pandemic.

Scenario 2: Cold War thinking makes a comeback

Much like in the first Cold War in the 1950s-1980s, ideological differences could create a world divided into blocs by 2027.

In one arena would be the US, EU, and their allies. China and its associates would make up the other. Non-aligned countries would create a third, volatile cohort.

With tensions running high, policymakers predictably focus more on national security than economic growth. Governments become heavy-handed with supply chains and cross-border investments, imposing export controls and other restrictions. In a glimmer of what may come, China recently sanctioned two US companies for selling weapons and military technology to Taiwan—part of a series of recent maneuvers between the US and China.

All this division would create trade barriers that force companies to reorient supply chains so operations stay within their bloc. Meanwhile, export controls on strategic technologies and minerals would force blocs to create different technology standards, further discouraging cross-border flows. These restrictions would lead to higher costs for everything including essentials—food, services, fuel.

In this scenario, corporate resilience is key, so leaders looking around corners now should find ways to create a more agile organization by making internal processes more efficient and brace for a changing regulatory environment by exploring opportunities in “friendly” markets.

Scenario 3: Friends go first

For the third scenario, geopolitical alliances would stay strong while trade and capital flows relatively freely among allies. It’s an outcome somewhat akin to the early 20th century when the world was dominated by a complicated web of alliances.

Despite the various factions, political tensions would stay manageable, with governments focusing on supporting domestic growth. There would be some restrictions on cross-border flows because government policies favor supply chains within their alliance.

Altogether, this environment would create technological powerhouses that support growth in the hub, but bigger possible gains are limited because of trade barriers. Revenue growth would be modest, but limited by the alliances which fracture the global market.

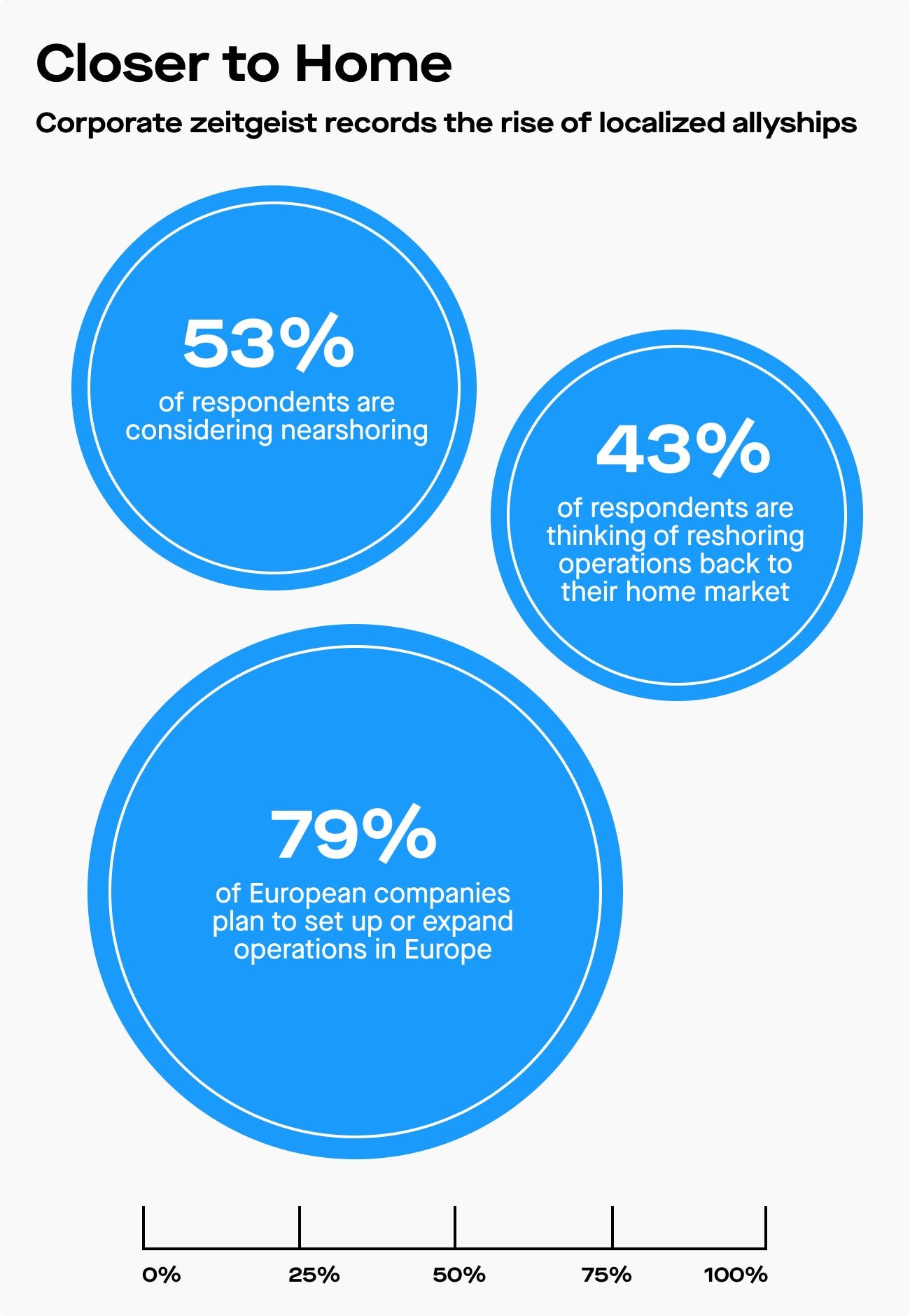

In response to the increasingly regional trade, companies would more and more rely on optimizing operations within alliances. Driven by political pressures and the desire to reduce carbon footprints, nearshoring and “friendshoring” key operations and supply chains, especially technology, would rise in popularity toward 2027.

In 2023, leaders are already responding to this trend, starting to use technologies, such as 3D printing and robotics, to produce certain orders locally and to avoid concentrating all their sourcing in a single market. They are diversifying their manufacturing into other markets after covid restrictions wreaked havoc on production timelines.

Scenario 4: Globalization gets lite

This is the most optimistic of all scenarios and represents a partial return to the 1990s and 2000s.

Low levels of geopolitical tension create a relatively stable and predictable global environment for companies. Policymakers set aside ideological differences to prioritize economic growth and solve shared challenges — like climate change — as multilateral efforts. For example, the European Union recently voted, after two years of negotiations, to create the world’s first carbon border tax that will be levied on imports.

In such a relatively open environment, companies are free to make decisions about operations, supply chain, and strategy largely based on market fundamentals, though sensitive sectors such as technology and energy would still need to heed political risks.

Global economic growth rebounds as governments pull back on policies that constrain boundary-less trade. With reduced barriers to trade and investment, companies pursue new M&A and investment opportunities in promising markets. Together, this environment is conducive to technological progress, lower inflation, productivity growth and improved living standards.

All of these post-covid scenarios are plausible so preparing for them starts with a clear understanding of what’s at stake and how the geopolitical forces impact your industry and company, everything from M&A strategy to supplier footprints, access to capital and talent. That way, business leaders can develop nimble approaches to manage the risks and be ready for whatever comes.

Learn more about how EY-Parthenon can use scenario analysis to future-proof your business.

This content was produced on behalf of EY-Parthenon by Quartz Creative and not by the Quartz editorial staff. Sources are provided for informational and reference purposes only. They are not an endorsement of EY-Parthenon or EY-Parthenon’s products or services. This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Member firms of the global EY organization cannot accept responsibility for loss to any person relying on this article.