Paytm has spotted an opportunity in India’s push for data localisation

The Narendra Modi government is considering a new set of laws making it mandatory for companies to store all the data of their Indian users within the country.

The Narendra Modi government is considering a new set of laws making it mandatory for companies to store all the data of their Indian users within the country.

The move will likely throw up a massive opportunity that Paytm, India’s largest digital payments firm, is lining up to cash in on.

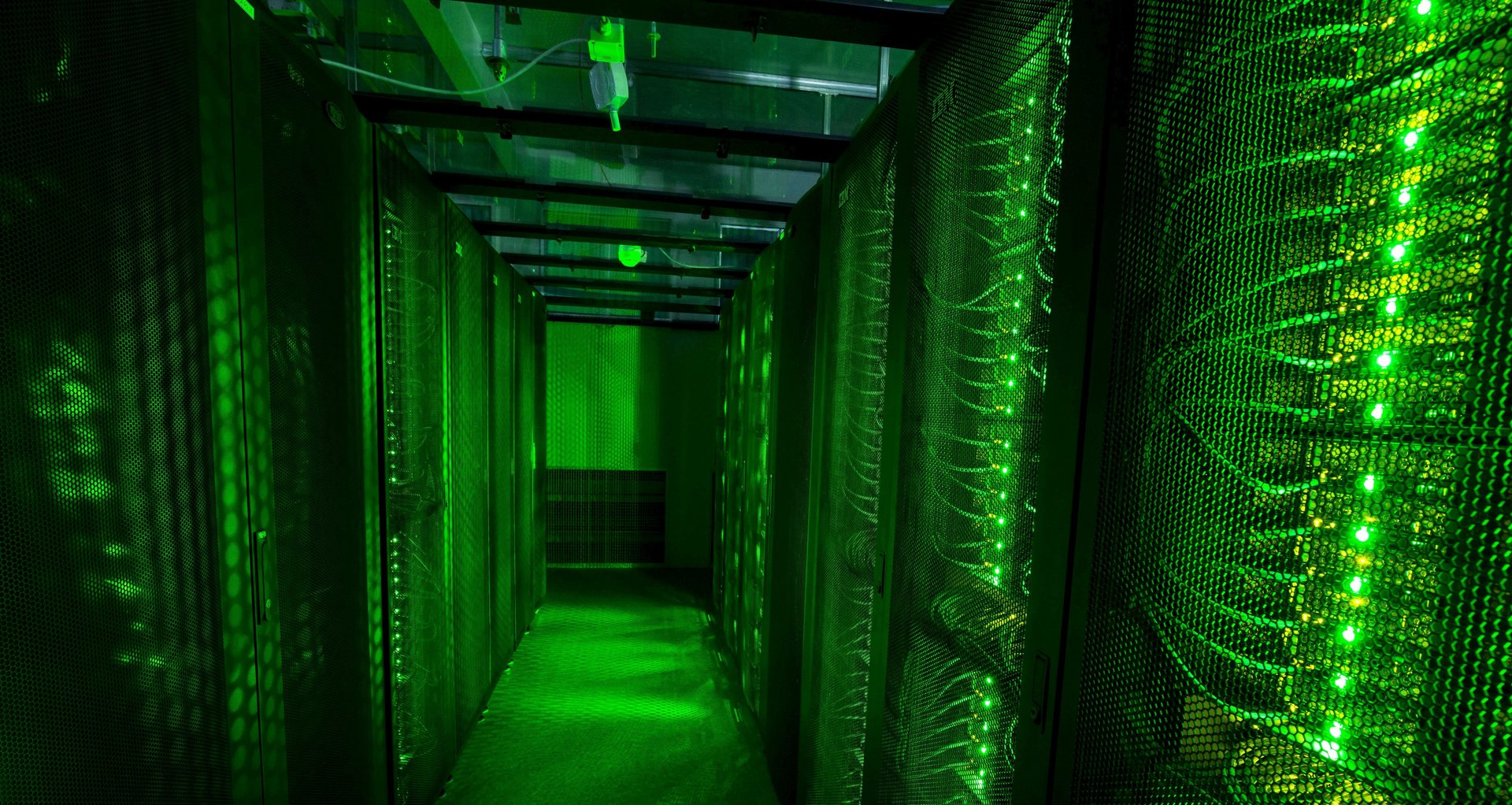

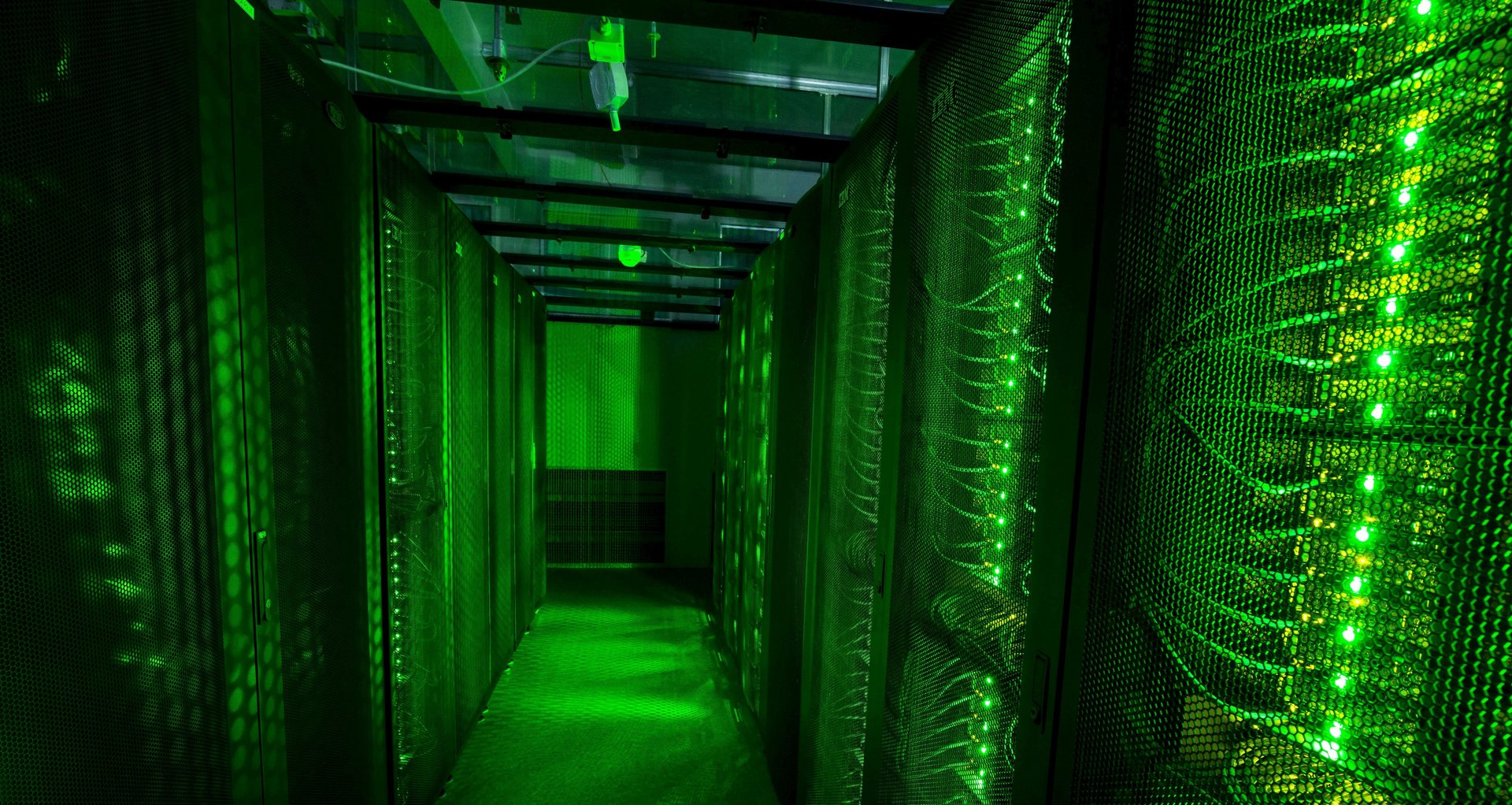

On Aug. 21, the Noida-based firm launched Paytm AI Cloud in partnership with Alibaba, the Chinese online shopping giant which is also its investor. The new initiative will processes and store all consumer data in servers located only in India and conform to the highest security and privacy standards, the company said in a blog post announcing the new initiative.

Currently, the leaders in data storage in India are American tech giants Microsoft and Amazon. If the proposed laws come through, they will need to make significant adjustments, which will take considerable time, during which Paytm wants to make its move.

“Paytm is doing what any company in its position would do,” Vinay Kesari, a tech and policy lawyer, told Quartz. “It is a homegrown company. Its infrastructure is in India. So it is hammering on that competitive advantage.”

The opportunity in the sector is massive, but despite Alibaba’s deep pockets and Paytm’s local experience, the new venture will face challenges.

India’s cloud market

Cloud computing is a growing market in India. Public cloud services—the largest segment of the market—are expected to grow 37.5% in 2018 to $2.5 billion, according to research and advisory firm Gartner.

While giants like Amazon and Microsoft do have some data centres in the country, their infrastructure is not sufficient to meet its demands. So if the proposed bill is enacted, these companies will need to build many more data centres in India.

During that time, there is likely to be a severe shortage of cloud storage capacities, driving up prices in India. That’s the space Paytm is looking to tap.

Paytm and cloud

While Paytm’s timing may be right, breaking into the market won’t be easy.

“Paytm is entering a very crowded and price-sensitive market. It will have to be very careful about what it introduces and at what cost,” said Sanchit Gogia, chief analyst at Greyhound Research. ”It is also a market that’s already dominated by existing IT vendors. Paytm is not an IT vendor, and it does not have that expertise.”

One of the risks is that the proposed data localisation policy, the biggest thing favouring Paytm, may not materialise in India after all.

“I don’t think there will be a blanket rule to keep all user data within the country,” Gogia said. “If you are talking about a global company, they have all the right to keep their data elsewhere. The proposed bill will have to make caveats for the companies which are not registered in India.”

Also, Paytm itself faces questions over Alibaba’s significant stake.

Alibaba runs a prominent cloud service in China and abroad and will provide the knowhow to Paytm. The Indian e-wallet, however, has said it will not share customer data with its investor.