“Hush money” or not, Infosys owes its former CFO $1.68 million

Yet another allegation of Infosys founder NR Narayana Murthy against the company’s former “outsider” management team has fallen flat on its face.

Yet another allegation of Infosys founder NR Narayana Murthy against the company’s former “outsider” management team has fallen flat on its face.

An arbitration tribunal today (Sept. 18) instructed the Bengaluru-based IT major to pay its former chief financial officer (CFO), Rajiv Bansal, the balance amount of Rs12.17 crore ($1.68 million) promised as his severance package.

The amount was held back by Infosys after its co-founders, led by Murthy, alleged that this huge payout—Rs17.38 crore in total—was “hush money” for hiding issues of poor corporate governance under the former management team led by then CEO Vishal Sikka.

“Such payments raise doubts whether the company is using such payments as hush money..,” Murthy had told The Economic Times newspaper in an interview in February 2017. He had even sought a refund of the first tranche of Rs5.2 crores paid to Bansal, who had left Infosys in October 2015.

In April 2017, Bansal approached the arbitration tribunal seeking payment of the balance. The tribunal has now ruled in his favour.

“While the award acknowledges that Infosys had bona fide disputes, its counter-claim for (a) refund of previously paid severance amount of Rs5.2 crore and damages, has been rejected,” Infosys said in a notice (pdf) to BSE.

It only proves that the ugly boardroom drama at Infosys a few years ago might have been futile. If anything, it may have cost the tech major a lot of goodwill.

“There’s a huge learning here (from the arbitration decision) for Infosys to remove itself from the founders to avoid such situations in the future,” said Sanchit Vir Gogia, chief analyst and CEO at Greyhound Research. “It’s about time that founders distanced themselves from the company. They have a moral obligation to do so now. In the end, this is critical to ensure client confidence.”

Much ado about nothing

Even over a year after the unceremonious exits of Sikka, chairman R Seshasayee, and independent directors Jeffrey Lehman and John Etchemendy, the company is yet to fully recover.

In fact, just last month, it saw the exit of another key official, CFO MD Ranganath.

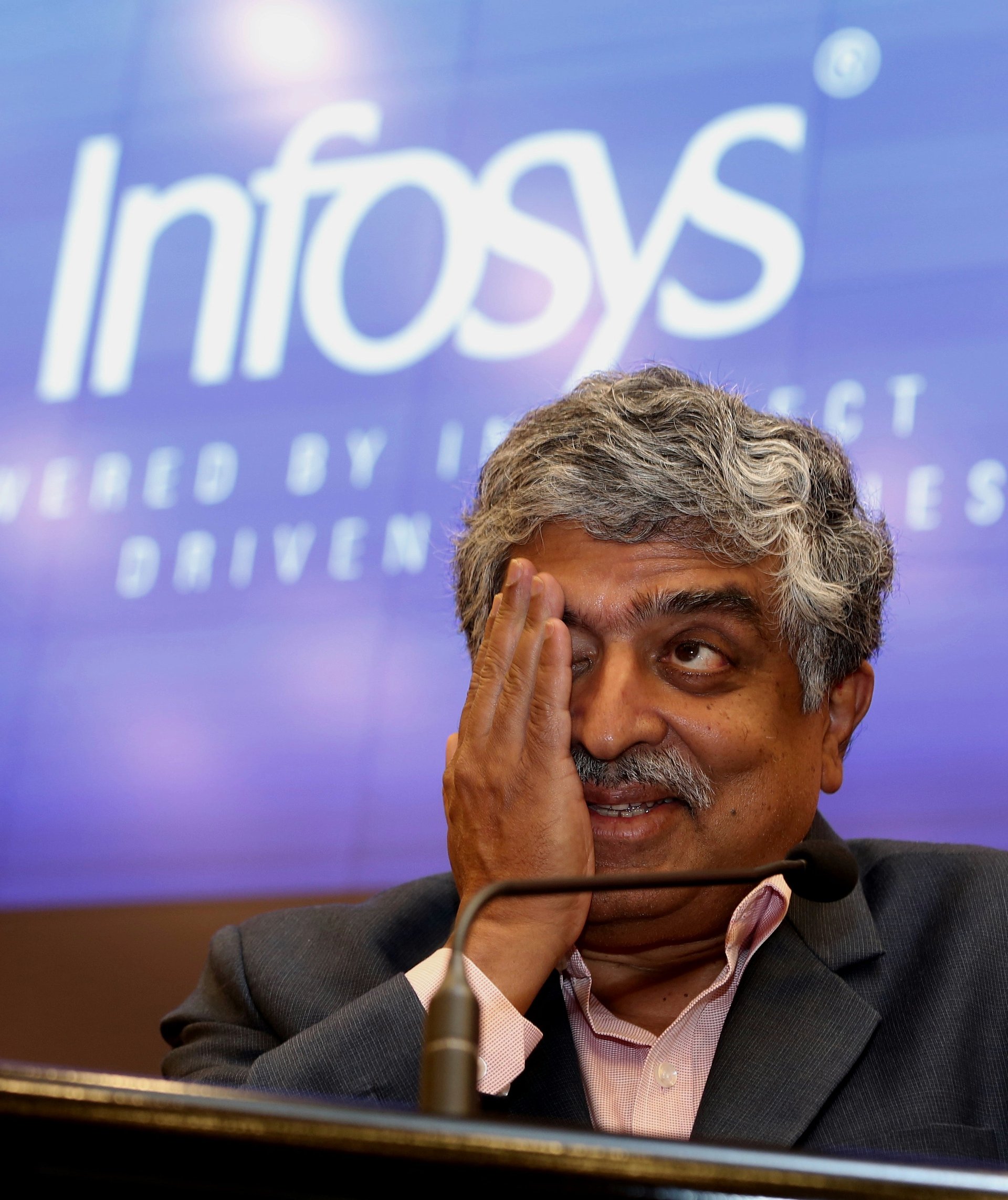

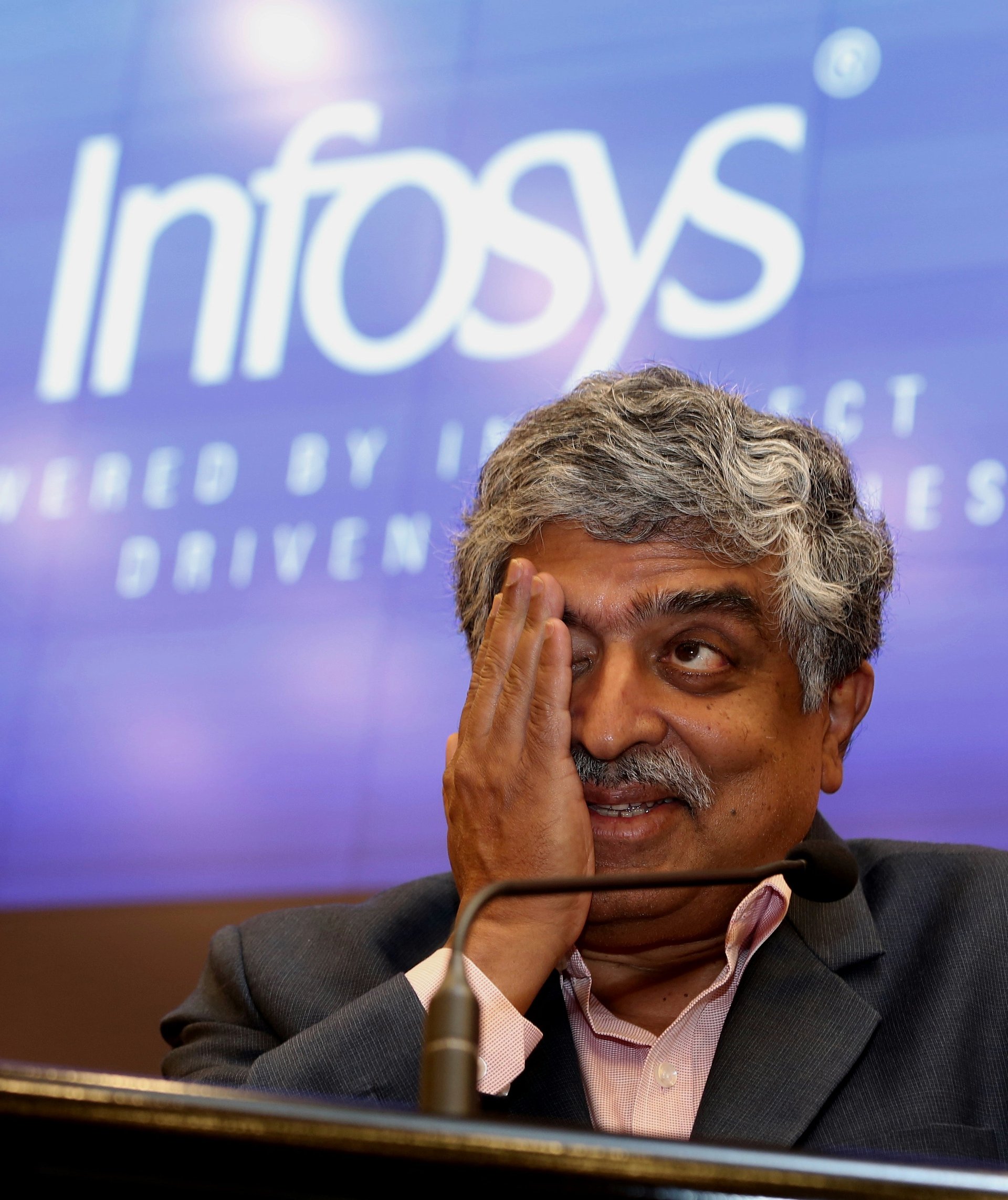

Meanwhile, Nandan Nilekani, the co-founder and non-executive chairman who returned to Infosys following Sikka’s exit, gave the former management team a clean chit in October 2017.

And just like the Sikka-Seshasayee team, Nilekani has refused to meet one of Murthy’s long-standing demands: making public the report of an independent probe into the $200 million acquisition of Israeli software firm Panaya.

“After careful reconsideration, the company has concluded that publishing additional details of the investigation would inhibit the company’s ability to conduct effective investigations into any matter in the future,” Infosys had said in a statement in October last year. “Confidentiality is critical to ensuring the candor and cooperation of whistleblowers and other participants in any investigative process. The precedent of releasing the full investigation reports could impair the cooperation of participants should the need for an investigation arise in the future.”

Murthy was clearly disappointed at the decision. The arbitration now only gives him more to brood over.