Indian police end the party for the country’s first cryptocurrency ATM

Life for India’s first cryptocurrency ATM has turned out to be short.

Life for India’s first cryptocurrency ATM has turned out to be short.

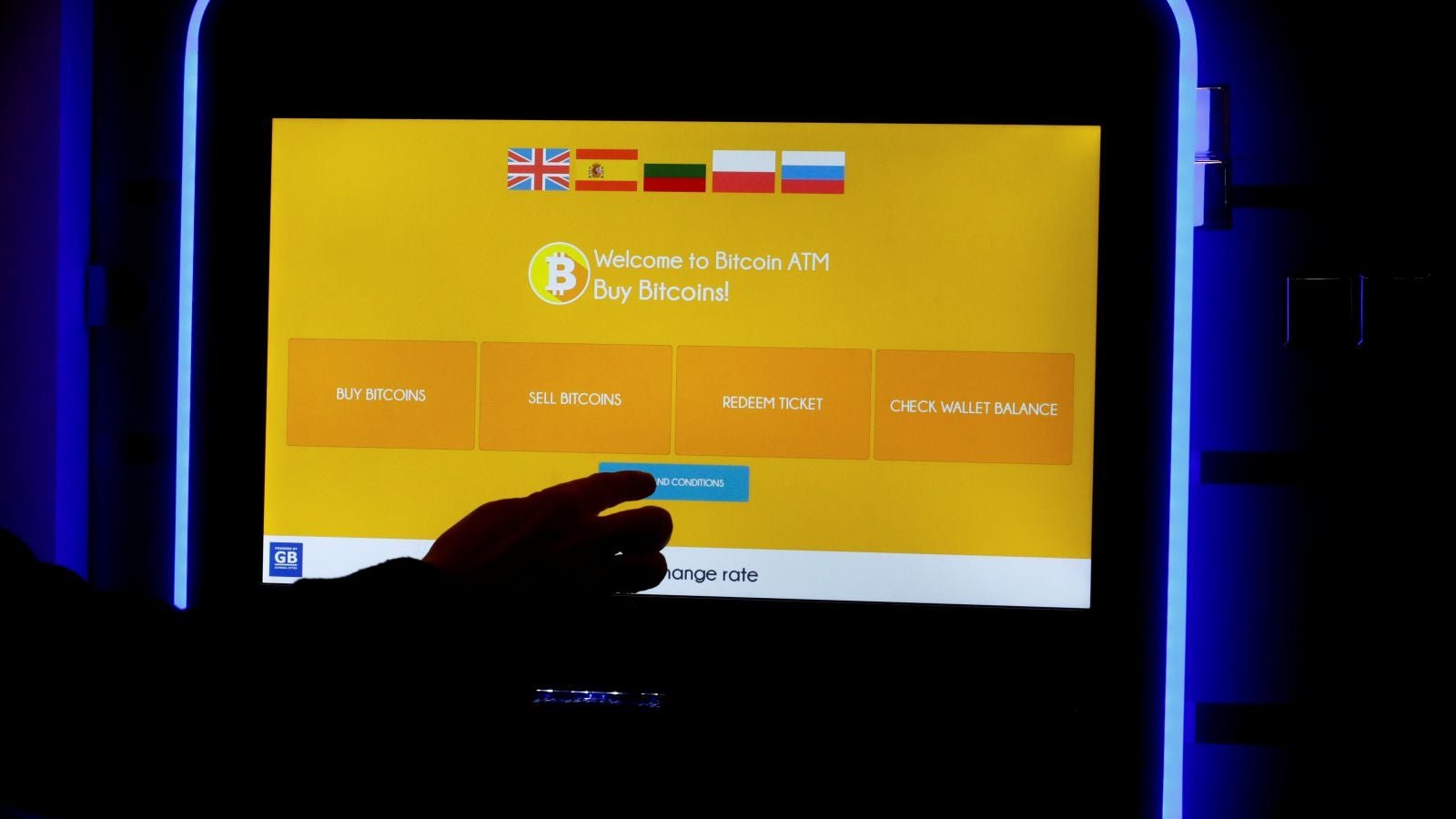

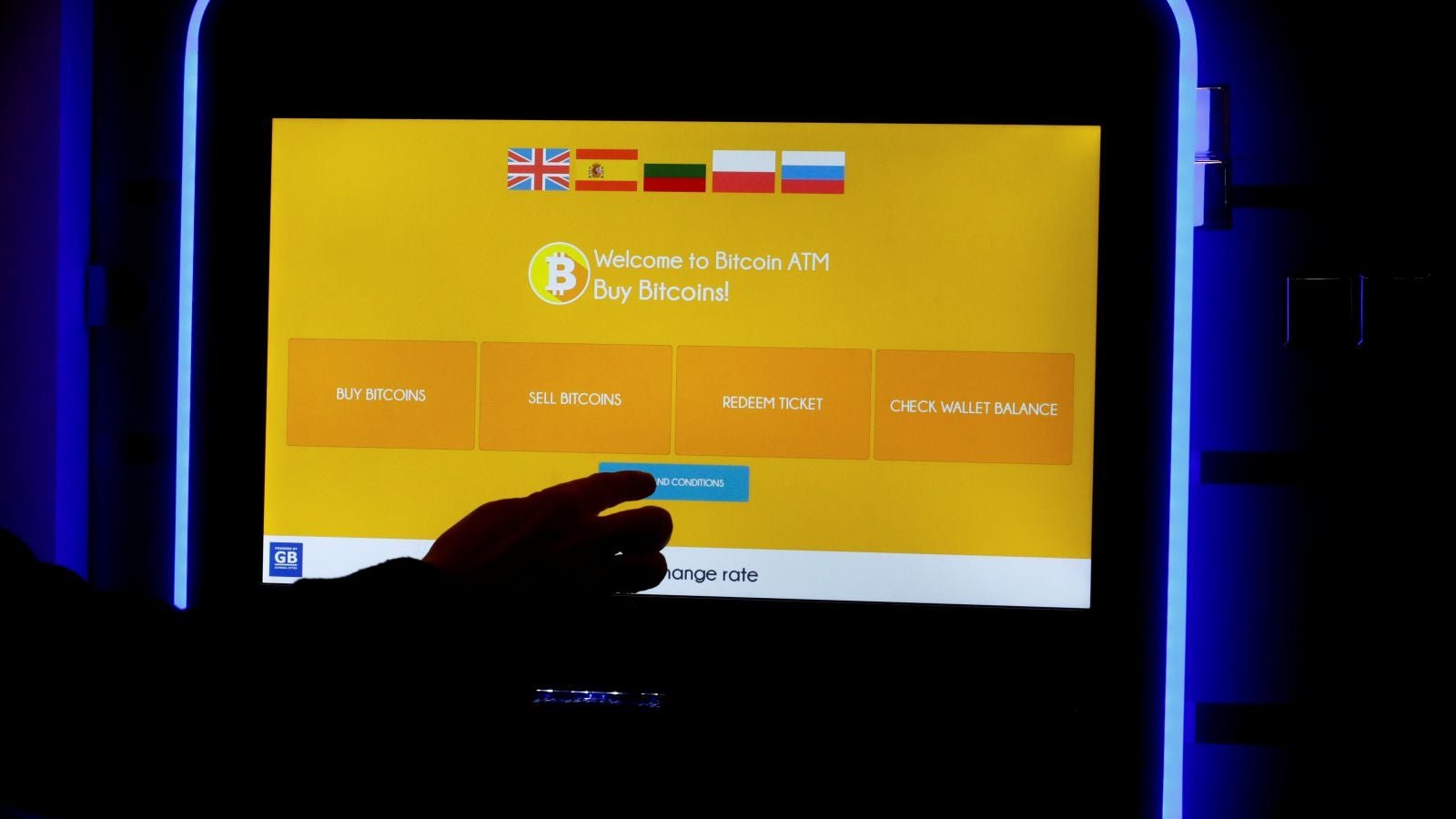

Last week, the virtual currency exchange Unocoin had set up the country’s first cryptocurrency ATM in Bengaluru. But on Oct. 23, the Bengaluru police seized the ATM and also arrested the firm’s co-founder, Harish BV.

The virtual currency ATM had not even started full-fledged functioning as operational upgrades were still underway last week.

“The ATM kiosk installed by Unocoin in Bengaluru’s Kemp Fort Mall has not taken any permission from the state government and is dealing in cryptocurrency outside the remit of the law,” the police’s cybercrime department said.

Apart from the teller machine, the police officials also seized two laptops, a mobile, three credit cards, five debit cards, a passport, five seals of Unocoin company, a cryptocurrency device, and Rs1.8 lakh ($2,500), officials said.

Calls and text messages sent to Unocoin from Quartz remained unanswered.

Unocoin had installed the ATM exclusively for its customers to deposit or withdraw money from their digital wallets. This balance amount could then later be used to buy digital currencies from the exchange’s website or mobile app.

In the coming months, the exchange was planning to set up around 30 more ATMs across the country, Sathvik Vishwanath, co-founder and CEO of Unocoin had said.

The legal debate

Unocoin had previously told Quartz that its ATMs have nothing to do with India’s banking system and, therefore, did not violate any norms laid down by the Reserve Bank of India (RBI). But in a blog post in January 2018, Unocoin had explained that, according to RBI norms, non-banking entities, including cryptocurrency exchanges, are forbidden from setting up or operating ATMs.

Emails sent to the central bank last week for clarification on this issue remained unanswered.

Other cryptoexchanges were also exploring the idea of cryptocurrency ATMs even though they lie in a legal grey area. “We had also tried to explore the ATM idea and had spent a considerable amount (of time) on it. Rest everything, from software, to logistics, etc. had fallen in place but we were unsure about the legal aspect and were sure that it will run into trouble with the authorities,” the CEO of another cryptocurrency exchange told Quartz, requesting anonymity. “Therefore, we dropped the idea.”

This crackdown on cryptocurrency ATMs comes at a time when the ecosystem in India has been struggling to survive. Earlier, this year the RBI cracked the whip on the bourses and traders, restricting all rupee-related trade. Since then, trading volumes have plummeted to one-tenth of its peak a year ago, even forcing one of the country’s largest exchanges to shut shop in India.

The exchanges had also dragged the central bank to the supreme court, where the final hearing in the case is still underway.

Want to read more from Nupur Anand? Subscribe to Quartz Private Key—Quartz’s premium crypto newsletter, delivered twice weekly.