India’s co-living sector will be worth over $2 billion by 2022

By 2022, India’s co-living industry will be 20 times bigger than it is today.

By 2022, India’s co-living industry will be 20 times bigger than it is today.

The shared-living market, which offers private bedrooms with common shared areas like kitchens and recreational rooms, stands at $120 million (Rs845 crore) today, as per data from research and advisory firm RedSeer Consulting. In the next four years, it’ll grow to surpass $2.2 billion in market value.

The organised co-living sector in India grew over 100% over the last year, industry experts told Business Line. And 60% of the market still operates informally, suggesting that a major chunk of the pie is there for the taking by tech startups foraying into the space.

“The last couple of years have seen the co-living market grow rapidly to reach a significant scale, driven by players like NestAway and others who doubled supply to almost 50,000 beds in 2018,” RedSeer’s report stated.

A slew of players is bullish on the concept. In October 2018, Softbank-backed hospitality startup OYO announced the launch of its co-living vertical OYO Living. Earlier this week, Bengaluru-based Zolo raised $30 million from IDFC Alternatives, Mirae Asset, and Nexus Venture Partners. By the end of this year, it is targeting 50,000 beds by year-end, up manifold from its current supply of 16,000. US-based WeWork also plans to bring WeLive—it’s serviced-apartment offerings in co-living formats—to India sometime in 2019.

Who’s co-living?

Two specific demographics, away from home and faced with sky-high rents, are subscribing to this upcoming trend.

“One is the typical migrant, white-collar professional who comes to another city for a job. The second set of demand is coming from the education market, where students go to different cities to pursue degrees,” Ujjwal Chaudhry, associate director at RedSeer, told Quartz.

“The need among these groups for this kind of a model is fairly severe because the entire experience is quite broken,” he added. “In terms of finding a place to actually negotiating with broker to finding flatmates, there are multiple touchpoints. A one-stop solution makes a lot of sense.”

For early-career professionals and students, the co-living system is easy on the wallet, costing between Rs9,000 and Rs15,000 per month for shared rooms and Rs17,000 and Rs25,000 per month for solo rooms.

The growing popularity of shared spaces among India’s youth cited by RedSeer was also highlighted in a December 2018 study by real estate consultancy Knight Frank India. Seven in 10 Indians aged between 18 and 23 gave co-living spaces a thumbs-up.

The next wave

Some co-living startups are going above and beyond just home-rental to make daily life more convenient. For instance, Delhi-based CoHo lets tenants choose weekday meal plans if they prefer eating out on the weekends, and OYO planned a weekday accommodation option to cut back on daily commutes.

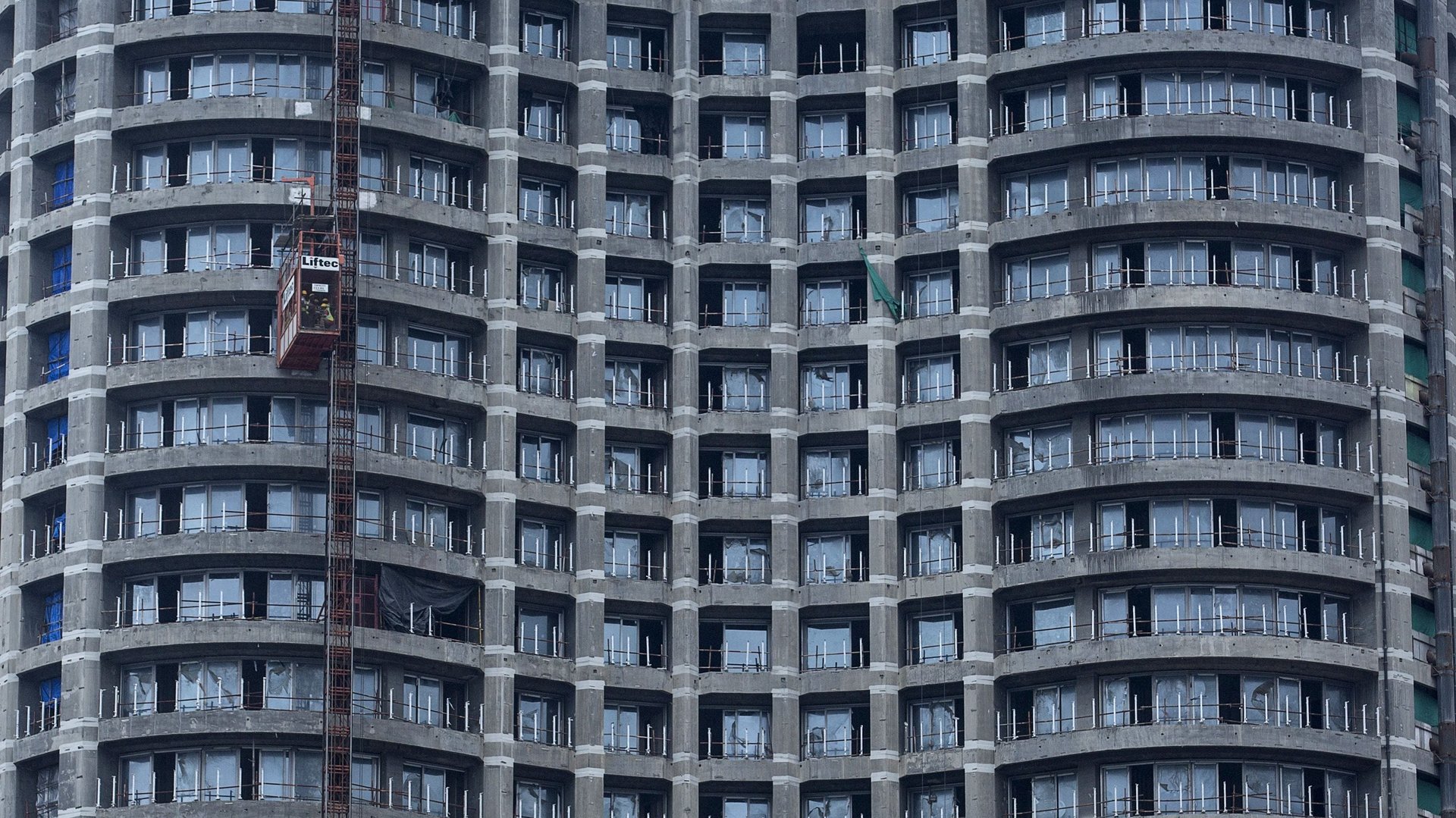

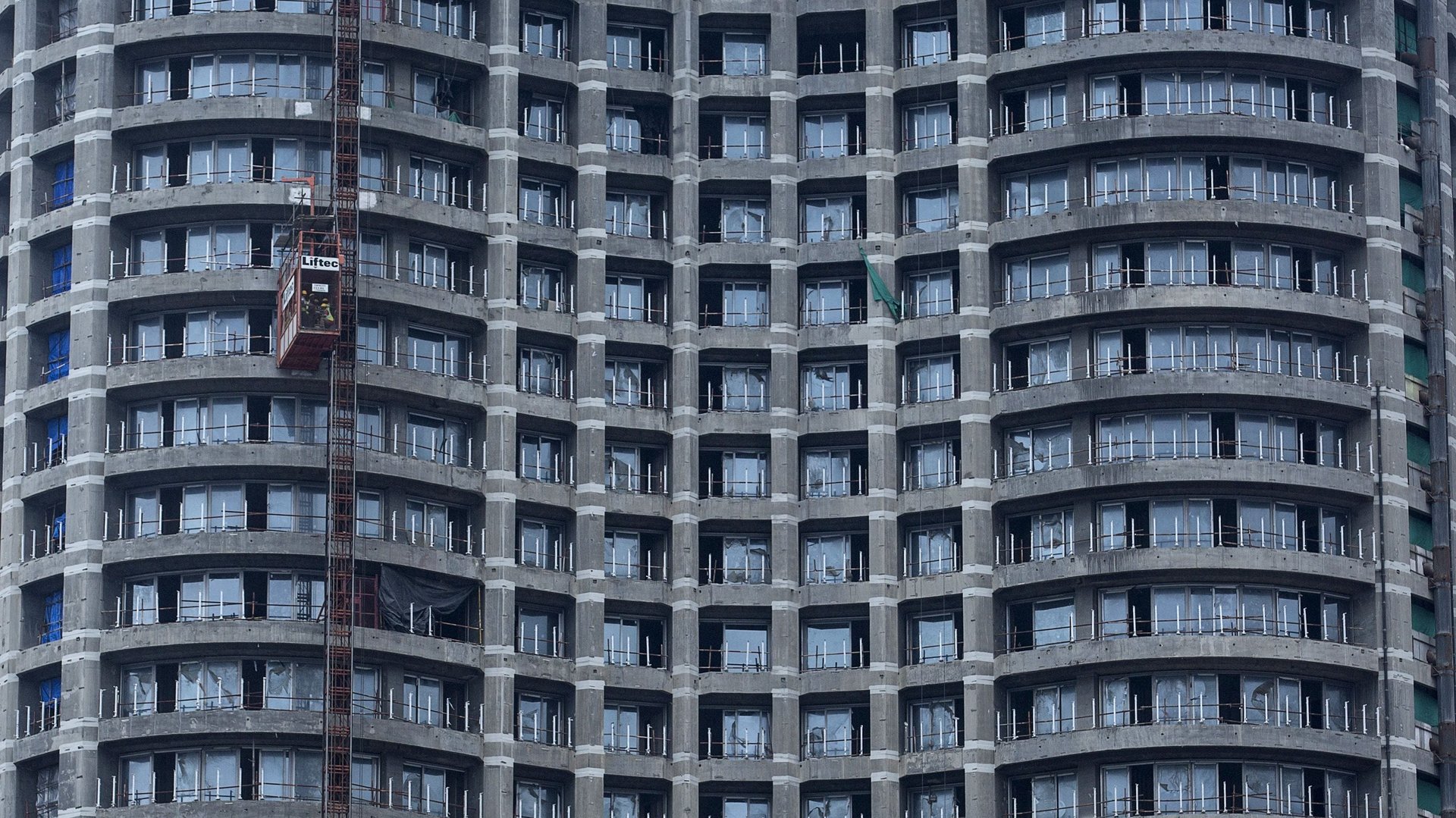

Though a simple property-listings template will survive in the market, a developer-partnership model is the winner, RedSeer’s analysis has shown. This refers to players that work with a real estate developer to lease an entire building or even co-partner while the building is being constructed.

“Then, you don’t have to figure out where the supply has to come from anymore,” Chaudhry explained. “Instead, you can focus on deploying value-added services such as catering, housekeeping, milk-and-grocery delivery, and so on in a much more efficient and localised concentrated manner compared to having properties scattered all over.”

Already, StayAbode Ventures is developing one of the biggest co-living projects in India with 1,400 people living in a community environment in Whitefield, Bengaluru. The area is home to a number of multinational firms including tech’s Big Five—Facebook, Amazon, Apple, Microsoft, and Google—and a working population of over 50,000 millennials. StayAbode’s project is slated to go live in September 2020.