In a quest to remain fiscally prudent, India’s budget stuck to the minimum

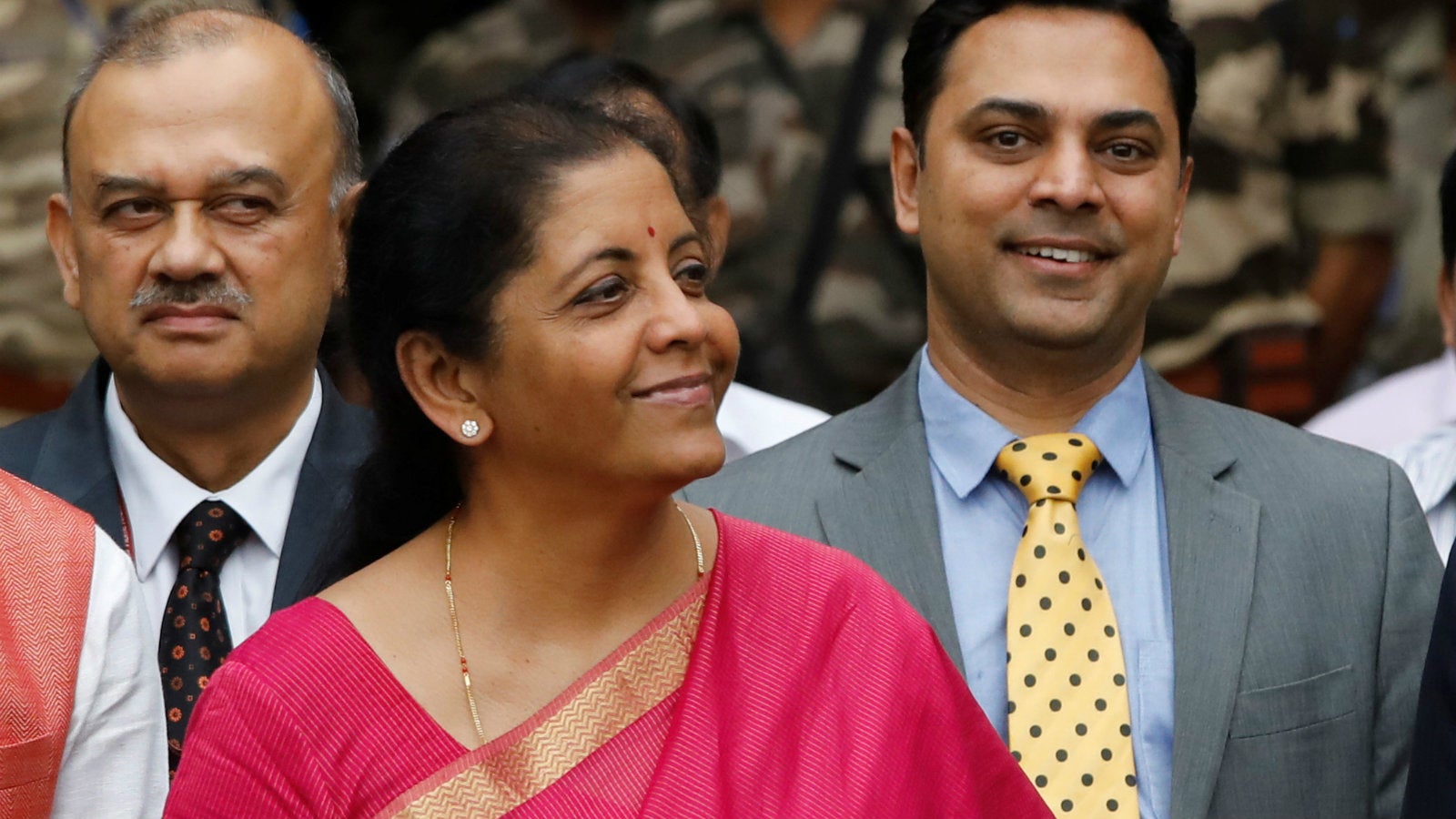

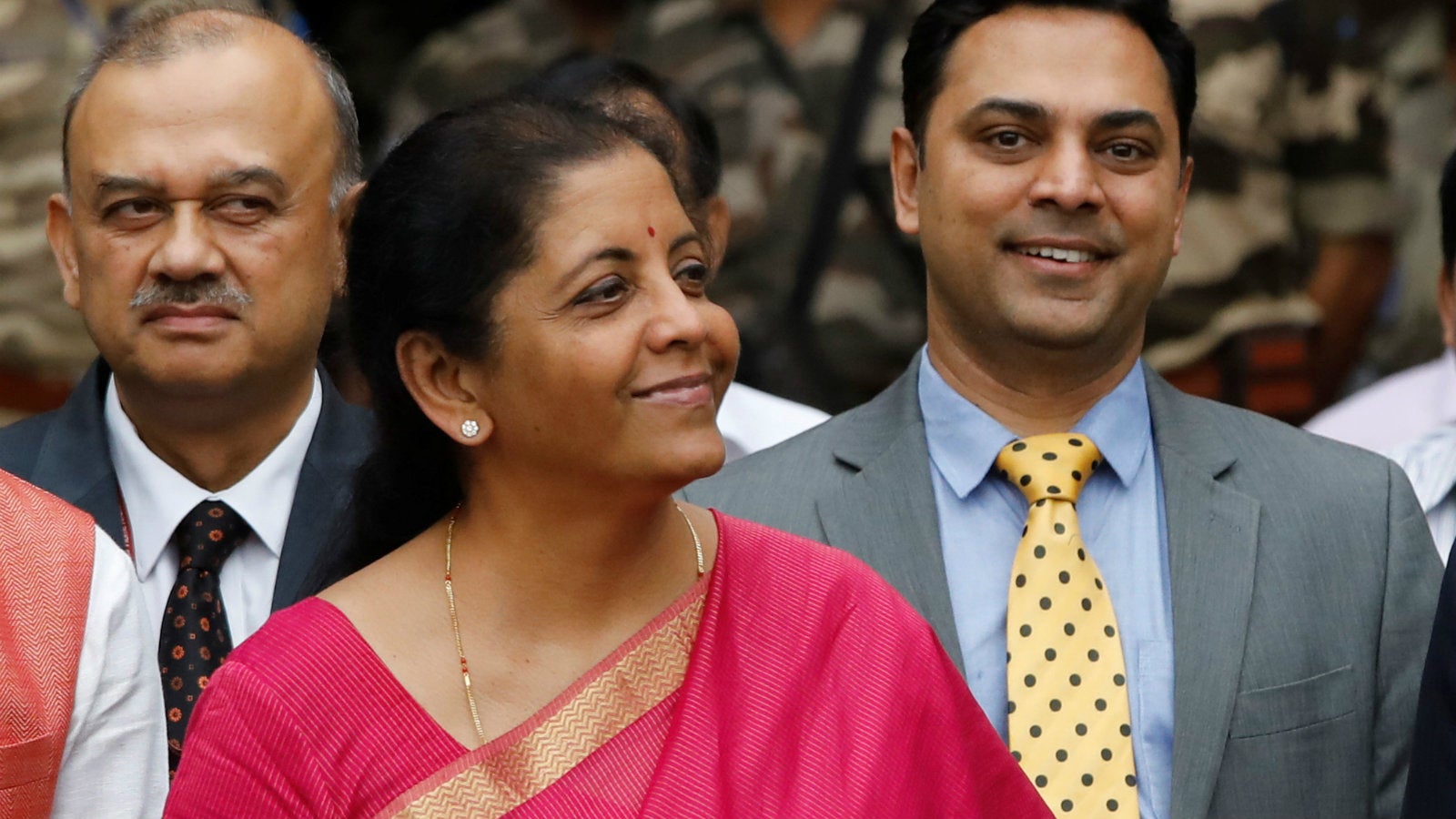

The task at hand for India’s finance minister Nirmala Sitharaman was clear cut, yet tricky.

The task at hand for India’s finance minister Nirmala Sitharaman was clear cut, yet tricky.

In her maiden budget yesterday (July 5), Sitharaman had to address the nagging issues of sluggish growth, unemployment, and declining investments while sticking to the path of fiscal prudence.

In the end, she steered clear of any high-scale stimulus packages that would have widened the fiscal deficit and focused only on the most embattled sectors of the economy. There were proposals to revive the troubled aviation and shadow banking sectors, for instance, besides a big push for infrastructure spending.

On the revenue side, the budget sought to generate higher receipts. There were hikes in the customs duty on gold, an increase in the levies on petrol and diesel, and higher disinvestment targets were set, while income tax rates mostly remained unchanged.

The combined result of these moves is an expected increase in GDP (to 7%) and a simultaneous lowering of fiscal deficit (to 3.3%) in financial year 2020, based on the budget estimates.

Heeding growth concerns

India had recently lost the tag of the world’s fastest growing economy, after GDP growth in financial year 2019 slowed to a five-year low of 6.8%.

In the current financial year, the government sees India becoming a $3 trillion (Rs205 lakh crore) economy. “It took over 55 years for the Indian economy to reach $1 trillion, but… in (last) five years, we added $1 trillion,” said Sitharaman. She added that the long-term goal is to become a $5 trillion economy by 2024.

To achieve this, the budget sought to smooth the rough edges of some embattled sectors:

Aviation: India’s airlines are reeling from high fuel prices, and rising cost of airport operations. The troubles at India’s oldest private airline Jet Airways has also put thousands of jobs at stake.

While there was no relief package announced for the sector, Sitharaman said the government will “examine suggestions of further opening up FDI in aviation.” Besides helping domestic airlines raise more money from overseas investors, the move may also aid the government’s plan to sell off debt-laden Air India, and meet disinvestment targets.

The easier FDI norms may also help find an investor for Jet that has been put up for sale under bankruptcy proceedings but has not found any buyers yet.

Another longstanding grouse of the sector was the high expenses incurred on maintenance, repair, and overhaul (MRO) of aircraft, which is currently mostly done overseas. The finance minister’s promise to “create a congenial atmosphere” for MRO activities will also aid the sector.

“We are confident of turning India from an importer of MRO to a net exporter and create over 100,000 direct jobs and revenues exceeding Rs35,000 crore in the next five years,” Bharat Malkani, president of the MRO Association of India said in a statement.

The proposal to make Ahmedabad’s tax-free GIFT zone a hub of aircraft leasing will also lower costs for airlines who currently rely on foreign lessors for aircraft.

NBFCs: The Indian economy has long been running on a single engine—consumption, which requires the easy availability of credit. However, lending activity in the economy has taken a hit lately thanks to the crisis in the NBFC sector.

To reverse the situation, the budget announced support for state-owned lenders to open up credit lines for shadow banks. “NBFCs that are fundamentally sound should continue to get funding from banks and mutual funds without being unduly risk-averse,” said Sitharaman.

Corporate tax: The annual turnover limit for companies to avail the lower corporate tax of 25% is now Rs400 crore, compared with Rs200 crore earlier. The finance minister said around 99.3% of companies will now come under the lower tax limit. The move is likely to stimulate growth for medium enterprises.

Affordable housing: A Rs1.5 lakh additional deduction was announced for interest paid on loans taken for houses worth less than Rs45 lakh. The thrust for affordable housing and the realty sector could be an important driver of growth as construction activity in India has been weak.

“Affordable housing is the focus of the government, and it’s a positive sign for the real estate sector. Ease of doing business is also a huge benefit,” Gautam Thapar, CEO of Delhi-based Thapar Builders said in a note.

Measures to boost growth notwithstanding, this was not a budget that pleased everyone.

Fiscal prudence

Free of election-year compulsions, the budget did not have any major schemes like the Pradhan Mantri Kisan Samman Nidhi announced in the interim budget in February. The programme assured a direct cash transfer of Rs6,000 per year to farmers with less than five acres of cultivable land.

In announcing the sop, acting finance minister Piyush Goyal had, at the time, given a pass to the fiscal deficit, which in financial year 2019 ended up at 3.4%—higher than initial estimates.

To stick to the 3.3% fiscal deficit target for the current financial year, Sitharaman did not announce any income tax concessions. In fact, the effective tax rate of those earning between Rs2 crore and Rs5 crore per year was increased by 3%, while those earning over Rs5 crore will now have to pay 7% more in taxes.

The government is also targeting revenues over Rs1 lakh crore from sale of public sector units this year.

There were also no major increases in the allocations to various rural programmes, compared with the last budget. No major announcements were made on job creation either.

Unable to dole cash, the budget sought to open up various sectors to foreign investment—insurance intermediaries can now attract 100% FDI and local sourcing norms were eased for FDI in single-brand retail as well, which will help companies like the iPhone-maker Apple.

Given the tight spending, it remains to be seen if higher growth targets can be met. The financial markets were not immediately confident. Both the BSE Sensex and NSE Nifty indexes ended budget day in the red.