Titan’s stock has risen 70% during a year of economic slowdown and a pandemic

One of India’s leading jewellery brands, Tanishq, is under fire over an advertisement it released last week that irked the country’s right-wing conservatives. Thousands of people called for #BoycottTanishq on social media for several days until the company pulled down the ad on October 14.

One of India’s leading jewellery brands, Tanishq, is under fire over an advertisement it released last week that irked the country’s right-wing conservatives. Thousands of people called for #BoycottTanishq on social media for several days until the company pulled down the ad on October 14.

But away from the social media noise, shares of Tanishq’s parent company, Titan, have been soaring relentlessly on the Indian stock exchanges.

As on Oct. 15, Titan’s share price was at Rs1,213 ($16.5), which is around 70% higher than its 52-week low on March 24, when a nationwide lockdown was imposed to curb the spread of Covid-19.

Titan’s stock was under pressure during the lockdown, which lasted for around three months, as stores and malls across the country were forced to remain shut.

Titan, the 36-year-old company owned by Tata Group, was predominantly known for its watches. But now it also has a strong presence in jewellery and eyewear segments. Titan gets 80% of its revenue from jewellery, which is why its shares are on the rise.

Demand for jewellery to revive

Many Indians consider the festive season, which begins from Oct. 17 with Navaratri this year, as an auspicious time to buy jewellery. The biggest boost for the jewellery industry is expected to come from the Hindu festivals of Dhanteras (which falls on Nov. 13 this year) and Diwali (Nov. 14).

The signs of recovery for Titan are already visible (pdf). Titan informed investors last week that walk-ins to its stores have been improving with conversion and average-ticket size growing in the September quarter as compared to the same period last year.

With the trend of online shopping gaining momentum, the company also noted that “the business through the e-commerce channel has grown significantly across all divisions.”

Besides festive shopping, analysts believe there is huge pent up demand, which could drive up sales.

Weddings were mostly postponed and hence the demand for jewellery was tepid. Also, people were afraid of venturing out due to the virus so they didn’t make much purchases for occasions, events, anniversaries, or other celebrations. So, obviously, there will be pent up demand which will come to fore,” observes Manoj Menon, head of research at Mumbai-based brokerage firm ICICI Securities.

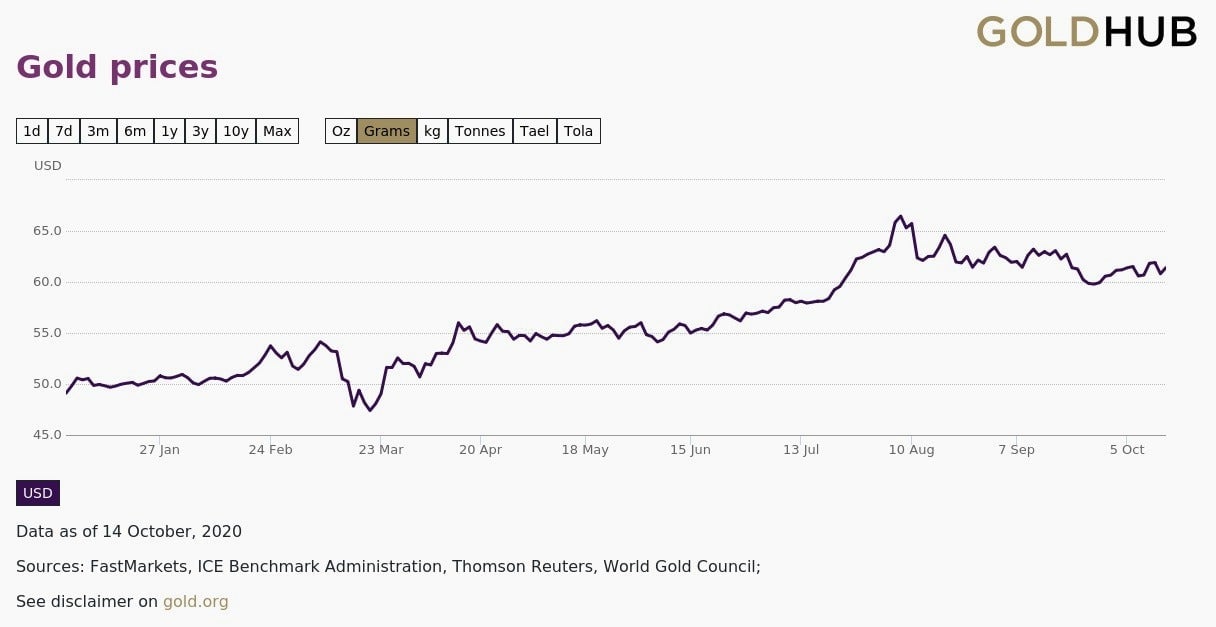

Golden prices are correcting

What could further fuel sales is the correction in gold prices. After scaling new heights in August, prices of the yellow metal are trending downwards, which could attract more customers.

“In terms of consumer behaviour, any correction is typically seen as a buying opportunity. It is likely to result in volume uptick,” observes Menon.

Even as gold prices are correcting, they remain at a higher level compared to the same period last year.

This also comes as good news to Titan. “The making charges are a percentage of sales; hence rising gold prices could be to Titan’s advantage,” states Jimit Zaveri, a fundamental research analyst, at HDFC Securities. Simply put, the making charges of jewellery rise in tandem with the increase in gold prices, which will further push up Titan’s revenue.