India’s central bank may have underplayed inflation but consumers will feel the pinch

The Reserve Bank of India (RBI) is trying to assuage concerns on rising prices, but Indian households may inevitably have to bear the brunt.

The Reserve Bank of India (RBI) is trying to assuage concerns on rising prices, but Indian households may inevitably have to bear the brunt.

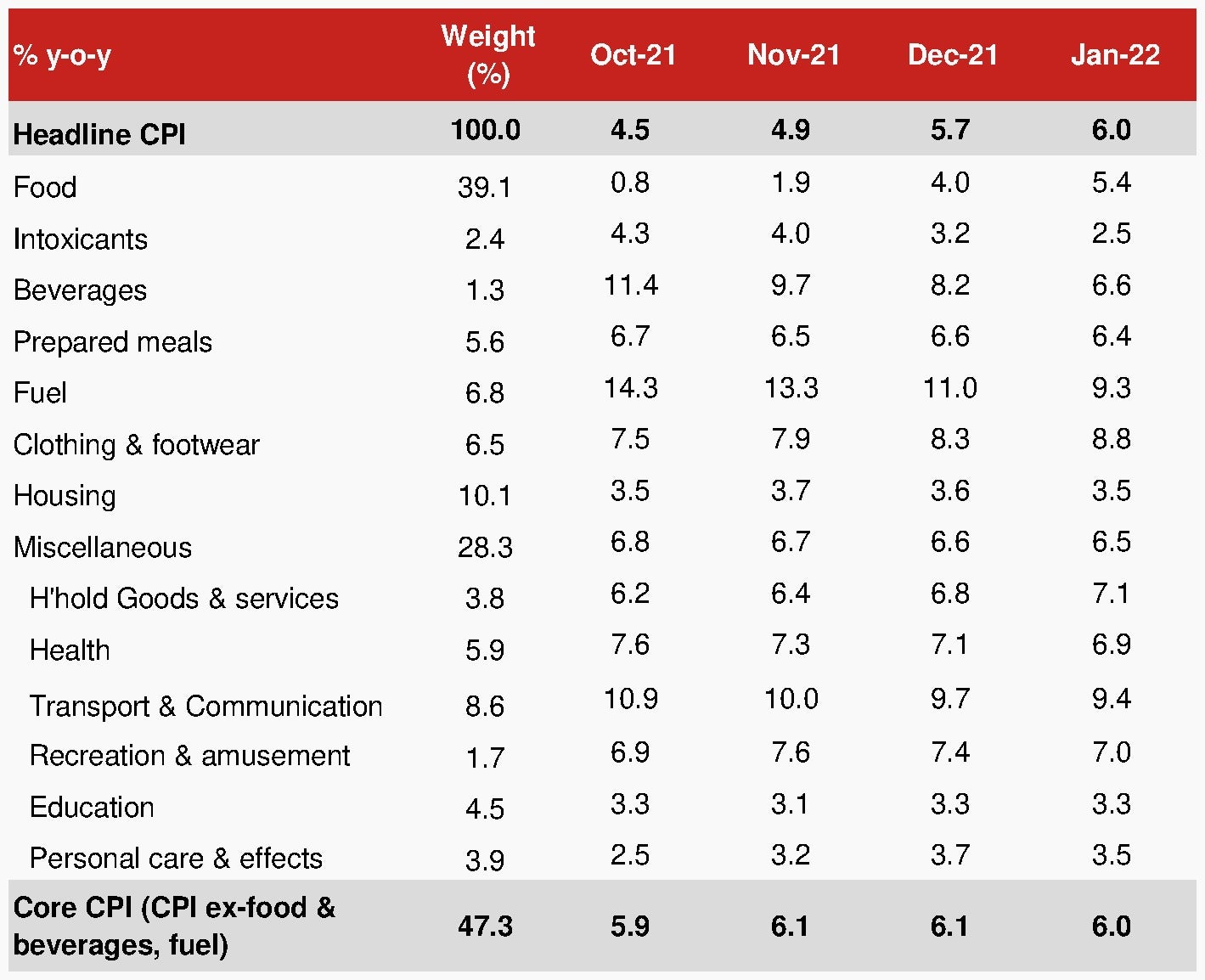

On Feb. 14, India’s retail inflation accelerated to 6.01% in January, just above the upper limit of the RBI’s tolerance band, driven by rising prices of food and manufactured items. The consumer price index (CPI) was at the highest in seven months, from a revised 5.66% in December and 4.06% in January 2021.

While the Indian central bank is committed to its inflation mandate, the uptick in January inflation, according to governor Shaktikanta Das, “…should not surprise or create any alarm, because we have taken that into consideration.”

He said on Monday that there was a sort of a “major delicate balance between inflation and growth.”

Amid the steep hike in food prices, the monetary policy committee decided to maintain the inflation forecast at 5.3% for the ongoing fiscal year, which is likely a peak. Interestingly, CPI inflation is expected to moderate to 4% in the December quarter going ahead.

However, analysts and popular consumer opinion suggest price pressures building up.

Nomura believes RBI has “set the bar high” for an increase in interest rates even though inflation is still around 6% now. Its projection of a decline in inflation starting April is, however, an overly optimistic view, given that price pressures may prevail.

Pressure on core inflation is concerning

Core inflation, which is non-food and non-fuel inflation, eased marginally to 5.96% in January from 6.01% in the previous month. But it remained elevated due to a higher-than-expected rise in prices across most sub-categories, analysts said.

The tax cuts on petrol and diesel in November have managed to ease some stress on consumers. Prices of items like tea, cooking oil, pulses, among others, have still increased by 20%-40% since the beginning of the covid-19 pandemic.

Indian consumers may have to pay more

Consumer goods companies may continue to pass on input costs to consumers in the January-March quarter.

Biscuits, beauty products, and home appliances are expected to get costlier as companies battle sustained high commodity and freight costs and margin pressures.

“These prices are based on the MRP principle and will not come down once increased. Manufacturers are in the process of passing on the higher input cost to the consumer and this will carry on for the next two months too,” Madan Sabnavis, chief economist at Bank of Baroda told The Times of India newspaper.

While household inflation expectation has eased since the last survey, the current perception at 9.7% is still higher than the projection made a year ago. What’s worse, the figure is in double-digits for the next three months and a one-year period, according to the RBI’s survey.

To worsen matters, a sharp rise in fuel prices is likely from March as the state elections conclude unless the government cuts excise duties further.

Nomura expects retail inflation to average 5.8% year-on-year in 2022-2023, higher than the RBI’s forecast of 4.5%. “Higher commodity prices, an increase in fuel pump prices after state elections, services’ reopening pressures, and elevated household inflation expectations are upside risks to inflation,” it said.