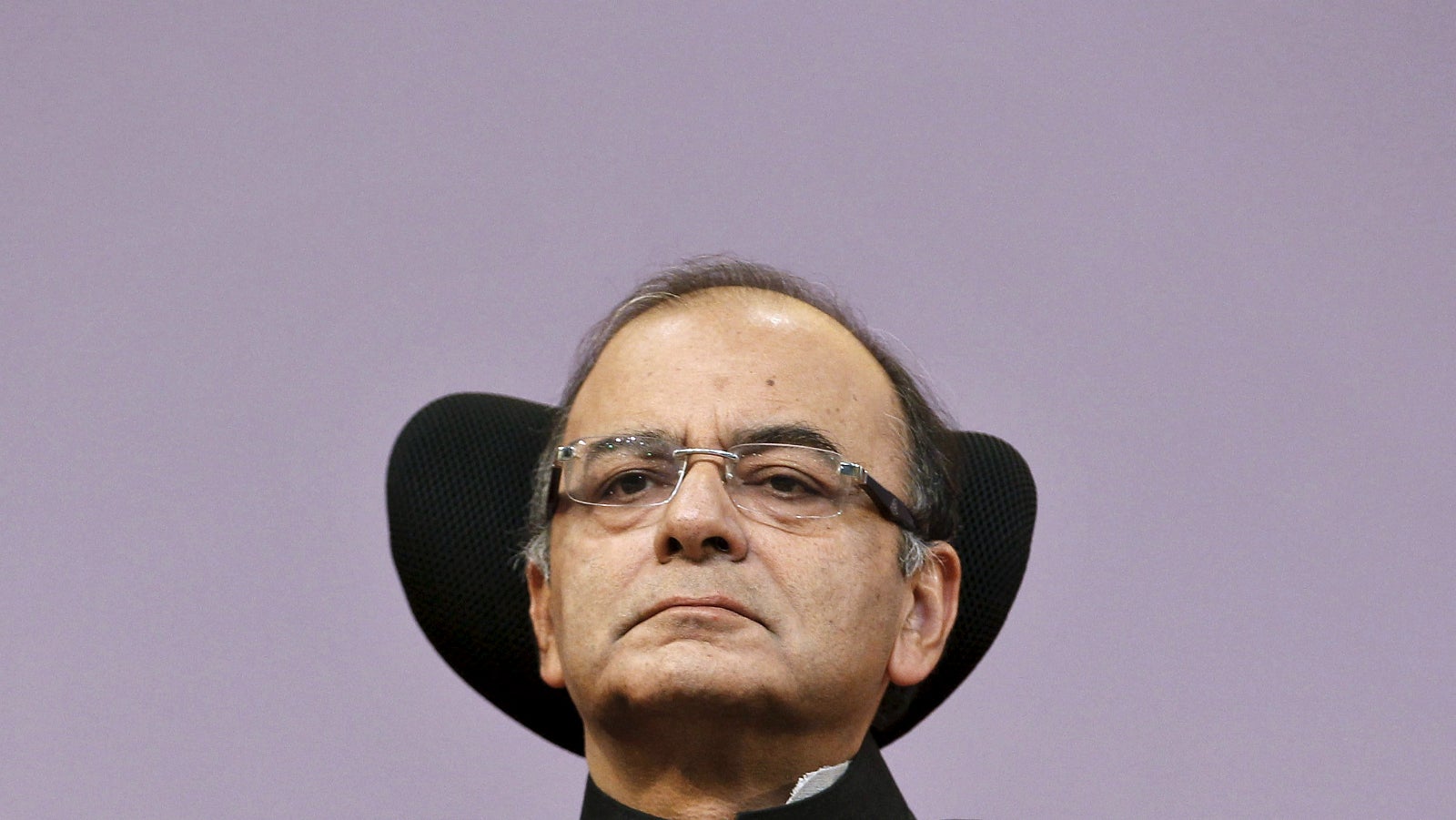

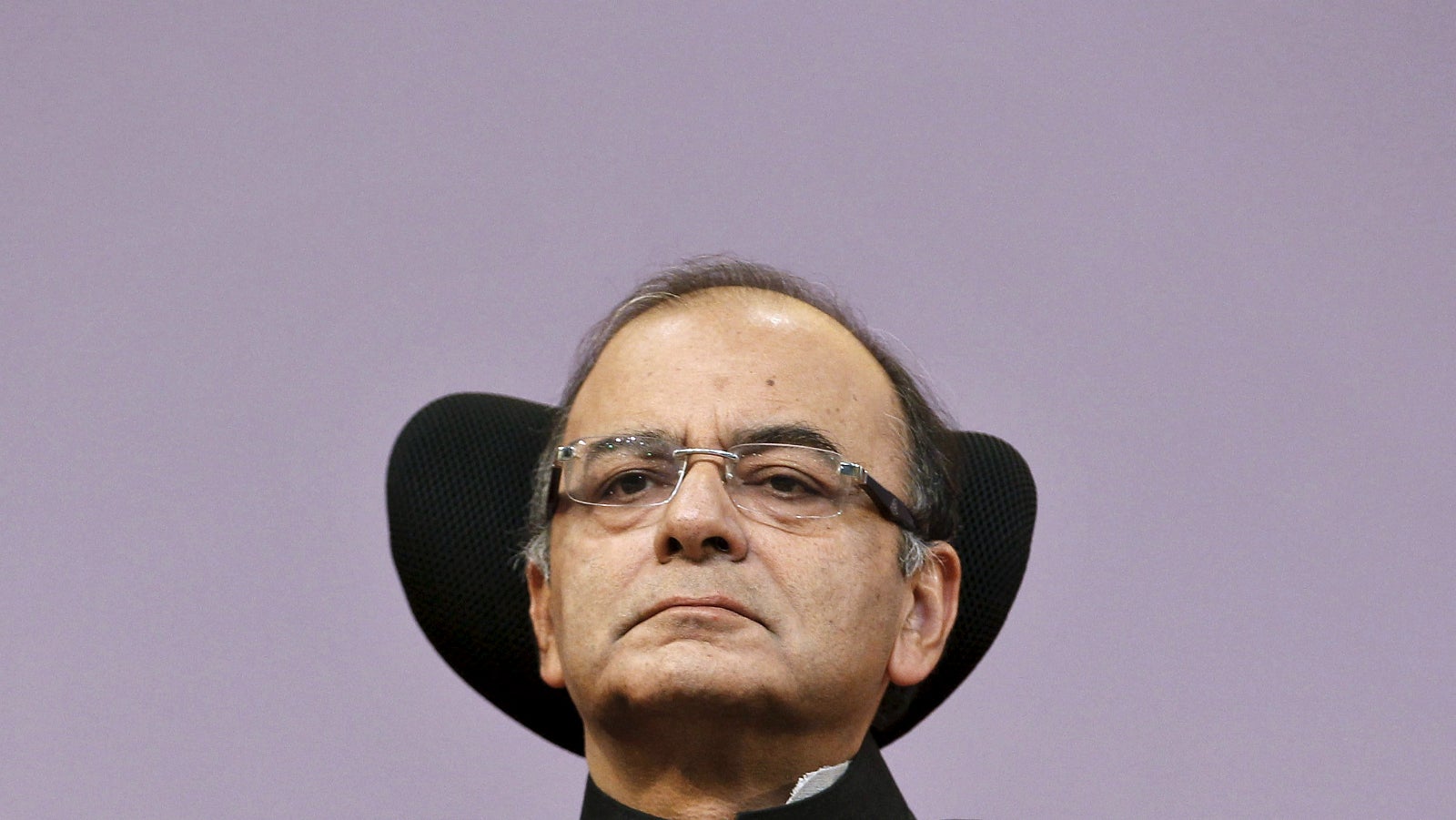

If Indian entrepreneurs could send one tweet to Arun Jaitley ahead of the budget…

Getting attention from the government is a new phenomenon for India’s startup community.

Getting attention from the government is a new phenomenon for India’s startup community.

Neglected for several years, young technology companies have been at the centre of business-related reforms announced in India over the last year. And now, the country’s startups hope they find mention in finance minister Arun Jaitley’s budget speech today (Feb. 29).

Quartz asked 16 entrepreneurs what they would want to tell Jaitley ahead of the budget—in 140 characters or less:

Naveen Tewari, founder and CEO, mobile advertising company InMobi

Make the promise of Startup India true: Tax holidays, ease of access and give room for startups to grow without the worry of regulations

Shankar Nath, senior vice-president, mobile payments startup Paytm

My list: fiscal consolidation for strengthening digital infra towards high bandwidth, simplification of KYC to eKYC, ease of doing business

Manish Chopra, CEO and co-founder, lifestyle deals marketplace Little

To get startups back from their Singapore HQs, make it as easy as they have to start and wind down + Rethink the Capital Gains Tax regime

Ambarish Gupta, CEO and founder, Knowlarity Communications

Clarity on angel tax would foster startups. Ease of compliance for new startups, removal of policies like self-certification for innovation

Sandeep Aggarwal, founder and CEO, used automobile marketplace Droom

I look for avenues of PPPs with telecos to fuel India with bandwidth & affordability & subsidy on smartphones to make Digital India alive

Varun Dua, CEO and co-founder, insurance portal Coverfox.com

Deregulation & allowing FDI in fintech. Relaxation in tax structures to make private secondary transactions liquid from taxation perspective

Umesh Malhotra, founder CEO, rural education service firm Hippocampus

The government should scrap service tax on all education related activities for children below 18 years

Bipin Preet Singh, CEO and founder, mobile payments startup MobiKwik

Lowering transaction fee, and incentivising retailers & users to pay digitally will speed up progress towards a cash-free, digital India

Bhavin Turakhia, CEO and co-founder, Directi

Govt should incentivise companies that work with educational institutions to address the talent crunch by creating skilled labour resource

Manish Kumar, CEO and co-founder, fund-raising platform GREX

Removal of angel tax & relaxation on capital gains will motivate individual investors to bet on startups which are considered as riskier bet

Gaurav Kushwaha, founder and CEO, online jewelry retail portal Bluestone

Grant industry status to gems & jewellery sector and encourage consumers by removing EMI ban on gold jewellery

Avinash Shekhar, chief financial officer, online furniture retailer Urban Ladder

Time-bound GST implementation roadmap should be a primary consideration. Clarity on taxes on inter-state transactions will benefit us

Sanjay Sethi, CEO and co-founder, online marketplace Shopclues

Tax incentives for employees who work with startups may be a good step forward. Policy support for listing startups is another expectation

Anuj Srivastava, CEO and Co-founder, home design and decor portal Livspace

35 new incubators in existing institutions, 35 new private sector incubators with government funding and flexible taxation for fund raising

Abhishek Kamani, CEO and founder, online portal for stationery and office supplies Zoffio

Introduction of GST would be a significant step which will help us expand our business in various states without hassles & help open markets

Pratap TP, co-founder, online gift cards portal Qwikcilver

Budget2016 should incentivise tech startups & provide benefits for innovative cloud-hosted SaaS products for them to Make in India