India might be a bright spot for Apple, but can it become the company’s next China?

It’s been a rough few months for Apple.

It’s been a rough few months for Apple.

On Apr. 26, Apple reported a 12% year-on-year decline in revenue for the fiscal second quarter, marking its first quarterly sales drop since 2003. Global sales of iPhone—which make up an overwhelming majority of Apple’s sales—fell by about 10 million units from the previous year, and the company’s performance in China—which has long been its growth engine—was unimpressive, with revenue from the region falling for the first time ever.

However, in India—the world’s second-largest smartphone market—Apple saw a whopping 56% increase in sales.

“We’ve been working (in India) with great energy over the last 18 months or so, and I am encouraged by the results that we’re beginning to see there,” Apple CEO Tim Cook said during the company’s earnings call.

The company views India as a “really great opportunity,” he said. “We will begin to see some really good (high-speed internet) networks coming on in India. That will unleash the power and capability of the iPhone.”

He went on to compare India—which is currently a minuscule market—with Apple’s second-largest market. “I view India as where China was maybe seven to 10 years ago,” he said.

But it will likely take longer than that for India to do for Apple what China did, if it can do so at all, analysts say.

India vs. China

Apple’s growth in India has been far more tepid than its early years in China were.

In 2011, just two years after Apple entered China, the company generated $12.7 billion from the country, which was about 11% of its annual revenue.

But even almost 10 years after the iPhone was first launched in India, the country has remained marginal to Apple’s global story.

India accounts for just about 1% of global iPhone sales in terms of both volume and revenues, according to market intelligence firm Counterpoint Research. Apple does not share a geographical breakdown of its sales in India.

Counterpoint says Apple is estimated to sell 3 million iPhones in India this year, up from 2 million in 2015.

“Apple’s sales growth in India during January-March 2016 is on a very small base. There is still a long time before India can be compared with China when it comes to iPhone sales,” Vishal Tripathi, research director at Gartner, said. “It is definitely not happening in the near-term. And even in the long-term, one cannot really say when it will happen.”

Aspirations vs. reality

iPhone is the most aspirational smartphone in India. But can aspirations alone increase sales?

As many as 32% of Indian participants in market research firm GlobalWebIndex’s January-March 2015 survey wanted to buy an iPhone, but only 9% owned one.

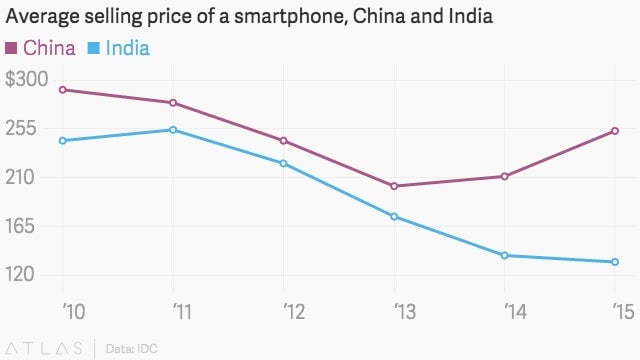

This gap between aspirations and actual purchases has mostly been due to iPhone’s pricing in the cost-sensitive Indian market.

Almost 70% of the smartphone sales in India are in the under $150 category. And prices of iPhones are among the highest in India compared to other countries.

“India’s socio-economic structure is very different from Apple’s larger markets like the US and China. Indians’ buying capacity is far lower, and at current price points, iPhone will continue to remain only aspirational in the near-term,” said Tarun Pathak, senior telecom analyst at Counterpoint.

And Apple, Pathak notes, doesn’t believe in compromising on its margins to offer cheaper products. For instance, despite its intentions to grow in India, Apple recently raised the prices of its iPhone 6, 6s, and 5s handsets in the country by up to 30%. Speculation was that the company wanted to put more distance between the price on these older models and the price on its newer model, the SE.

Out of Apple’s control

Apple may want to mine the Indian market better, but there are several factors deterring it from doing so—and many of those are outside the company’s control.

For instance, Apple has not been able to open a direct store in India so far because of restrictive regulations. For instance, 30% of the goods in the store would need be sourced locally. This would be a major hurdle for Apple, as India does not have the vendors it needs to meet this requirement. The Indian government has recently decided to make some exceptions and said it would waive the rule for companies that offer “cutting-edge technology,” The Times of India newspaper reported. But there is no clarity yet on whether or when Apple will get a go-ahead from the Indian government.

Similarly, pricing of devices in India has a lot of dependence on foreign-exchange fluctuations, as most smartphones in India are imported from other countries.

“Apple has many challenges in India right now, including unfavorable government policies. The country is increasing import duty on smartphones every year, which will only make iPhones even more expensive in the country,” Counterpoint’s Pathak said. “And iPhone sales in India are still so less that Apple cannot possibly ask Foxconn to start manufacturing in India at that small scale.”

One of the ways in which Apple could take on the pricing challenge was by selling refurbished devices in India. However, last year, the Indian government turned down the company’s request to import and sell refurbished iPhones and iPads, saying this would add to India’s e-waste. In January this year, Apple again sought permission to sell refurbished iPhones, but there has been no decision on the matter yet.