Jensen Huang starts selling Nvidia stock. He could unload more than $800 million in shares this year

The Nvidia CEO disclosed his first major sale of the year, offloading 100,000 shares between June 20 and 23 — and netting around $14.4 million

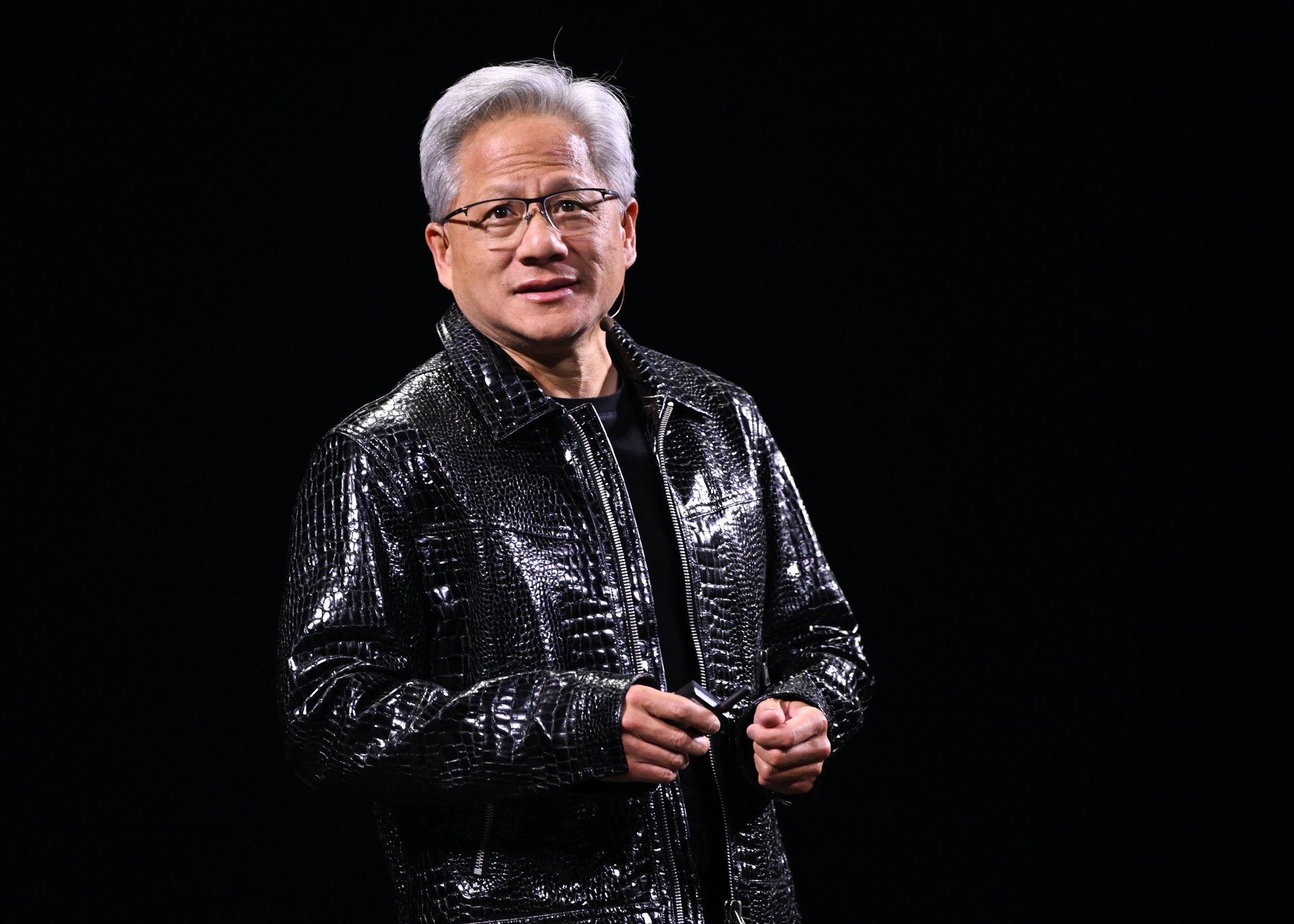

Artur Widak/NurPhoto via Getty Images

Nvidia CEO Jensen Huang is starting to cash in on the AI boom he helped ignite. He has started selling company stock for the first time this year, unloading 100,000 shares over a few days in June (the 20th to the 23rd) for about $14.4 million. That’s just the opening move in a much larger plan: Huang could sell up to $865 million worth of Nvidia stock by the end of the year.

Suggested Reading

The move is part of a pre-scheduled Rule 10b5‑1 plan — a routine way for executives to sell shares without triggering insider trading concerns. But this isn’t just a one-off or a sudden shift; Huang ran a similar plan last year, offloading around 6 million shares for more than $700 million. He still holds a commanding stake in Nvidia: roughly 75.7 million shares directly and hundreds of millions more through trusts and partnerships.

Related Content

Even after these planned sales, he’ll remain one of Nvidia’s largest individual shareholders — by far.

News of the stock sale hasn’t rattled Wall Street.

Nvidia shares barely flinched following the latest sale, hovering above $144 and continuing to outperform the broader market. The move was expected. Analysts have chalked Huang’s stock sale to financial planning and don’t seem to be sweating — not when the sale is transparent and structured, at least. Under 10b5‑1, insider sales often reflect personal financial planning, not imminent trouble.

For Nvidia shareholders, Huang’s sale isn’t a bearish warning as much as it is a founder cashing in. As long as his stake stays significant and the company’s future earnings hold strong, this remains a wealth-management move, not a vote of no-confidence. Nvidia’s stock remains up over 7% year to date and over 22% in the past year with Huang at the helm of the ship.

At this point, Huang’s net worth sits at roughly $126 billion, according to Forbes’ Real-Time Billionaires List, making him one of the richest people in the world (No. 10). And that net worth is almost entirely made up of his Nvidia shares. His planned stock sale is a way to de-risk and diversify after the company’s astonishing rise.

That rise hasn’t been without whiplash. Back in January, Chinese AI startup DeepSeek claimed it had trained a ChatGPT-level model for a fraction of the cost — triggering a market selloff that wiped out $600 billion from Nvidia’s valuation and cost Huang an estimated $20 billion in a single day. At the time, Nvidia was the world’s most valuable company. Now, it’s back below Microsoft and Apple but remains a behemoth in the $3 trillion club.

Why sell now? Markets are cyclical — even for companies riding once-in-a-generation tech waves. Nvidia’s position at the heart of the AI boom has made it indispensable but volatile. Offloading shares while demand remains sky-high and investors remain bullish is solid risk management, not an ominous sign.

It’s not just Huang selling stock. Other top Nvidia executives — such as CFO Colette Kress and executive vice presidents Debora Shoquist and Jay Puri — have also adopted 10b5‑1 plans and sold significant stakes. And billionaire board director Mark Stevens sold more than 600,000 shares for about $88 million on June 18, according to a separate Monday filing.

This planned sale isn’t Huang’s first rodeo. A similar plan launched in mid‑2024 culminated by early 2025, resulting in roughly six million shares sold and generating north of $700 million. In both rounds, Huang retained a titan’s stake — about 75.7 million shares personally and another 783.4 million held via trusts and partnerships. And after Huang’s 2024‑25 sale plan, Nvidia reached a record valuation.

Earlier this year, Nell Minow, vice chair of corporate governance specialists ValueEdge Advisors, told Fortune that Nvidia needs greater transparency around succession planning, warning that repeated, large-scale insider selling can shake investor confidence unless counterbalanced by robust leadership succession policies.

But Huang isn’t stepping away from Nvidia or signaling doubt. If anything, the scale and structure of his plan suggest long-term confidence. The company continues to outperform — despite any China- and trade-related challenges — and Huang’s vision for the company remains vast. Nvidia’s latest Blackwell chips are in such high demand that supply is booked through 2025. Data center revenue continues to soar. And despite brief challenges, its dominance in AI hardware remains unshaken.

So while Huang is taking some chips off the table, he’s still very much playing the long game.