Meta is teaching people VR is lame. ByteDance could be the one to change that.

The entry of TikTok's parent company into the US virtual reality market may be Meta's biggest challenge

The most successful applications in the virtual reality (VR) space are gaming apps. Yet Meta, the maker of the most popular VR headset, the Quest 2, seems to be primarily focused on its VR social network Horizon Worlds. This disconnect from the reality of the VR market was highlighted in a recent interview with gaming legend John Carmack, the former chief technology officer for Meta’s VR unit.

“[Games like] Minecraft and Fortnite that have 100 million plus users, I still think that that’s the right way to go to build the metaverse,” Carmack said on artificial intelligence researcher Lex Fridman’s podcast in August.

“Meta is doing a bottoms-up capability approach with Horizon Worlds where it’s fairly general purpose. Creators can build whatever they want. It’s hard to compare and compete with something like Fortnite, which also has enormous amounts of creativity, even though it was not designed originally as a general purpose sort of thing. Personally, I would have bet on trying to do [an] entertainment valuable destination [i.e. a game] first and expanding from there.”

The truth of Carmack’s perspective is borne out in the app rankings on Steam, a VR game distribution platform. Of the top 10 most played VR games on Steam, only one, VR Chat, is a social media-style app like Horizon Worlds—all the others are all games.

It may be that, in the rush to emulate its social media success and stickiness with Facebook, Meta is overlooking its obvious gaming path to success that it already has a foothold in through its apps Population One and Beat Saber.

When your chief evangelist has an image problem, doubling down is probably not the right move

Meta’s metaverse problems aren’t limited to its app strategy.

A story published by The New York Times on Oct. 9 claims that Meta’s CEO, Mark Zuckerberg, “surprised some employees by making himself the innovator face of the company’s metaverse push.” Zuckerberg’s push to “recast his public image,” as the article states, comes after years of negative stories surrounding his leadership of Facebook regarding user privacy and political speech, among other issues.

This is the marketing elephant in the room.

VR already faced a steep challenge in terms of getting consumers to strap a headset to their faces to experience a new kind of interactive platform. But when the leading face of that innovation is one that has suffered so many public blows to his credibility, what he’s selling will need to be undeniable, and not require the leaps of faith inherent in adopting VR.

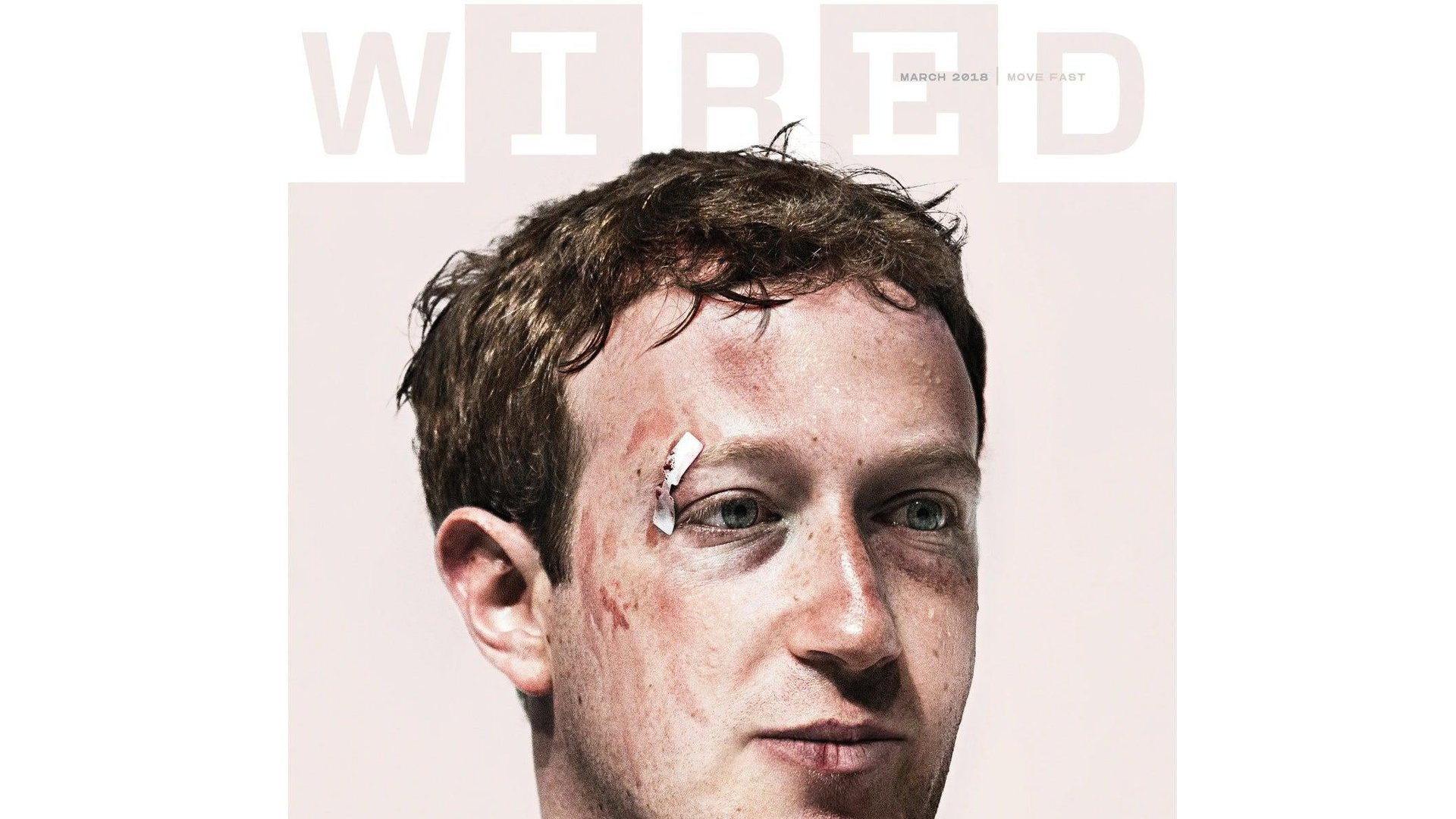

Wired magazine has made a sport of roasting Zuckerberg on its covers. In 2018, an artist’s rendering showed Zuckerberg battered and bruised on its cover. The following year, the cover showed a stoic photo of Zuckerberg appearing before Congress, framed by a collection of mocking and angry emojis.

Selling the dream is a non-trivial exercise that often hinges on who the messenger is. Not long after Apple’s CEO Steve Jobs died, the company’s new leader, Tim Cook, realized that he wasn’t the same kind of charismatic salesman as his predecessor. In response, he began introducing innovative new products to the public through various members of his team, most notably the widely admired Craig Federighi, Apple’s senior vice president of software engineering.

Unfortunately, for Meta, as long as Zuckerberg remains the leading pitch person for its metaverse products, the company may struggle to shed the founder’s past image problems.

Meta won’t stop pushing the metaverse, but it may not have an answer for the TikTok of VR

Despite a recent hiring freeze, cost cutting, and potential layoffs, Meta doesn’t appear to be pulling back from its commitment to VR. This week’s Meta Connect event is expected to launch the company’s new, higher-end VR headset.

Nevertheless, given the hurdles Meta faces, some are looking to Apple and its long-rumored device to possibly lead the way into the immersive future. While all signs point to a potential VR headset of one kind or the other from Apple, such a device would be something of a surprise. Cook has repeatedly extolled the virtues of augmented reality (AR) over VR, referring to the latter as isolating. Furthermore, Apple has yet to make significant inroads into the premium gaming space, an area vital to success in the VR sector.

The more likely threat to Meta’s VR dominance is TikTok parent ByteDance and its Pico Interactive unit, which has already begun selling its new direct Quest 2 competitor, the Pico 4, in Europe and Asia. Several developments indicate that ByteDance has every intention of selling the Pico VR headset in the US, soon.

Steam’s most used VR headsets chart lists the Quest 2 as capturing about 41% of the market (not counting older versions of Meta’s VR headsets), while the Pico Neo 2 only has 0.03% of the user base. However, the majority of Steam’s users are in the US and Europe, and none of Pico Interactive’s products are available in the US yet. Therefore, 2022's usage disparity will likely undergo a marked change when the Pico enters the US market.

If ByteDance’s success in disrupting the US-dominated mobile app landscape with TikTok is any indication, Meta should be concerned.