Big Tech will go full speed ahead on AI spending after Nvidia's earnings, strategist says

Kristina Hooper, a strategist at Invesco, breaks down Nvidia's earnings and predicts how Friday's jobs numbers could affect the Fed rate cut decision this month

Kristina Hooper, Chief Global Market Strategist at Invesco (IVZ), spoke with Quartz for the latest installment of our “Smart Investing” video series.

Watch the interview above and check out the transcript below. The transcript of this conversation has been lightly edited for length and clarity.

ANDY MILLS (AM): On Friday, there’s a jobs number coming out. Do you have any predictions on how, what that would be and what the market’s gonna do?

KRISTINA HOOPER (KH): I suspect we’ll be around in line with expectations, although I know that markets are getting a little nervous that it could be a little hotter. So two caveats. First of all, the most important metric for me in the jobs report, and I would suspect also for the Fed, is wage growth. And I expect that will have a three-handle. We’ll still see that in a relatively good place. And that to me is the most important reading for the Fed in terms of its contribution to inflationary pressures. Number two, I don’t think whatever we get from this jobs report on Friday will derail the Fed from cutting rates in September. Now, I don’t expect more than 25 basis points in cuts, but that’s okay. I just wanna see the start of easing and I don’t think that this jobs report will do anything to derail that.

AM: Right. Yeah. Right now, there’s a prediction of a 100% chance of a cut in September. So it seems like this jobs number is something that will inform them, but not change their mind.

KH: But the market’s always looking for something to worry about. It’s a bit of a nervous Nelly. And so right now I think the focus is on that and the potential for it to derail. But again, I don’t think it’s gonna happen.

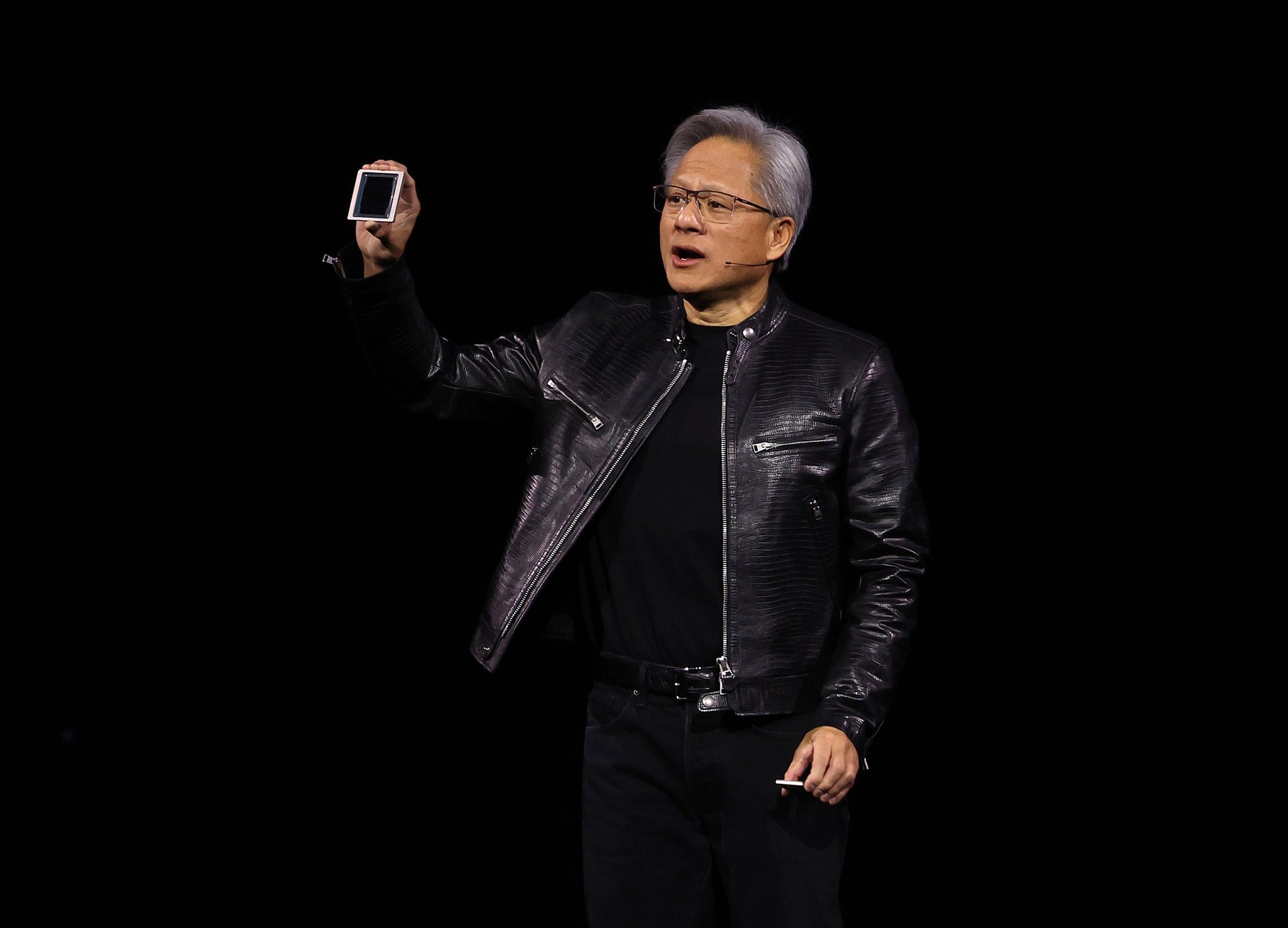

AM: Speaking of the focus of the market, last week it was Nvidia, like, what’s Nvidia gonna do? And their earnings report was pretty good. Do you see the sentiment changing or shifting in any particular direction after they’ve soaked up these numbers?

KH: Well, so two key takeaways. First of all, when stocks, whatever the stock is has a high valuation, when it is priced for perfection or near perfection, you tend to have greater negative reactions. There’s a nit pickiness among investors when you have very high valuations and lofty expectations for the future. Having said that, there is also a concern around spending on AI by companies. I think that is one of the big fears is that this trend can’t continue. Having said that, what I’m seeing and what I’m hearing is that most companies are full speed ahead on their spending on AI. They see that as very important and they’re also of the belief that it is providing other benefits that they are, for lack of a better term, modernizing in many ways as a result of their AI spend. And so they’re willing to do it, and I think we’ll continue to do it. Will every dollar have a really high ROI? No, but I don’t think that’s gonna stop companies because they see the risks of not investing as greater than the risks of investing.

AM: So everybody’s spending, and that’s okay according to the market right now. But at some point I think some of these companies might strike gold, but others might hit a dead end and people would freak out. But we just don’t know right now.

KH: We don’t. And again, what we’re hearing is that the kinds of investment they’re making into technology are helpful to their business. So even if they don’t see as much benefit from AI in general and the uses for their particular businesses in general, they’re positive on the impact of that spend. And I don’t think that’s gonna change much. Yes, there could come a time when, especially evaluations are very high and there’s that priced for perfection mentality among investors where there could be some punishing going on. But again, I think that this is generally a positive that will continue. I look to the 1990s and the spend on the internet, many scoffed at that. And I’m sure there wasn’t a high ROI on every dollar spent, but I certainly think companies looked back and were happy they spent on it, and it was an important part of how we saw an improvement in productivity for the economy in general.

AM: Thank you, Kristina.