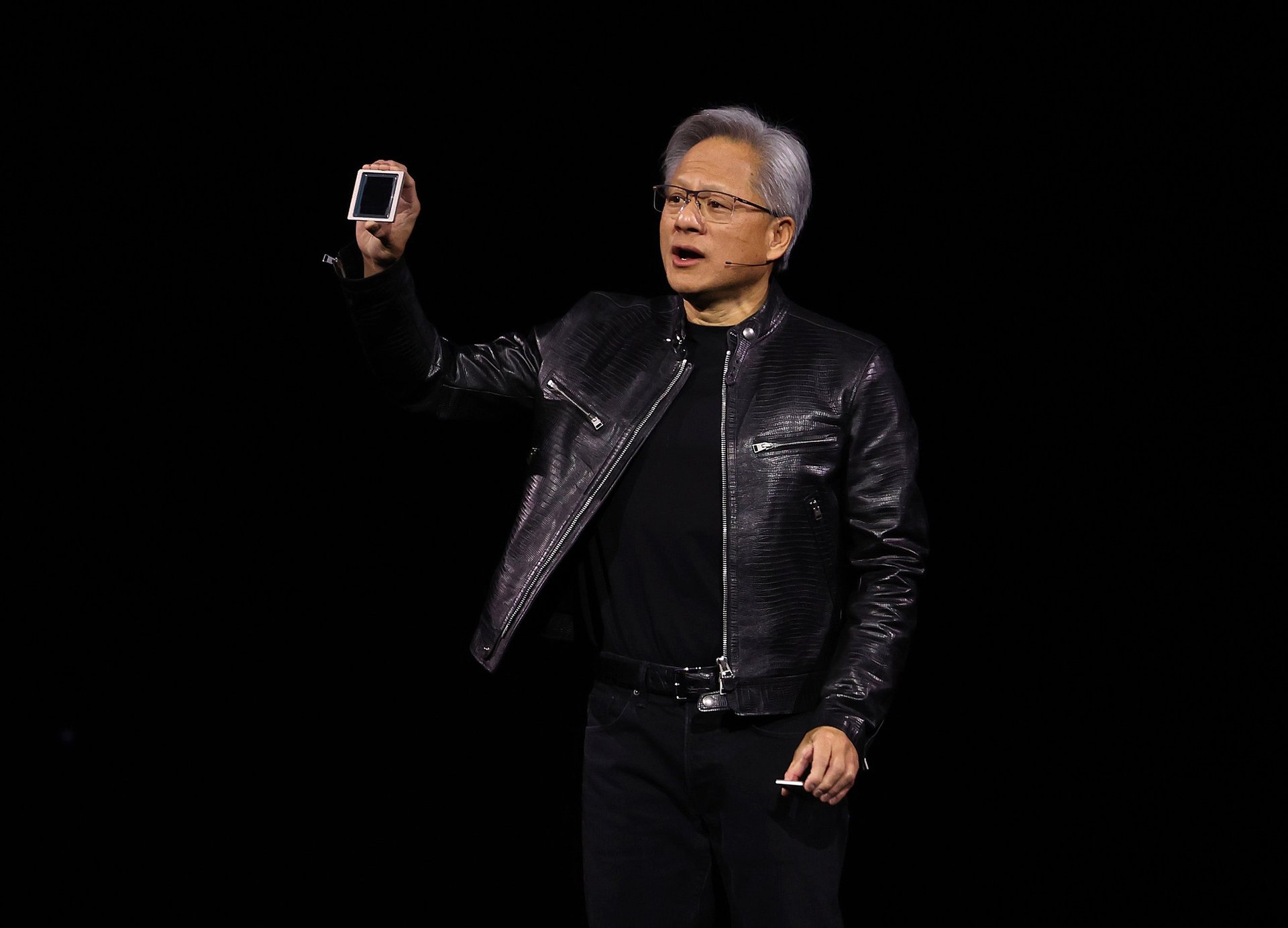

Nvidia is giving employees a 25% stock boost and calling it the 'special Jensen grant'

The grant, named after Nvidia CEO Jensen Huang, will give employees of the chipmaker a bigger piece of its AI-fueled stock growth

Demand for Nvidia’s chips led the company to become the first chipmaker to hit a $2 trillion market cap, and now it’s reportedly rewarding staff with a stock boost.

Suggested Reading

Nvidia employees are getting a one-time “Jensen special grant” of an additional 25% of the amount of stock units they received when joining the company, Business Insider reported citing sources familiar with the matter. The grant is named after Nvidia co-founder and CEO Jensen Huang. Employees were reportedly told of the additional restricted stock units (RSUs) during annual performance reviews at the beginning of April.

Related Content

The amount of RSUs employees will receive depends on the company’s share price, which closed on average around $898 for the month of March, Business Insider reported. The “Jensen special grant” will reportedly vest in equal installments over four years, with the first portion vesting on September 18. Sources told Business Insider many recent hires were given stock options worth $200,000, and they will receive an additional $50,000 of RSUs. Employees also get quarterly annual equity refreshers based on individual performance, Business Insider reported.

A source told the publication Nvidia is giving out the grant so employees can still benefit if the company’s share price falls in the future. Nvidia declined to comment.

In February, Nvidia beat analyst expectations when it reported record fourth-quarter revenues of $22 billion — up 270% from the year before. In March, the company, which has been fueling the AI high, pushed past Saudi Arabia’s Aramco to become the world’s third most valuable company. It had previously beat out Amazon and Google parent Alphabet to become the third most valuable company in the U.S. by market cap.