Is a recession coming? Here's what JPMorgan and other banks, analysts, and economists say

Consumers and businesses could have a long slog ahead

Economists are sounding the alarm over the threat of a recession in the U.S. as uncertainty reigns over tariffs and the job market begins to feel pressure from layoffs.

Laura Jackson Young, an economics professor at Bentley University, said uncertainty is underlying the risks.

“There is a material threat of recession that has risen in recent weeks and is something we can’t ignore,” Young said, adding that when businesses and households lack clarity about the future course of the economy, they become more restrained in spending plans. “Much of what is driving the chaotic swings in financial markets right now is driven by uncertainty.”

“This is especially pronounced for businesses considering if now is a good time to invest or expand their workforce,” Young added. “We also may see effects on consumer spending as people start boosting their savings with unclear prospects for their job security.”

Check out the latest recession forecasts from banks, analysts, and economists.

2 / 9

JPMorgan Chase

Economists at the country’s biggest bank are increasingly bearish. JPMorgan has upped its odds of a recession this year to 40%, citing “extreme U.S. policies.”

3 / 9

Moody’s

Mark Zandi, chief economist for Moody’s, sees the risks of a recession in 2025 as uncomfortably high — and rising.

“I would put them at 35%, up from 15% at the start of the year,” Zandi posted on X, adding that the typical recession probability is 15% and the U.S. economy historically suffers a recession every six or seven years on average.

“The economy will likely suffer a downturn if the Trump administration follows through on the tariff increases it has announced and maintains those tariffs for more than a few months,” Zandi wrote.

4 / 9

Larry Summers

Former Treasury Secretary Larry Summers shares the alarm of other economists, posting on X: “ I would have said a couple months ago a recession was really unlikely this year. Now, it’s probably not 50/50 but getting close to 50/50.”

Summers blamed the current recessionary risks on the Trump administration’s policies.

“There is one central reason,” he said. “Economic policies that are completely counterproductive. All the emphasis on tariffs and all the ambiguity and uncertainty has both chilled demand and caused prices to go up.” Summers added that Americans are getting the worst of both worlds: concerns about inflation and an economic downturn and more uncertainty about the future and that slows everything down.

5 / 9

Goldman Sachs

Goldman Sachs (GS)’ team of economists, led by Jan Hatzius, raised its 12-month recession probability from 15% to 20%. The probability was only slightly increased because “the White House has the option to pull back if the downside risks begin to look more serious,” Hatzius said.

6 / 9

Morgan Stanley

Morgan Stanley (MS) Chief U.S. Economist Michael Gapen now puts the likelihood of a recession at about 20% to 25%, twice as high a risk as in any given year.

“The probably has risen, given the combination of policies, tariffs, spending cuts, and immigration controls,” Gapen said, adding that whether we actually experience a recession is “up for debate.”

Tariffs, Gapen said, could push inflation upward in the short term. Employment growth and consumer spending are the keys to whether there will be a recession.

7 / 9

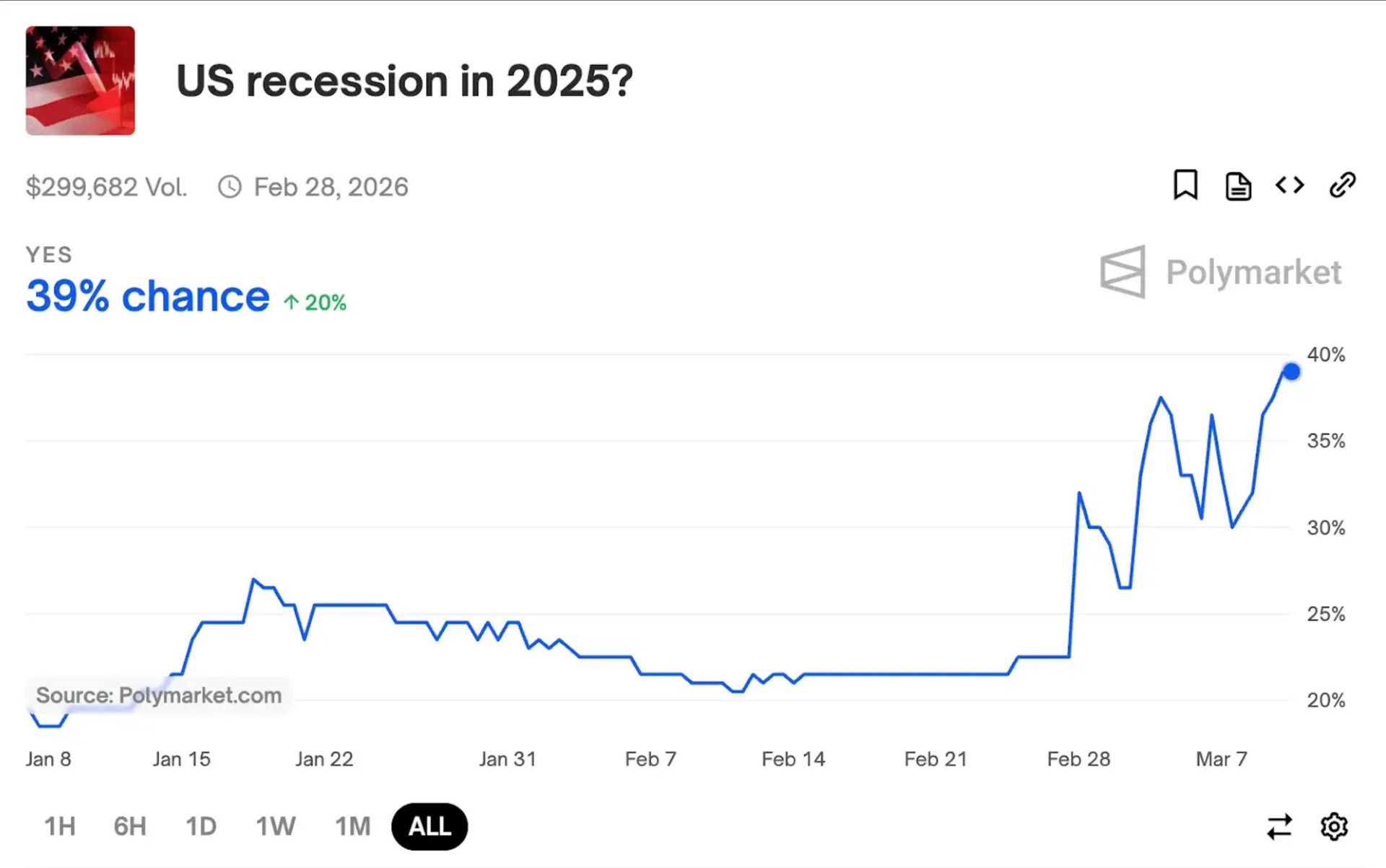

Polymarket

The well-known betting market platform now puts the odds of a recession at 39%. The odds began rising rapidly in late February as tariff fears took hold.

8 / 9

Apollo Global

Torsten Sløk, an economist at Apollo, highlighted in a recent note that recession odds are increasing for the U.S., the U.K., and Europe. Sløk correctly predicted that the U.S. would avoid a recession last year when other experts said otherwise.

“The biggest downside risk is that policy uncertainty could create a sudden stop in the economy where consumers stop buying cars, stop going to restaurants, and stop going on vacation, and companies stop hiring and stop doing capex,” Sløk said.

9 / 9

TD Cowen

Jeffrey Solomon, the president of TD Cowen (TD), predicted the economy could tip into a recession in the second half of 2025.

“People have to take a breather and say: ‘Wow, is this real? Is it not real? What’s going to happen with it? I can’t really afford to make any capital investments until I understand what the landscape looks like,’” Solomon told CNBC.