The student loan 'default cliff' is coming

Millions of Americans are in trouble with their student loans. But the Department of Education remains largely shuttered during the government shutdown

Francis Chung/Politico/Bloomberg via Getty Images

The U.S. is hurtling toward a student loan “default cliff” that could drag down millions of borrowers — even as much of the federal government, including the Department of Education, remains shutdown.

Data from the New York Fed shows that more than 10% of all student-loan balances are now seriously delinquent, or more than 90 days past due, up from less than 1% a year ago.

Within that pool, about 4.3 million borrowers are even further behind, approaching default, defined as 270 days past due. Add in the 5.3 million borrowers already in default, and the total rises to near 10 million people. That’s around 3% of the total U.S. population, or one in every 25 American adults.

Causes and consequences of the 'default cliff'

The apparent explosion in student loan delinquencies partly reflects the end of pandemic-era policy.

For nearly four years, most federal loans were in automatic forbearance: payments paused, interest frozen, missed bills never reported as late. As a result, delinquency rates hovered below 1%. When those protections expired last fall, tens of millions of borrowers were suddenly expected to resume payments, many without any warning or recent contact with servicers.

Since then, DOGE-driven layoffs at the Education Department and a 1.1 million-case backlog in income-based repayment applications have left borrowers unable to access lower-payment plans. And now, with federal workers furloughed during the shutdown, those applications are once again frozen.

Credit score data suggest many of the millions of troubled borrowers have already taken a 100-point hit, the steepest drop since the Great Recession.

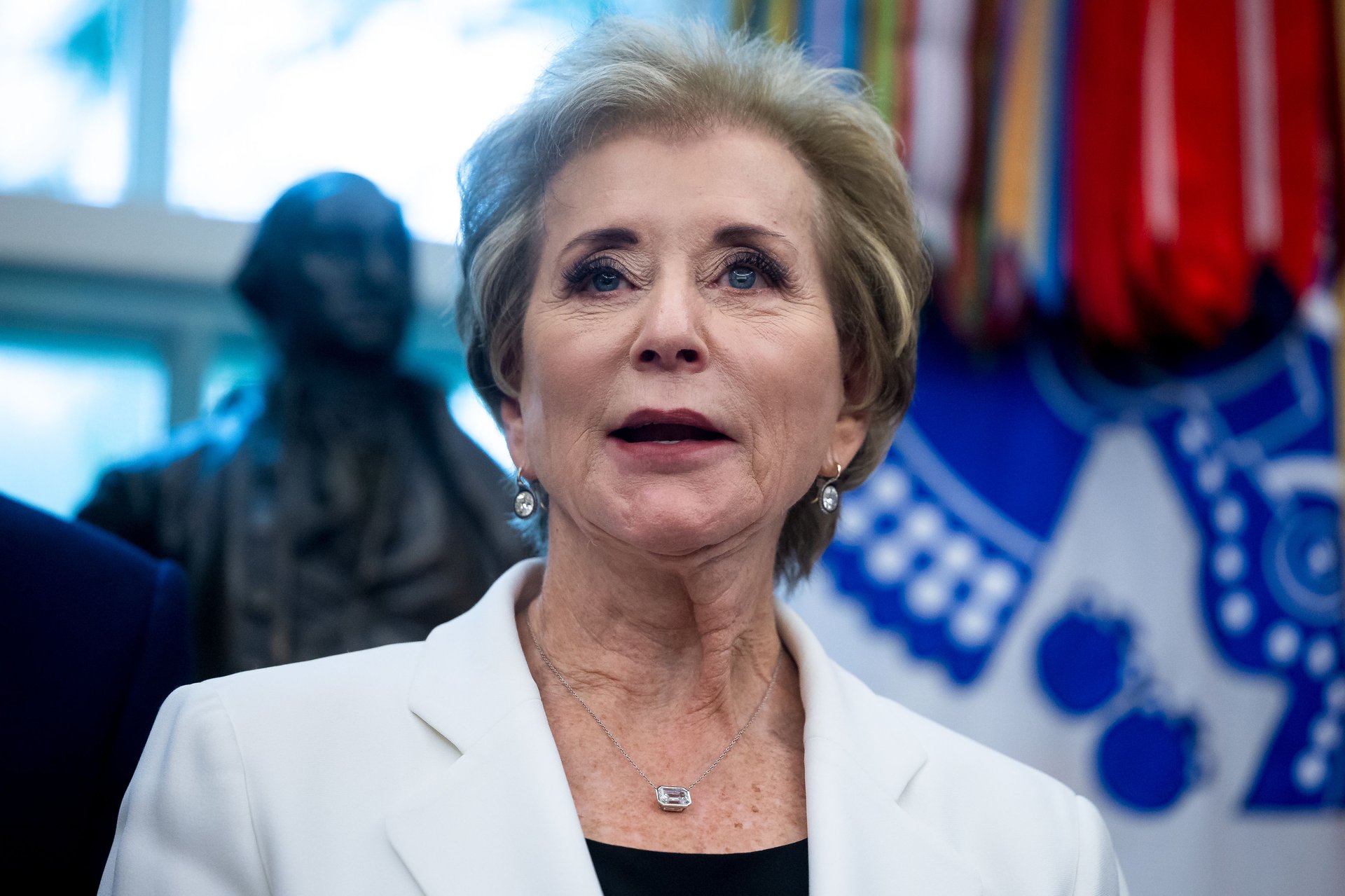

Thus the U.S. faces one of "the largest mass student-loan default events in modern history,” according to a letter this week from Senator Elizabeth Warren, Senator Chuck Schumer and dozens of other Democrats, who are calling on the Trump administration for emergency action such as a temporary, interest-free forbearance. The senators urged Secretary of Education Linda McMahon to halt wage-garnishment collections and clear the backlog as soon as the government reopens.

Why McMahon is unlikely to help borrowers

However, Linda McMahon has taken a strict, punitive stance on student-loan leniency since becoming Education Secretary under Trump. In her own words, “borrowing money and failing to pay it back isn’t a victimless offense,” and she’s framed repayment as a moral obligation rather than an economic policy issue.

McMahon argues that forgiving or delaying repayment shifts the burden “to others,” effectively treating federal student debt like private commercial lending. Critics, however, note the irony that both she and President Donald Trump personally benefited from debt forgiveness and bankruptcy protections that student borrowers are legally denied.

Meanwhile, administration officials are reportedly considering selling slices of the $1.6 trillion loan portfolio to private investors, a move critics say would function to strip away important borrower protections.